Crypto in FSIs: Less Bread, More Circus

Also in this issue: Should Traditional FSIs Chase International Growth for Digital Products?

Crypto in FSIs: Less Bread, More Circus

Between 2011 and 2017, over 10,000 merchants began accepting Bitcoin for payments. However, since almost no one carried Bitcoin or wanted to spend it due to its price swings, which made FX margins unmanageable, most merchants quietly dropped it within months. Demand for Bitcoin has remained strong in investment, trading, and illicit finance, but the episode reinforced a hard lesson in financial services: solutions in search of a problem don’t scale.

In 2025, none of the fundamentals that negated Bitcoin as a payment method in 2017 have changed, but the lessons seem to be getting forgotten. In the US, it’s now politically fashionable for certain merchants to signal alignment with the MAGA movement. Once again, we’re treated to a wave of pronouncements about how Bitcoin payments are faster, cheaper, and the future of commerce.

Steak 'n Shake COO Dan Edwards: “Bitcoin is faster than credit cards. We are saving 50% in processing fees. We are seeing a spike in growth after accepting Bitcoin.”

Sure. Tesla and Starlink love reminding people they “accept” Bitcoin, too. Yet curiously, no one ever discloses actual payment volumes. Another frequently cited use case is global liquidity management. Still, once again, none of the players touting these capabilities in press releases provide hard data on transaction volumes, setup costs, and operational efficiencies. If it’s such a game changer, why is everyone so quiet about the numbers?

Thanks to Trump’s economic populism, dollar-linked stablecoins are getting the most attention. It’s no longer just banks and payment players launching them; retail giants like Amazon and Walmart are now considering issuing their own. Their long-held goal is to finally replace legacy payment providers with a private ecosystem where suppliers, partners, and customers transact entirely within their walled garden.

Netting payments in a closed-loop ledger turns settlement into simple database reconciliation, potentially unlocking billions in float and operational savings. Look at Circle: the company pays Coinbase to distribute USDC, has limited visibility on end-user activity, and parks the float in Treasuries. It’s hardly a defensible business model — yet it commands a market capitalization of over $60 billion.

Like in 2017, large traditional financial services and insurance firms feel compelled to play along — but now with 10x the budget, just in case this novel medium turns into the next Visa or SWIFT. Franklin Templeton CEO Jenny Johnson recently rattled off some of the hypothetical value-creation use cases:

Enabling hedge funds to unwind positions across multiple counterparties instantly

Providing investors access to any market globally

Real-time, 24/7/365 settlement for trades

Portfolios with limitless tokenized assets, staked for yield

Converting home equity into blockchain-based annuities

Many large FSIs now want to own the winning stablecoin network. But without coordination, the proliferation of private crypto rails will only deepen the existing fragmentation in fiat finance. Some incumbents still hope US legislation will eventually impose interoperability frameworks and meaningful oversight.

Yet the same regulators who missed the ALM crisis are now expected to navigate a sprawling, opaque crypto ecosystem (“$30 trillion, but not all payments”). That’s especially unlikely under a Trump administration focused on narco-trafficking and slashing regulatory budgets, with the top risks flagged in 2023 likely even worse today.

Crypto has genuine payment advantages — just not in the use cases its proponents like to discuss. For years, Russian cybercriminal networks have dominated the ransomware economy, driving real, large-scale crypto payments via Bitcoin. Yet you never hear crypto advocates celebrating that success or pushing to replicate similar innovation in other developing markets or the West to challenge Russia’s dominance.

Luckily for crypto proponents, Trump appears to view any crypto usage as positive, as long as it’s dollar-denominated, with the possible exception of narco payments originating from the US. If America’s primary goal is global dominance, USD stablecoins are a crucial tool. Russia, Iran, the Houthis, and others can continue evading sanctions through crypto, as long as it’s stablecoin dollars. If Trump makes peace with any of them, one form of USD transfer becomes another, much like what happened with Syria.

In that context, Trump doesn’t even care if USD stablecoins are manufactured outside the US. Societe Generale recently announced plans to issue USD CoinVertible without worrying about tariffs on its circulation. If Tether USD coins are printed by Italians with HQ in El Salvador and have faced no fines in recent years, the only real question is why the top US banks are just getting started. Maybe they’re worried a Democrat could become president in the next election and end the music for everyone.

Of course, the most amusing aspect of the crypto hype is how native players and some adjacent fintechs continue to pretend to work on disruptive use cases. They can’t just enjoy making billions by solving boredom, circumventing sanctions and AML, and enabling well-off folks in developing countries to bypass capital controls. Stripe continues to acquire crypto companies to build an ecosystem for edge cases, while pretending that stablecoin technology will transform fiat finance.

Coinbase’s stated mission is to improve the lives of billions of unbanked people worldwide through access to financial services in the world’s poorest countries. That sounds like a massive, money-losing hassle. Perhaps it’s worth waiting until those individuals have access to water, electricity, and basic safety first. In the meantime, how can we encourage more Americans to get involved with crypto? Let’s tell them to buy Bitcoin instead of a home.

Leading players know that legal crypto is a medium of decadence, not desperation. Coinbase naturally partnered with American Express to offer a Bitcoin credit card and secured an exchange license in Luxembourg. Anyone would prefer that over going to a poor country and spending years trying to make a difference. That’s why they’ve stayed on the sidelines as history’s most ambitious crypto experiment unraveled in failure.

While smaller traditional FSIs should ignore crypto, larger players are right to dip their toes in. Even if it doesn’t move the P&L needle, launching stablecoin products helps develop operating muscle and retain innovative talent. In the end, incumbents will continue to incumb by watching crypto-native and adjacent fintechs, then using their perceived threat as a call to action. For example, a decade ago, Ripple’s overhyped claim that “XRP would replace SWIFT” pushed SWIFT—after decades of milking 1970s tech—to launch GPI and Go, erasing any advantage Ripple might have had.

However, if your FSI wants to actually profit from crypto, edge use cases will eventually fade while core ones continue to expand. Trading, investment, and issuance are generating massive value today. Like in ancient Rome two millennia ago, once your FSI’s target segment has enough bread, they want to enjoy some circus. Why should Cash App, Revolut, Robinhood, and other novel players be the only ones earning easy money?

Should Traditional FSIs Chase International Growth for Digital Products?

When deciding on digital transformation revenue-generating use cases, FSIs have three expansion choices: segments, products, and geographies. For example, Chase feels it’s hitting market share limits in the US, so it’s making a big bet on Europe—starting with simple deposit products and now considering credit cards, beginning in the UK and planning to expand into Germany.

Santander is expanding in the opposite direction, boldly entering the US with marketing featuring high-yield savings accounts and unconventional ads. Offering yields above Treasuries helps attract 100K customers easily. Like Chase, Santander now aims to cross-sell those customers into revenue-generating products. The key question in both cases remains: what substantial competitive advantage do they have against numerous strong local incumbents and neobanks?

The answer is unclear, as none of the global banks have yet figured it out, with Citi, BBVA, and HSBC on the retreat. Leading fintechs are also struggling with international expansions. Cash App left the UK, N26 and Monzo left America. Struggles in developed markets are evident, given the already intense competition for profitable customers.

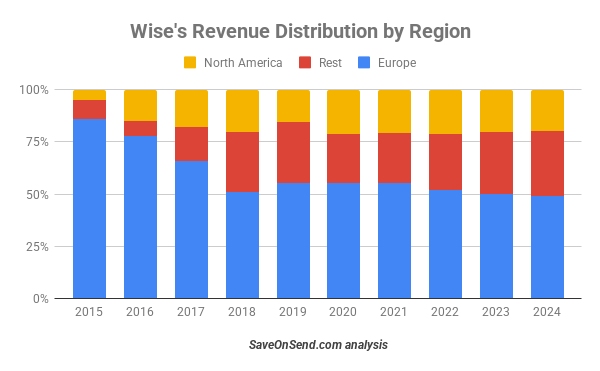

Even for Wise, North America remains its slowest-growing region, with revenue up just 11% recently. Like Revolut, Monzo, and N26, breaking beyond the European expat niche in the U.S. has proven difficult against entrenched players like Chase and agile fintechs like Remitly.

Furthermore, developed markets are overregulated, especially in banking, where hundreds of policies must be maintained for every function. Regulators assume capitalism is harmful and believe FSIs exploit poor people to make excessive profits. As a result, price controls and other restrictions on risk-based products exist at both national and local levels. In this environment, offering credit cards to customers with low credit scores and little competition may seem exciting. Still, there’s a high risk they won’t repay, and regulators will hold you responsible.

Developing markets, on the other hand, still present opportunities—albeit rapidly fading. Not because of competitive traditional banks, but due to fintechs. This occurs in two ways: through company expansions, such as Revolut in Moldova or Nubank in Mexico, and via fintech “mafias,” where executives leave established firms en masse to launch new ventures.

PayPal, Stripe, Revolut, and other fintech “mafias” show how executives absorb key playbooks from their original companies and successfully apply them to new segments, products, or markets. With its first unicorn, the Tinkoff alumni are emerging as another mighty talent forge, driving fintech innovation across the Americas and Asia.

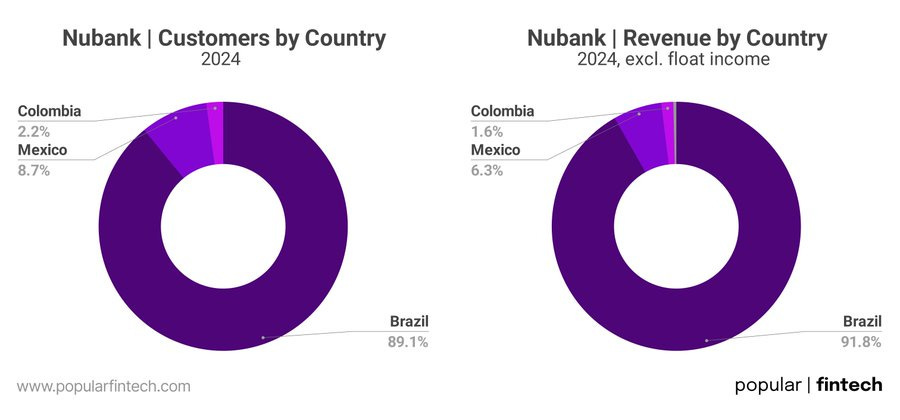

TBC Bank from Georgia is now expanding into Uzbekistan, the largest country in Central Asia, which boasts advanced payment rails and robust regulations. As an early mover, it has captured a 45% ROE on lending products. Nubank, of course, is the most interesting player, so far expanding into two countries while fortifying its home turf. Brazilian consumers are no longer easy pickings, leading the world in mobile device adoption for retail purchases.

Mexico, vacated by traditional global banks, is probably the most interesting market for a showdown among the world’s top neobanks, in a historic moment. Nubank, Revolut, and ex-Tinkoff alumni are about to cross swords (and playbooks) in the same country for the first time. God help the remaining unbanked in Mexico. Until Chase and Santander prove they can become formidable players abroad, it might be better to wait until these leading neobanks run out of steam.