FSIs Targeting 5-10% in Long-Term Growth Is a Reasonable Aspiration for Digital Transformation

Also in this issue: GenAI Might Not Be Increasing Intelligence, but New Artificial Features Are Still Useful for Some Use Cases.

FSIs Targeting 5-10% in Long-Term Growth Is a Reasonable Aspiration for Digital Transformation

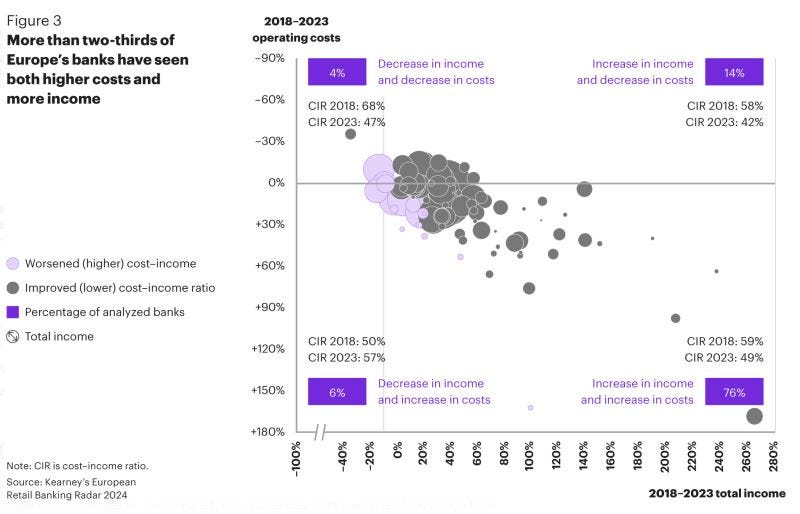

Mathematically, scaling could be achieved with zero revenue growth simply by reducing costs. A large portion of FSIs have been doing exactly that, preferring this cooler term to the traditional “optimizing” or “cost-cutting.” Such scaling without growth is easy, as demonstrated by the recent analysis by Kearney of the European retail banks. Only 6% have been unable to improve their cost-to-income ratio in the last 5 years:

The real scaling of rapid revenue growth with relatively smaller costs is quite rare among FSIs. On the chart above, no large retail bank has been able to maintain above a 10% income growth rate. Without impressive growth, the silver lining of spending hundreds of billions on digital transformation in the last 5 years is that it at least helped defend against consumer fintechs. At the same time, there are dozens of small and mid-size players that have been growing income by 20% and even 30%. Have they discovered a sustainable differentiation to disrupt the leaders or is it a temporary phenomenon due to a smaller baseline?

The answer is likely the former. Contrary to the common belief among experts, size does not matter when it comes to differentiation. Quite the opposite, it expands organizational entropy. For example, Capital One is almost ten times bigger than OneMain, but both companies have perfected subprime lending to such a degree that their stock has been in unison for the last several years. To start growing in double digits, Capital One has to risk reinventing its business and operating models to put players like OneMain out of business and grab their revenues.

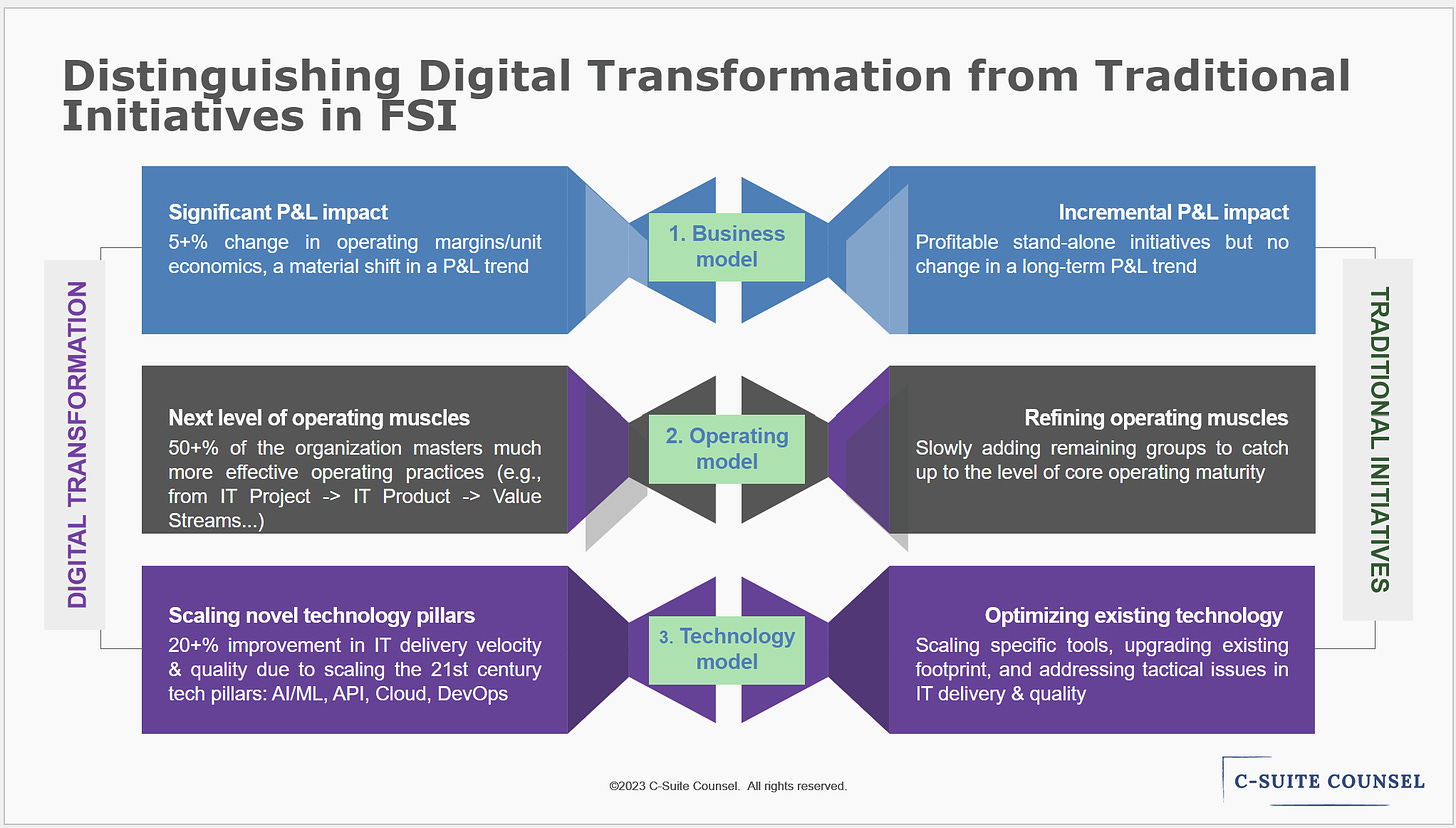

Compared to traditional improvements, creating lasting differentiation requires thinking more like a disruptor. This mindset differs from the favorite pronouncement of FSI CEOs over the last decade of running a technology company. Doubling the speed of software releases is an important component, but for many years, that alone has not created enough value to entice financial services and insurance clients to switch providers. More effectively launching new business models still does.

Creating such real differentiation is rare, even among leading original fintechs that were launched in the late '90s. For example, PayPal’s stock remains at 80% of its highs due to the lack of hope that it will grow in double digits again. In October 2023, a new CEO, Alex Chriss, a long-overdue replacement of Dan Shulman, was viewed with some healthy skepticism regarding whether he would pursue a transformational opportunity. Would he sell off non-core businesses, drastically cut organizational bloat, and launch new businesses? The answer seems “unlikely” - so far, it has mostly been PR stunts around marginal improvements in the checkout experience and the in-house stablecoin PYUSD.

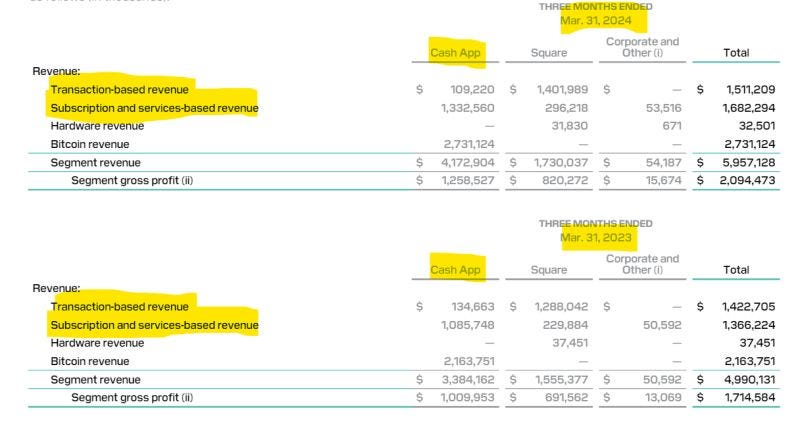

Even the newer successful fintechs are gravitating toward single-digit growth rates. Cash App's revenue growth has been under 20%, and it is still far behind the top-10 retail banks in terms of non-Bitcoin revenue. Other well-known neobanks like Chime and SoFi have seen revenue growth decline to the 25-30% range. Since they are 3-4X smaller than CashApp, it is likely their velocity will materially decline before reaching a similar scale.

Could we have reached the point when FSIs are so mature that creating lasting differentiation is impossible for traditional players and fintechs at scale? What if there is never going to be the Amazon, Spotify, or Netflix of financial services and insurance? The only hope left in the Western world seems to be Revolut. While roughly half the size of CashApp’s revenue (non-crypto portion), Revolut’s growth has uniquely accelerated from 50% to 2X. But until such velocity continues for a few more years, 5-10% annual growth remains a reasonable target for FSI’s digital transformation.

GenAI Might Not Be Increasing Intelligence, but New Artificial Features Are Still Useful for Some Use Cases

Like with Cloud and SaaS before, not just big banks, but even leading fintechs are increasingly voicing skepticism about the ROI of GenAI. The mistaken hope in each case was that the technology itself would be a game-changer because it replaces current capability at much lower costs and enables high-value products to accelerate revenue growth. In a recent interview, Revolut’s founder, Nik Storonsky, offered a sobering assessment of GenAI’s ROI on top of traditional ML models like Random Forest (regulatory concerns aside):

The cost of over $10 million to train a dummy model is magnitudes higher than training a much smarter new junior hire on a traditional model.

The design and architecture of a transformer neural network need to be fundamentally changed to be more cost-effective, justifying ROI for a marginal impact.

The recently released version of ChatGPT hasn’t changed those expectations. On the one hand, it is even better at emotion detection and translation and has plenty of other fun features clearly enjoyed by OpenAI employees during the demonstration.

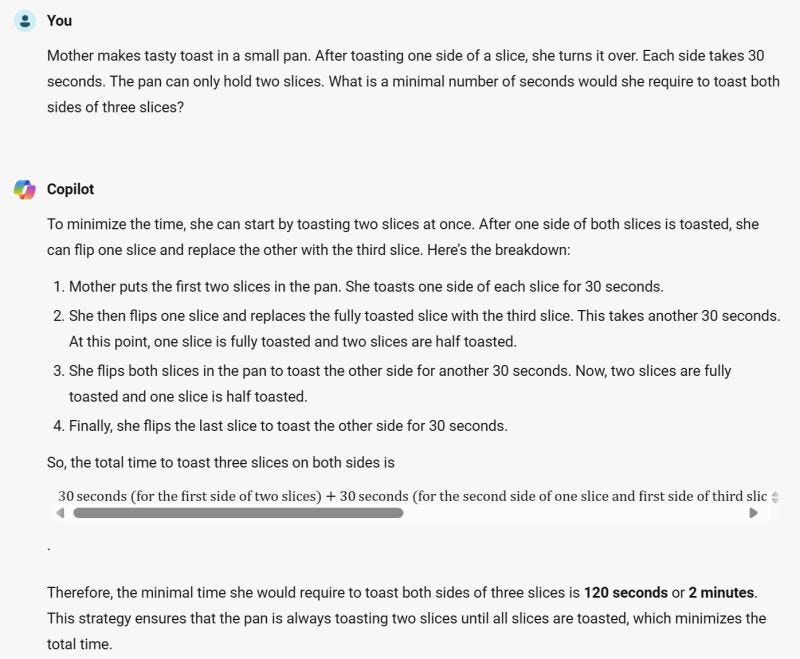

However, all the artificial features of ChatGPT’s new version can’t hide the elephant in the room: it is not becoming more intelligent to impact FSIs’ business models. In the basic brain teaser, ChatGPT doesn’t just give the wrong answer but incorrectly summarizes its own solution in Step 3:

While GenAI can’t reason and its intelligence seems to have plateaued, GenAI tools are already used in production to cut the processing of complex documentation for corporate clients significantly. In a recent conversation with a global executive of a $50B insurer, their turnaround time has improved from 2 weeks to 1 day.

"The industry has been attempting to address this issue for decades, including more recent efforts involving ML. Only GenAI finally has the capability to process unstructured data with a surprising accuracy of over 80%. Suddenly, our underwriters could make decisions within days rather than weeks. For independent brokers, our primary sales channel, this turnaround speed is by far the most important criterion."

The CEO of Lemonade, Daniel Schreiber, recently described a similar use case in production:

“We have a lot of documents that are inbound, whether it’s receipts or more complicated documents, health reports from vets, the state of a building, from surveyors … verbose 50-page technical documents that need to be reviewed in some detail, and then you will have to generate responses based on them.”

Those companies won’t share details of how their models work, but to get a general idea of such use case, there is a demo from a dedicated startup, Intrepid Fox (disclosure: it is founded by my friend, Roman Zilber, who was profiled in another newsletter).

Such documentation processing-related use cases are also easier to digest by regulators who are more concerned with how FSIs and fintechs use AI to underwrite products for customers:

If your FSI doesn’t work with complex documentation, the software engineers will still benefit from a more effective bot buddy for pair programming. It won’t create a differentiation but might improve retention a bit and still have a positive ROI on a few hundred dollars per seat in annual spending.