Can FSIs Match Leading Fintechs in Harnessing Novel Technologies?

Also in this issue: The Most Underrated Barrier to Digital Transformation: Customer Preference

Can FSIs Match Leading Fintechs in Harnessing Novel Technologies?

Digital transformation aims to accelerate business value by driving top-line growth through new business models or enhancing profitability through scalable operations. Leading fintechs excel in both areas. By leveraging innovative technologies alongside strong business and operating models, companies like Nubank and Remitly continue to achieve rapid revenue growth while expanding profit margins.

Klarna, preparing for its IPO, has been particularly vocal recently, highlighting its success—growing revenue by 30% while reducing its workforce by 20% due to AI implementation.

In contrast, traditional FSIs, including some of the largest ones like Bank of America, have struggled with both dimensions. CEO Brian Moynihan often highlights the 25% reduction in headcount since 2010. However, that occurred in the previous decade. In recent years, banks' revenues have grown in line with inflation while maintaining the same headcount despite allocating 12% of revenue—$12 billion annually—to technology.

Revenue acceleration aside, FSIs are familiar with leveraging technology to reduce headcount. The introduction of mainframes, ATMs, internet banking, and other innovations in the 20th century caused significant shifts from manual tasks to automation and customer self-service. Traditional FSIs are also well-versed in managing headcount through business divestitures and reducing management layers. So, why hasn’t the impact of automation been as pronounced in recent years?

Not for lack of investment. These days, FSIs are more eager than ever to implement novel technologies. For example, even though the ROI of generative AI remains unproven, the hype shows no signs of slowing down. Accenture's GenAI bookings have continued to triple, approaching $5B annually. Accenture CEO Julie Sweet recently explained that clients across all industries are seeking big-bang revolutions rather than marginal evolutions. After all, if there’s one thing the C-suite has learned since the 1960s, the best way to deploy novel technology is through massive top-down transformations. Right?

“Our clients are focused on reinvention, which means large-scale transformation.”

Another popular approach among traditional FSIs with novel digital tools is "Let a thousand flowers bloom." In a recent CIO Dive interview, Tony Marron, managing director of Liberty IT, a subsidiary of Liberty Mutual, shared a typical roll-out and outcome from that approach:

After setting up a foundation, the company integrated generative AI into everyday work for its 45,000-member workforce via access to an internal, non-public version of OpenAI’s ChatGPT, called LibertyGPT. The rollout was accompanied by training, workshops and guardrails to encourage efficient, responsible use and build digital acumen across the business.

Around 1 in 4 employees are using LibertyGPT now, saving an average of 1.5 hours per week per person, according to Marron. Teams across underwriting, tech, claims and marketing leverage the tool for summarization and knowledge management.

It’s OK to treat GenAI the same way as teaching employees to use Excel more effectively—many large FSIs are still grappling with finding differentiation—as long as the total costs for large FSIs like Bank of America and Liberty Mutual remain in the low millions. However, in recent conversations, I’ve learned that some large FSIs have budgeted tens of millions for GenAI initiatives in 2025.

Since the overall US economy is performing well and FSIs have extra momentum with hopes of looser regulations under Trump, there may not be an immediate urgency to generate ROI. However, as Mao Zedong’s original "letting a hundred flowers blossom" strategy turned out to be a trap, deploying novel technology at scale without a clear business case becomes a ticking time bomb.

In the meantime, FSIs with sizable innovation budgets must ensure at least one core business product operates like a leading fintech. In this model, technology and data usage are driven by revenue-generating value streams rather than centralized functional leaders at the enterprise or department level. A recent survey of US and European financial institutions highlighted the varying budgeting models for data purchases. Which entity would be better equipped to defend ROI?

The most dangerous stage of digital transformation (IT Product) occurs when the IT/Data group in FSIs is significantly more advanced than its business counterparts. With budget freedom given to heads of IT and Data, this stage often leads to overspending on novel technologies, driven by misplaced confidence in understanding business needs. The longer FSIs remain in this stage, the less likely they are to catch up with leading fintechs in maintaining rapid revenue growth or significantly improving profitability.

FSIs with smaller budgets can take comfort because innovation typically takes a decade to mature, with clear use cases and ROI emerging over time. Rushing into costly investments with cutting-edge vendors can be counterproductive, particularly for mission-critical applications. While these FSIs may not reach fintech-level digital maturity, they can maintain reliable engagement with traditional vendors until novel technologies become more mainstream.

The Most Underrated Barrier to Digital Transformation: Customer Preference

As an FSI executive, it’s tempting to violate the first rule of capitalism, "give people what they want," when prioritizing new products for digital transformation. You watch many customers make suboptimal product decisions or fail to use proven digital tools and think, “If only they could try it, they would love it.” And then there’s that famous Steve Jobs quote:

“Some people say give the customers what they want, but that’s not my approach. Our job is to figure out what they’re going to want before they do.”

To make matters even more confusing, some customers view financial services products as entertainment, like video games or OnlyFans. If OnlyFans can generate $7 billion in revenue, it’s no surprise that Fartcoin could reach a $1 billion market capitalization. Does your FSI have a product that caters to younger males with discretionary income and free time, offering them an easy chuckle?

Some FSIs tend to move faster than others to monetize any new demand. BlackRock went all in on ESG funds when climate catastrophe and social justice were trendy, then scaled back those efforts in the US when right-wing populism gained momentum. More recently, it joined the crypto bandwagon with the iShares Bitcoin ETF, eagerly promoting Bitcoin’s mission and adoption tropes to its clients. Regulatory scrutiny seems unlikely as long as the numbers keep rising and a crypto-friendly Trump administration remains in charge.

There is a broader consumer segment for products that solve pain points, but the bar is higher when persuading customers to switch providers. When Wise (formerly TransferWise) launched its unique product in 2011, it struggled to gain traction with its core segment—expats. It wasn’t until the company embraced a rebellious image and launched bold campaigns in major financial centers that it gained momentum.

The more expensive the financial services and insurance products, the harder it is to find a sustainable model to scale it purely with digital means. For my advisory role and newsletter stories, I always try to sign up with leading fintechs and insurtechs to test their products and learn firsthand if there’s an exceptional value proposition. So far, I’ve had much better luck with more straightforward banking and payment products than insurance.

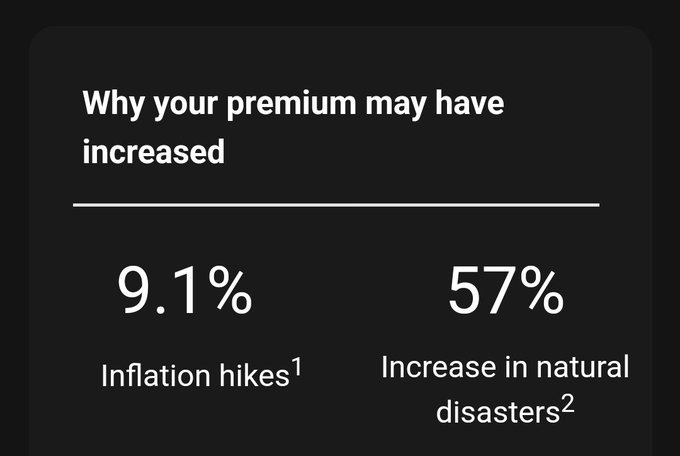

When trying Root Insurance, after a month of providing them with my driving data for free, their quote was 40% higher than the incumbents. Next Insurance, a leading insurtech for small businesses in the US, was trickier. Their first-year pricing was great, but the second-year renewal came with a 66.1% price increase despite no claims or changes in my circumstances. Not surprisingly, when I tried applying as a new customer, the price was the same as the previous year. To justify the increase, Next Insurance came up with the following fascinating rationale:

The inconvenient truth about digital transformation across all financial services and insurance is that customers often prefer in-person experiences or hybrid access. Since branches can't be shut down, this limits the ROI of launching new digital products, such as mobile banking. A recent survey found that the younger generation not only visit bank branches every few months, but about 70% also prefer having a nearby branch when considering a switch.

Twenty-six years after its launch and 17 years after Citi acquired it from ABN AMRO as part of a broader acquisition, Mortgage.com remains solely a lead generation portal. It's neither a technology issue nor internal politics driven by channel conflict—blame the consumers. In 2021, only 12% of mortgages in the US were obtained entirely online, and the real kicker is that this number hasn’t changed since.

FSIs don’t want to publicly acknowledge this reality, as they might be perceived as too retrograde. However, subtle signals suggest that some verticals, like life insurance, are meant for digital capability as an enabler rather than a standalone business line. One such indicator is when their Chief Digital Officer is also the Chief Information Officer, as seen in this recent announcement by Northwestern Mutual:

Northwestern Mutual today announced the appointment of Dave Gordon to executive vice president and chief digital and information officer. In his role, Gordon will be accountable for technology and digital strategy, with oversight of the company's AI capabilities, software engineering, data engineering, enterprise architecture, technology infrastructure, and information risk and cybersecurity. He also has responsibilities for the company's digital products and foundational tech capabilities.

For the digital products your FSI is launching in 2025, have you confirmed significant customer demand, or is this an attempt to create what consumers want before they realize it? If you're unsure, hopefully, the product will at least offer some entertainment value. FSICoin, anyone?