Digital Innovations Come and Go While FSI’s Physical Footprint Endures

Also in this issue: Beyond Signaling - FSIs Must Align Digital Transformation with Operational Maturity to Meet Expectations

Digital Innovations come and go while FSI’s Physical Footprint Endures

My 21-year-old Israeli niece exclaimed with delight, 'The banks here are so awesome!' Unbothered by our shocked expressions, she continued, 'The people there were welcoming and knowledgeable, and the design was incredibly comfortable.' Her enthusiasm for the banking branch experience contradicted everything we had been hearing for almost three decades. Since I moved to the US in the late 90s, the constant refrain has been 'the branch is dead.' Leading experts have been assuring us that the digital revolution, fintechs, and more recently AI would eliminate the need for physical branches. Yet, stubborn consumers, including the younger generation, continue to frequent them, and some even enjoy the experience.

© Photo credit: Exiting Bank Branch (C-Suite Counsel)

1. “The reports of branch death have been grossly exaggerated.”

Extreme pronouncements often grab attention, leading to articles that either portray FSIs' physical presence as outdated and wasteful or as potentially detrimental to underserved communities.

EXCLUSIVE: The death of the bank branch! American banks have shut almost 10,000 branches since 2019 - leaving scores of communities without access to basic financial services

It may be validating for financial experts and journalists to assume that the top concern for proverbial Montana's elderly or Alabama’s poor population is the lack of nearby branches, but it is not. In the United States, the number of branches per capita is among the highest in the world:

Although the number of bank branches per capita in the US started declining by approximately 0.5% annually around 2010, this downward trend has not accelerated, and there are still approximately seventy thousand branches in existence.

2. Do FSI executives not understand their business?

Since the Western poor and elderly are not being overlooked, let’s shift our focus to the issue of hard cash. Should FSIs eliminate their physical presence and allocate the freed-up funds toward achieving remarkable returns through digital transformation? Advocates for such a strategy mainly consist of incentivized digital vendors and consultants, and their argument goes something like this:

Since the 1990s, there has been a rapid paradigm shift from analog to digital which fundamentally transforms every component of human experience.

Consumers, accustomed to the convenience of using apps like Uber and Amazon, are increasingly avoiding the cumbersome physical outlets of FSIs.

A competitive FSI landscape results in increasingly narrower margins, and maintaining a physical channel becomes an additional high-cost burden without material returns.

By now, it is evident that none of these assumptions reflect reality. While fintech vendors and consultants may not share such a sentiment, regular individuals still yearn for the analog world. They visit shops, restaurants, and yes, FSI outlets, not out of necessity but because they genuinely desire to do so. Furthermore, as the 2023 banking crisis in the US demonstrated, consumers (as well as businesses) turn to incumbents with substantial physical footprints during times of trouble.

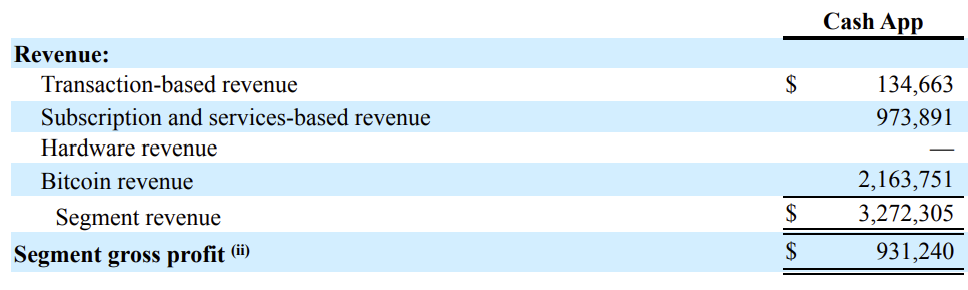

As we discussed in the previous newsletter, FSI incumbents often have the worst prices which makes their profit margins the envy of asset-light players. For instance, in Q1 2023, Chase’s NET margin (32% = $5,243 Net income/$16,456 Net revenue) exceeded the GROSS margin of Cash App (28% = $931,240 Segment gross profit/$3,272,305 Segment revenue):

Why would consumers not seek the best price from digital-only players? I personally encountered this puzzling phenomenon when I launched SaveOnSend in 2015, a comparison app for remittances designed to help migrants choose the most cost-effective option, typically found in digital channels. Surprisingly, apart from the Indian migrant community in the US, other migrant groups seemed willing to pay higher fees for an in-person experience. This rationale aligns with my niece's preference for visiting Wells Fargo's branch and reflects the mindset of the majority of regular individuals. Several factors contribute to this perspective:

The convenient locations of physical outlets, often situated nearby, with minimal waiting time and comfortable waiting areas.

The friendliness and welcoming nature of the staff, who greet visitors with a smile and demonstrate enthusiasm when serving them.

The availability of staff who can address specific questions on the spot, and who offer personalized assistance instead of generic answers found online.

The knowledge and expertise of staff in guiding individuals through complicated financial decisions (e.g., monthly savings to meet long-term goals or understanding trade-offs of higher spending limits).

While the points mentioned above may seem obvious to most FSI field employees, they can come as a surprise not only to vendors and consultants but also to employees in the IT and Data groups within FSIs. Surprisingly, even leading 'agile' teams in FSIs often need to be encouraged to step out of the office and actively engage with customers for whom they are developing innovative digital features.

3. Implications for FSIs

One of the recurring themes in our weekly newsletter is the optimization of digital transformation activities with the ultimate goal of generating significant revenue. Here is how Jennifer Piepszak, Chase Co-CEO, describes this practical mindset:

“It’s not a binary choice between branch and digital. Most of our banking customers engage with both.” She added that the two channels “cast halo effects on each other, as we see higher digital account production in markets where we have a branch presence.”

So the FSI physical footprint is here to stay. However, similar to other retail players with physical networks, there is a significant disparity in service quality within the same franchise. For example, a Chase branch in Stamford, CT, has an inferior look and feel compared to a Chase branch in Greenwich located just 5 miles away. The reason behind such differences is a practical one and can be observed in grocery or merchandise outlets in the same communities. The quality of service and investment in upgrades are largely influenced by the pool of nearby consumers and employees. As affluent individuals often prefer to live in separate areas from those with lower incomes (shocker, I know), it creates clusters of different service quality in alignment with different customer expectations.

A one-size-fits-all physical network would be overkill for some customer segments and underwhelming for others. As my niece pointed out, there is a stark contrast between banks in the US and Israel. She described bank branches in Israel as resembling an 'inside of a crowded bus' and characterized the service as rude. However, if Israelis don't mind this experience, it wouldn’t make sense to spend money on upgrading it. Digital transformation doesn't replace the physical footprint; instead, it augments it in spots with profitable demand while leaving what already works alone.

Beyond Signaling: FSIs Must Align Digital Transformation with Operational Maturity to Meet Expectations

Many seemingly illogical behaviors exhibited by FSI executives can be explained by a simple factor: like any normal humans, they tend to prioritize easier tasks. This phenomenon can be likened to teachers in failing US public schools who spend valuable time discussing unrelated topics with students. It is not that they are activists; rather, the challenge of leveling up another human being is exceptionally difficult. Consequently, they resort to easier tasks, resulting in persistently embarrassing proficiency scores over the past 10-20 years:

Digital Transformation is a highly challenging leveling-up endeavor aimed at accelerating value creation through the transformation of business and operating models. It leverages five crucial digital pillars of the 21st century: Agile, API, Cloud, DevOps, and AI/ML. In essence, it enables FSIs to generate significantly increased revenue through innovative digital methods. Since mastering the complexity of digital transformation requires time and effort, many FSI executives, like those teachers, opt for an easier path while still signaling ambitious goals.

1. Suffering consumer segment as the primary focus of digital transformation

As we discussed in another newsletter, although the value of digital transformation can be easily quantified, FSIs often fail to do so effectively. Instead, we frequently encounter more abstract justifications for digital transformation, such as defending against fintech competitors or modernizing legacy systems. Today, let's delve into a more compelling case that illustrates the divergence between the stated objectives of digital transformation and the tangible initiatives being pursued.

Idealistic young employees nowadays often seek a noble mission in their jobs before becoming parents and homeowners. Additionally, the rise of social justice causes and the popularity of stakeholder capitalism in the past decade have compelled almost every FSI and fintech to signal a higher purpose beyond banal wealth and power accumulation. This shift has prompted some FSIs to also emphasize their commitment to social impact in the context of digital transformation. Sastry Durvasula, Chief Information and Client Services Officer of TIAA, a $30-billion-revenue FSI, describes the underlying purpose of their digital transformation efforts as follows:

“Our transformation journey is integral to us achieving our mission in the face of America’s retirement crisis.” […] Durvasula notes that the problem is even worse for women and diverse populations. Women routinely live as much as 30 years after they’ve stopped working and retire with 30% less retirement income than men, and 54% of Black Americans do not have enough to retire.

Americans love rooting for the underdog, so it would be fantastic if TIAA could profitably prevent poor women and minorities from falling into destitution during their final years.

2. How shall TIAA proceed?

With such a great mission in mind, where does TIAA start? First of all, as we discussed in this newsletter, they shouldn’t even attempt such ambitious end-user outcomes until TIAA masters Level 3 (IT Product) of digital transformation and is ready to implement Value Streams with real agile practices (not IT-centric innovation):

Once TIAA reaches Level 3 and creates the “Poor Women Retirees” value stream, the next step will be to actually meet a representative sample of those women and understand why they “retire with 30% less retirement income than men.” That discovery would then inform TIAA’s understanding of root causes and potential solutions, and help decide if a digital approach would address them.

3. What will TIAA do instead?

While seemingly obvious, there is almost no chance that TIAA would pursue the above approach. The first red flag is the lack of a business champion. While Sastry’s role is acceptable for accelerating transformation (see this newsletter for a successful example), he needs to find a peer who would be responsible for creating a profitable business out of that poor women & minorities segment.

Sastry probably doesn’t have such a champion, so his top initiatives are within his direct control (see the Forbes article for more details):

AI-Powered Client Services: personalized client experience, back office automation, fraud protection.

AI for ESG investing: a proprietary municipal ESG scoring framework to achieve net carbon zero.

Data governance for AI/ML development environment: field personnel access to insights.

These are typical initiatives for an advanced asset management company, and one of them might even create a significant P&L impact. However, it would be unrealistic to expect that such initiatives would achieve TIAA’s digital transformation mission of addressing retirement inequality. In 3-5 years, however, TIAA might be ready to get going. Such far away goalpost, while is not an exciting external signal, sets realistic expectations for employees and customers.

Other FSI Digital Transformation Reads

CDO Deepak Sharma on banking IT success

Bat Out of Hell: Identifying Your Durable Advantage in Fintech