Does Higher Digital Maturity Correlate with Faster Earning Growth in FSIs?

Also in this issue: Ignore PR Claims of Generative AI Making Human Customer Service Obsolete

Does Higher Digital Maturity Correlate with Faster Earning Growth in FSIs?

Bigger FSIs are generally more digitally mature than smaller ones when measured by the effectiveness of their operating model, the proliferation of digital channels, and the modernity of their technology stack. This is driven by having more discerning clients who demand better digital support, a larger budget for improving digital capabilities, and the employment of stronger talent to manage modernization.

A recent study across banks, credit unions, and fintechs identified an exception that confirms this general rule. Indeed, there will always be smaller FSIs that are more digitally mature than larger ones. However, the average size of digitally mature FSIs is almost 30 times higher than in earlier stages:

Another interesting finding of that study was that "the most digitally advanced institutions reported twice as much revenue growth in 2022 as the least digitally advanced." The revenue impact seems obvious in the context of fintechs, which are generally known to grow faster than traditional FSIs while also being digitally mature. However, does faster revenue growth necessarily translate into faster earnings growth, the North Star of digital transformation?

It is not obvious that the digital capabilities alone of traditional FSIs and fintechs could create such differentiation without a unique business model. To illustrate with data, in 2023 all 76 neo-banks in the US were unprofitable! Launching more products and features faster could generate more revenue, but it does not guarantee profitable growth; in other words, it is insufficient differentiation.

Business Model —> Operation Model —> Technology Model

A decade ago, there was excitement about a breakthrough in property insurance companies' ability to assess post-storm damage. Instead of dispatching expensive human adjusters into hazardous areas, hundreds of drones would automatically take to the air, capturing images of properties. However, on a recent podcast, CSAA Insurance Group Managing Principal of Strategy & Innovation, Brian Gaab, discussed the decision to shut down such a pilot after a few years due to insufficient image resolution.

The same disappointment with the digital promise can be found in car telematics. A decade ago, most of us thought the ability to use car and smartphone sensors would be a material differentiator in profitable prospect targeting and car underwriting, more precise post-crash payouts, and generally improve drivers’ behavior. Yet, after a decade of scaling telematics ahead of others, Nationwide is facing worse than industry average losses. Tesla Insurance’s combined loss and expense ratio is almost twice the industry average.

That is why we can’t be surprised when FSIs like PNC are spending $1 billion in the next few years on opening 100+ branches while renovating 1,000+ existing ones. While it takes 3-5 years for a new branch to turn a profit, it is a highly predictable result. Higher digital maturity might indeed lead to a faster ROI, but it also comes with a significantly higher risk of failure. Hence, successful traditional FSIs pursue a balanced approach, investing in both digital initiatives and traditional methods, rather than viewing digital maturity as the ultimate goal.

Ignore PR Claims of Generative AI Making Human Customer Service Obsolete

In breaking news, translated unequivocally by almost every tech and fintech expert, Klarna recently announced that just one month of using OpenAI has resulted in replacing the work of hundreds of human agents and generating tens of millions in profits within a year:

Skeptics of the massive impact of Generative AI (GenAI) may dismiss McKinsey's estimate of $2.6-4.4 trillion in annual value in banking. However, a traditional FSI or fintech promising a numerical profit contribution in the short term for a specific use case seems like a clear-cut validation. But is it, though?

As a quick history, contact center automation picked up in the wake of the 2008 financial crisis. The drop in FSI revenues necessitated a search for savings, leading to customers being pushed to use self-service via IVR and websites for simple questions rather than seeking live help. This resulted in a reduction in the majority of phone conversations and a wave of shutdowns of on-shore and off-shore contact centers.

In parallel, FSIs began introducing chat as an alternative to phone and email. For example, Klarna implemented chat capability almost a decade ago and then refreshed it around five years ago, resulting in the majority of live customer conversations transitioning from phone and email to chat:

Automating all contact center mediums has been ongoing with increasingly advanced analytics since the beginning of the 2000s. Today, 85-95% of inbound customer calls are handled by self-serviced IVR. The automation was further accelerated with the scaling of machine learning starting a decade ago, and in the last few years, with chatbots. Hence, Klarna's announcement raises questions with one of three possible scenarios:

a) never used chatbots before, so Klarna is just catching up to traditional FSIs.

b) used chatbots already, but GenAI has created a breakthrough in self-service

c) cherry-picked impressive numbers as positioning for a rumored IPO.

The first red flag was the negative reaction by Klarna’s customers who tried using its chatbot. They consistently shared that it was the same clunky experience as in any other company, which mostly involved scraping internal documents. Indeed, as FSIs scale chatbots, the tool has become the biggest source of customer complaints. A recent Capgemini study found that 61% of retail bank customers contacted agents because they were unhappy with chatbot resolutions.

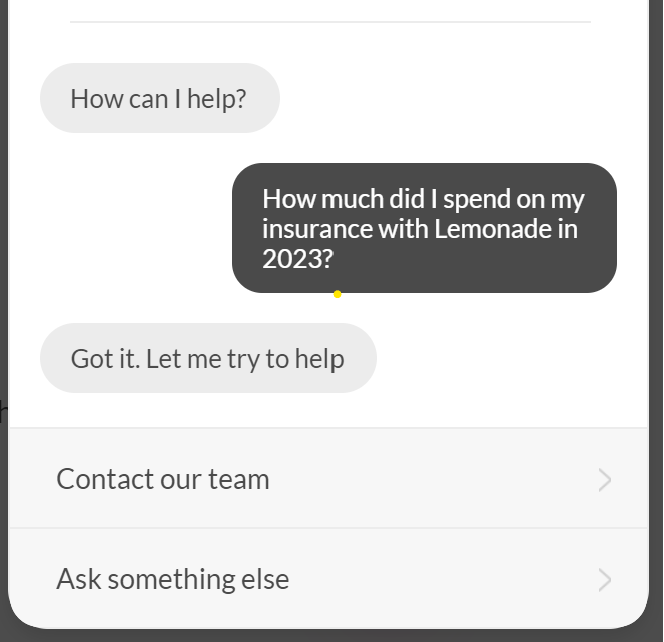

Even if a startup was founded in the last decade and claims to be AI-native, like Lemonade, their chatbot is still awful. To even the most basic questions, it refers customers to a human agent. The only breakthrough since the invention of GenAI seems to be that chatbots are better at recognizing the tonality of customer questions, resulting in more authentic responses, albeit with the same outcome:

But the true evidence of Klarna’s intention came in this hilarious response to a curious reporter:

You see, it's really about the impact on society! It's like in early 2023 when many experts were warning us that if GenAI development wasn't stopped, humanity could reach the point of no return in 6 months. And yet here we are, with GenAI still unable to solve basic brain teasers.

It would be foolish for FSIs to stop investing in their talent in contact centers. Quite the opposite, high-touch human service is what differentiates FSIs like American Express and fintechs like Wise and Mercury. It's okay to leverage the GenAI hype for publicity, just not at the expense of the customer.