4 Signs an FSI Executive is in a Digital Bubble and How to Break Free

Fintech fans still believe in victory, digital-only growth is unsustainable, digital is a plus for Term Life and not for Wealth Management, the danger of a digital-only mindset, how to break free

4 Signs an FSI Executive is in a Digital Bubble and How to Break Free

If you are a financial services or insurance executive, does any of the following directionally describe your current behavior?

Targeting new segments or products with digital-only solutions before addressing significant growth, profitability, and scalability impediments in the core business;

Prioritizing digital over human-based solutions without personally engaging with end-users on their pain points and preferences;

Launching more digital features before evaluating the impact of existing ones and advancing playbooks in case of failure;

Relying on exalted experts for data points about superb digital-only performance without asking for proof of ROI and sustainability at scale.

If not, congratulations on retaining common sense despite the onslaught of digital-only accolades! If yes, sorry, but this means you are operating in a digital bubble. This newsletter will explain how you got there and help you start developing the operational muscles to break free from it.

The Always Imminent Disruption of Traditional FSIs by Fintechs

Brett King, a prominent influencer in financial services, recently expressed bewilderment shared among fintech experts, founders, and VCs: why would a traditional FSI invest any effort in making their physical locations as inviting as an Apple Store?

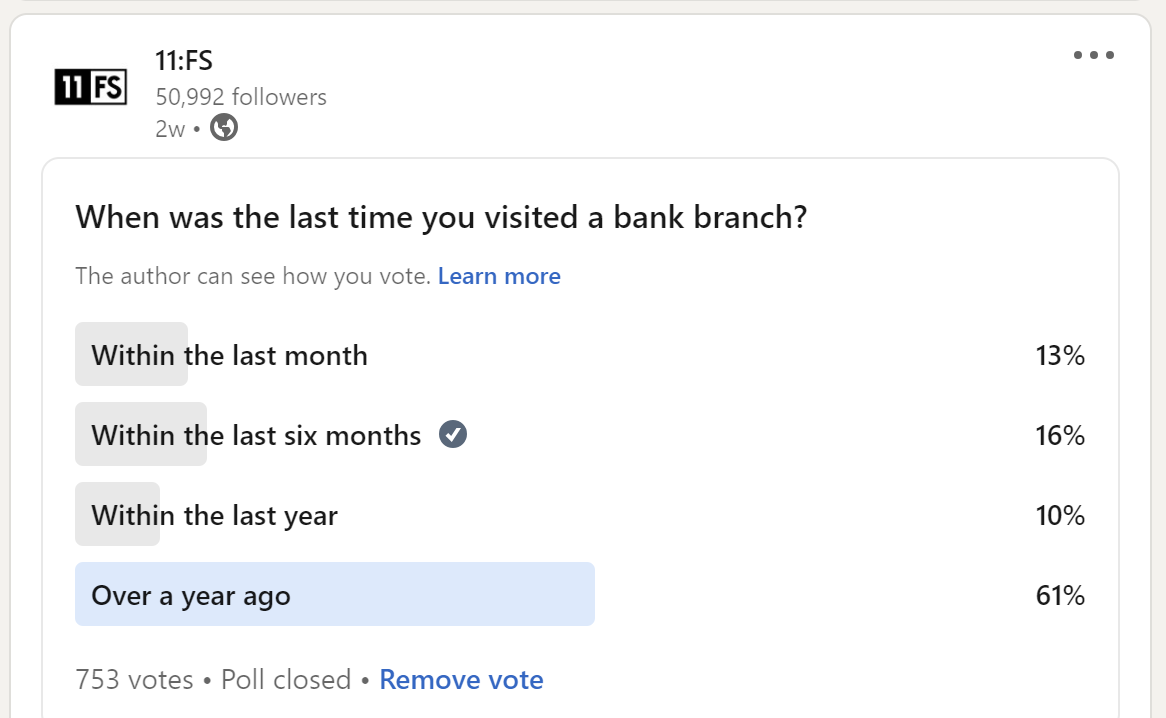

Such a sentiment is not illogical—services are indeed different from goods—and the implied conclusion is that traditional FSIs are clinging to their legacy footprint instead of setting their virtual products free of those chains. It’s also understandable why fintech experts and executives don’t appreciate nuances of digital vs. physical attributes across different verticals and consumer segments. Most of them don’t use human-based channels and thus don’t naturally perceive that need for others:

In their view, akin to humans facing an existential threat of global warming, traditional FSIs always seem 10-15 years away from massive disruption:

To be fair to them, it takes years to understand the detailed trends in each product line in each region, and for a broad fintech expert, it would be impossible. Hence, they have to look for the broadest, black-and-white pattern. Unfortunately (or fortunately), the financial service and insurance industries are way more nuanced and fluid. Even the best-performing fintechs are learning about their “blind spot” on this topic as we speak, and FSI executives could also learn how to break out of their digital bubble from the following examples.

The Myth of Sustainable Digital-Only Secret Sauce

Remitly, one of the best-performing remittance fintechs globally, shared that view of digital-only superiority in 2020 when it launched a bank for migrants. How hard could it be to cross-sell millions of their existing happy customers among migrants in the US? Remitly’s differentiation was a bank account without the US-issued ID/SSN, and it even found a chartered bank willing to act as its private label:

Three years later, the neobank was shuttered to "redeploy resources to higher returning investments, targeted at our core remittance customer." Remitly discovered that only a minority of their customers were underserved, and those required heavy in-person engagement in their native language.

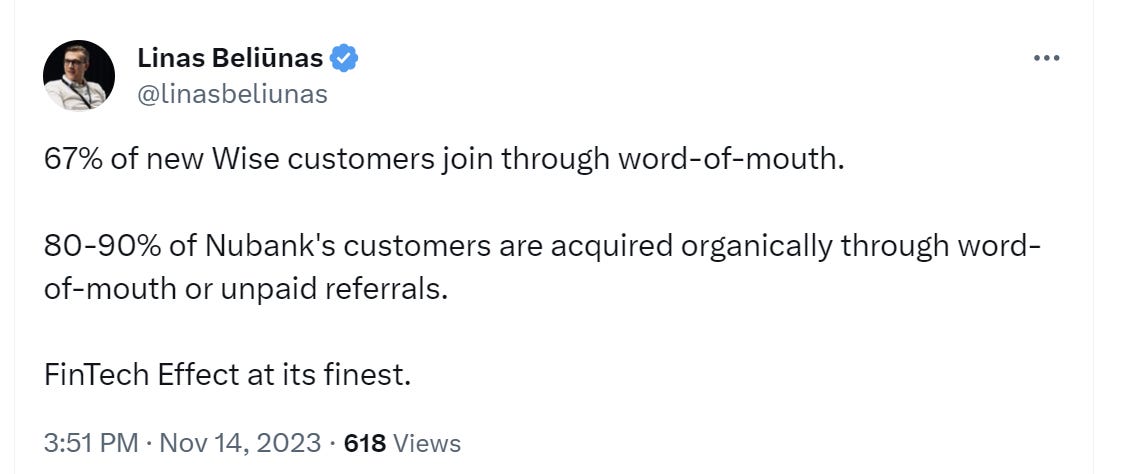

Is Remitly’s neobank fiasco an odd exception while the digital wave is rapidly crashing the physical fortifications across the world? Many experts still think that fintechs’ digital-only model has a superior power in organically attracting consumers through word-of-mouth:

Those are very impressive historical numbers, and Wise and Nubank’s $5-10 customer acquisition cost is remarkably low not just when comparing it to traditional FSIs but even to peer fintechs. Wise’s main fintech competitor, Remitly, is spending 5X on marketing as a proportion of revenues. But before an FSI executive feels inferior from this performance data, the right question to ask is whether this channel has a runway at scale.

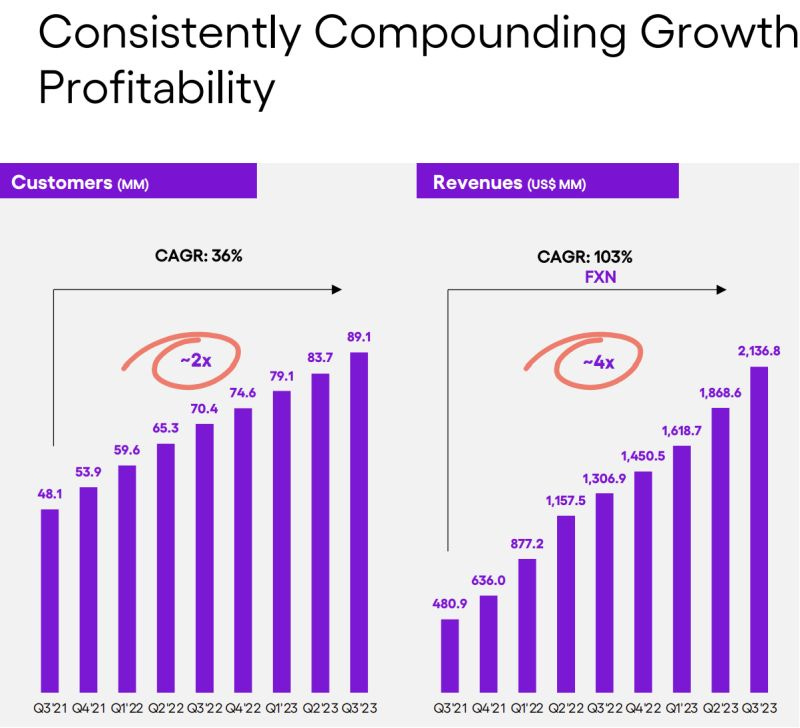

The title in Nubank’s Q3 2023 presentation is a good exercise in that regard. It highlights consistently compounding growth, which is the best evidence of a fintech discovering a secret digital-only sauce. Reflect on the data on their slide for one minute to spot an issue before reading further.

The "2x" and "4x" highlights, along with "36%" and "103%," are masking Nubank’s rapidly decelerating growth, which is literally the opposite of "consistent." In the last year, the growth rate declined for:

Customers: 46% -> 26%

Revenues: 172% -> 64%

For Wise, it is an even worse story: the volume growth in its core business, consumer money transfers, collapsed from 49% to 8% in the last year.

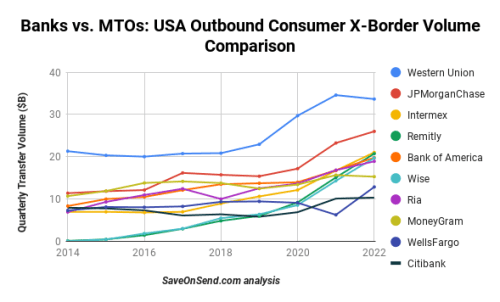

Hence, the scale attained by inexpensive referrals for Nubank and Wise thus far is unlikely to expand sufficiently to disrupt their main competitors among traditional FSIs: the largest bank in Latin America, Itau, boasts revenues four times that of Nubank while Western Union and Chase transfer 50-100% more consumer volume out of the US than Wise.

Surprisingly, very few fintech experts pay attention to the change in top-line growth. Renowned expert Simon Taylor shared this proprietary insight about Wise:

An FSI executive should always treat such pronouncements with skepticism. Sure, mid-size and small players have been losing share to the leading FSIs for decades, and the trend accelerated with the arrival of fintechs. However, the pie is also growing, so losing share doesn’t necessarily equate to losing business. The cause for alarm about the digital wave would be if any top bank indeed lost most of its business to a fintech.

Let’s use the US banks’ Call Reports to confirm if Wise has poached customers from incumbents en masse. In short - nope, it hasn’t. The top 4 banks are responsible for roughly 75% of all consumer cross-border transactions and 50% of that transfer value. Between 2014-2022, collectively, not only did they not lose most of their business, but they have actually doubled their transfer volume:

When founding SaveOnSend almost a decade ago, I was, like Simon, assuming that the banks would be in trouble a decade later, maybe not disrupted but at least stagnating. However, with Wise’s dramatic slowdown in consumer transfer volumes, the banks’ business has been unaffected and will stay so for the foreseeable future.

Another often-parroted point in a digital bubble is the differentiation in customer experience. For example, SoFi's CEO is capitalizing on that potential secret sauce by creating a one-stop shop:

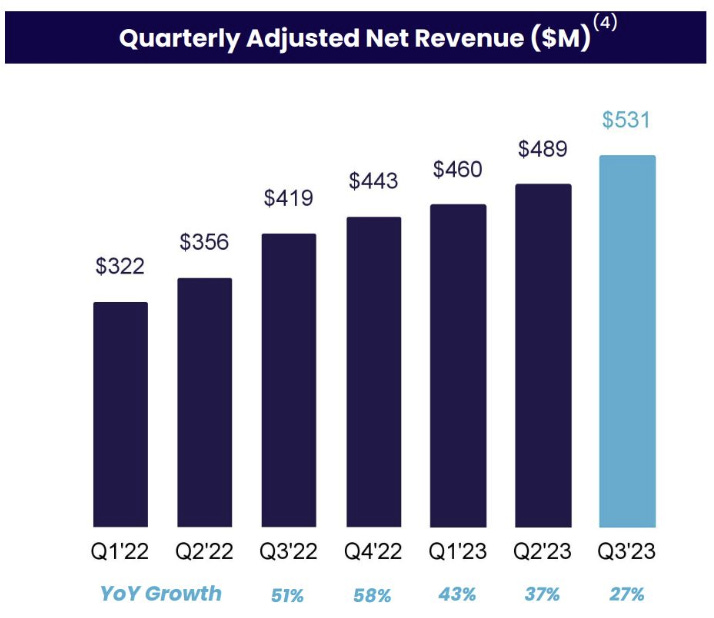

Cool. How is the runway looking for that mission? SoFi’s revenue growth rate has been dropping around 10% each quarter to below 30% in Q3, 2023:

While cheap online referrals or unique customer experiences may seem like sustainable differentiators to an uncritical FSI executive, their effectiveness falls drastically once a fintech approaches the scale of incumbents.

Nubank, Wise, and SoFi are some of the most effective fintechs in the world. Let’s remember dozens of well-run fintechs and digital subsidiaries of large FSIs that have been shuttered. If the offline capabilities of incumbents had no value and were only there as an appendage of evolution, how are the large FSIs doing fine with all those extra costs while their digital subsidiaries have an average shelf life of 3 years?

A Tale of Two Verticals: Term Life vs. Wealth Management

Charles Dickens' "A Tale of Two Cities" is centered on the history of the French Revolution (1789-1799). A less tumultuous decade, 2011-2021, was nevertheless eventful for startups attempting to revolutionize the financial services and insurance industries. The superlative aspiration of "it was the best of times for fintechs, it was the worst of times for traditional FSIs" was shared by most of us in the industry during that period.

But after trillions were spent on digital efforts in traditional FSIs and on startup funding in that decade, we can now clearly see that a digital-only approach is revolutionary only for specific capabilities within some products, and even there, traditional FSIs could lead the uprising even better than startups.

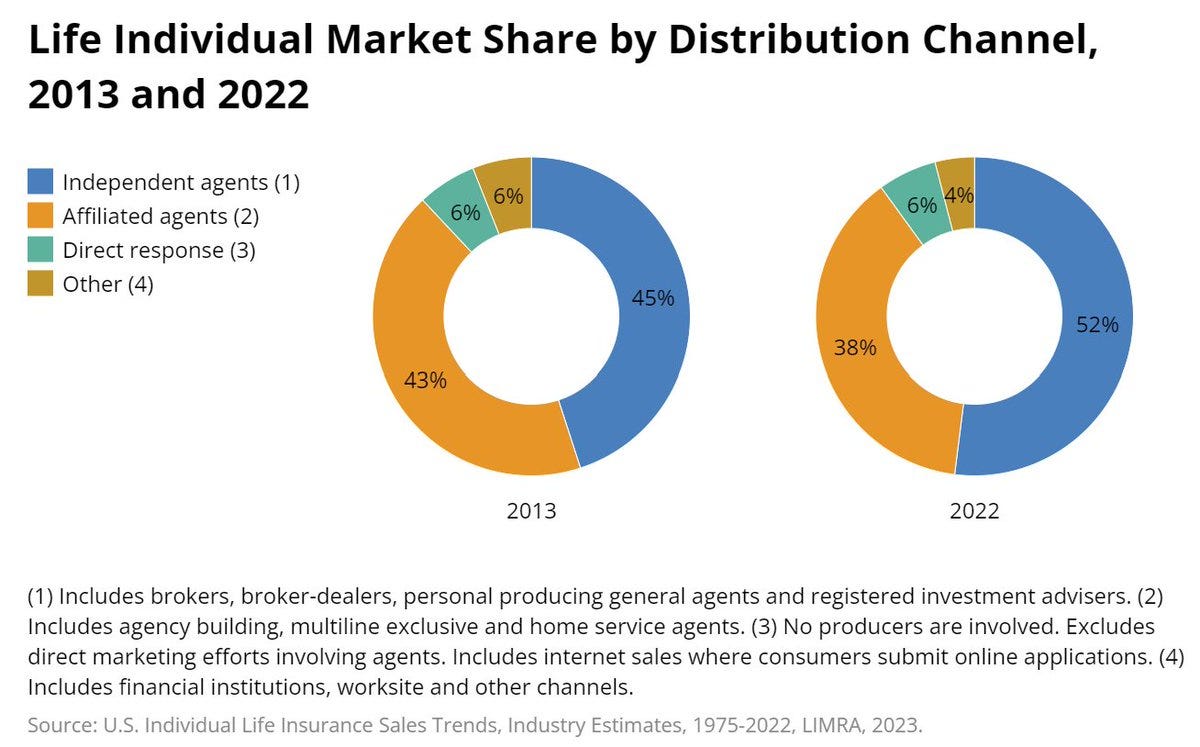

For example, in the last decade, life insurance sales showed no improvement in the tiny portion of consumers who want to buy it digitally on their own. Yes, fintech experts, what you call a "virtual product" is still not being bought virtually despite billions spent internally and on insurtech funding.

Rather than a ubiquitous digital-only approach like the recent shutdown of Haven Life by MassMutual, a skeptical FSI executive should prioritize high-transaction products and functions that could be partially digitized at the opportune moment.

That is exactly what Fred Tavan has done at Legal & General (L&G) in the US. As Chief Pricing Officer who also oversees data science at this life insurer, Fred explained in a recent interview how he seized on newly available sources of consumer health records in the US a few years ago. He partnered with data vendors and transformed how L&G enables independent agents to sell its products. Instead of sending all customers for tests and physical exams, the health risk of a significant portion could be assessed in real-time online:

‘So, two of the things that were the most painful in the process in the past were having to have an exam, fluids had to be drawn. And also to go out and gather all of the attending physician's statements, APS as we call them. And that took weeks and that's what kind of turned the whole journey into like weeks and months process before an underwriting decision was made. Well, now we're able to find more and more vendors that have real time data sources.’

Since L&G moved faster than larger players by introducing real-time capability, independent agents began shifting business, moving it to the #1 spot in the US. Five years ago, L&G policies had no real-time sales, but currently, one-third of them are decisioned and issued in real-time. Rather than stepping into the Digital Bubble, Fred embraced a more nuanced formula:

The right time + the right focus + hands-on transformation = Winning

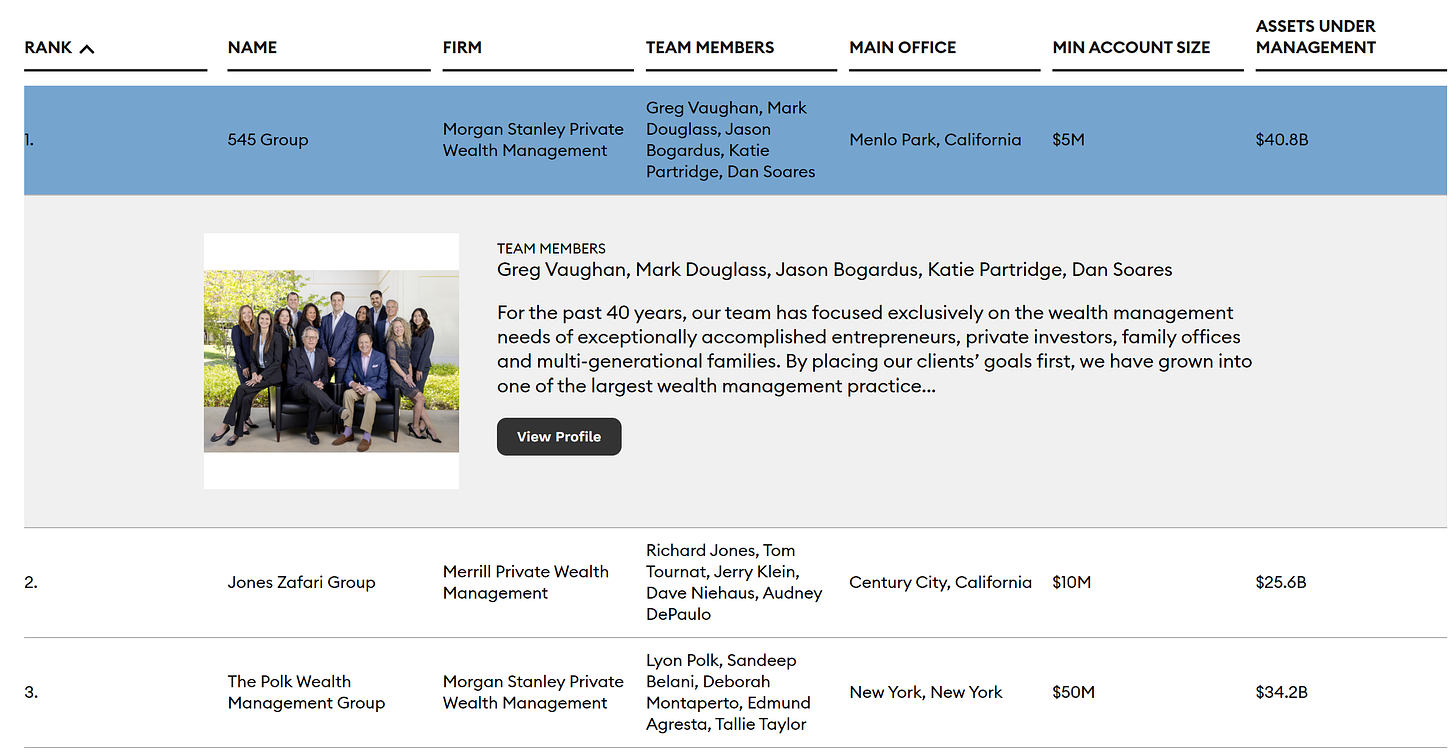

Could a nuanced digital approach be a game-changer for any financial services and insurance product? Nope, at least not yet. Take wealth management as an example. In the recent ranking of America’s top wealth management teams, Morgan Stanley had 4 spots in the top-10, including #1 and #3. Are they leveraging some unique digital capabilities?

Rather than launching cool digital features, Morgan Stanley has perfected the traditional model, expanding, not automating, human engagement. According to insiders, the firm differentiates in three ways:

Encouraging its financial advisors (FAs) to regularly travel to their clients.

Empowering FAs to build lasting relationships with clients outside of work (F1 race, fashionable restaurant, golf games, etc.).

Enabling FAs with a contingent of accountants and lawyers to offer high-touch estate planning solutions.

Similar to Remitly's experience in catering to lower-income migrants, affluent consumers also require a human connection to establish trust in their financial dealings. Their perspective is that human advice is a crucial product feature, not a legacy mistake. Furthermore, many consumers still prefer human connection over self-services. Odd, isn't it?

The Danger of a Digital-Only Mindset

Ok, so, the best fintechs might not have a digital-only secret sauce, and only certain functions in some high-transaction products are predisposed to replace humans, but is there a significant downside to adding digital features?

Many FSI executives get caught in a digital bubble, assuming that every problem has a digital solution without considering serious trade-offs.

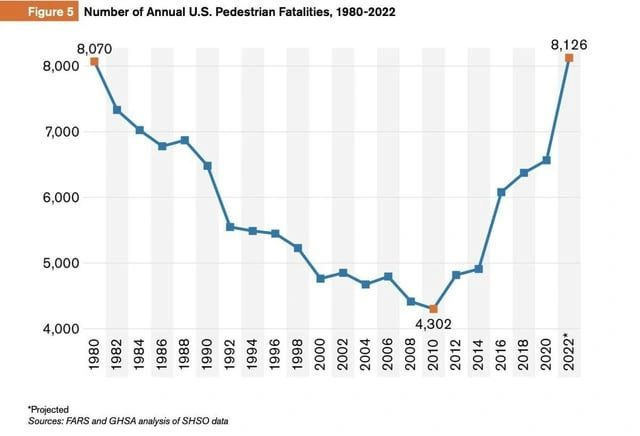

Unfortunately, every digital change has unintended consequences. Even smartphones, while being incredible innovation, have also created some dangerous and growing effects that we don’t fully understand. For example, since 2010, the distraction created by smartphones has contributed to a nearly doubled number of pedestrian fatalities in the US, bringing the country back to levels reminiscent of the time before strict DUI laws were implemented.

As we discussed in another newsletter, customer experience is rightly considered a top priority for FSI executives, but they often miss the circular danger of addressing it with digital means. Chatbots and FAQs for customers, or GenAI tools for the Customer Support staff, can be valuable, but they are also significant contributors to customer dissatisfaction. By jumping to faster launches of digital solutions, new self-inflicting problems could easily overshadow an intended benefit.

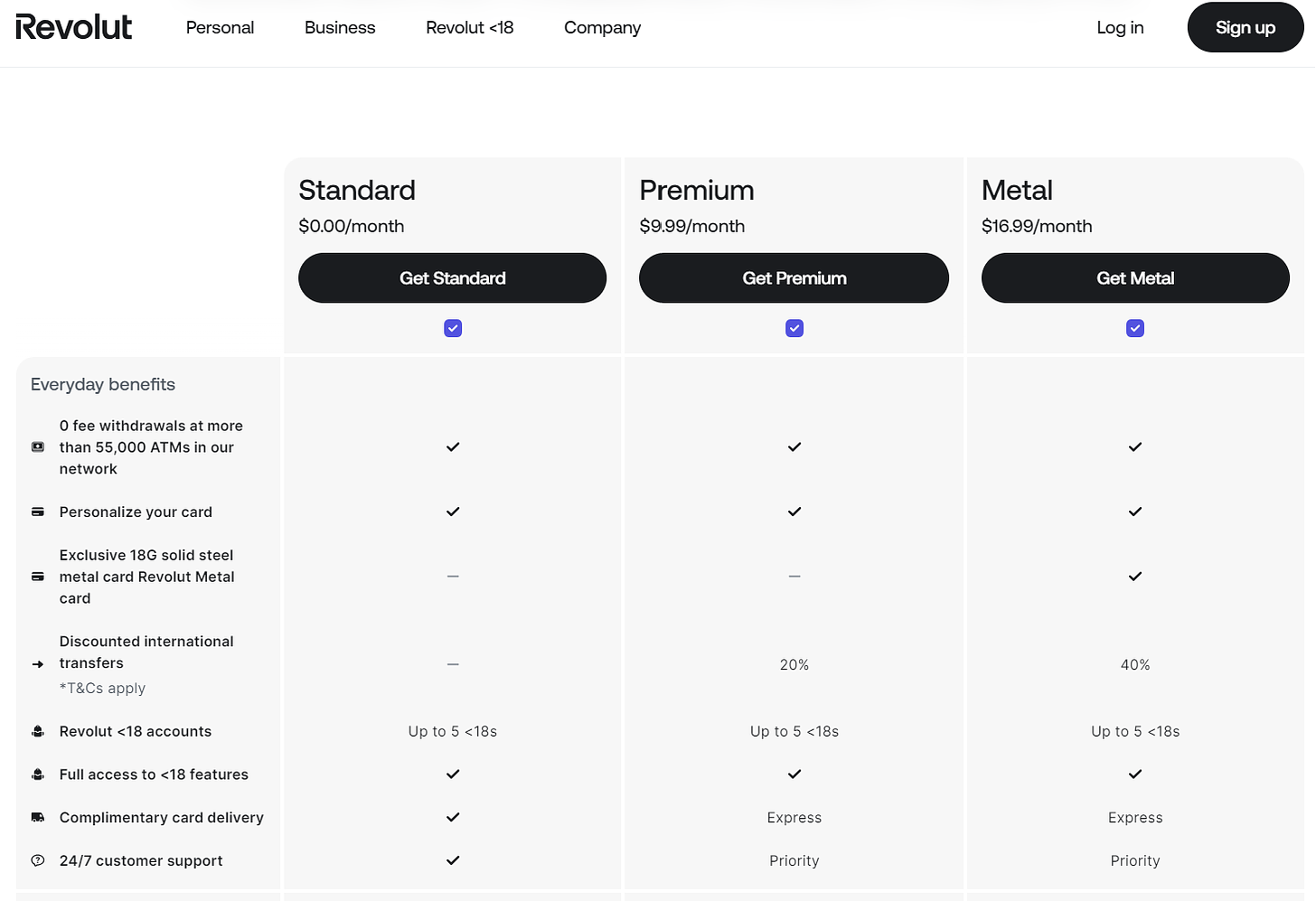

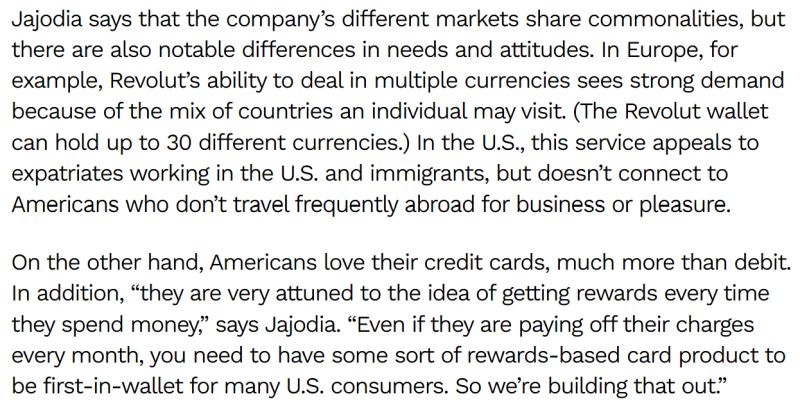

Besides being wastefully annoying to customers, a digital-only mindset constrains executives from considering traditional solutions that still work well. Revolut, one of the best-known global fintechs, learned it the hard way when launching in the US in 2020. It had ambitious plans to rapidly gain market share among a wide spectrum of upper-middle and well-off consumers by offering unique digital features in the US.

Those features seemed odd to some of us in the US when Revolut launched in 2020, but the fintech took three years to learn that those were not priority benefits for the target segments. In a recent interview, Sid Jajodia, Revolut U.S. CEO, acknowledged that those consumers require, above all, a traditional product: a credit card with generous rewards.

The Allure of and How to Break Free from the Digital Bubble

Acknowledging being in a digital bubble is very challenging. DBS Bank presents a fascinating case in that regard. The bank is widely considered a gold standard for digital transformation and even calls itself the world’s best:

But starting in 2023, its systems began to give up, failing with increased frequency from a couple of outages annually to first bi-monthly occurrences and then three outages in October. The lack of resolution prompted a harsh regulator response:

Banned from acquiring new business ventures for six months;

Not allowed to reduce the size of its branch and ATM networks in Singapore;

Must not make non-essential changes to its IT.

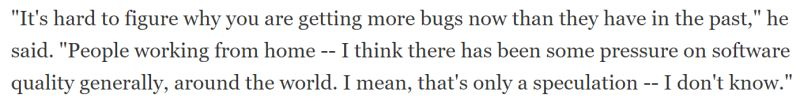

Surprisingly, DBS’ CEO, Piyush Gupta, not only didn’t know what was causing the outages but singled out work-from-home (WFH) as a potential root cause.

The bank that prides itself on acting more like a startup and industrializing innovation can't think of other reasons than WFH that are impacting its resilience. Hmm…

If an FSI executive is brave enough to break free from the digital bubble, the first step is to publicly (or at the least with their own team) acknowledge that they have a problem. Then, use critical reasoning techniques from this newsletter coupled with the three components of the leveling-up playbooks:

Apply the best resources to fix significant growth, profitability, and scalability impediments in the core business;

Ensure that human-based solutions are considered together with digital-only ones for expected end-user reaction and differentiation; and

Regularly assess the impact of completed digital initiatives and adjust playbooks for new initiatives accordingly.

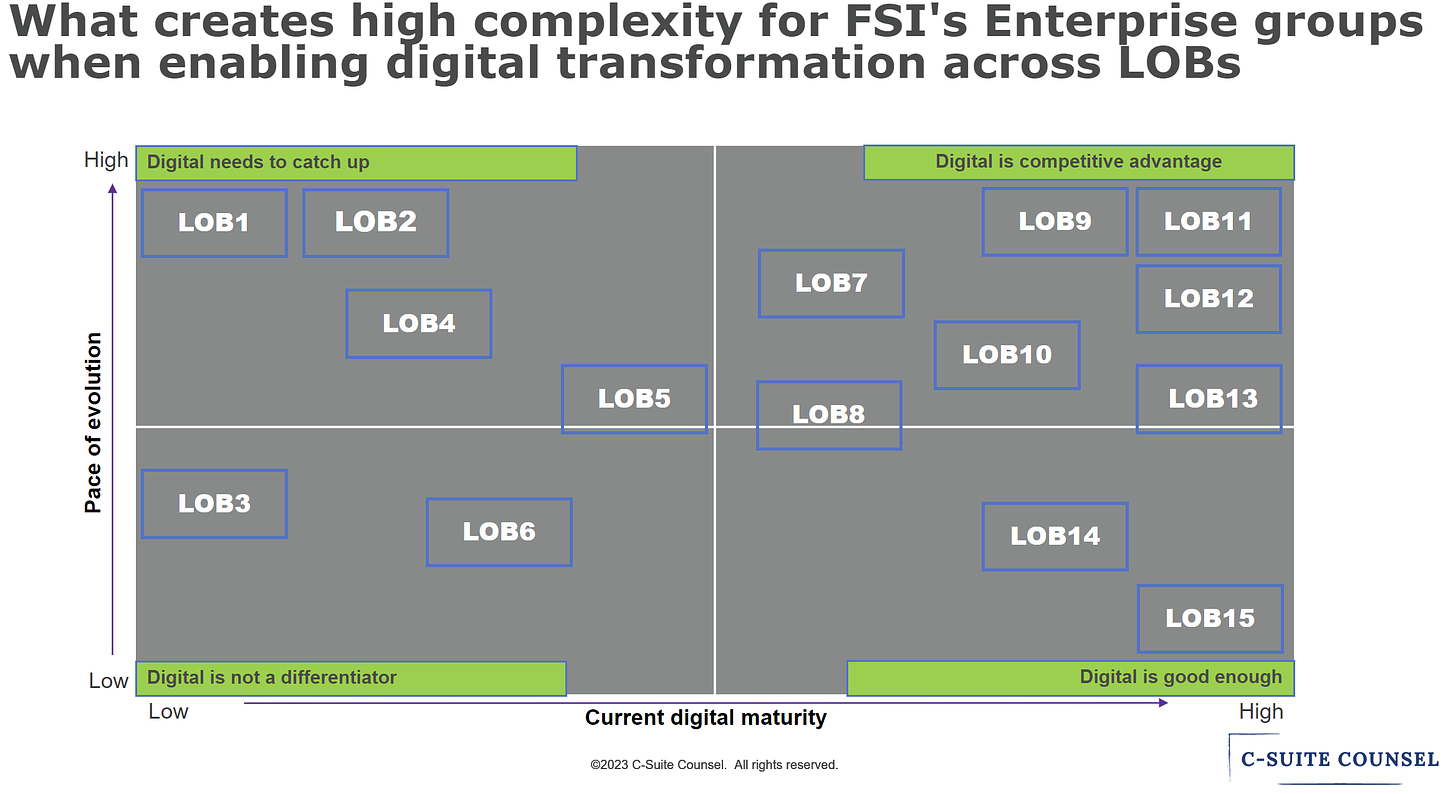

Such a nuanced approach goes directly against human nature, even for top-notch FSI executives. It requires both continuous personal transformation and a desire to operate in a highly heterogeneous and fluid environment. The good news is that more FSI executives are joining this path and enjoying functioning at multiple speeds:

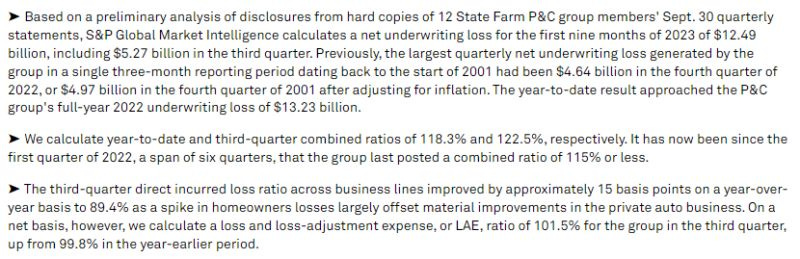

In conclusion, here is a quick test of your break from the Digital Bubble. Imagine if you were the FSI CEO, and you have been losing a lot of money for six straight quarters, with billions of losses in the last quarter alone. How would you leverage digital transformation in that context? Would you go all-in with Cloud, send all employees to Agile training, or maybe invest in a Generative AI startup?

If your gut reaction was “quite the opposite - I need to start making deep cuts to the discretionary initiatives/staff while raising prices,” you are becoming immune to the digital-only virus. Congratulations!