A Spectre is Haunting FSIs — The Spectre of Project Managers

Also in this issue: The Myth of FSI Disruption and Its Irrelevance for Digital Transformation

A Spectre is Haunting FSIs — The Spectre of Project Managers

When transitioning from IT projects to IT products, and even to Value Streams & Platforms operating models, many FSIs tend to retain the bureaucratic role of project managers but with a different, more Agile-sounding title. Fidelity, for instance, which is one of the most digitally mature players in money management in the US, might have over a thousand individuals with the title "Scrum Master."

Fidelity’s description of the Scrum Master role typically involves a combination of scaling Agile practices and tools. However, there is no mention of the Scrum Masters' role in making themselves redundant by leveling up team members, which would ultimately allow them to transition to the next team without increasing their numbers.

Why would even leading FSIs be supportive of employing such enormous numbers of intermediaries with no desire to constrain their expansion?

Distinguishing Project Management from Agile Management

At first glance, both project and product management share a common objective: 'get things done.' However, a crucial distinction lies in how they achieve this goal—delivering a one-off project with a focus on meeting requirements according to deadlines and budget constraints versus continually improving product KPIs (or OKRs).

IT project managers’ raison d'être is to establish predictability rather than chaos, with little concern for the business impact of their projects. Hence, in a typical FSI, project managers often devote an excessive amount of time to fudging financials and aligning with senior stakeholders rather than leveling up team members and maximizing their business impact.

Given that every FSI executive is aware of the above points, the industry has been embracing what seems to be a more effective approach to delivering digital capabilities for over a decade, based on Agile methodologies. A typical transformation journey begins with an IT Product operating model and eventually evolves into business-led cross-functional teams that directly generate business impact, along with shared IT-led teams that support business efforts.

The naming conventions vary significantly between FSIs and fintechs. However, I prefer to refer to those teams as Value Streams and Platforms, as it is the most self-explanatory terminology. While there is an ultimate level of KPI-centric operating model, most FSIs are unlikely to reach it in the next decade, making it less relevant. Achieving proficiency at each phase is extremely challenging, primarily because it necessitates a radical shift in how executives and employees fulfill their responsibilities.

To expedite digital transformation, project managers are substituted with Agile experts whose sole responsibility is to rapidly coach others in advanced techniques, ultimately rendering themselves redundant. This approach entails elevating the digital capabilities of every stakeholder, from junior employees to senior executives, in their respective roles.

Naturally, these temporary Agile coaches must have a deep understanding of what good looks like for each team role in the context of significant product scaling. But what proportion of the 1,000+ Fidelity 'Scrum Masters' had such experience before their hiring? Hopefully, it is at least 10%, but what could the other 90% really teach Fidelity employees?

The Reality of Agile Management in Traditional FSIs

The root cause of having such a density of intermediaries is that the majority of FSI executives prefer to avoid the process of leveling up. They believe that "you can't teach an old dog new tricks" and have no desire to engage in hands-on work. As one C-level executive explained to me, "I did hands-on work for 20 years, and I am done with that."

Instead, these executives are hoping that a new digital routine among employees or a new digital tool could achieve transformation on its own, perhaps with some high-level oversight. This approach has led to a plethora of Agile workarounds, where some parts of the organizations are speeding up their processes while top-down management clings to the status quo. These workarounds are sometimes humorously referred to as 'wagile' (a combination of 'waterfall' and 'agile') and with extensive methodologies like SAFe.

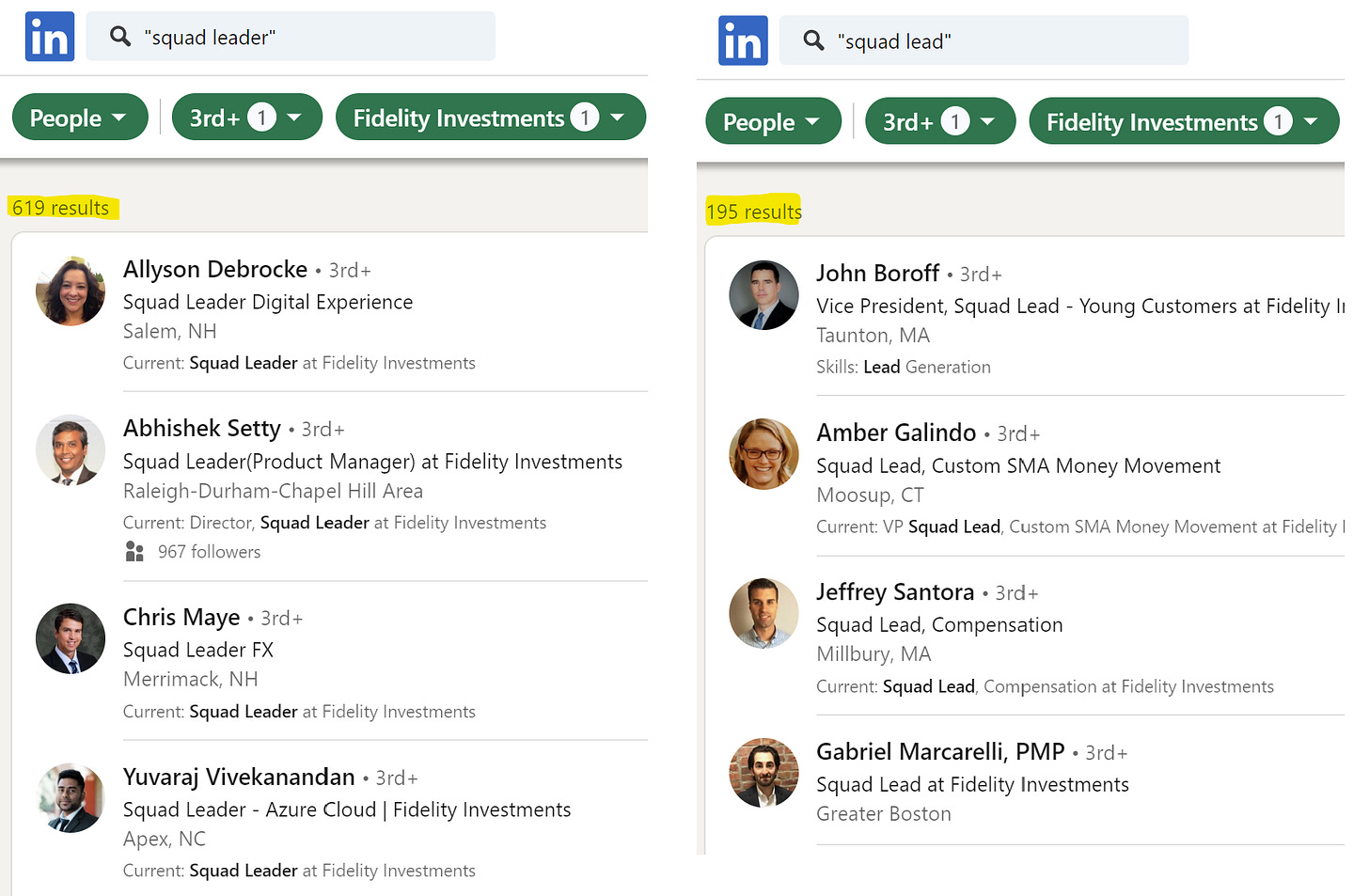

Besides a legion of 'Scrum Masters,’ Fidelity also employs hundreds of 'Squad Leaders' and 'Squad Leads.' These roles are intended to be permanent and are meant to lead business products and shared digital services (aka 'Value Streams and Platforms'). However, the question remains: why would Fidelity need hundreds of them?

The answer becomes self-evident when you review the description of these roles. Instead of emphasizing a significant P&L impact or scalability, they essentially resemble the same project management role from the 20th century, albeit with more contemporary jargon.

As discussed in another newsletter, in a genuine Agile environment, both vertical and horizontal teams are designed to substantially improve specific metrics while maintaining minimalistic team compositions with T-shaped profiles.

Sometimes, a particular team may not be making a significant impact, but it still provides a crucial service. In such cases, the optimal solution is not to appoint hundreds of team leads like Fidelity but to consolidate several workstreams under a single lead, optimizing for KPIs.

What Can Counteract the Allure of Top-Down Management?

Fidelity serves as an apt example of the formidable challenge FSIs face in relinquishing hierarchical management structures that prioritize control and consistency over ROI and business impact. Much like many other FSIs, Fidelity's leadership has witnessed the pitfalls of attempting to expedite digital transformation from the top-down, rather than empowering and enabling business units to chart the most suitable course. And, yet, it keeps the same top-down approach.

15 years ago, Fidelity was the market leader for institutional clients in the US. Instead of trusting that division to maintain the lead, the CEO and enterprise leadership insisted on accelerating their digital transformation, spending more than $10 million on management consultants. The odd goal was to catch up to the digital maturity of the consumer division without regard for fundamentally different client needs. Coincidentally, Fidelity’s institutional business has fallen significantly behind, now in 4th place, far behind the new leaders.

The same unnecessary uniformity is driven within Fidelity's technology. Rather than heeding divisions’ requests to be left alone, they have been pushed to use enterprise-wide solutions that were optimized for efficiency in remote locations in the US and India.

The depth of embedding, both in mindset and scale, of this new Agile bureaucracy is overwhelming. Even executives who understand how counterproductive it is, feel powerless to do anything because the majority of their peers are benefiting from growing budgets and reporting layers.

Nothing personal, but with potentially over 2,000 Fidelity employees in those "Squad" and "Scrum" roles, they are competent enough to come up with new activities for themselves. Moreover, due to the network effect, an increasingly large part of their weekly activities is spent on interacting among themselves. This self-perpetuating leviathan is unlikely to reverse at this scale unless a severe recession or new leadership intervenes.

What Good Looks Like in Agile Management?

This problem is not unique to FSIs. Even leading digital natives are shocked to discover the self-perpetuating nature of their product management ranks. The debate was reignited earlier in 2023 when Airbnb's CEO, Brian Chesky, declared the transition of their pure product managers into product marketers.

A consensus among the most effective companies is that some form of “product manager” is required for large scaling. T-shaped profiles for engineers mean they could play a role as product managers when needed, but this isn't their specialty and may not align with their preferences. Hence, for critical scaling efforts, a dedicated top-notch product manager would pay for themself, but for smaller goals, management overlay could be sporadic or even absent.

FSIs like Fidelity are unlikely to undergo a radical transformation by someone as hands-on as Elon Musk, who reduced his workforce by 80% while deploying significantly more impactful features. However, financial services and insurance companies could still learn from the best fintechs and embrace best practices within one of their leading divisions, hidden initially from the Enterprise-level group's radar.

When hiring a pilot product manager or squad leader who knows what good looks like, FSIs could learn from Wise, a leading fintech, in their approach to finding the right background. To achieve success in driving significant business impact from a digital product, such candidates should obviously demonstrate a specific track record. FSIs may not be able to attract dozens of such recruits, but it's feasible to lure ONE person by promising direct involvement from the LOB head.

To eventually demonstrate to the rest of the FSI the significantly greater impact that the right Agile team can achieve, each of its members should possess a T-shaped capabilities profile, which includes experience in product management. Here is how Wise describes the profile of a backend engineer.

The spectre of project management will continue to haunt FSIs, corroding all effective practices until truly drastic measures are taken. Don't wait; start a counter-revolution in your area today. You might be surprised to find colleagues who would root for the underdog. And it's more fulfilling than pretending to trust the uniformity of top-down management.

The Myth of FSI Disruption and Its Irrelevance for Digital Transformation

When an FSI executive mentions "disruption" of financial services or the insurance industry, it is usually a tactic to secure a bigger budget and get approval for a large vendor deal. As for the real disruption of incumbents, despite two decades of well-funded startups, major traditional players continue to get on. As discussed in another newsletter, when a sizable FSI does fail, it's extremely rare and usually occurs for the same reasons as 500 years ago, not due to a novel disruption: a combination of management greed and excessive risk-taking.

Furthermore, the more complex the FSI product and client segment, the less likely it is for a startup to disrupt it. It's much harder to build a superior underwriting model than a snazzy front end. Hence, it's not surprising that the most prominent fintechs in the West started as payment companies: Revolut, Wise, Cash App, and others. Payments also carry a risk of fraud, but it's less intensive than providing outright loans.

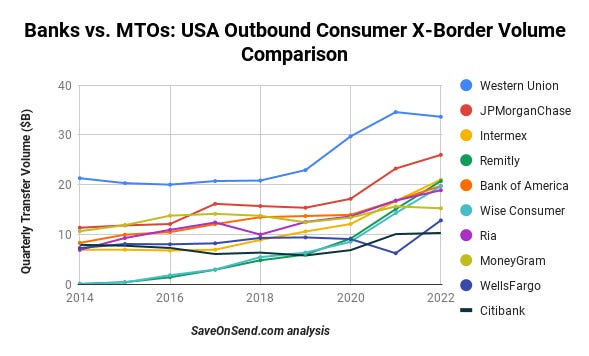

But even in the payments sector, the incumbents have not disappeared. For example, in consumer cross-border money transfers out of the US, fintechs like Remitly and Wise have experienced significant volume growth in the last decade. However, some money transfer incumbents and banks have also grown by almost as much.

How is it possible that everyone is experiencing growth? This is because financial services and insurance are not a zero-sum game. As the global economy expands, it significantly increases the demand for FSI services and reaches more customers. So, unless a disruptor is truly massive and continues to grow rapidly, the incumbents maintain their position.

Moreover, we have yet to discover a startup in financial services or insurance with the disruptive determination of Amazon, Netflix, or Spotify. Typically, a successful startup targeting traditional FSIs becomes more interested in launching additional products in more regions, which naturally reduces its chances of disrupting a specific niche.

While Remitly used to achieve over 100% growth, it has now declined to 40% growth in the cross-border consumer space, and Wise has decreased to 15%. Without literally pushing incumbents out of business and taking over their customers, indefinite fast growth is impossible.

Another interesting case in payments is merchant acquiring. According to BCG’s latest payments report, the disruptors are rapidly increasing their combined market share:

“Digital natives (such as Adyen, Checkout.com, and Stripe) and ISVs (such as Toast and Square) are winning a growing share of the acquiring market. Three years ago, these players accounted for roughly 35% of acquiring market revenues in North America and Europe combined. Today that figure has increased to 40%.”

Indeed, it sounds like disruption; however, some of the largest traditional players, including banks and banking conglomerates, continue to grow. While their growth may not be as rapid as that of digital natives, it still enables them to maintain their presence in the market, and they are not at risk of going out of business.

So, if there is no real disruption, what's the point of digital transformation? Precisely. When someone suggests that your FSI will be wiped out by startup disruption, that person is attempting to create fear because they lack the data to make a valid argument. The purpose of digital transformation is not to avoid bankruptcy but to generate significantly more revenue in segments that could greatly benefit from digital capabilities.

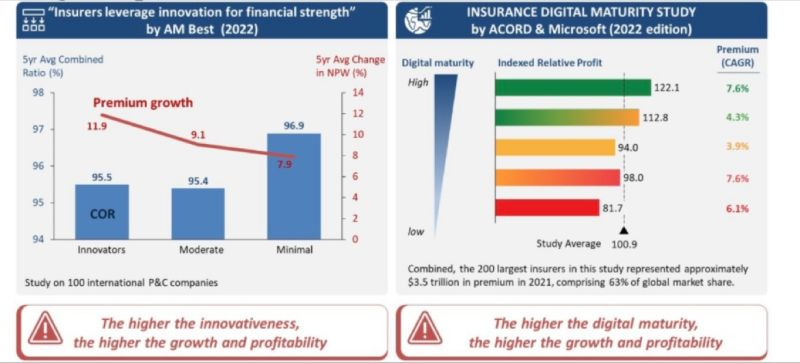

The good news is that more and more segments fall into that category. According to a recent report by FIS and the IoT Insurance Observatory (Nick Dunn and Matteo Carbone), there is a clear advantage to having higher innovation and digital maturity capabilities in insurance. The lagging carriers still show decent profitable growth but are visibly performing behind their more advanced peers.

Are your FSI leaders more motivated by the fear of disruption or by the opportunity to generate profits for shareholders and outperform their peers?

Other FSI Digital Transformation Reads

How Fifth Third Is Delivering on the Promise of Digital Transformation

The dark arts of digital transformation — and how to master them