Why Can’t FSIs Agree On The Roles in the Operating Model?

Can FSIs Leapfrog Digital Transformation Steps? Other FSI Digital Transformation Weekly Reads

Why Can’t FSIs Agree On The Roles in the Operating Model?

A common theme of our publication is the difficulty of digital transformation because it requires FSI executives to develop new operating muscles. In the previous newsletter, we discussed the natural reasons for resisting the most effective operating model. Now, let's delve deeper into the critical step after the operating model is defined: clarifying everyone's roles and responsibilities.

Digital transformation is intended to break down organizational silos, but many FSI executives struggle to collaborate effectively in this new paradigm. For such financial services and insurance executives, collaboration often means simply holding regular meetings to share updates without inviting intensive public scrutiny. Since they don’t necessarily know what “good” looks like on the next level of maturity, FSI leadership often creates more silos and buffer roles instead of encouraging their managers to develop new collaborative skills. The hope is that someone will eventually influence others to become better collaborators. This approach, however, leads to new and existing roles never being thoroughly discussed, which causes edge responsibilities to keep falling through the cracks, perpetuating a vicious cycle of more intermediary hires and organizational bureaucracy.

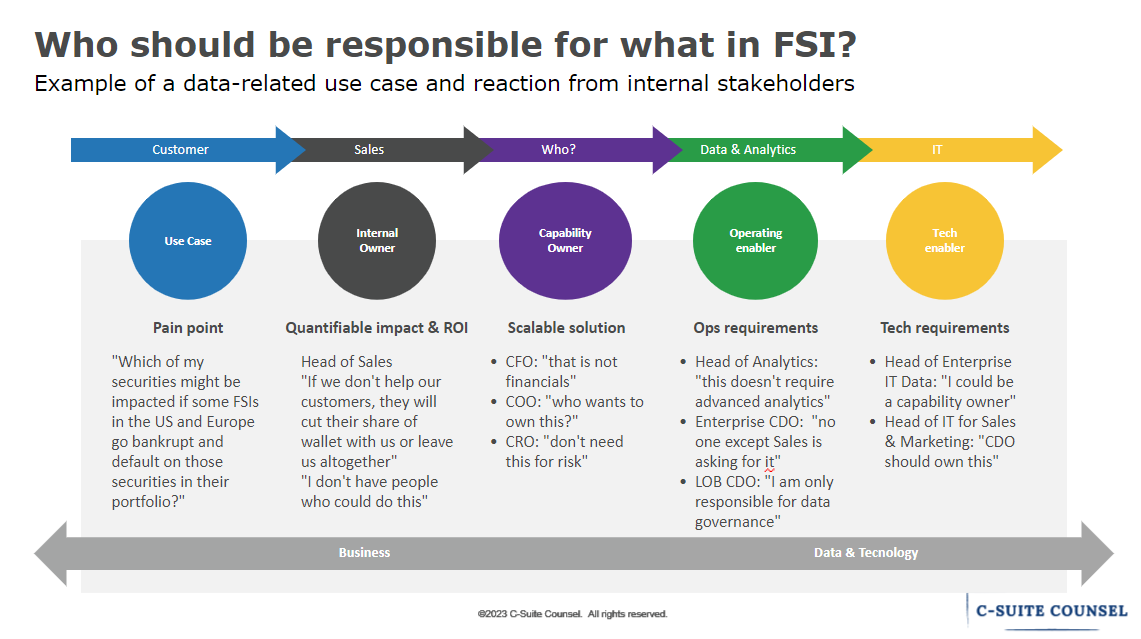

As a result of the issues described earlier, many financial services and insurance companies end up with an excessive number of executive and middle-management roles, which is further complicated by a lack of clear alignment on everyone's responsibilities. This problem is particularly noticeable in data-related use cases. To illustrate this point, let's consider a recent real-life example from a large FSI. Who do you think should be responsible for each aspect of this data-related use case?

Who is responsible for ensuring clarity of everyone's roles in the above FSI example? The CEO. However, as is often the case in such FSIs, no one will remind the CEO of this responsibility. Instead, the most agreeable executive (the "team player") will typically step up and push through a one-off solution, at the expense of their own team and with no additional reward.

But what could be simpler than agreeing on roles? As with many couples struggling to align their respective roles in a relationship, it is easier said than done.

In the context of digital transformation, it is essential to maintain such a rigorous alignment in order to master entirely new capabilities. This approach also facilitates the self-selection of suitable employees. For instance, an FSI executive who is not willing to practice the second and third levels of the above framework could prefer to seek opportunities with a lower maturity LOB or a less demanding company.

In the earlier example of a data-related use case, if that LOB CDO only wants to engage with governance and holistic strategy, an FSI will be at a disadvantage in digital transformation. Conducting unending governance reviews and telling others what they are doing wrong is easy. Capturing and making data useful is tedious, but that is the job in digital transformation. Rather than hiring another expensive buffer, find a better-suited replacement for the current executive and tighten the alignment going forward.

Can FSIs Leapfrog Digital Transformation Steps?

The global CIO of a top US bank interrupted our dinner meeting in a private club, saying, "I have to take this, please continue without me." We were there to answer the CIO's questions about how AI, IoT, Blockchain, and other advanced technologies could create differentiation for FSIs. As the CIO began an intense phone call next door, his team noticed our disappointment and explained that there was another Severity 1 outage (those are bad/rare). When I asked, "How many Sev 1s do you have annually?" they replied, "Hundreds." The irony of discussing AI in this context seemed to be lost on everyone.

While the aforementioned case may be extreme, in my experience over the last five years, most FSIs have wasted millions by disregarding a chasm between their current level of digital maturity and the complexity of the digital initiatives they are attempting to scale. Take a moment to compare current maturity of your FSI vs. implied maturity of your digital initiatives this year - are you also attempting to skip a step somewhere?

Hopefully, your FSI is more pragmatic, but here are some typical examples from my personal experience:

Level 1→5: an asset manager, $10+M on building a BaaS fintech

Level 2→5: a life insurer, $100+M on integrating with a large accelerator

Level 1→4: a commercial P&C carrier, $10+M on data platform.

We discussed in the inaguaral newsletter the futility of crossing this chasm with the example of no-code platforms. When approving such massive expenditures, CEOs are hoping that

3rd party (platform vendor, SI, accelerator) would make an FSI more effective: participating employees would be eager to observe more advanced counterparts and start copying their ways of working in real-time

such an effort will make enough money to generate a significant implied ROI: FSI would profitably grab a significant market share due to a 3rd party capability available to everyone else

After a decade of such attempts by FSIs, those assumptions, unfortunately, are always incorrect. A lower maturity FSI wouldn’t have employees who are capable to learn from observations on their own. Such employees require a hands-on manager, who knows what “good” looks like, to level them up.

Discovering a lucrative business model often takes years and does not necessarily depend on having superior technology. Rather, it requires a large customer base with a significant pain point who are willing to pay for a solution to that problem. Ideally, these customers should not already be on the radar of key players in the industry. Leapfrogging through the steps of digital transformation won’t help here either.

But what if a Level-3 FSI tries jumping straight to Level 5 by cordoning off their stronger employees with more autonomy and generous funding? Fails every time.

It’s like playing for a college vs. professional team. The same operating muscles that are good enough to win the former (core segment) are inadequate for the latter (new segment).

It’s great if your FSI has an extra $10-100 million to spend on leapfrogging, and building cool stuff is fun when it’s not your money. Just be aware that you will be learning what not to do.

Other FSI Digital Transformation Weekly Reads

Arvest Bank reskills IT to support its banking core refresh

How banks modernize digital core, keep in reg compliance

CIOs must evolve to stave off existential threat to their role