Client-Centricity in FSIs Means Sometimes Embracing Irrational Preferences

Also in this issue: Which Metric Is Critical for Business Heads in Consumer Finance to Monitor Annually?

Client-Centricity in FSIs Means Sometimes Embracing Irrational Preferences

My favorite exercise with FSI executives planning to pilot a new digital product is to ask, "What are the top five pain points of your target segment?" Then, we pose the same question to the actual prospects and look for any overlap. With fintechs, the overlap is usually 2-3 out of 5; with traditional FSIs, it's around 1-2. How is this possible when customer-centricity has been an industry mantra for a decade?

The reason is simple: executives often believe they already understand their customer segments, not realizing they tend to project their own internalized preferences onto product development. They're also swayed by experts who recycle the same myths, sometimes for decades. One such myth is that consumers deep in debt rationally want to fix their financial health.

On the surface, the situation seems dire. In the US, between 2015-2023, cash usage dropped by half, replaced by a surge in credit card payments. Now, 87% of the U.S. consumers own a credit card, with a whopping 47% being so-called “revolvers” who carry outstanding credit that in total surpasses $1.3 trillion (kudos to banks advancing financial inclusion :-). Nevertheless, it is a mistake to think that these consumers prioritize getting rid of debt over indulging in their next discretionary purchase. Americans tend to value materialistic things and are generally inclined towards risk-taking, which often leads to spending beyond their means across all income segments.

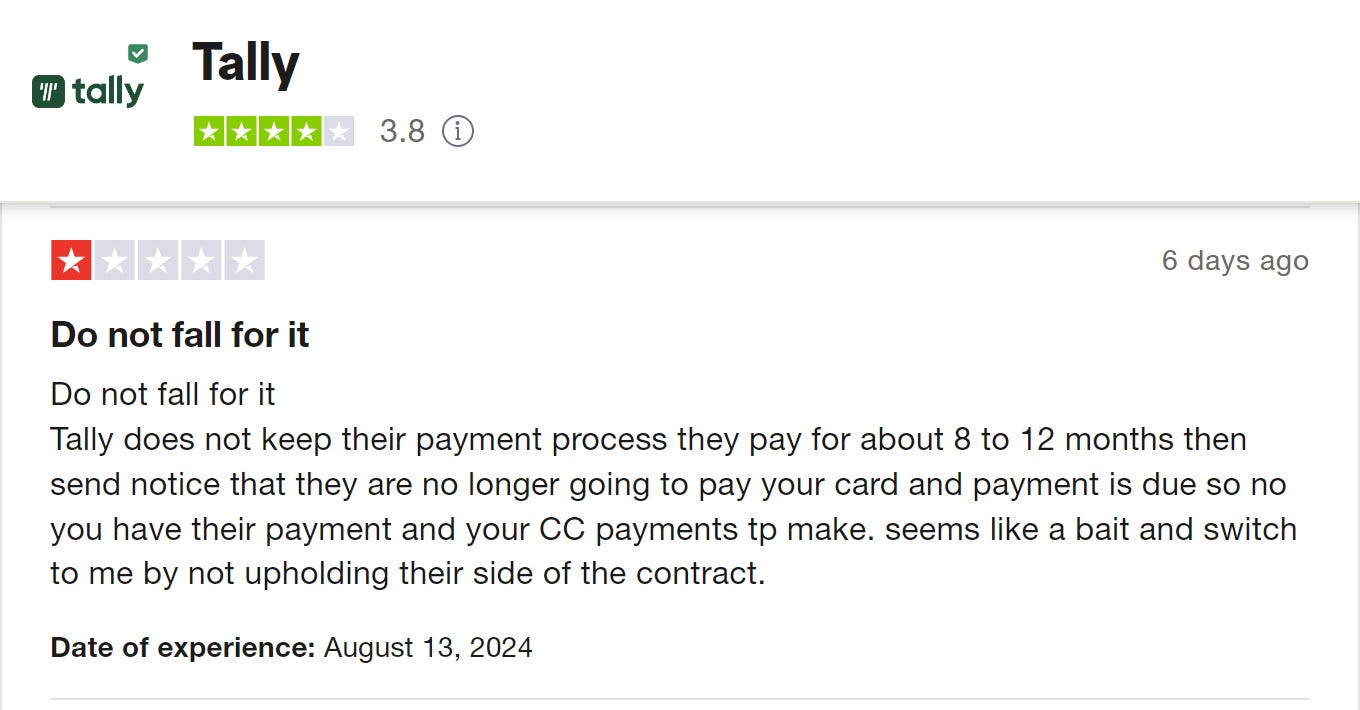

Yet, traditional FSIs and fintechs keep trying to fix these deeply ingrained financial behaviors. The latest casualty of such futile attempts is the fintech Tally, once valued at $855 million, which recently went belly-up.

Tally aimed to teach Americans in persistent debt to be more frugal and refinance their loans at lower rates. However, once again, the misunderstanding of behavioral economics as a solution rather than an explanation of the problem proved costly. As a result, yet another lending fintech, launched to succeed where traditional players had failed, ended up shutting down after and leaving customers worse off.

Conversely, fintechs like Robinhood posess a deep understanding of their target customers. Robinhood knows that their devotees enjoy trading, spending, and the general feeling of success. In a recent interview, Robinhood CEO and co-founder Vlad Tenev explained the rationale behind their seemingly unprecedented Gold credit card, which offers 3% cash back on all categories with no annual fee:

Transactors: Fidelity Investments offers 3% cash back to clients with $2+ million in assets, profiting from more assets at 0.2-1% advisory fees.

Revolvers: Capital One earns a gross 6% per transaction while covering up to 3% in losses and rewards.

The challenge, of course, is whether Robinhood can match Fidelity in attracting assets, and Capital One in minimizing charge-offs. Despite offering a six-decade-old product, Robinhood enhances its chances of eventual success by offering something that both aligns with its customers' revealed preferences and offers a physical token of financial behaviour that looks expensive and beautiful.

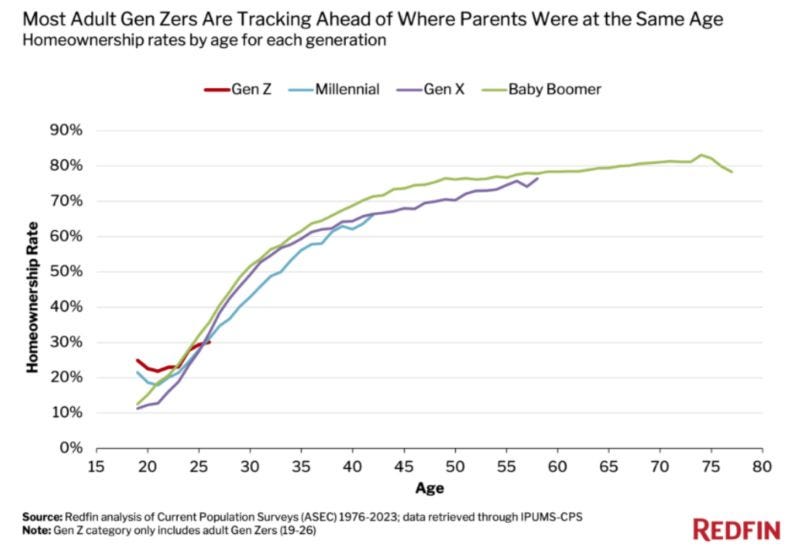

Instead of heeding expert opinions on consumers' financial hopelessness, traditional FSIs and fintechs need to recognize that Americans are doing well overall. The disconnect between the pessimism in expert pronouncements and reality is particularly stark for younger generations. Gen Z and Millenials are not only 25% wealthier than previous ones at the same age but are also stubbornly becoming homeowners at a similar rate:

A fascinating aspect of client engagement for FSIs involves money management products. For the majority of consumers, low-cost index funds have been the best solution for decades. No need for increased engagement or fancy digital features—just set up regular contributions and forget about them until retirement, much like a term life insurance product. This approach would result in stress-free clients and bored fund managers.

However, a significant portion of well-off consumers would find low-cost index funds too trivial and non-exclusive. Thus, a client-centric FSI would cater to those irrational preferences by investing clients' money in riskier and more obscure assets, while charging significantly higher fees in the process. The ultimate example of prioritizing prestige over financial outcomes was recently highlighted by Bloomberg. Family office advisors for a wealthy European family generated only half the returns of an index fund over decades while becoming billionaires themselves—no fancy digital features required.

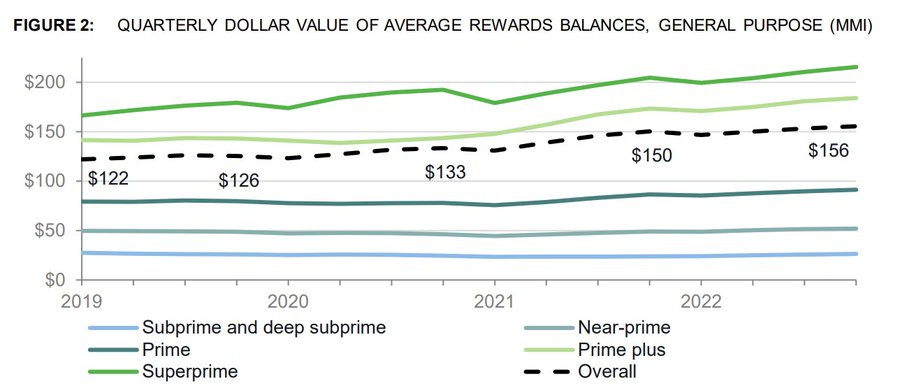

Another example of enabling irrational behavior is high-end credit cards. While many might assume that affluent consumers pay substantial annual fees to earn points and book luxurious travel for free, this isn't always the case. With overall rewards balances surpassing $33 billion in 2022, growth is primarily driven by those who pay $500-$5,000 in annual fees and hoard millions of points. I know such individuals with Amex Platinum and Black cards who still choose to pay for Economy tickets, even on cross-continental flights.

When launching a new digital solution for clients, ensure it aligns with the target prospects' revealed preferences. Don't try solving their seemingly irrational behavior; instead, find ways to monetize it.

Which Metric Is Critical for Business Heads in Consumer Finance to Monitor Annually?

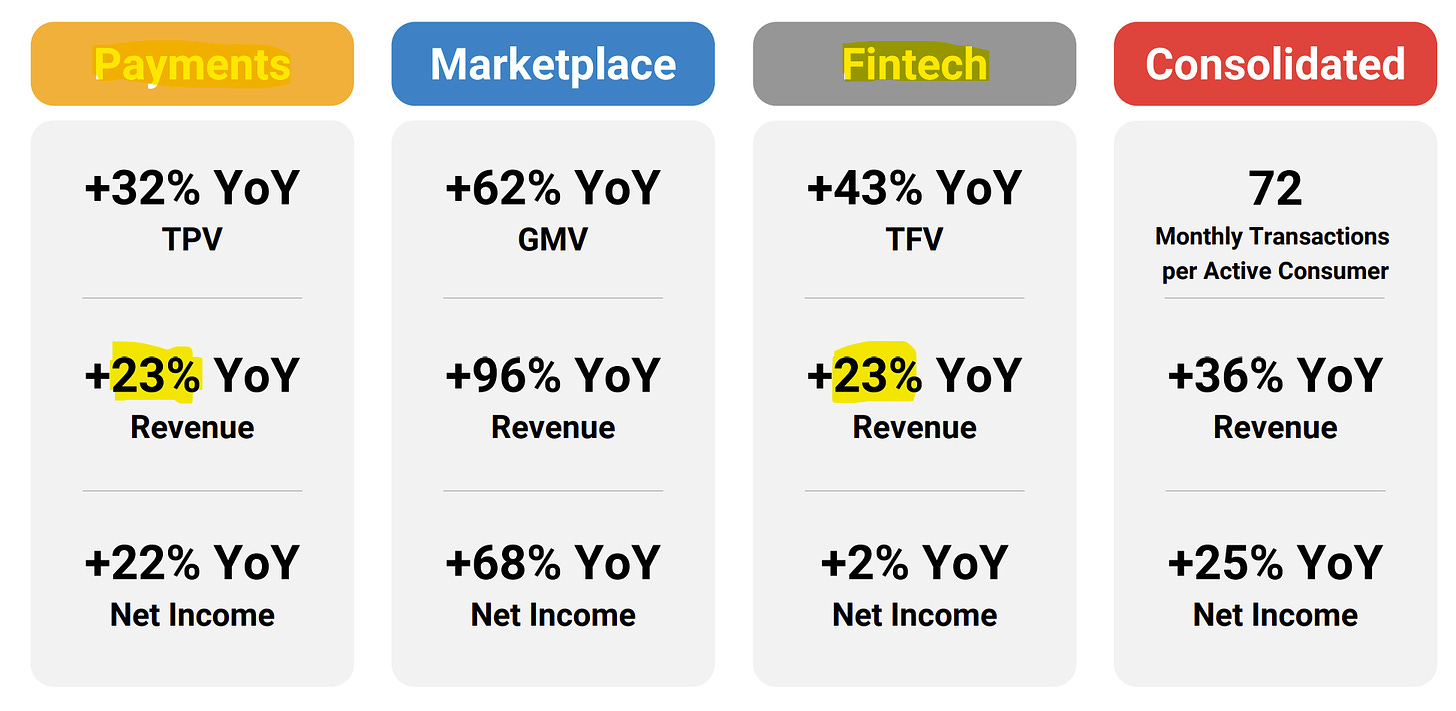

Even the most successful fintechs can't sustain rapid growth indefinitely. As demonstrated by players like Cash App, Kaspi, or Wise, a startup typically doubles its core business volumes in the first five years, after which growth velocity begins to decline, plateauing around 20% by the decade mark. For instance, Kaspi, a leading consumer fintech across the former USSR republics outside of Russia, is growing at 36%. However, without e-commerce, Kaspi’s financial services alone generated about $1 billion in quarterly revenue and grew 23% in the latest quarter:

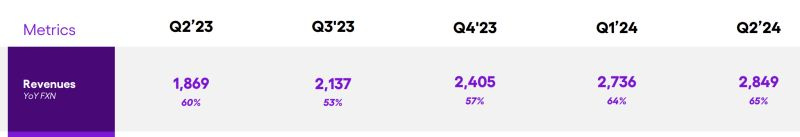

Even among the world's top fintechs, there's a notable difference in revenue generation before growth slows to around the 20% floor. For instance, Wise's consumer division, growing at 24% with $1.1 billion in revenue for the recent fiscal year, is less impressive compared to Kaspi or Cash App, which grew 23% with $1-1.4 billion in core business revenue per quarter. Afer nearly two decades, Tinkoff Bank in Russia is still growing at around 40%, but its quarterly revenue remains below $1 billion for now.

Similarly, Chime Bank seems less effective than Cash App, growing 30% with $1.3 billion in annual revenue for 2023. Cash App was growing at Chime’s rate a year ago while being three times larger, and it is unlikely that Chime will sustain 20+% growth when it reaches Cash App’s current size in about five years.

The difference in outcomes among these fintechs is largely due to their varying levels of prudence. For example, Wise spends less than 4% of its revenue on marketing, with that ratio declining over the past year. Meanwhile, Cash App targets lower-income consumers in the US, focusing on P2P payments and launching riskier products with more aggressive marketing.

Chime, on the other hand, has been building a safety-mindful bank aimed at capturing direct deposit salaries and monetizing the interchange rate loophole on debit card transactions. To the surprise of some experts, the neobank recently decided to install 4,000 branded ATMs in Walgreens and other retailers. In an email to American Banker, Nick Fairbairn, Vice President of Marketing at Chime, explained their strategy for integrating digital and physical channels:

"We know consumers need good solutions digitally, but also solutions for their financial services in the real world that are as convenient as the mobile ones. We are continuing to enhance our members' experience by bringing more physical services beyond those we offer digitally to make using Chime the best option for everyday people in America."

It seems like an outlier move, considering that cash usage has dropped by half over the past decade to just 16% of all payments by value in the U.S., leading to a gradual decline in branch and ATM footprints. For Chime, investing in branded ATMs is an opportunity to enhance loyalty among its core lower-income customers, where cash is still more prevalent. However, this strategy won’t accelerate its growth.

What does this mean for the disruption of traditional FSIs? There is no immediate threat from even more intense fintechs like Cash App. After a decade, this largest neobank in the US has become the 10th largest consumer bank in the country. However, the leading incumbent, Chase, remains 12 times larger while growing at low single digits.

One notable global exception is the Latin American neobank Nubank. Remarkably, it continues to grow at over 60% while generating almost $3 billion in revenue per quarter. Nubank is now more than half the size of the leading consumer incumbent in LatAm, Itaú, in terms of revenue and profit, while growing 15 times faster with no signs of slowing down. At this rate, it could become the region's largest consumer bank next year.

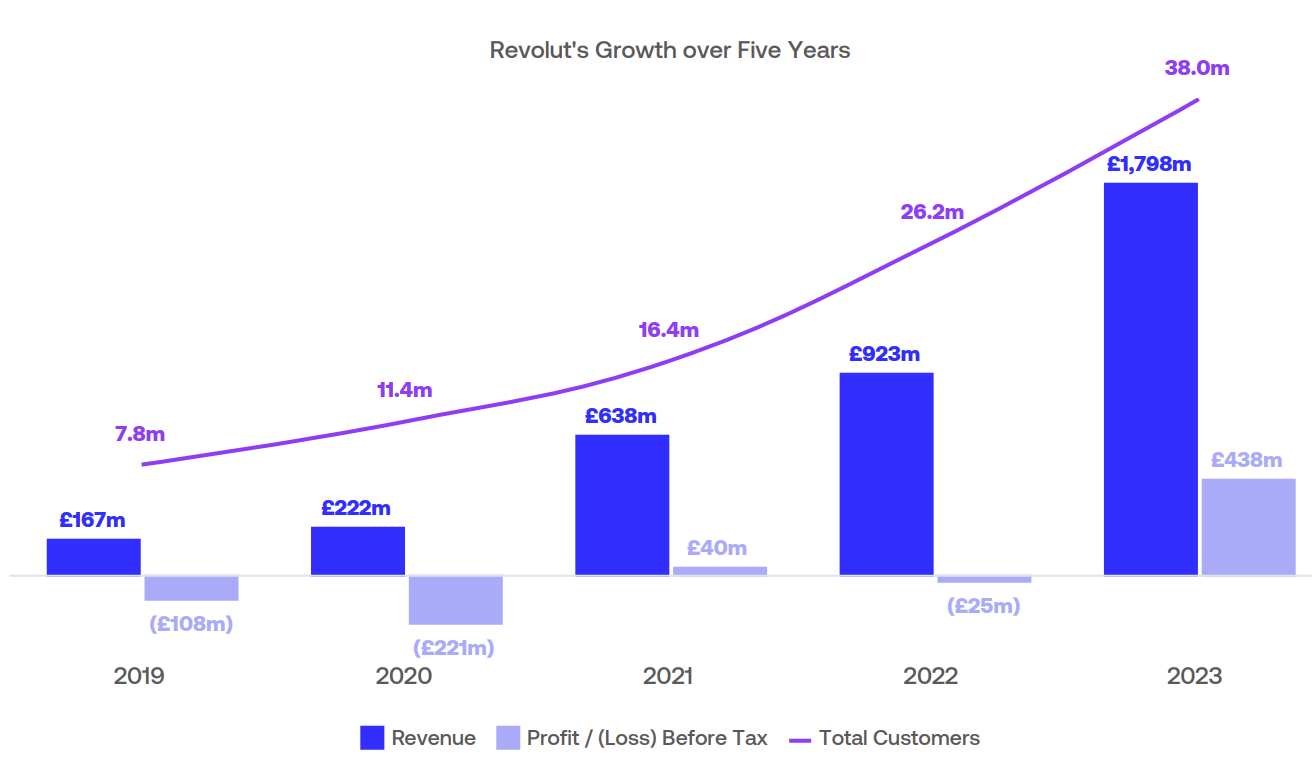

The top dark horse in extending rapid growth is Revolut. After nearly a decade, it doubled its revenue, surpassing $2 billion annually last year. In its latest press release, Revolut reported 80% growth in the first half of 2024. If this pace continues, Revolut could reach $1 billion in quarterly revenue this year while growing significantly faster than any consumer fintech of its size outside East Asia and LatAm.

For traditional financial services players in the markets where these fintechs are expanding, the obvious implication is that growth will eventually come at their expense. It’s never too late to start building digital transformation muscles, especially if the growth of these leading fintechs doesn't slow down. Just as with Amazon, Netflix, or Spotify, a single fintech sustaining growth above 20% indefinitely could eventually disrupt the entire industry. In the meantime, keep an eye on their growth metrics annually.