Beware of TDS (TradFi Derangement Syndrome) When Pursuing Digital Transformation

Bitcoin fixes this, taking lessons from digital natives and leading fintechs, the actual (non-tech) success factors for FSI upstarts, what makes TradFi hard, how to stay immune to TDS

Beware of TDS (TradFi Derangement Syndrome) When Pursuing Digital Transformation

The role of technology is one of the key tensions in the digital transformation debate. A decade ago, the conventional wisdom was that by implementing better technologies and tools (AI, API, Cloud, DevOps), financial services and insurance companies would be able to delay an inevitable disruption by startups and maybe even outcompete some traditional peers in the meantime. A decade later, this has proven to be false. Plenty of so-called disruptors are struggling with sustainable growth, while traditional FSIs are doing fine with unclear correlation to their technology spending.

And yet, the dismissal of the capabilities of traditional financial services and insurance companies continues. As I kept seeing critical stories and commentary about "TradFi," I started wondering why so many experts have an issue with "trade financing." Only a few months ago, I realized that it stands for Traditional Finance.

That unwarranted negativity reminded me of the phenomenon of Trump Derangement Syndrome. After Trump's victory in 2016, people noticed how previously capable experts, known for their ability to predict the real-world consequences of various actions, started spouting consistently wrong opinions. Even more surprisingly, their audience didn't seem to care about the growing ratio of incorrect predictions, so the experts didn't feel the need for retrospection.

TradeFi Derangement Syndrome (also TDS) appears to be a similar phenomenon where no amount of counterfactual pronouncements seems to be deterring many fintech experts, startup founders, and even some TradFI executives from embracing an ineffective approach. What is behind this phenomenon in FSI verticals, and how can FSI executives immunize themselves from making big mistakes in the pursuit of digital transformation?

TDS Becomes a Meme: Bitcoin Fixes This!

The extent of the TDS pandemic became evident in an almost universally positive reaction to the recently released commercial by Coinbase:

In it, a married Western college-educated woman who was at the top of her class is struggling with rent and transportation, and the only way this family could afford the basics is if they work "2-3 jobs" because, as the ad surmises, "Everything is terrible." But of course, there is an answer, a different system with no lines, no paperwork, and permissionless.

This could have easily been an SNL skit, just with the ending tagline of "Bitcoin fixes everything!" But no, with the rampant spread of TDS, the ad was seen as meaningful by many fintech experts and even some FSI executives. These otherwise bright people believe that college-educated Westerners in their 30s are unfairly suffering from TradFi and yearning for an entirely different system.

FSI executives should recognize a common trap of digital transformation in this ad - solving an imaginary problem with an imaginary solution because it feels revolutionary. After 11 years, Coinbase's only achievement was to push low-and-middle-class consumers into trading highly speculative instruments, but what is next? With all its Silicon Valley pedigree and unlimited funding, the fintech doesn't have any practical ideas left, so it has to default to a superficial criticism of the TradFi system.

Without a plan to compete with TradFi, Coinbase's CEO threatened to move to Europe or could have considered a move to El Salvador, a crypto-friendly country, but who would want to leave the world's largest market and its sufficiently gullible population? Hence, for now, we are likely to witness increasingly bizarre variations of the "Bitcoin fixes this" meme:

One could reasonably retort that Tobacco, Junk Food, and Alcohol are also trillion-dollar industries like crypto and are causing far more damage to regular consumers by a large margin. Fine, as long as we all agree that crypto is a vice rather than a solution to a broken system, you are not in danger of TDS.

A similar cliché often arises in discussions about digital natives. These firms are supposedly so superior that traditional FSIs better keep up with their digital capabilities or else. One such firm is Airbnb, whose founder, Brian Chesky, has a legendary status among digital experts. But none of them seem to wonder if Airbnb's practices or technology are indeed superior in effectiveness to traditional competitors.

That is a simple method for identifying potential replicable best practices in digital transformation. Is achieving them disrupting traditional players? The answer is evidently "no" for Airbnb in the hospitality industry. Once Airbnb gained scale and went public in 2020, the sustainability of its business model has been doubtful, while its leading traditional competitor is doing much better:

Maybe traditional FSIs should be learning from the Marriott CEO rather than Brian Chesky about how to create value at scale.

Even Leading Fintechs and Insurtechs Suffer from TDS

As we discussed in another newsletter, while fintechs are not dying, they are not winning either. For example, most neobanks are currently in the same state—still growing in double digits but not going to disrupt incumbents. A decade after launch, N26 to Deutsche Bank's consumer business is what SoFi is to Chase: <5% of revenue/deposits of a still-growing incumbent, i.e., DB's annual growth delta is larger than the total revenue/deposits of N26.

Taking a decade to build a neobank valued in billions while reaching profitability is an impressive feat. Still, it is widely different from proving that TradFi is facing some existential crisis. Yet, similar to many fintech experts, neobank executives still believe that TradFi is somehow inferior.

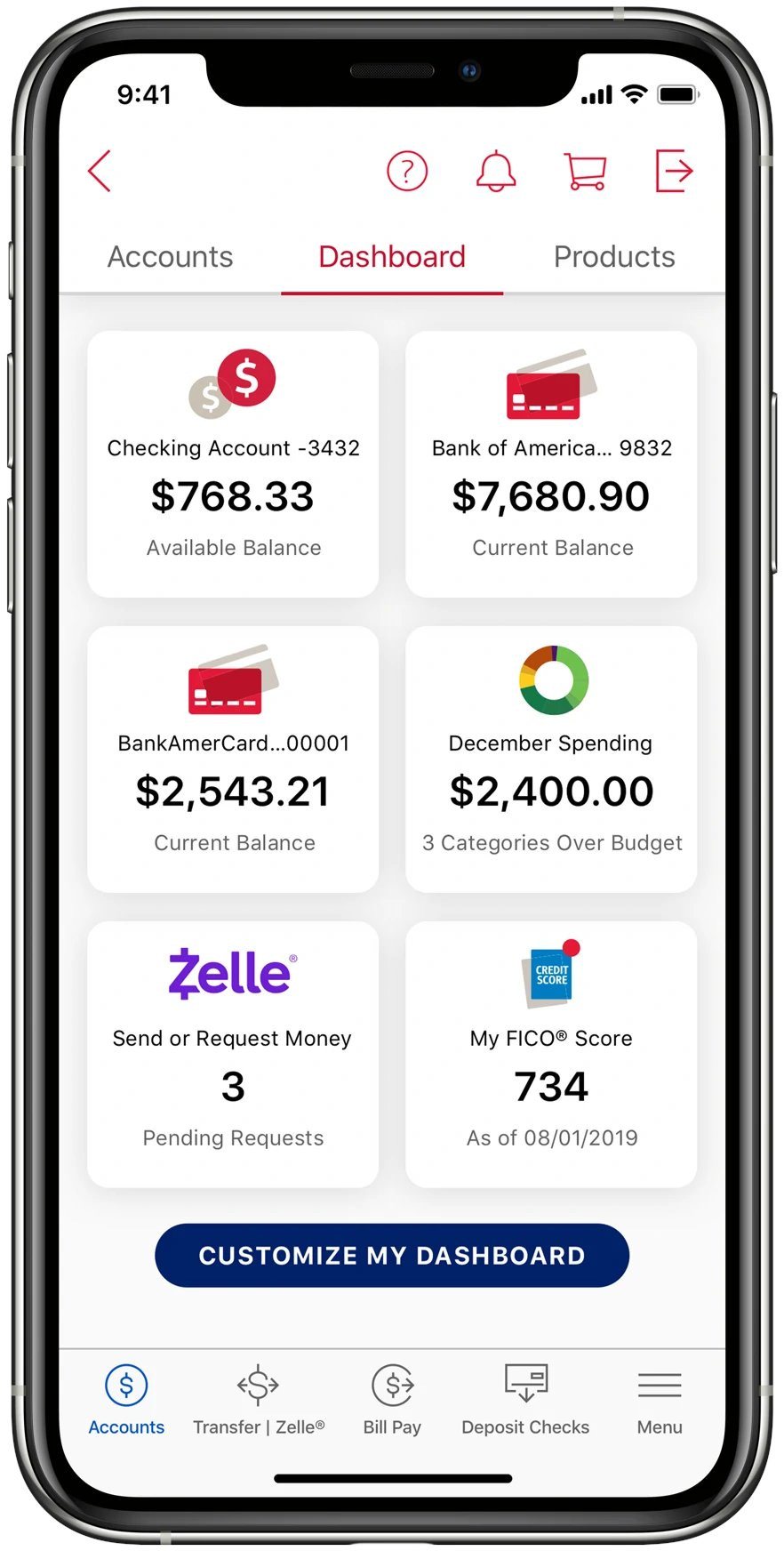

I recently had a revealing public exchange with Cash App's Product Lead, Kristen Anderson. She believes that most banks are "shipping really terrible experiences to customers" and that there is still a significant gap between their UX vs. a fintech like Cash App. As proof, Kristen shared her account view in Cash App:

First of all, many large banks have similar dashboards with performance buttons. But more importantly, do regular consumers need to know how their assets are performing daily? Of course not, they need a bank that keeps their money safe, makes key tasks easy, and earns some passive income during the year. So should Bank of America copy Cash App's UX or vice versa?

The answer may be neither, as it depends on whether BofA's customers use that dashboard at all or need something even more dynamic. As we discussed in another newsletter, BofA's chatbot Erica generates 40% of its interactions without personalization, and the remaining majority are push notifications not because customers are asking for them.

A similar episode of TDS came from another leading consumer fintech, Monzo. Its CEO recently declared, "It's clear to me that the American customer needs a product like Monzo. That's a huge gap..." Such a pronouncement would have already been a stretch when Monzo was founded in 2015, but there have been four years of no traction since its launch in the US.

Like other affected players, Monzo's CEO can't articulate the pain point of the US consumer that apparently no traditional bank has been able to address. But maybe Monzo is marketing some revolutionary product that would drive a new need. Well, it is a budgeting calculator and cutesy-looking cards.

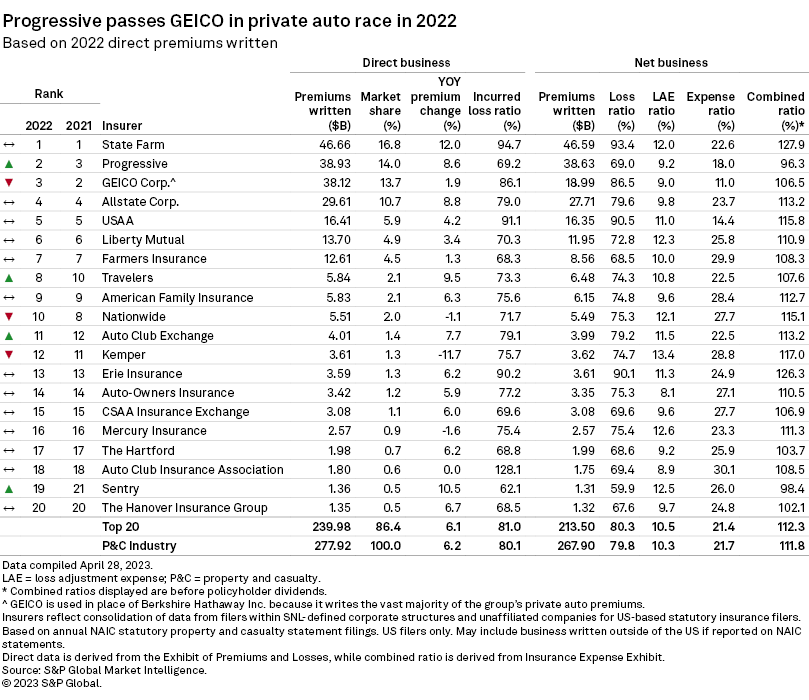

Most well-known insurtechs are similarly confused. In the US, Progressive Insurance and other incumbents have been eating their lunch. The traditional carriers match or outperform insurtechs in UX, data, and every other digital capability, whereas startups' AI and Telematics gimmicks don't wow investors anymore. As a result, their stocks have plummeted by 90-99% from their highs.

So what is left for these insurtechs to do? They formed a lobby to pursue favorable regulatory frameworks in the hope of stopping this reverse disruption.

Like Coinbase blaming "the system" for its failure to create adoption, the leadership of these insurtechs is so infected with TDS that they can't acknowledge that traditional insurance companies are objectively better and that the system works.

While some startups are still trying to survive due to these blind spots, others have been folding once investors smartened up to understand that TradFi is a formidable competitor. One of the biggest areas of misunderstanding is when fintechs are targeting specific supposedly unfairly treated ethnicity or gender with digital-only solutions.

Their premise is that white, Christian, male-dominated banks care more about preserving their group's powers in society than growing the customer base. Thus, they don't care for or don't want to serve some other demographics. The solution then has to be a digital-only service that speaks to that specific victim group and their plight, but it keeps not working.

Biological differentiation, such as ethnicity or sex, works for clothes and skincare but doesn't scale digitally for services. Messaging women online by a stranger, suggesting they can't handle the regular "man-investments" due to their lower confidence seems impossible without sounding demeaning and creepy. One has to believe that TradFi is horrible to take such a massive risk.

The Revealing Commonalities About Successful Upstarts (It's Not About Tech)

Once an FSI executive lets go of TDS and returns to the fundamentals of growing a business, the opportunities for value creation could be much larger.

A former insurance executive and currently an investor, Adrian Jones, offered a fascinating analysis during the recent InsureTech Connect conference. In it, he asked the audience to contemplate the names of the most successful insurance startups founded in the last 15-20 years. What a great quiz to uncover if one might have TDS:

As a surprise for many experts, insurtech founders, and even some industry executives, the answer has little to do with technology. All those companies were either focusing on a risky client segment (B2B) or grew through good-old roll-ups with mastery of integration. As a result, while well-known consumer insurtechs are valued in the $0.1-2 billion range, these upstarts are worth $5-20 billion. Adrian’s analysis pointed to 7 commonalities of their success:

It is not that technology is unimportant, but being on the cutting edge is not a prerequisite to creating a lot of value; moreover, it could be a distraction from getting the first four components right.

Traditional Finance and Insurance Are Much Harder than They Look

JPMorgan recently came out with a supposedly bombshell announcement that its AI Technology is starting to generate revenue. It reminded me of a decade-old story about a journalist interviewing people in an internet cafe in Lagos about why they keep sending millions of "Nigerian Prince" emails since they are so obviously scammy. "Because they work," was a reply.

TDS makes FSI executives forget to analyze the effectiveness of their digital initiatives. Generative AI could send times more solicitations to Chase's customers and leads to its sales reps, and some of those will generate revenue, but at what costs? It's not just the upfront investments and ongoing support, but the costs of annoyed customers and sales reps who are receiving a ton more low-quality notifications.

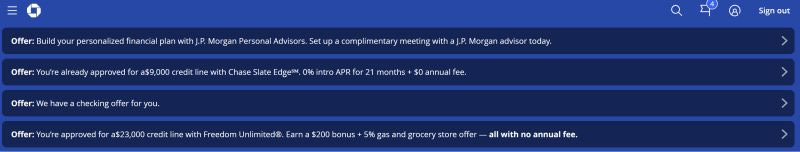

Such higher-performing TradFis don't just do it because it's trendy or to fool investors, but also because fixing traditional issues is much harder. For example, if you are a decade-long Chase customer and see four offers when you log in, you might reasonably expect that two to three of them are somewhat relevant. I mean, JPMorgan has all the necessary information about you, and they are spending $15 billion a year on technology. But no, all offers are irrelevant:

Chase is making a balance transfer, a gas-based credit card, and checking offers to its long-term customer who never revolved, doesn't have a car, and already has a checking account with them. Fine, the offers are irrelevant, but maybe Chase could explain why it is sending them to a specific customer. Nope. Imagine what it takes to fix this issue vs. launching a Generative AI pilot or moving another application to the Cloud.

Telematics in auto insurance is another fascinating illustration of the difficulty of justifying digital transformation, even in a specific use case. A globally-renowned telematics expert, Matteo Carbone, is specifically admired for his no-nonsense, numbers-driven approach to analyzing what works:

I have been involved with telematics in auto insurance on and off since 2019, but Matteo's expertise is unparalleled, and he has doggedly pursued any evidence of whether it is working or not. In his latest article, Matteo analyzes a decade-long Nationwide Insurance journey:

After a decade, Nationwide claims to have achieved strong adoption, leading to three notable benefits: 1) 24-34% customer savings, 2) 2-3% higher retention, 3) 10% reduction in handheld distractions, i.e., a potential trifecta of great pricing + happy customers + fewer accidents. Should other traditional carriers embrace Nationwide's practices?

Not yet. It is still too soon to know whether a decade-long focus has resulted in a differentiated business model: as of 2022, Nationwide Auto dropped from the 8th to the 10th rank in written premiums, with a combined ratio of 115%:

JPMorgan and Nationwide illustrate a tactical hardship when pursuing digital transformation - estimating ROI, revenue growth, and profitability in their analysis of the initiatives. Yes, neither Nationwide's CEO, CFO, Head of Auto Insurance, Head of Telematics, nor the members of that value stream are likely to know how to estimate those North Star metrics of digital transformation. Nonetheless, they are pursuing it anyway in hopes that something great will eventually come out.

When engaging with the best Agile teams in a top-10 FSI like Nationwide, I always ask if they could guess how much money they made for their company last year. The answer at leading firms like JPMorgan and Nationwide would almost always be "no idea." This is surprising since calculations are relatively simple and usually take me a couple of hours with 3-5 of the most knowledgeable stakeholders. But even more surprisingly, many don't want to know because of concerns about repercussions if the numbers don't look good.

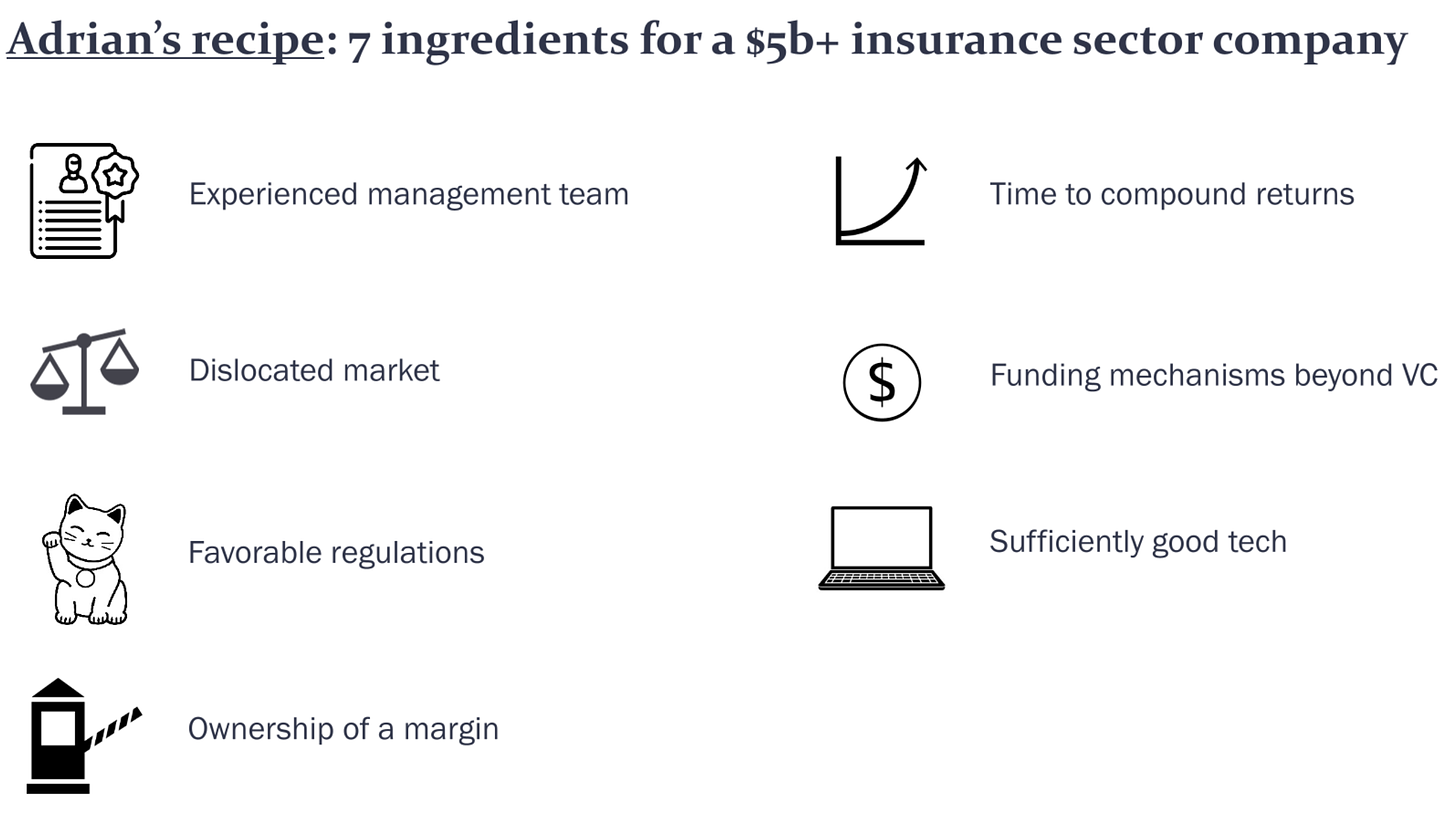

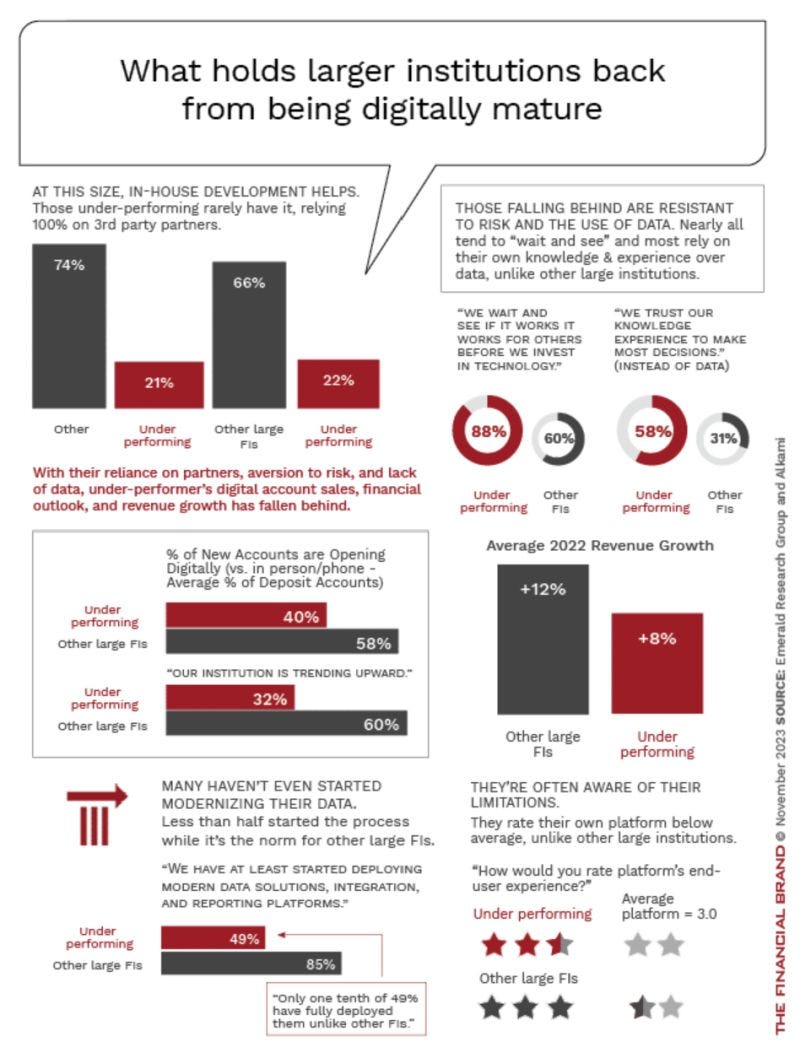

Once traditional FSIs crunch the numbers, they would indeed realize that the upside is often not going to be significant enough to invest a decade or two in scaling a specific digital capability. For example, recently published research again proved that larger underperforming banks engage significantly less in in-house development and data modernization, are less inclined to spearhead change or embrace data-driven decision-making, possess inferior platforms, and secure fewer customers through digital means. Sounds like a call to digital arms in those underperforming banks, no?

Not necessarily, since all that effort resulted in a growth rate of 8% instead of the 12% achieved by well-performing banks. It's understandable why some larger banks are slower to evolve:

How to Become Immune to TDS: Don't Be Stupid

Charlie Munger, who recently passed away, was legendary for his long-term investment style and for wisecracks against various trends that are meant to obfuscate what matters in value creation over generations. With regards to FSIs, he opined:

‘It's not that great of business as a business. Casualty insurance. It's a tough game. There are temptations to be stupid in it. It's like banking.’

It’s stupid to pursue digital transformation due to startups getting a lot of funding or because the experts believe that TradFI is about to disappear. Digital capabilities are shiny objects that don’t require much brainpower and new operating muscles from executives unless they are meant to drive returns from those investments.

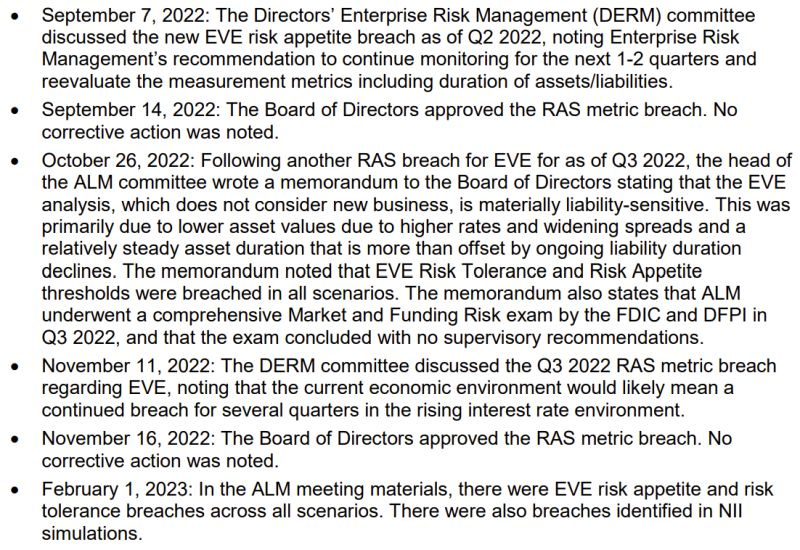

One of the most vivid illustrations of how FSIs don’t want to develop new operating muscles that are not trendy is First Republic Bank (FRB). It was an incredible franchise that disappeared seemingly in a couple of months in early 2023.

When three regional banks collapsed, including FRB, in the US in early 2023, it was funny to see TDS-prone experts immediately declaring the root cause being a lack of fintech capabilities, like the digital acquisition of deposits. From the recently released analysis of the Office of Inspector General, the reasons appeared more mundane - the risk breaches were repeatedly ignored, while regulators avoided making recommendations that disagreed with the management:

In conclusion, with this knowledge, you should now be immune to the TDS virus and always focus on the basics first. Is my FSI resilient? Have material risks been resolved? Are client needs being addressed? Afterward, it would be much easier to determine if digital transformation could still be very beneficial or if the current technology maturity is already good enough.

Out of many fantastic pieces you have written this is absolutely Top 3. You nailed it.