FSI Executives Repeat Stalin's Mistake in Transformation

Also in this issue: Digital Transformation Makes Money by Monetizing Pain Points, Not by Creating New Demand

FSI Executives Repeat Stalin's Mistake in Transformation

By 1935 Stalin came to a profound realization, recognizing a major mistake in his approach. In his quest to make the USSR competitive, he had invested precious billions into Western industrial equipment. However, there was a scarcity of talent capable of harnessing the full potential of this technology. To acquire these funds, Stalin resorted to confiscating agricultural products, resulting in the starvation of millions, just to see the world's best technology underused. It was at this critical juncture that Stalin initiated a nationwide effort to level up the workforce, declaring the rallying cry, "Talent Solves Everything!"

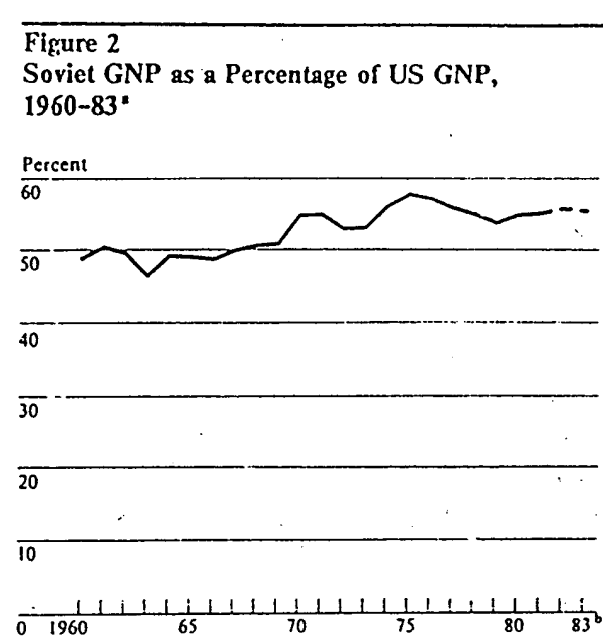

From that point onward, the USSR became intensely focused on education and training. In 1984, CIA research revealed that the Soviet Union not only equaled half of the US gross national product but was also on an upward trend.

How was this possible without capitalism? Apart from the military, you can likely deduce one other spending category in the Soviet Union that was comparable in size to the US: Education.

The primacy of talent over material resources has been a consistent theme throughout history at a country level, with a recent and prominent example being Singapore, now ranking among the top 5 countries globally by GDP per capita. The question arises: is this same axiom of talent primacy applicable to FSIs? How do FSI executives perceive the talent-versus-technology sequence in the context of accelerating digital transformation?

What Would You Change with a Magic Wand to Accelerate Transformation in Your FSI?

Broadridge posed this question to 500 executives in FSIs worldwide, and surprisingly, the predominant responses focused on technology and analytics.

It's as if someone asked 500 basketball coaches how to build a better team faster, and instead of wishing for players like those from the Chicago Bulls circa 95-96, their choice was better sneakers and training data. Similarly to Stalin before 1935, many FSI executives seem to equate transformation primarily with better equipment. They hope that by replacing legacy technology with modern and integrated platforms, they will finally be able to drive higher output in transactions and users.

In other newsletters, we frequently address the fallacy of prioritizing velocity as the ultimate goal of digital transformation. Since velocity, rather than achieving a substantial P&L impact, is commonly emphasized as an objective, business executives often find it convenient to complain about the slowness of their IT counterparts. On the other hand, IT executives conveniently attribute the sluggish pace to legacy technology.

Old technology → ??? → Modern technology → ??? → Faster releases → ???

Both sides, Business and IT executives, frequently avoid addressing a crucial question: "Does our FSI employ talent across various touch points with a proven track record in implementing modern technology and leveraging it at an accelerated pace?" In this context, it's ironic to see what surveyed executives consider their most significant challenge in digital transformation: Balancing innovation with daily business operations. What those executives may not fully appreciate is that if they are grappling with the complexities of outdated legacy technology, their ability to succeed in scaling innovation becomes even less likely.

Comparing Technology and Talent for 10X Growth

In 2016, a year after his dismissal, former Barclays CEO Antony Jenkins founded a core banking vendor, now known as "10x Banking." Similar to many of his former C-Suite peers in the financial services industry, Antony firmly believed that technology could be a game-changer. Therefore, he aimed to create a core platform 10 times better than the systems banks were using at the time.

Capitalizing on the fintech enthusiasm between 2017 and 2021, 10x Banking raised over $250 million. However, the challenge of building a core platform that is ten times better for FSIs was already significant back in the 1990s. In recent years, the competition has intensified even more with the emergence of new vendors, along with established incumbents and fintechs creating their own platforms.

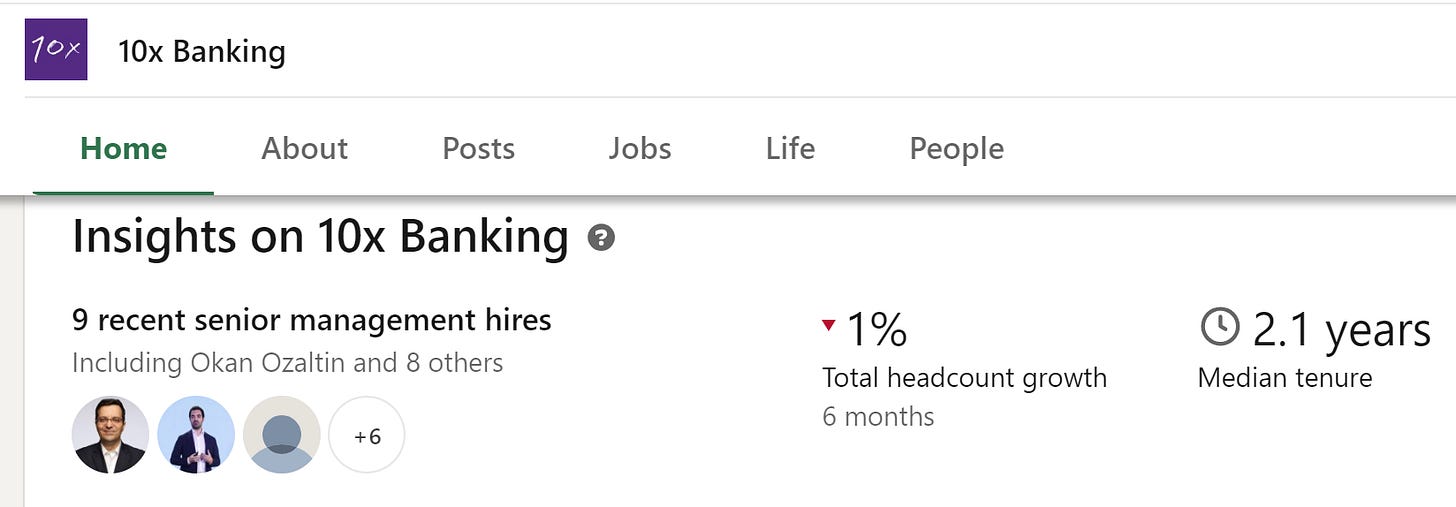

The inability to demonstrate a "10X" improvement over existing vendors, along with a misplaced faith in the preeminence of technology, has led to performance that falls below expectations. Currently, 10X Banking is dealing with a stagnant employee headcount, with only one open position available in non-technical areas. Employee reviews are generally average, and the company has just two published clients. Moreover, there is a lack of transparency regarding their financial performance.

In fairness to 10x Banking, the failure to achieve a transformative improvement is a common occurrence for any new technology designed to transform traditional financial services and insurance companies. It typically takes the industry two to three decades to fully comprehend the trade-offs of any innovation, including the understanding that it, by itself, provides only marginal improvements.

The most recent hope for FSIs to achieve a 10x jump in performance lies in Generative AI. The first year has been somewhat underwhelming, as discussed in another newsletter, but let's envision the ideal scenario where it could become a game-changer for FSIs. To reach this transformative state, every playbook must be programmed, and each application needs to be re-architected to facilitate automated and real-time implementation of the following steps:

Analysis of P&L improvement opportunities → Changes to CX across all customer touch points → Changes to UX across all related applications → Changes to code across internal/external APIs → Change management for affected employees and vendors → Change management for impacted customers

Currently, even the best fintechs handle each of these steps manually, often in an ad-hoc manner, and with incomplete playbooks. It may take 5-10 years for a leading fintech or vendor to automate just one of these steps, even with batch data and relying solely on machine learning. Even if Generative AI manages to address all these steps in the next 20-30 years, achieving a 10x differentiation will not primarily come from the technology itself. Instead, it will stem from the talent responsible for developing and effectively deploying it.

Moreover, it won't be just Generative AI with the right talent. The key to success remains consistent: for innovations like APIs, Cloud, DevOps, Codeless, AI, and others to have a 10x impact, they must be utilized collectively and harnessed by the right talent across all touch points.

Such a lengthy innovation process means that FSI executives would be wise to avoid adopting it until they have individuals who can swiftly harness its potential. This decision is not only about avoiding the waste of company budgets but also a matter of job security. Coincidentally, the lack of short-term impact played a role in Antony Jenkins' firing from Barclays. During his three years in the role, Anthony introduced numerous well-meaning changes, but they failed to deliver a substantial P&L impact, as noted by the Board Chairman at the time:

"What we really need is profit improvement and returns improvement and that is a different skill."

The Horse Before The Cart

Fortuitously, from the same Broadridge survey, some FSI executives recognized the crucial role of talent, with one-third highlighting the "digital talent shortage" as one of the secondary challenges.

Recognizing the significance of talent versus technology similarly distinguishes the successful fintechs and insurtechs from the struggling ones. Swiftly implementing new technology and expanding into new products or regions is easy, while capturing profitable market share from incumbents is hard. For leading fintechs, the paramount importance of talent, particularly those who share the founders' sense of purpose and impact, has become a commonplace belief, as exemplified in this statement from a co-founder of Wise:

“It’s a cliche, but the importance of the early team, the first 10, 20, 30, 40 people, can’t be underestimated — because they will end up hiring the first few 100 people. That ends up kind of building the culture of the company.”

In response to this point, a defensive FSI executive might argue that it's relatively easy for fintechs to prioritize talent because they begin with a clean technological slate and don't have the burden of technical debt. However, this perception doesn't align with reality. Fintechs often face tremendous pressure to discover a product-market fit through experimentation and then scale it rapidly. In this process, they frequently accumulate technical debt (the monolith) and duplicative tools.

The contrast between a traditional FSI and a leading fintech becomes evident a few years later when the fintech restructures its operating model to methodically tackle technical debt, as illustrated in this example from Wise.

Level Up Talent or Get Out of the Way

In my discussions, a typical FSI executive often has a blind spot when it comes to evaluating their own capabilities and those of their team. Instead, they frequently attribute the lack of progress to less competent peers and outdated technology. They may genuinely be uncertain about what excellence entails in the next phase of digital transformation and may lack a manager who can recognize and address these blind spots.

To confirm if you have a significant blind spot about your personal talent gap and that of your reports, consider this exercise: Write down what you and your team are doing fundamentally more effectively than a few years ago in the same roles. If you can't identify any transformative improvements, that could be an indication that there is a talent gap that needs to be addressed before focusing on more advanced technologies.

The key distinction between a manager and an individual contributor lies in their duty to level up their reports. Nevertheless, many FSI executives prefer to function more as career coaches, emotional confidants, or subject matter experts (SMEs). These executives frequently identify with the famous quote by Lee Iacocca, "I hire people brighter than me and get out of their way." If their FSI has to transform, those executives must decide: do I learn how to level up myself and my reports, or do I get out of the way? Because in digital transformation, Talent Solves Everything.

Digital Transformation Makes Money by Monetizing Pain Points, Not by Creating New Demand

Steve Jobs and Elon Musk's brilliance created a trap for the less ludicrously talented founders and executives. Steve and Elon's capacity to initiate new product categories that generate immense value led the rest of us to believe that generating new demand is feasible. This misconception caused even the most exceptional digital brands to be perplexed by the lack of demand during the initial 2-3 years until they discovered how to incentivize their customers to continuously try their product.

Similarly, the myth of replicating iPhone- or Tesla-level demand persists in financial services and insurance. Many of the efforts by traditional FSIs to create entirely new products without addressing clear pain points have proven unsuccessful (see this newsletter). Even the digital initiatives that manage to survive often struggle to make a substantial impact. Take, for instance, the largest digital subsidiary among European FSIs, BoursoBank, with 5 million customers. It might seem quite impressive, right?

However, nearly three decades after the initiation of that digital unit by Societe Generale, it still generates less than 50 million in quarterly net income, which is less than 5% of the parent company's overall results.

Digital transformations are so costly and risky that they necessitate customers to spend significantly more on new or improved FSI products afterward. However, when there are no clear pain points, this economic model becomes unlikely to succeed.

In certain FSI niches, transformation might not only be unprofitable but also counterproductive. For instance, during the last 5 years of working with Wealth Management businesses, I have yet to encounter use cases where decade-old technology wouldn't suffice. Furthermore, the introduction of digital features to Wealth Management clients is often met with suspicion, as it may be perceived as an attempt by the FSI to diminish the personal, offline connections that clients value the most, often built over decades with their advisors.

Telematics in auto insurance provides a more nuanced example of demand creation versus addressing pain points. Even after more than two decades, the concept of creating an entirely new class of products based on capturing a driving record remains a question mark. However, when auto insurance companies more recently started using telematics to address pain points in their claims process, such as reducing manual labor and fraud, they achieved results much more swiftly.

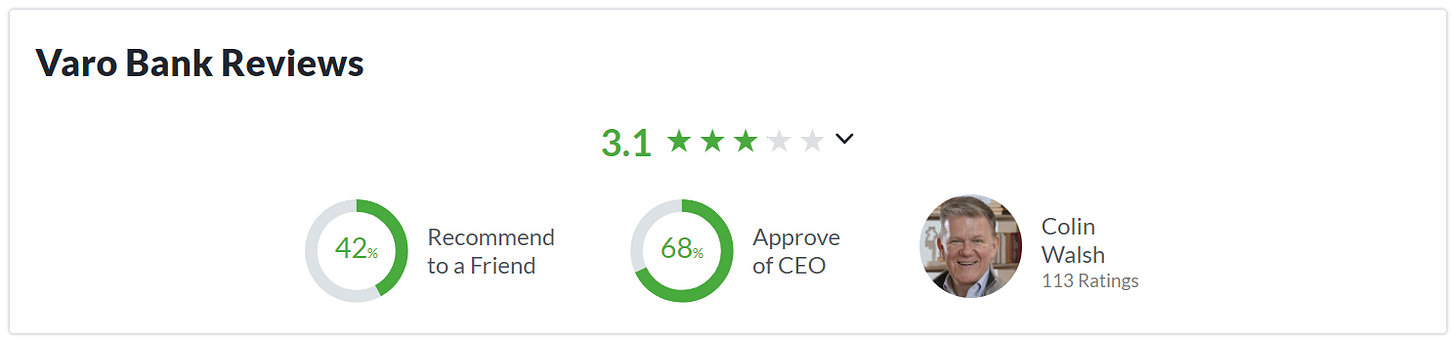

Even some strong fintechs serve as case studies illustrating the importance of addressing customer pain points rather than relying on creating demand with a superior solution. After launching in 2015, Varo became the first all-digital nationally chartered U.S. consumer bank in 2020. It also raised $1 billion to date, primarily focusing on a lower-mass segment.

Nonetheless, Varo is down to only a 15% growth rate, with revenues and growth times smaller than leading peers such as Cash App and SoFi, while operating at a loss.

The reason for this predicament is that Varo keeps launching a myriad of products in the hopes of creating a superior integrated solution. One of Varo's recent launches was another P2P payment feature for its customers, which the CEO confusingly explained as a way to lower the cost of acquisition. Is there any consumer left in the US who is so dissatisfied with their domestic money transfer options that they would switch their banking provider for something better? A fintech expert, Alex Johnson, summarized everyone's surprise:

“Varo rolled out a new P2P payments service called “Varo to Anyone”. It’s built on the card rails and is the company’s third(!) P2P payments capability. I have no idea why they’re going this hard at P2P.”

A persistent focus on creating demand often leads to reversals and layoffs, as Varo has already experienced in 2022 and 2023. This, in turn, results in poor employee reviews:

What could be the explanation for such a strategy despite a decade of evidence for fintechs and two decades for digital natives that it doesn't work? Varo's founder and CEO inadvertently explained it in a recent podcast. His analogy for Varo's mission was upgrading Walmart-type customers into a Whole Foods experience (start at 16:35).

The obvious fallacy here is that Walmart customers might still have some pain points, but a lack of sophisticated produce is not one of them. Here is how Whole Foods' founder explained it:

“Whole Foods has opened up stores in inner cities. We’ve opened up stores in poor areas. And we see the choices. It’s less about access and more about people making poor choices, mostly due to ignorance. It’s like a being an alcoholic. People are just not conscious of the fact that they have food addictions and need to do anything about it.”

Colin Walsh's background might shed light on why he is stuck on such a counterproductive strategy. He developed professionally at American Express and Lloyds, both known for offering higher-end solutions.

Similar to Whole Foods' founder, it could be admirable that Colin wants to introduce lower-income customers to the solutions that people in his social circle use, but what makes money is addressing their real pain points.

Other Insightful Reads

Voya Financial’s Technology Gets an Overhaul to Ready It for AI

Q&A: An Insider’s Perspective on the Shifting Trends in Banking

Liberty Mutual’s CIO Articulates The Ingredients To Foster A Tech-Forward Insurance Company