Can Partnerships Accelerate FSIs Digital Transformation?

Preaching Culture Impedes Digital Transformation of FSIs, Other FSI Digital Transformation Weekly Reads

Can Partnerships Accelerate FSIs Digital Transformation?

The Head of Digital Business at a mid-sized asset manager requested an urgent call, 'We made a mistake with our fintech platform partner. We've already spent $10M, and our big launch is nowhere in sight. Do you know of a better vendor?' I was dumbfounded. Just six months earlier, I facilitated a brainstorming session with their C-Suite where we agreed that they needed to focus on stabilizing their IT infrastructure before attempting anything 'digital' beyond an MVP. The executive explained, 'CEO had a vision and the capital to pursue it, so we went all in.'

The previous newsletter explored the futility of leapfrogging digital transformation via a separate fin/ins/wealthtech subsidiary. But could the acceleration be accomplished by partnering with a more advanced solution provider instead? Most of the FSIs certainly hope so. Earlier this month, Manulife decided to adopt Fidelity Clearing Canada's uniFide platform specifically to 'accelerate digital transformation' for advisors and clients.

Leo Zerilli, Manulife Investment Management’s head of wealth and asset management for Canada, hailed the agreement as an important milestone in the firm’s digital transformation. “We have seen an increased demand for wealth advice that has only heightened in the last few years,” he said. “This investment allows us to grow our wealth business, both organically and through targeted recruitment, to meet the needs and expectations of both advisors and clients.”

The approach of purchasing a platform and expecting transformative results is always the same: we buy a platform, yada-yada-yada, and our business is transformed, making lots more money. This approach is indistinguishable from the mindset of typical FSI business executives in the 90s, who saw IT as a back-office cost center they did not need to understand. Among all FSI platforms, Unqork has been the most effective at capitalizing on this mindset. Our first newsletter explored how Unqork successfully convinced FSI business executives that they were purchasing a plug-and-play solution that would enable them to bypass IT entirely.

It is no wonder, therefore, that 55% of responders view partnerships as 'very important' to their 3-year strategy, according to the recently published by EY-Parthenon the 2022 U.S. Banking Strategic Partnership survey. More 'silver bullets' please.

How are the results so far? In a specific use case of driving loan volume, more than two-thirds of financial institutions reported a <5% increase in loan volume in 2021 from fintech partnerships. Here are the results across all use cases from the EY survey:

40% of the banks: partnership failure rates 20-40%

30% of the banks: partnership failure rates above 40%.

The actual results are typically worse than what respondents are willing to disclose. Recently, more details emerged about a failed consumer play by Goldman Sachs (Marcus), which was intended to transform the firm into a digital powerhouse. Goldman Sachs made every mistake in the book, but their partnership with Apple takes the cake:

What is less well-known is that Goldman won the Apple account in part because it agreed to terms that other, established card issuers wouldn’t. After a veteran of the credit-card industry named Scott Young joined Goldman in 2017, he was flabbergasted at one-sided elements of the Apple deal, according to people with knowledge of the matter.

“Who the f--- agreed to this?” Young exclaimed in a meeting after learning of the details of the deal, according to a person present.

As regular readers may expect, an inadequate operating model in FSIs is often the primary culprit for failed partnerships. Attempting to achieve transformation without undergoing the necessary internal change has been consistently futile. The same EY survey surfaced two major pain points:

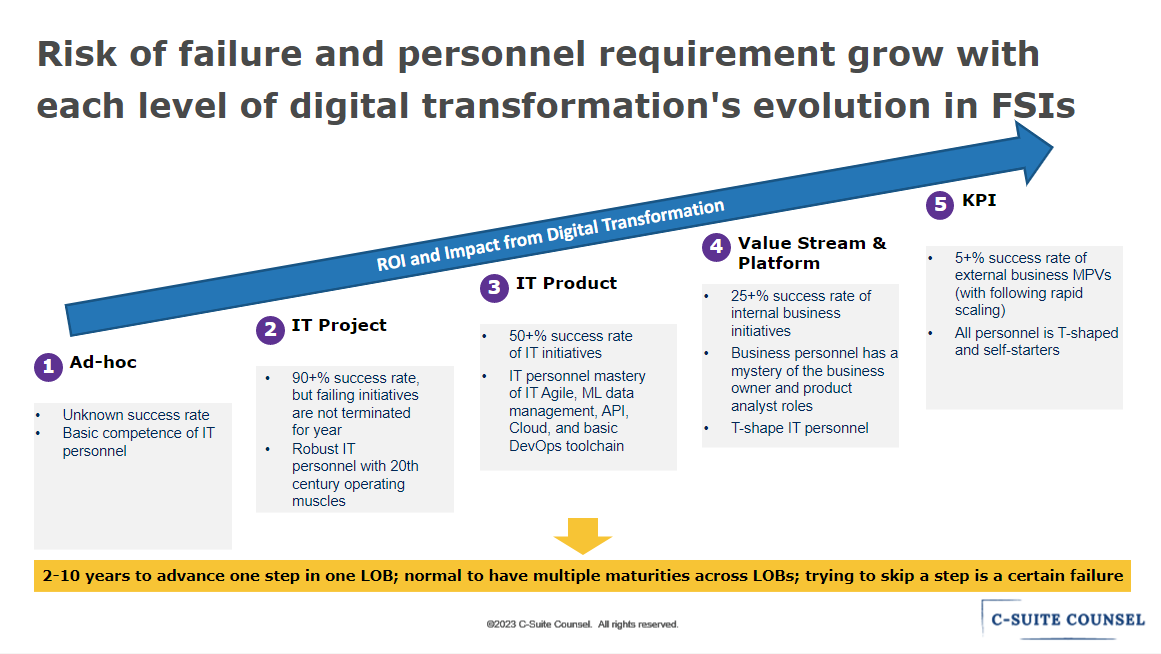

Ready for the hard part that shows you how to organize a successful digital partnership? The primary requirement is that all parties involved must have achieved a minimum of Level 3 digital maturity. The 'all parties' encompasses all groups involved with the selection, onboarding, and scaling of partnership capabilities, e.g., business development, sourcing, business line, IT. If any of these teams operate in a siloed, waterfall model, they may not be involved in a digital partnership until they have leveled up their own operating muscles.

After identifying a subset of FSI that is capable of a digital partnership, the shared capability owner assumes responsibility for ensuring the success of the partnership. It's that manager's responsibility to comprehend how their service facilitates higher earnings for business owners and to determine whether and which partners will assist in scaling their service more efficiently. Therefore, the objective of a partnership in the context of digital transformation is not to replace or circumvent an internal shared capability, but rather to enhance it and accelerate its organic evolution. In this operating model, groups such as business/partnership development or sourcing/ procurement do not serve as primary decision-makers; rather, they function as enablers to the head of the relevant capability.

If your FSI is not quite ready for such an agile approach, there is one simple use case for digital partnerships. During a recent conversation with a former Head of Partnerships at a $50B FSI, I inquired about the impact of digital partnerships her team had signed before 2022. She replied, 'Mostly nothing. We were simply asked to sign as many partners as possible to boost our 'digital' multiple by institutional investors.' It worked out to a degree. The company's stock price nearly doubled before investors wised up. Nevertheless, this approach is still more practical than counting on a partnership to accelerate digital transformation on its own.

Preaching Culture Impedes Digital Transformation of FSIs

A newly promoted executive at an FSI reassured his team, 'Empathy will be the defining value of our group,' but my confused expression must have been apparent. He had previously asked me to facilitate a team alignment session with his reports, using best practices from financial services and insurance startups as a guide. However, whenever I brought up the challenges of implementing these practices - such as acquiring new skills, adjusting roles, and adopting a new mindset - he affirmed to his team that they were already highly competent and that empathetic engagement was his top priority. It wasn't until a year later that I discovered the reason for his odd behavior: the head of HR had advised him that he needed to balance out his reputation for being too direct and intelligent to be successful in his new role.

The direct, in-the-open debate was not a norm in typical FSI culture since the late 90s. A public disagreement in a financial services or insurance company would often start with something like 'Apologies in advance, I am about to say something probably stupid, and feel free to shut me down, but what about…', and even then, many FSI managers would prefer to discuss their concerns behind a person's back. In the 21st century, the expanding decadence of the Western world further obfuscated FSI's opaque cultural norms with symbolism like 'empathy' and 'inclusivity.' The resulting culture is meant to create a 'safe space' for understanding & preserving everyone's sensitivity, with the goalpost of no one being upset.

It's no wonder that many FSI employees, including executives, don't want to level up through digital transformation steps. Who would want to jeopardize the status quo of getting paid a lot of money without feeling upset? Employees vent + managers listen + nothing changes = everybody wins. It’s a familiar setting of expensive therapy sessions that makes clients feel good about their life choices without the unpleasantness of addressing the root causes of recurring depression. Such an environment also frees FSI managers from managing employees, making them de-facto senior peers or individual performers. And wouldn't an HR/DEI professional know better than a manager how to understand and validate staff's feelings? The 20th-century style of management is likely to lead to an HR complaint, so more and more FSIs are pushing out the middleman (manager) away from employee management and inserting HR to deal with employees’ concerns, finalize performance reviews, and decide on promotions and salary increases.

Digital transformation is an unfortunate hiccup in this kumbaya environment. By design, a high degree of failure and differentiation in the learning curve steepness requires vigorous debate and tough personnel choices. The clash with a typical FSI culture results in an amebic pace of digital transformation and a constant search for 'silver bullets,' as we discussed in a previous newsletter.

I used to enjoy saying, 'Culture eats strategy for breakfast,' as if I had some secret insight while my audience ineffectively labored in trenches. Preaching enlightened culture is an easy signal of virtue that professional audiences love to hear (a sermon of kindness), without questioning whether the presenter ever transformed anyone including oneself.

However, what if you are not a typical FSI executive who would rather preach culture at conferences while delegating difficult personnel activities to HR? You're willing to endure the discomfort of transforming your FSI’s culture in order to accelerate digital transformation. Let’s proceed then.

In digital transformation, FSI managers’ #1 job is to make themselves redundant by leveling up their employees. The company culture changes when employees become more effective in their increasingly complex roles, i.e., change in process changes culture rather than preaching culture changes process.

To illustrate, let’s compare FSIs to schools. Americans, just like the rest of the world, are shocked by the extremely low proficiency rates despite the highest spend-per-pupil across the US school districts. The best illustration is New York state, the highest spender, double the country average. But the outcomes are far from the best in the nation, they are below average (and trending down):

A typical teacher in the NY state school is like a typical FSI manager doing a lot of activities with students (employees), and it’s mostly a waste of everyone’s time. Lack of leveling up would be bad if the spending was relatively low, but for the top-spending school district (or FSI embarking on expensive digital transformation), it takes willful ignorance to participate in such a scheme.

The foundational employee management practices were perfected by the end of the 20th century and were then enhanced for digital transformation by 2012 (see this newsletter). Leveling up always starts with a manager’s understanding of how the operating model is supposed to function for each role profile. Ray Dalio, the founder of Bridgewater Associates, came up with person-level schematics (machine = design + people).

Please note the paramount importance of the first step. In order for an FSI manager to effectively level up someone to take ownership of a machine, they must first possess the necessary competencies themselves. One potential 'red flag' of a manager who may struggle with digital transformation is if they frequently repeat the adage 'hire people brighter than me and get out of their way,' which could indicate a lack of interest or skill in managing people.

This demanding approach is another reason why digital transformation cannot be executed successfully across an entire FSI. Most financial services and insurance companies lack a critical mass of managers and employees who are eager to level up in every department. Typically, only 10-20% of their staff fall into this category, and the best ones have 30-40%. For FSI executives willing to embrace this painful process, the key is to focus on transforming pockets of the organization where there is enthusiasm for change. Leave the preaching about culture change to other colleagues.

Other FSI Digital Transformation Weekly Reads

Digital transformation: Key considerations for banking leaders