Micro Pricing as a Pinnacle of Digital Transformation in FSIs—If Only Regulators Stay Out of It

Also in this issue: Identifying Pain Points to Justify Digital Transformation Becomes More Challenging Even in Less Advanced Markets; JPMorgan Chase Global CIO Outlines an Effective Operating Model

Micro Pricing as a Pinnacle of Digital Transformation in FSIs—If Only Regulators Stay Out of It

Living in the US after growing up in the Soviet Union can be confusing these days, especially regarding debates around FSI pricing. Rather than embracing axiomatic supply and demand, there is ongoing wishful thinking for some authoritarian solution. This has been especially pronounced since COVID, when printing lots of money suddenly stopped being an obvious precursor to higher prices:

Prices did rise, and once again, the law of supply and demand was disregarded in favor of the “gouging” theory. It presumes that FSIs increase prices not based on their costs and client willingness to pay but because they are taking temporary advantage of vulnerable segments. To combat said gouging, the American government has been setting up price caps at state and federal levels. Recently, the “Administration has taken on Big Banks to bring down overdraft fees from $35 to as low as $3.”

While making me nostalgic about childhood in the USSR, price caps do have one unfortunate outcome: diminishing supply, mostly affecting riskier segments. In a recent interview with The Wall Street Journal, Marianne Lake, CEO of JPMorgan Chase’s Consumer & Community Banking, described the likely impact:

Lake said Chase is planning to pass on the costs of higher regulation and charge customers for a number of now-free services, including checking accounts and wealth-management tools, if the rules become law in their current form. She expects her peers in the industry will follow suit.

“The changes will be broad, sweeping and significant,” Lake said. “The people who will be most impacted are the ones who can least afford to be, and access to credit will be harder to get.”

This is not just an idle warning or an exciting opportunity for startups to fill the resulting void. P&C insurance companies have been leaving states where price caps make their business models unsustainable. However, if regulators believe that prices are mostly inflated by FSIs to rip off customers, their response is to further constrain supply. States like California question insurance companies’ financial solvency and threaten to investigate their books as recently documented by the Los Angeles Times:

“State Farm General’s latest rate filings raise serious questions about its financial condition,” Ricardo Lara, California’s insurance commissioner, said in a statement. He said his department would use all of its “investigatory tools to get to the bottom of State Farm’s financial situation.”

Moreover, six decades after enacting anti-discrimination laws, US regulators also believe that FSIs remain covertly racist. As a consequence, rather than viewing novel technology like AI as a potential enabler for FSIs to improve pricing for riskier segments with better analytics, the main concern is with collecting data to prove their lack of discrimination:

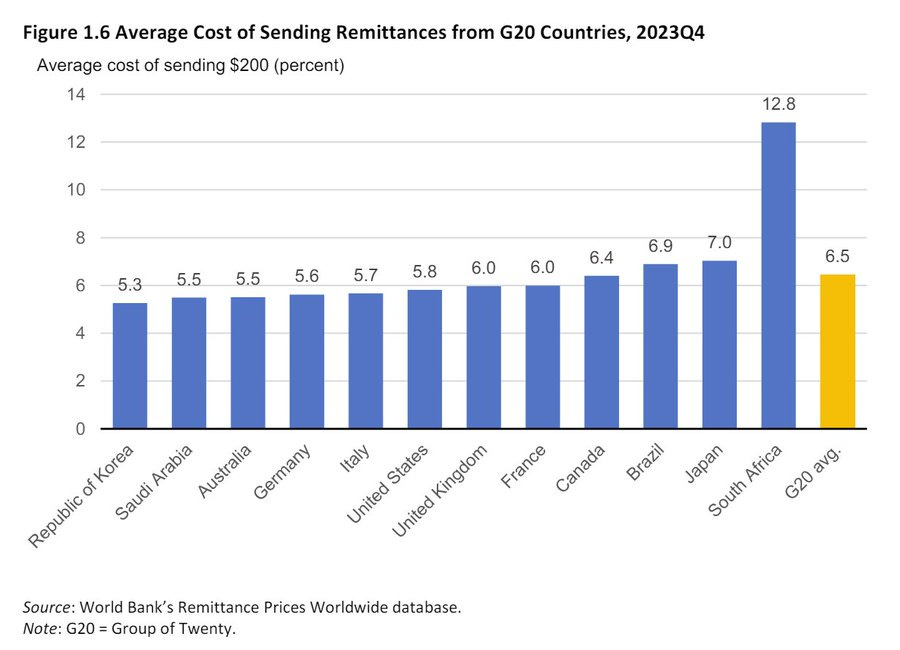

Dealing with price caps and accusations of price discrimination might be shocking in the supposed birthplace of capitalism, but it's more common throughout the world. For example, for remittances, sending money from South Africa costs twice as much as in other G20 countries. The obvious reason is constrained supply—a combination of outdated infrastructure and excessive bureaucracy/corruption that creates higher costs for new entrants. However, those factors seldom come up; instead, it is more typical to hear that incumbents like Western Union and MoneyGram should be lowering their prices.

In such products and geographies, there is less reason for FSIs to digitally transform since they won’t be allowed to monetize their advantage. Taking a state official to a sports game might be more beneficial and less expensive than scaling digital capabilities.

The good news is there are still plenty of areas where governments haven’t materially constrained supply, and competition could flourish. For remittances, the average price worldwide has declined from 20% to less than 5% in the last three decades due to a steady stream of increasingly cost-effective entrants: from Western Union to Xoom to Wise.

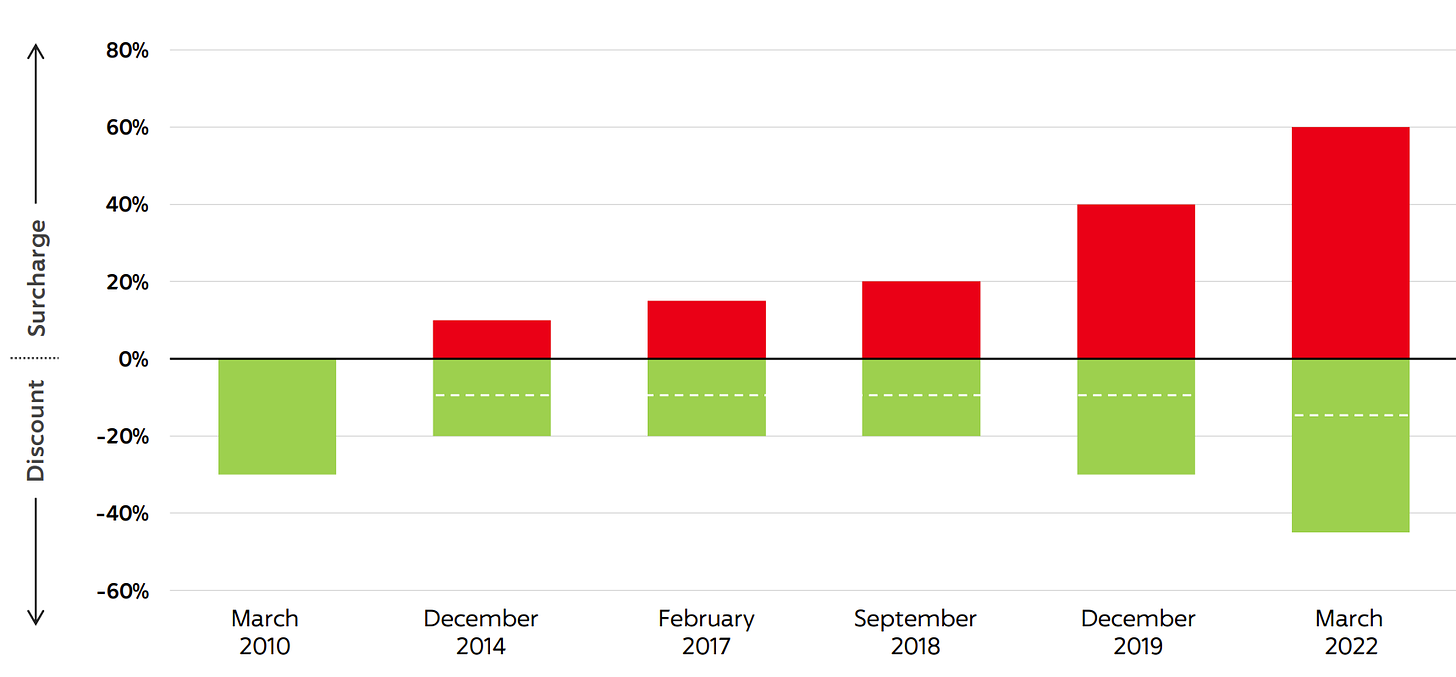

Progressive Insurance has been a leader in the auto insurance industry with micro pricing. Since the introduction of its in-car telematics device to track drivers' behavior in 2010, Progressive has significantly expanded its price tiers, offering discounts up to 40% and surcharges up to 60% (thanks to Matteo Carbone for the find):

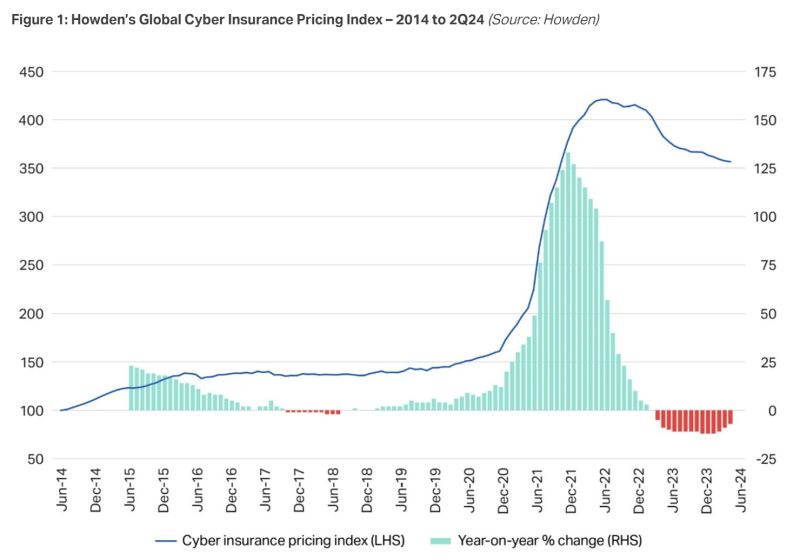

Cyber insurance is one of the most intriguing products because it involves firms actively assisting clients to improve their capabilities, which ultimately leads to lower prices for the whole industry. This genuine customer-centric approach is now being piloted for some consumer financial products but remains generally unprecedented, even among the best fintechs.

Digital transformation enables a magnificent expansion of supply through better analytics and novel business models. This results in greater variability of pricing among clients depending on their particular risks, which not only gives underserved customers more options but also incentivizes them to maintain prudent behavior. If only regulators could stay out of it.

Identifying Pain Points to Justify Digital Transformation Becomes More Challenging Even in Less Advanced Markets

Digital transformation is predicated on a simple premise—that there is a big pain point in the target client segment that could be profitably addressed via new digital rather than traditional capabilities. Because digital transformation is expensive and risky, "big" is the key word; there's no point in bothering otherwise. PC Chakravarti, Chief Strategy & Transformation Officer of Techcombank, one of the top-5 Vietnamese banks, recently emphasized this critical element:

As we accelerate our bank-wide transformation with a sharper focus on business impact, we are increasing our emphasis on:

(a) Upgrading our business operating model - agile where relevant, value stream aligned.

(b) Uplifting our people capabilities & mindset - end to end ownership, customer obsession and relentless execution focus.

(c) Big drivers of impact - in our bank-wide build and go to market pipeline.

This emphasis seems self-evident, yet we are more likely to hear such clarity from FSI executives outside of the US, like in Vietnam. The world’s top consumer fintechs are also often found outside of the US. For instance, despite targeting the lower-income segment since 2012, Chime has accumulated only 7 million customers. Compare that with Nubank in Brazil, with over 90 million customers, or Kaspi in Kazakhstan, with 15 million customers in a much smaller market.

The reason is simple—with significant progress over the previous decades, there are not many big pain points left for fintechs to tackle or for traditional FSIs to justify the hardships of upgrading operating models and leveling up talent. With less than 5% of Americans unbanked, many of them are career criminals, addicts, or face other challenges that make them undesirable for FSIs. For example, in the Bay Area, where many consumer fintechs and innovation teams from leading banks are based, targeting concentrations of 30,000 unbanked homeless individuals is unlikely to yield demand or behavior changes sufficient to make them profitable customers.

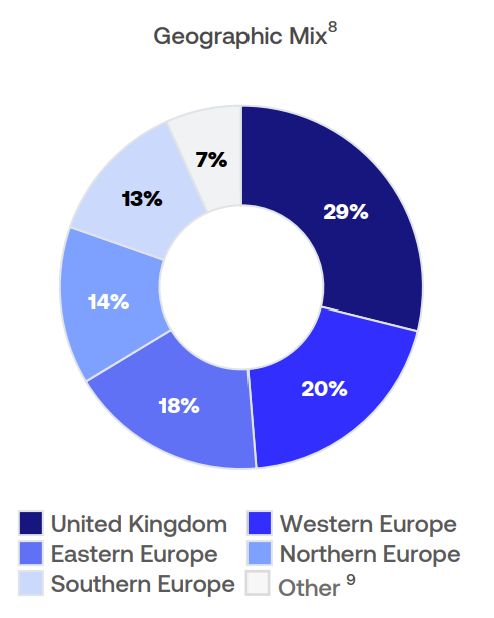

For that reason, among Revolut’s 38 million retail customers, it's notable how little traction it has gained after years of attempts in developed financial markets like the US, Australia, and Japan, remaining predominantly a European player:

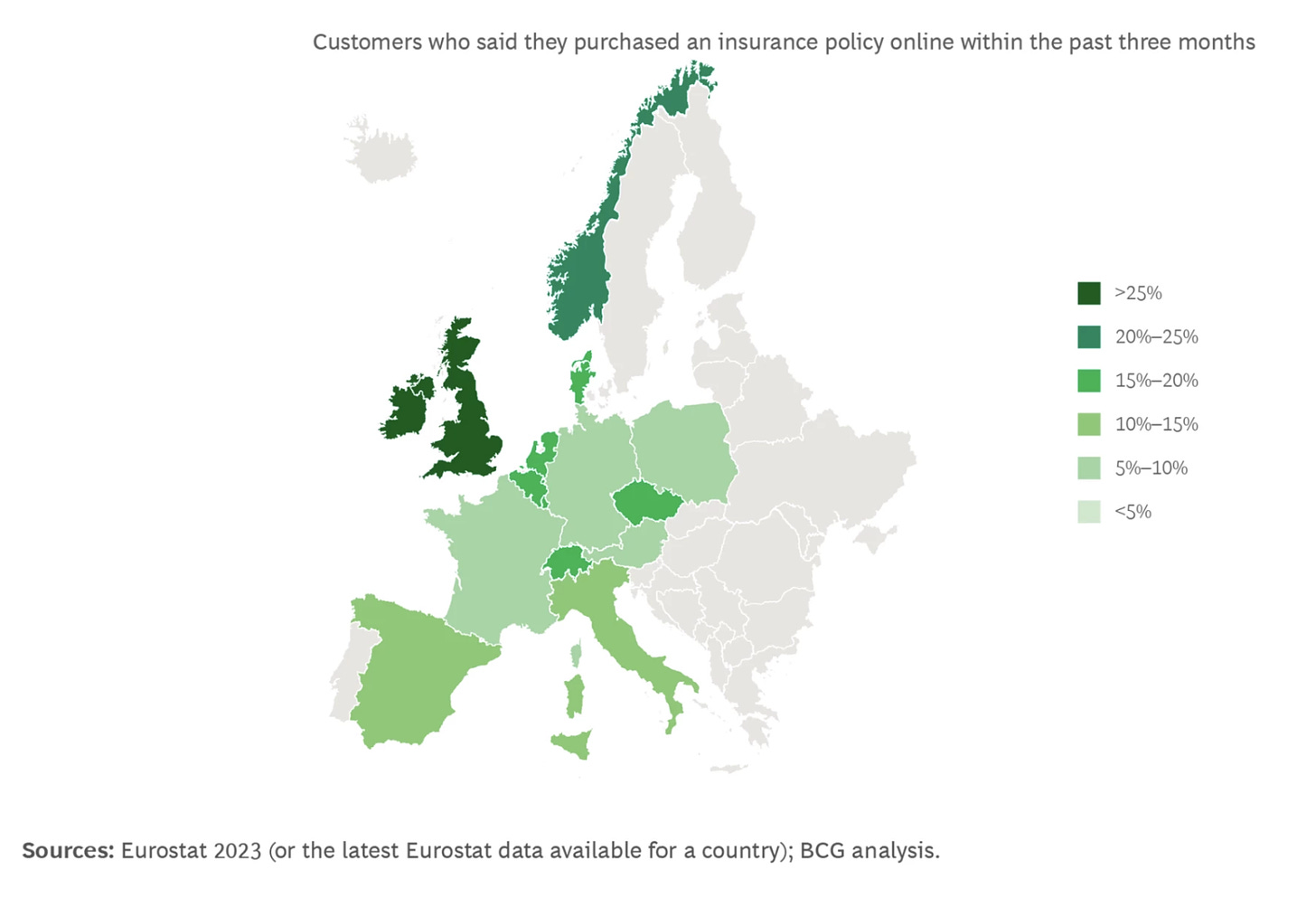

Luckily for Revolut, many European countries have been underdeveloped in terms of the use of digital services, especially in Eastern Europe, where the fintech has generated more revenue than in Northern or Southern Europe. As recently as 2023, less than 5% of Eastern Europeans used digital channels for products like insurance:

However, even in those "developing" economies, the clear cases for digital transformation will become harder to identify. Traditional FSIs will have to compete not only with local incumbents and fintechs but also with leading global fintechs prioritizing the same markets. Mexico, the Philippines, and Uzbekistan have recently been in focus for their still untapped opportunities in financial services and insurance. But for an ambitious FSI considering global expansion, time is running out.

JPMorgan Chase Global CIO Outlines an Effective Operating Model

One curious shift in the narrative of some fintech experts over the last decade is their sudden realization that top incumbents like JPMorgan Chase won’t be easily disrupted. However, rather than acknowledging that these players are well-managed, the reason is often attributed to their sheer size. While JPMC's $17 billion IT budget is massive, it is far from being the top spender among its peer group relative to revenues. What makes it unique is the effectiveness of its processes.

A recent interview with Lori Beer, global CIO at JPMorgan Chase, highlighted what good looks like in managing technology. Like leaders of any cost center, CIOs such as Lori have two main goals: improving satisfaction from upstream business lines/functions and supporting them with greater scale each year. In Lori’s own words, IT responsibility lies in enabling business growth and continuous optimization.

Even though generative AI can be costly, it does not change these core objectives. If the head of an upstream group wants to launch a new service uniquely suited by generative AI, the Head of IT would assess the additional compute costs, and if the ROI justifies it, the rollout effort would commence. In a well-functioning FSI, such efforts are synchronized with an evolving target state data and compute architecture:

“It was over three years ago that we laid out an AI data strategy and AI strategy,” she said. That involved forming an operating committee to align the data strategy and cloud strategy in part because the most advanced data management capabilities are in the cloud. “So we sort of got a bit ahead of that train.”

Rather than blindly following hype bubbles, the most effective traditional FSIs consider novel technology for its trade-offs against previously implemented systems: scalability, security, and resilience. While Capital One’s CEO unnecessarily pushed toward a cloud-only environment, resulting in $270 million in fines and settlements from just one breach, JPMC has mastered a more nuanced approach:

“First and foremost, we have to think about it in the context of: What is the resiliency standard, the essential service, that I need to provide. In some cases, if I have an application or workload that’s not an essential service, moving to the cloud is a lot easier, right? If I have something that requires the highest [level] of resiliency, maybe I run those things in my highly efficient, highly effective, highly protected data centers.”

As a bonus to their primary responsibilities, a strong Head of IT also offersse their upstream peers periodic insights on more effective use of technology and opportunities for technology-based differentiation. This process becomes more important for leading FSIs like JPMC, which typically have a separate team dedicated to exploring new ideas and engaging upstream groups in proof of concepts (POCs):

“… at any point in time, we probably have like 200 POCs going on. We are continuing to test and learn and we’re in a position to be able to do best in breed, whether it’s cyber technology or something else.”

The trick with innovation is to match investment with expected returns over a much longer timeline than required for proven technologies. A typical breakdown, including in JPMC, is 1-3 years vs. 3-5 years.

As leading traditional FSIs like JPMC continue to evolve, they are not only differentiating themselves from other large players but also raising questions about whether there remains a significant difference in capabilities between their technology group and the best fintechs.