Accelerating Digital Transformation: Why FSI Leaders Must Rethink How They Create Urgency

Also in this issue: FSIs and Fintechs Are Doubling Down on Traditional Channels

Accelerating Digital Transformation: Why FSI Leaders Must Rethink How They Create Urgency

Some FSI titans always feel the need to create a sense of urgency—not because they’re trying to win the market, but just enough to keep employees on their toes and to attract media coverage. Ray Dalio of Bridgewater Associates is the most famous example, spending four decades regularly predicting depressions and, more recently, civil war and fascism in the US.

Jamie Dimon is also known for constantly catastrophizing, to the point he’s often joked about for “predicting ten of the last zero recessions.” Since October 2024, Dimon has been insisting the US is already in World War III and urging the government to stock up on bullets and guns.

Dimon’s habit of manufacturing urgency often leads to puzzling justifications for JPMC’s massive tech spend. On the earnings call in 2023, he pointed to competition from Wells Fargo and, “obviously, Marcus, it’s Apple, it’s Chime, it’s Dave.” Wells Fargo was only recently allowed to grow again. The Marcus–Apple Card partnership was such a flop that no bank wants to acquire that portfolio. Chime and Dave are doing well, but they cater to a lower-income segment that is outside Chase’s core market.

More relevant to digital transformation, Dimon’s remarks at this February town hall became infamous for many reasons, but one curious thread was his claim that Bank of America was ahead in digital. “Don’t say, well, we’re the best in the world. Assume that they’re doing something better. Even Bank America does something better than us. Shocking, I know, but. [laughter] It’s the digital world. They were ahead of us in digital.”

Let’s look at how BofA performed versus JPMC over the past decade. JPMC has maintained a consistently stronger efficiency ratio, with the gap widening steadily. It has also delivered significantly better revenue growth. If anything, being “better at digital” seems to have been a liability for Bank of America rather than an advantage.

Urgency is a critical attribute for fintechs, as they need to meet milestones to survive in their early years. But is it essential for traditional FSIs? Only if they want to build visible differentiation in digital capabilities versus peers. The pace of capability expansion in financial services and insurance depends on the effectiveness of the operating model, the quality of its talent, and the urgency with which that talent works. To maximize differentiation, FSIs should operate at the KPI-driven stage of an operating model, hire the sharpest talent, and motivate them to work longer hours.

The most effective operating model has been well understood for over two decades, thanks to Amazon, with later refinements from Netflix and Spotify. Hiring strong talent can be handled through rigorous interviews. You can even push people to work long hours. But how does an operating model ensure that this time is actually spent effectively?

Many of our readers have personally experienced fake urgency—long nights and weekends consumed by mindless activity. I once clocked 110-hour weeks in M&A, but most of it was manufactured intensity: hours of waiting, sporadic directions, with real work finally picking up in the late afternoon and continuing into the early morning.

Unlike the performative chaos typical of traditional FSIs, the best fintechs manage to attract and motivate people to work long hours while actually using their time productively. Mayur Kamat, former Head of Product at Binance, described on a recent episode of Lenny’s Podcast what that feels like inside a Chinese fintech culture.

The operating model revolved around an aggressively flat organizational design, even more extreme than Revolut’s. It was typical for leaders at Binance to have 50 direct reports, keeping front-line staff closely connected to the C-suite. Leaders would schedule 11 PM daily reviews to ensure that nothing remained blocked for more than 24 hours.

No gimmicky sense of urgency—whether it's talk of imminent war or threats from digital-native competitors—can substitute for leadership's hands-on involvement. This means not micromanaging or offering generic coaching, but instead leveling up alongside front-line teams and empowering them to build faster by making tough decisions and removing blockers in real-time.

When financial services or insurance executives announce initiatives meant to “accelerate digital transformation,” it’s easy to guess what they don’t mean: “I will fundamentally push myself, my team, and my peers to operate differently by this time next year.” No—the likely meaning involves buying new tech, signing fintech partnerships, hiring consultants for a digital PMO, or launching a shiny new product. They’re accelerating the amount of digital stuff, not steepening the organization’s learning curve on how to apply that stuff effectively.

This is why, every time FSI execs are handed a magic wand for digital transformation, they pick technology and data infrastructure. It’s like an average BMW driver wishing for an F1 car instead of waking up as an F1 driver with a world-class pit crew. With the right approach to urgency, an FSI C-suite could cut its decision-making bodies in half while shifting decisions to empowered, autonomous teams. That’s the kind of effective speed that creates real differentiation—and leaves competitors clinging to silver-bullet fantasies.

FSIs and Fintechs Are Doubling Down on Traditional Channels

Even if the C-suite fully commits to hands-on learning in accelerating digital transformation, the starting question is always why? The right answer is to accelerate market share capture, as the best fintechs do. But even here, the follow-up question is whether digital capabilities are the most effective way to achieve that. In industries like money management and life insurance, even on the consumer side, the honest answer is often no.

Thrivent targets a 2% increase in its advisor force for the year, contrasting with the industry's average growth rate of 0.3% over the past decade. Thrivent indicated that this recruitment initiative coincides with a period of growing demand for financial advisors, particularly among younger generations.

Some financial and insurance products are too complex for the average consumer to buy and manage fully on their own, even for digitally fluent Zoomers. For well-off clients, the complexity multiplies with the number of products they hold and the interdependencies between them.

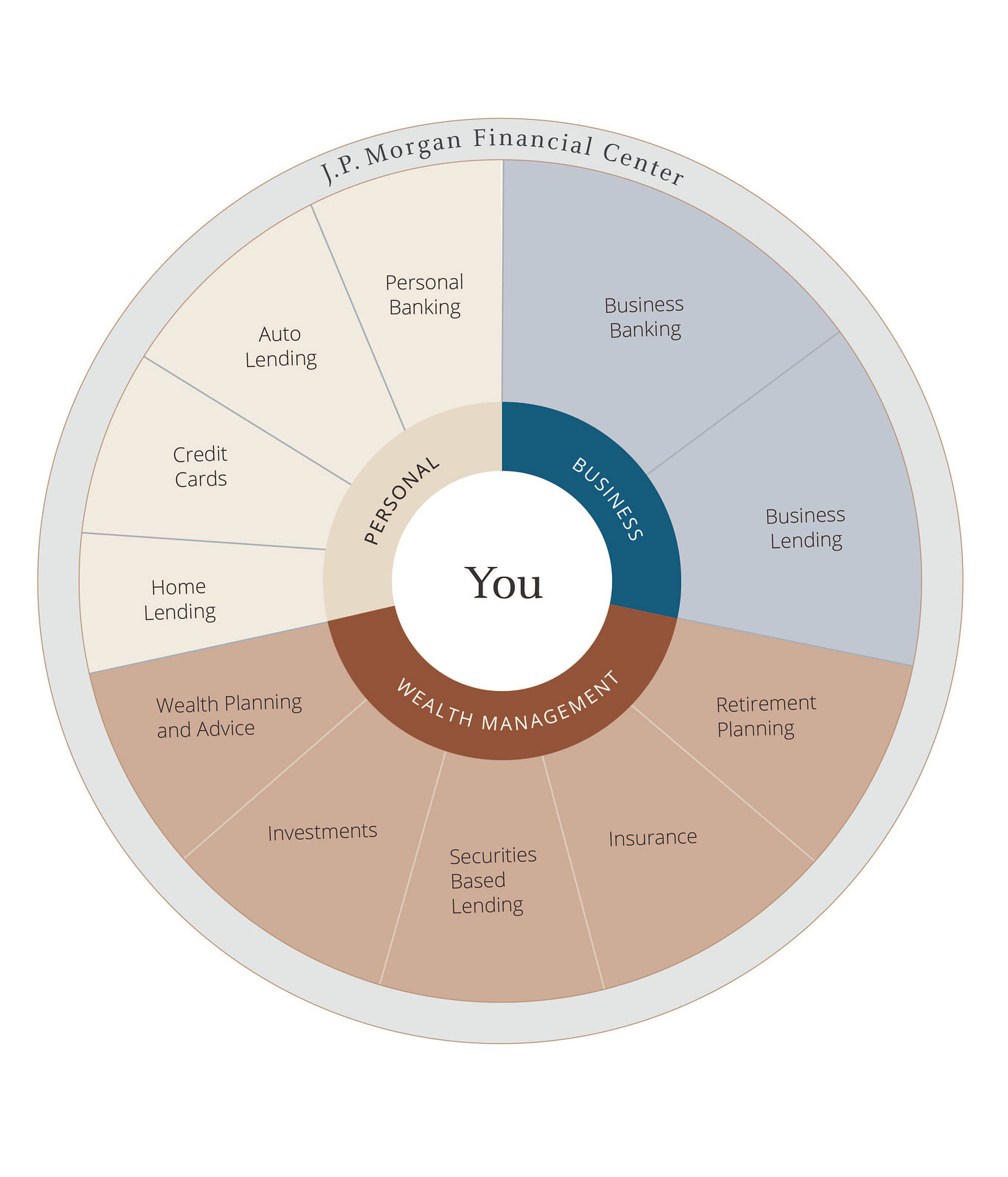

Home, auto, business, life, and umbrella policies can technically be purchased separately online, but managing them as a portfolio—or poaching a client from another carrier—still requires human involvement. In financial services, consider what JPMorgan Chase recently prioritized to grow its current 10% share of affluent segment investing dollars: opening new financial centers, with plans to double the current number over the next two years.

Capital One leads traditional FSIs in digital capabilities—AI, cloud, agile, APIs, you name it. So when it aimed to reimagine banking and expand beyond credit cards, the centerpiece of its strategy became its 60 Capital One Cafés. These locations focus on delicious food and handcrafted beverages, offer workspaces for team meetings and community events, and yes, provide some banking services.

Santander pursued a digital consumer strategy in the US through its Openbank brand. In its first year, Openbank easily acquired 100K customers by marketing online savings accounts that pay above Treasury rates. However, to make the economics work and grow a real banking business, Santander has started opening full-service branches—still branded as Openbank—so customers can learn about those high-yield accounts alongside traditional banking services.

Some traditional FSIs, like Fifth Third, are even brave enough to admit that adding more digital features may no longer be necessary. Unlike a decade ago, having a best-in-class mobile app today does little to acquire or retain customers for both traditional FSIs and fintechs. As long as core demographics don’t complain, overengineering with extra features and polish is, at best, neutral and, at worst, a costly burden.

Even the world’s top fintechs, such as Revolut, see tremendous value in traditional channels. Known for its focus on physical cards and, more recently, wealth management, Revolut has also launched ATMs inspired by a popular Russian design. The company plans to deploy 200 machines in Spain and then across Europe and beyond.

In its press release, Revolut explained the need to “reimagine” ATMs because cash still accounts for 60% of POS payments and to attract new customers who can open accounts and receive physical cards on the spot. In the rush to digital transformation, don’t forget to “reimagine” traditional channels in your FSI.