Aligning Digital Transformation in FSIs with Sub-Segment Customer Demand

Also in this issue: GenAI May Not Transform FSIs, But the Promise of Differentiation Remains

Aligning Digital Transformation in FSIs with Sub-Segment Customer Demand

For the past couple of decades, I’ve had my go-to falafel guy in Israel, despite only visiting him and my family once a year. He’s refused to accept credit cards all this time, and it hasn’t affected the constant line outside his tiny shop. Last week was no different: “Falafel’s on me, just don’t mention credit cards,” he said, before asking to take a picture with his “American fan.”

Seven decades after their introduction, credit cards usually work like magic—allowing travelers to buy things in foreign countries with just a piece of plastic, no ID required. Yet many places thrive without digitizing their payment systems. In developed countries like Germany, cash remains a primary payment method. According to a recent Kearney survey, consumers there are content with relying on their traditional bank for all their needs, rather than switching to or opening an account with a fintech:

The resilience of traditional financial services is also evident in one of 2024’s most ironic trends: banks proudly announcing massive investments in branches. Bank of America, PNC, Chase, and others are celebrating new branch openings, seemingly in defiance of digital influencers and as a signal of their commitment to financial inclusion.

Both a Yemeni falafel shop near Haifa and Chase bank in the U.S. have found profitable business models rooted in traditional customer interactions. However, some might view Chase’s focus on branches as a defensive move—"It’s not like they can compete with fintechs in the digital space, so branches are their only play." A decade ago, it was widely accepted, including by me, that neobanks would differentiate themselves from traditional banks by being customer-centric, leading to superior user experience and satisfaction. But how has that played out according to recent consumer surveys?

In the U.S., Chase is significantly ahead of Cash App, while Chime’s customer satisfaction lags behind nearly all major banks. Surprisingly, Cash App's Product Lead expressed excitement over these survey results. After more than a decade, the largest U.S. neobank is barely keeping pace with traditional banks among Gen Z and Gen X consumers—yet this is being viewed as a win:

Similarly, traditional banks performed well against digital ones among Gen Z in a recent YouGov survey. Consistent with other studies, younger consumers don't dislike their traditional banks; in fact, they value the human interaction found in nearby branches.

However, the resilience of traditional channels and customer satisfaction with traditional FSIs may obscure a more nuanced view of competitive intensity. Leading consumer fintechs tend to excel at operating on a sub-segment level, focusing on areas where their digital business models can effectively address significant pain points.

The most popular sub-segments for consumer fintechs are those with much lower access to mainstream financial products. To be fair to traditional FSIs, they often deprioritize these segments for pragmatic reasons, such as lower revenue and profit potential due to limited funds and high delinquency rates. Moreover, many fintechs frequently highlight the challenges faced by these segments while primarily targeting well-off consumers.

Cash App is a rare exception; with its hip-hop aesthetics and the right influencers, it has effectively targeted younger black consumers. After a decade, Cash App has captured twice the market share within this segment among its active users compared to their proportion in the population:

Similar to the lessons learned from Capital One three decades ago, traditional banks now have an opportunity to learn from fintechs like Cash App on how to effectively target riskier consumer segments interested in digital-only engagement. For example, Cash App’s Borrow product reached $4 billion in volume in 2023, reflecting a 74% growth. Notably, 70% of its active users have “poor” credit ratings (FICO < 580).

For FSIs undergoing digital transformation, prioritizing new customer-facing use cases should focus on identifying demand within specific sub-segments. The key concern with targeting lower-income groups is whether digital products worsen their financial situation by increasing debt. Despite claims of promoting "financial inclusion," leading fintechs like Cash App and Affirm have not shared data on how their products affect customers' financial health. Hopefully, traditional FSIs will be more transparent.

GenAI May Not Transform FSIs, But the Promise of Differentiation Remains

The financial and insurance sectors have undergone a glacial change in their operating model over the past few centuries. The transition from abacuses to calculators and then computers has allowed FSIs to introduce new product features at lower costs, but it hasn't fundamentally transformed their organizational design and governance, till recently. Like the hierarchical structures of 16th-century Italy, many FSIs today still operate with business & functional silos. Many are struggling to manage themselves as integrated enterprises, as Citi may have recently discovered.

Hopefully, Citi's C-suite will be compelled to learn firsthand the difference between master and reference data and what it takes to provide enterprise-wide data as a service to external users like regulators. However, its traditional operating model is likely to persist overall.

The fintech evolution of the past quarter-century has given us hope for a fundamentally new operating model: turning the traditional model on its head by granting P&L decision autonomy to cross-functional product teams (aka value streams) and requiring business and cost-center executives to learn how to support those front-line units.

Even the world’s best fintechs have learned the hard way that sustaining such seminal transformation is challenging. The forces of organizational entropy require founders to micromanage drastic resets every 5 to 10 years, as their salaried hires often lack the intensity to maintain a superior operating model independently. A decade ago, an intriguing thought came into view: could emerging technologies like blockchain or AI fortify the advanced operating model or even unlock an entirely new tech-based operating model?

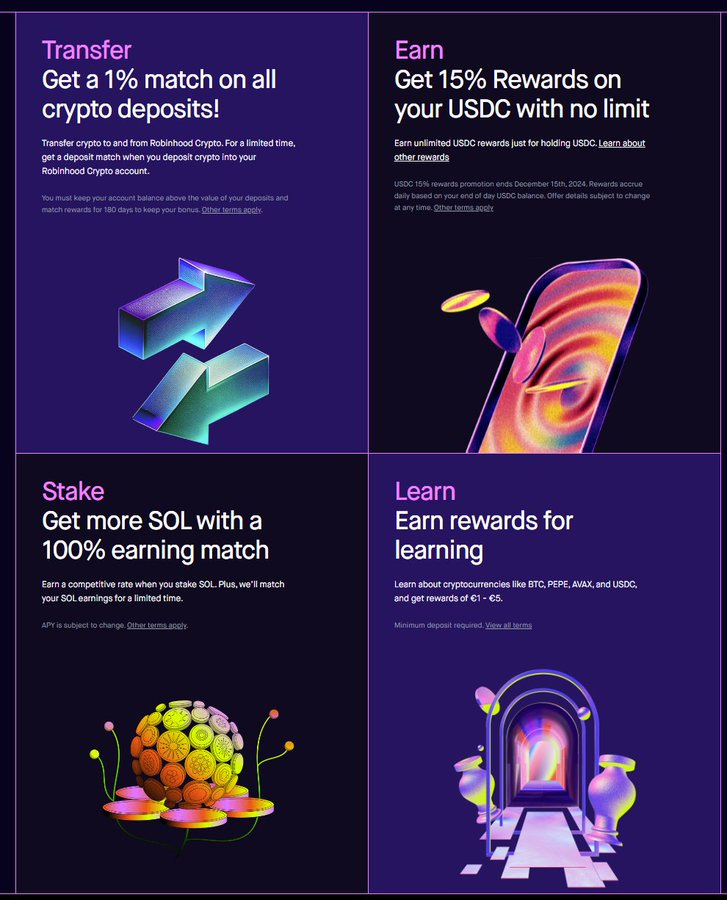

For blockchain, the answer has been a resounding “no.” Leading fintechs with crypto products like Coinbase, Cash App, and Robinhood have merely expanded deposit boxes and day trading to new types of assets via digital channels. The Web3 operating model that promises to “Break The Cycle, Update The System” sounds appealing, but the reality is that printing money and convincing consumers to buy it for fiat currency is simply more lucrative.

In contrast, AI presents a potential vision for a unique operating model that goes beyond catchy slogans. It’s easy to imagine how GenAI, upon reaching AGI, could entirely replace humans in the increasingly complex aspects of FSI operating models:

Five centuries of operating model evolution: Hierarchical silos → Autonomous teams → AI-only governance

For now, it remains just a vision, as the arrival of AGI continues to be postponed. However, expert hype and investor pressure have pushed financial services and insurance companies to appear ready for a potential AI revolution. A clear sign of readiness involves expanding data-related leadership roles, exemplified by New York Life, which now boasts three data chiefs:

The second-best move is to hire a well-known consulting firm. Accenture recently reported 3X growth in GenAI sales for two consecutive years, reaching $3 billion in bookings this year. In a recent interview with CRN, Accenture Chair and CEO Julie Sweet clarified that most of the deals remain on the smaller side:

For all of fiscal year 2024, Accenture had $3 billion in new GenAI bookings, including $1 billion in its fourth quarter, Sweet said. For the full fiscal year, it had nearly $900 million in revenue. This compares with fiscal 2023 when the company reported about $300 million in sales and roughly $100 million in revenue from GenAI.

“This was an area where our clients continued to buy small deals, and we focused on accelerating our growth here,” she said.

While GenAI may not transform the operating models of FSIs, significant advances in its computational capabilities keep the promise of differentiation alive. Using brainteasers as a proxy, I was shocked by the progress in the latest releases across top GenAI platforms, especially ChatGPT. Whether it was an 18th-century folk puzzle from Russia or a complex problem about cutting-edge space exploration, I spent hours trying to stump the bot, but to no avail.

The areas of differentiation are also becoming clearer. Unlike machine learning, GenAI is unlikely to be leveraged in customer-facing products due to regulatory concerns surrounding its black-box nature. Fintech expert Jevgenijs Kazanins highlighted a recent quote from Affirm COO Michael Linford, which confirms this hesitation even among relatively risk-tolerant players:

"So I don't think you're going to see us talking a lot about AI in the context of underwriting really at all. I do think there's a lot that AI is doing in the corporate entity."

Automating the manual work of relationship managers, risk underwriters, financial crime fighters, and contact managers has plateaued with machine learning, but GenAI offers additional runway potential. With a cost-center focus, the use cases have advanced into production across large FSIs, although they remain in the early stages of scaling, consistent with Accenture's observations. In the same interview, the Accenture CEO highlighted a couple of projects with FSIs:

Sweet discussed several GenAI projects the company worked on during the quarter, including a project to help accelerate the transformation of TIAA’s retirement record- keeping capabilities and operations and a project to develop AI-powered underwriting solutions across multiple lines of business at QBE Insurance Group.

One interesting aspect of GenAI is whether it will create a competitive advantage for larger FSIs purely due to their size (data volumes) rather than effectiveness. Generally, size does not equal scaling effectiveness or return on investments. Many large FSIs are spending billions on technology while experiencing years of stagnation in both top-line growth and expense reduction. Recent BCG studies of various insurance verticals confirmed that bigger is not always better:

In 2025, we will start seeing the actual ROIs from the GenAI deployments made in 2023-2024, particularly across cost center use cases. This will likely begin with large FSIs that already have a proven track record of using pre-generative AI for large-scale automation. However, AI-driven transformation of the operating model might have to wait until the 22nd century.

Other Insightful Reads

A tale of two transformations: Lloyds and Chase UK on driving change in the banking sector