Digital Transformation Has a Singular End Point, But It’s Unattainable for Most FSIs

Also in this issue: Generative AI Hype is Subsiding in FSIs, and It's Still Too Soon to Know the ROI; The US is Becoming Increasingly Hostile to Fintech Visionaries Monetizing Social Causes

Digital Transformation Has a Singular End Point, But It’s Unattainable for Most FSIs

Even though most FSIs won't get there in our lifetime, digital transformation has a singular endpoint that has been known for more than a decade. To accelerate the capture of business value via digital capabilities, every leading FSI and every fintech in the world follow the same digital transformation milestones: from an ad-hoc operating model to IT projects, to IT products, to Value Streams & Platforms, to KPI centricity. The only difference between FSIs and fintechs is that the former are typically stuck in the initial stages, while the latter are founded in the advanced stages from the start.

Even the best fintechs are not reinventing a new operating model but creating increasingly intricate playbooks with decreasingly marginal returns. Stripe's valuation just hit $70 billion, and its best-known product lead, Jeff Weinstein, recently spent two and a half hours with one of the most insightful interviewers on the topic of digital products. Just imagine how much you could learn about the most effective operating model for scaling products in your traditional FSI.

Nope, you will learn nothing fundamentally new. You will hear a lot of tactical suggestions and descriptions of novel playbooks on improving customer experience. For example, when gathering customer feedback, Stripe doesn't just have employees try the feature; they organize a "study group" where employees act as owners of an imaginary small business, with made-up names and business models.

Compare that insight to the fundamental tenets of a target state operating model related to customer centricity: minimalistic cross-functional teams, full autonomy to scale a product, and goals centered on significant P&L impact. It's cool that Stripe found instances where it's more efficient for employees to pretend to be clients rather than reaching out to prospects directly, but the additional P&L impact from such advanced techniques is unlikely to be substantial.

And to be fair, what are the chances of being materially more effective than the playbooks from the prime scaling periods of the three most influential digital natives of the 21st century? Amazon, Netflix, and Spotify had to invent and perfect their operating models during those periods because no one had successfully grown with such velocity and scale before.

The lack of novelty or reinvention of the endpoint of digital transformation is also why we only hear about typical layoffs from leading FSIs like Citi and fintechs like Block, never a fundamental change in how they operate. Similar to Elon Musk eliminating 80% of Twitter's dead weight, Jane Fraser cutting 10% of Citi’s workforce was a good-old culling of low-performing employees and a bureaucratic moat. To make it sound more hip, some FSIs started blaming layoffs on generative AI, but the actual drivers are always the same as recently described by Intuit’s CEO:

“… significantly raised the bar on our expectations of employee performance, resulting in approximately 1,050 employees leaving the company who are not meeting expectations… reducing the number of executives (director and above) by approximately 10%… eliminating more than 300 roles… close two of our sites in Edmonton and Boise, where we have over 250 employees…”

When FSIs deviate from that singular transformation path, it always backfires. Since becoming Citi’s CEO in early 2021, Jane Fraser announced a new era of leading with empathy, believing it would establish an enduring competitive advantage. After the stock halved by late 2023, Citi had to embrace a proven operating playbook, and its stock went up 70%:

The digital transformation journey is long and ambiguous for a typical FSI, not because the definitions or milestones are unknown, but due to the need for executives to level up their own operating muscles to achieve each next operating model horizon. This crucial change is rarely discussed in the context of FSIs’ talent-related priorities.

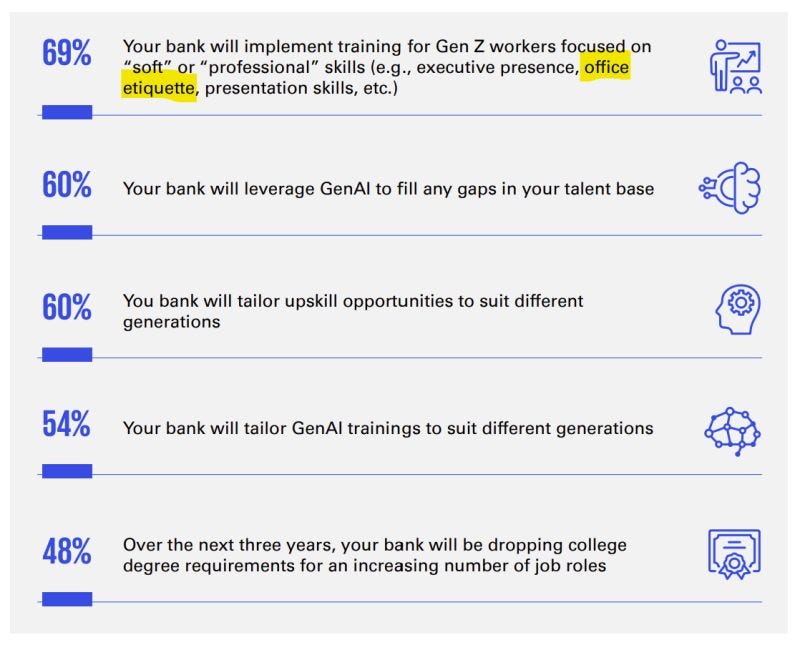

In a recent KPMG survey of US bank executives, the focus was on onboarding new hires, especially younger generations. Teaching Gen Zers the office etiquette of maintaining eye contact and speaking in complete sentences is foundational for basic teamwork, but will it help those FSIs evolve from IT product teams to Value Streams?

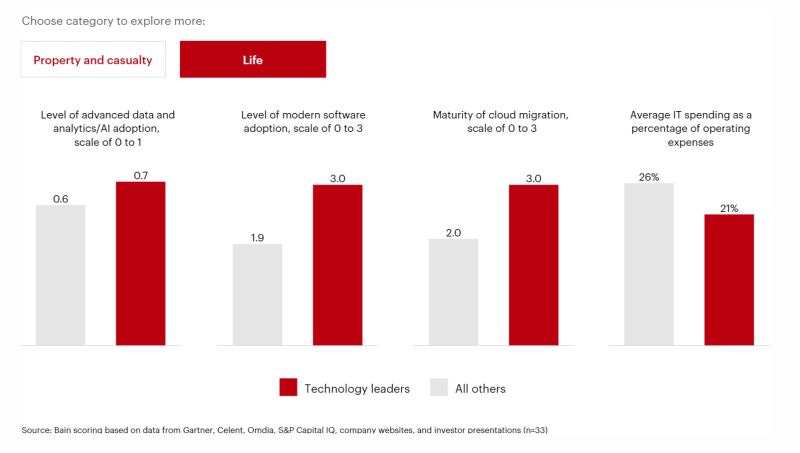

Another common response that muddles the meaning and destination of digital transformation is conflating it with scaling technology solutions through higher IT spending. Unfortunately, this does not necessarily correlate with outcomes, and IT budgets should vary significantly year-to-year based on ROI maximization. For example, Bain & Company found that the fastest-growing life insurance companies, unsurprisingly, have higher technology maturity but spend much less on technology:

If your peers on the leadership team badmouth digital transformation next time, use that opportunity to remind them how straightforward the theory and destination are. Ask if they are willing to partner with you to level up their own operating muscles.

Generative AI Hype is Subsiding in FSIs, and It's Still Too Soon to Know the ROI

Like blockchain several years ago, FSIs' hopes for generative AI are based on one big "if." Blockchain solutions are game changers IF everyone switches from traditional cross-border and domestic networks to the new single crypto-based rail. Similarly, generative AI would be revolutionary IF data quality didn’t matter.

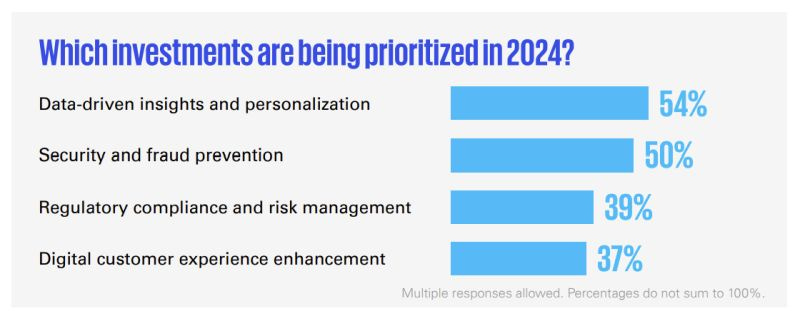

How could data quality not matter? The thinking goes that GenAI’s cognitive abilities would progress so rapidly that it would figure out how to retrieve the right data from anywhere and fill the gaps as needed. If you believe that, it's less surprising that the same banks with chatbots incapable of answering questions outside of FAQs were recently prioritizing generative AI investments in insights and personalization:

A year and a half later, the hype is starting to subside, and the miraculous properties of generative AI are losing believers among executives in financial services and insurance. An increasing number of C-suite leaders recognize that generative AI won’t miraculously pull data from unstructured sources, and even leading FSIs like Citi will still spend years fixing data issues the old-fashioned way:

Like all technology hype, generative AI was amplified by vendors, consultants, and analysts based on the simple fact that FOMO and the threat of disruption are effective for driving sales and engagement. For example, Citi’s recent analyst report warns of AI agents' potential to disrupt consumer finance. Citi even highlighted specific business lines susceptible to disruption, perplexingly suggesting that wealth management is as disliked by clients for its high friction as debt refinancing and that debt refinancing is as simple a process as buying stocks:

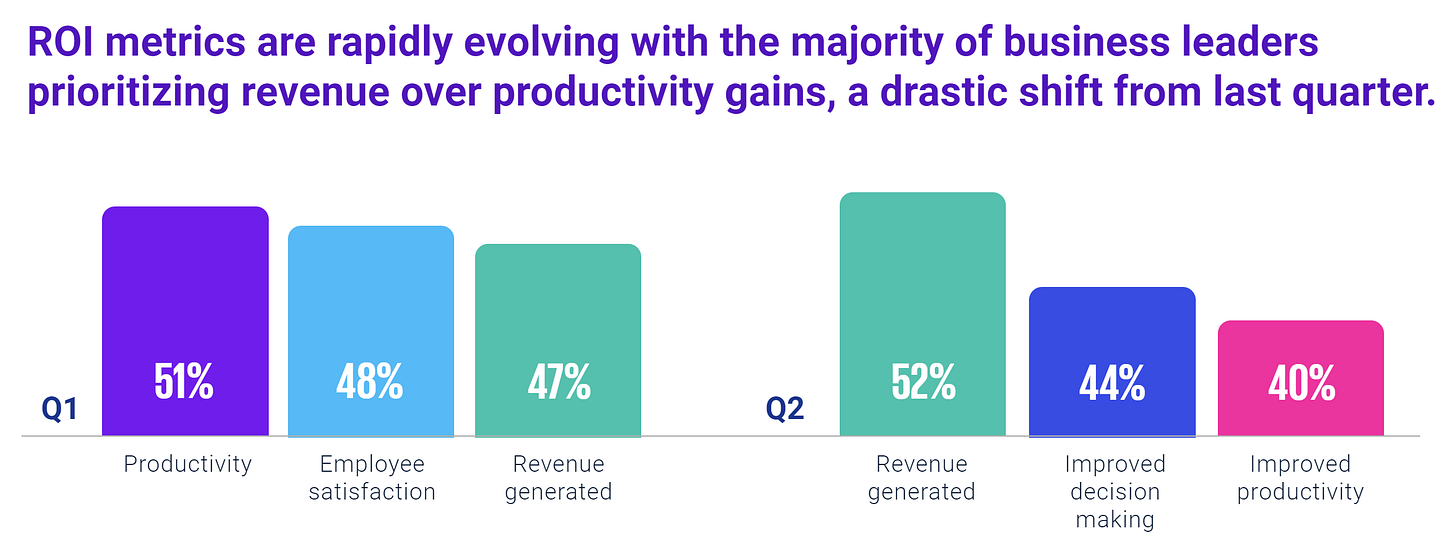

This confusion is not confined to the financial services and insurance sectors. In a recent KPMG survey of C-suite and business leaders across industries, the most likely ROI areas shifted randomly from one quarter to the next, signifying that no one still has a clear idea of where generative AI could create meaningful returns:

Considering the US booming economy and the early phase of the hype cycle, I expected the generative AI bonanza to last until the end of the year. However, Julia Bardmesser, a former CDO at Voya, recently shared that many FSIs are already beginning to apply ROI rigor:

I was at lunch with a CDO, and he shared - “We now have a really strong ROI requirement for any AI related implementations, otherwise, we put them on the backburner.” Many others have echoed a similar sentiment.

More CEOs are articulating specific priority use cases for generative AI implementation in their FSIs. Automatically capturing and synthesizing phone call information is one of the most popular use cases, second only to software development. While Morgan Stanley applies this to wealth managers, Wells Fargo’s CEO recently shared their focus on call center staff:

“…we put a lot of effort into answering that [customer questions] correctly but also making sure that we're capturing that information, understanding root cause across all these calls we get. That means bankers have to go -- telephone bankers have to go in, actually enter what the call was about, what they think the root cause is. We then have to aggregate that and so on and so forth. Through GenAI, that can be done automatically…”

We will have to wait until next year to start validating the ROI of such efforts, but it is already clear that the likely winners will be confined to narrow use cases with targeted investments. If the generative AI pilot in your FSI is not set up to measure its financial impact at scale, there might still be a few months before the Board and CEO start asking, “How much did we spend on that techy thing, and how much money has it made us so far?”

The US is Becoming Increasingly Hostile to Fintech Visionaries Monetizing Social Causes

One of my favorite topics in financial services and insurance is the monetization of social causes. Since Enron invented carbon credits in 1997, visionary CEOs of traditional FSIs and fintechs realized that many wealthy and gullible Westerners feel guilty about the state of humanity and are willing to spend lavishly to alleviate that feeling. Building an unnecessary office tower or flying in a private jet doesn’t help reverse global warming, but purchasing fake carbon offsets makes that concern less pressing. Massive data centers for the promise of GenAI may seem decadent, but carbon offsets generated by not providing electricity to Sub-Saharan Africans make it more palatable.

In many Western countries, both corporations and politicians were happy to support visionary FSIs, and ESG ETFs alone have already surpassed half a trillion in AUM worldwide. It could have been much more if not for the interference of pesky American conservatives who keep asking for proof that ESG is not a scam. The US tax agency also recently intervened in a willing exchange between sellers and buyers, warning about clean energy credit scams:

The IRS is obviously correct in disallowing clean energy tax credit scams for individuals. Only business entities can afford to hire bankers, fund managers, and consultants to ensure that such scams meet all legal requirements, as long as no one gets too greedy.

We discussed in April how BlackRock overplayed its ESG hand by trying to force companies to change their strategy and governance, but one fintech seems to have taken this to a whole new level. Bloomberg recently reported on a visionary fintech named Aspiration that is “struggling to stay afloat and faces an investigation by US authorities, including the Department of Justice and the Securities and Exchange Commission.”

Aspiration checks all the right boxes for clever social monetization. It’s the DiCaprio-funded disruptor with "anti-Wells Fargo" social consciousness, fossil-fuel-free, nonprofit-friendly, and, of course, with the tagline, “Clean rich is the new filthy rich.” Aspiration raised initial suspicion in 2021 from ProPublica, which reported on discrepancies between the fintech’s PR statements and reality:

5 million passionate members → anyone who has ever signed T&Cs

Planted over 35 million trees → the cumulative total of to-be planted trees

Fossil-fuel-free fund investing → owns shares in multiple companies that are either huge users of fossil fuels or are in the industry itself

Cash flow positive → Adjusted EBITDAM

That seemed like nitpicking, considering that climate catastrophe is always a decade away and humanity needs out-of-the-box thinkers to prevent it. Unfortunately, Bloomberg uncovered that Aspiration has potentially evolved to the ultimate level of greenwashing—going beyond the popular practice of making up carbon credits to also fabricating their buyers.

It started innocently in 2020 when Aspiration stumbled upon a social monetization gold mine by reselling reforestation services performed by others to corporate clients at a very high markup:

Within a year, this new unit leapt to more than half of Aspiration’s sales—accounting for $56 million of the $100 million in revenues it reported for 2021. But the explosive growth in Aspiration’s new business was driven in part by dubious deals that inflated the company’s revenue....

While US government agencies declined to confirm what is included in their investigation, Bloomberg’s interviews with 28 former employees and several of Aspiration’s corporate customers, along with a review of numerous internal company documents, identified specific examples of potential fraud:

An unusual number of customers were Colombian celebrities, including an actor and several retired soccer players. Two of them told Bloomberg Green that they had signed agreements simultaneously with Apogee Pacific LLC—an entity that was controlled by Joseph Sanberg, Aspiration’s co-founder, board member and a major shareholder—which would cover the costs they were supposed to pay Aspiration.

Hopefully, the world won’t again witness visionary leaders like those from Enron and FTX going to jail for accounting misinterpretations. But just in case that pressure doesn’t subside, your traditional FSI or fintech is better off launching the next social monetization use case in Western Europe, Australia, or Canada.