FSI CEOs: The Real Bottleneck in Digital Transformation

Also in this issue: Do FSIs Truly Understand the Difference Between Scaling and Cost-Cutting?

FSI CEOs: The Real Bottleneck in Digital Transformation

With so many traditional FSIs struggling to accelerate revenue growth, what exactly is holding them back? They have more resources than rapidly growing startups, more years of product experience, and a deeper understanding of regulators. It’s not as if winning fintechs have invented entirely new ways to make money (except perhaps in crypto). As it has been for centuries, success still comes down to identifying a target segment's pain points and desires, addressing them more effectively than competitors, and doing so profitably.

Even fintech OGs like PayPal are struggling, with stock prices going back to 2017 levels. In the latest quarter, PayPal’s revenue growth slowed to less than 5%, and profit margins declined. The previous CEO left a mess, driven by an aggressive global acquisition spree and a preference for vision over integration. His successor, Alex Chriss, came from Intuit, best known for its TurboTax oligopoly.

Chriss recognizes that transformation requires stronger talent, but PayPal already had a relatively solid team compared to traditional FSIs. So, where will this even more effective talent come from? Is Intuit’s operating model advanced enough for Chriss to develop insights into what PayPal’s transformation should look like? His leadership team so far—drawn from Intuit, Walmart, Fiserv, EY, Verizon, SoFi, Wells Fargo, and GE—is not necessarily of the transformative caliber of Stripe, Affirm, or Adyen.

How can CEOs learn to win market share in financial services if they haven’t led a successful fintech themselves? The answer lies in studying the CEOs of winning fintechs. A decade ago, it made sense for FSI CEOs to scoff at comparisons with fintech peers—smaller size, lighter regulatory scrutiny, and modern tech stacks created vastly different operating realities. But today, the comparison is far more relevant as leading fintechs expand across multiple countries, face regulatory fines, and struggle with legacy technology from internal monoliths and acquisitions. If PayPal couldn’t hire a CEO from one of its high-growth competitors, why not learn from their operating routines?

In my conversations, it’s puzzling when FSI CEOs dismiss discussions about the best fintechs and instead choose to ask about “the latest” from digital natives. It is as if they could learn more from Amazon’s updates than Revolut or Affirm—companies actively trying to disrupt them. There are exceptions, of course, in markets where startups struggle to compete with incumbents. Take consumer P&C insurance, for example. Insurtechs like Lemonade should be learning from incumbents like Progressive Insurance:

✅ 200x the size ✅ Same growth rate ✅ 10% net income vs. 20% net loss ✅ Same LA fire losses.

But if an FSI faces an onslaught from successful fintechs and isn’t growing like Progressive, its CEO must pay attention before revenue growth shifts from stagnation to decline. Consider Western Union. Since 1982, it has been the undisputed leader in international consumer money transfers - but no more. It lost global leadership to Wise in late 2022 and the U.S. crown to Remitly in late 2024.

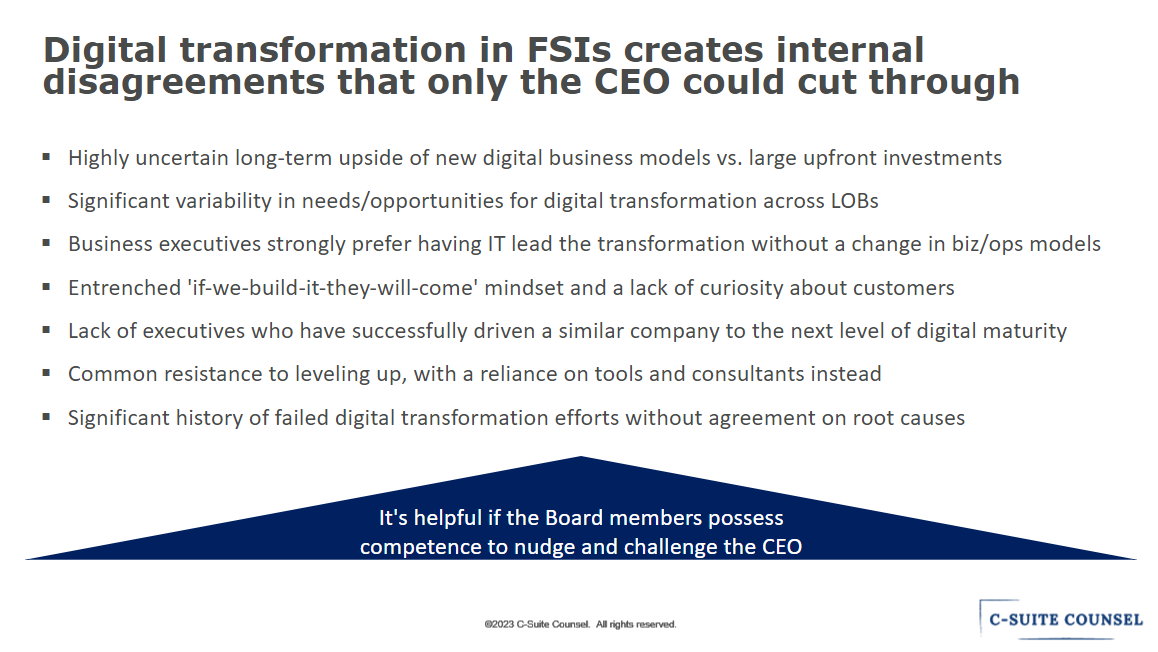

CEOs of large FSIs like to imagine themselves running technology companies, yet they mistakenly define digital transformation success by novel channels and tech stacks rather than revenue acceleration. As a result, they don’t feel urgency to strengthen their own operating muscles by learning from faster-growing fintechs. Meanwhile, CEOs have a unique role to play in digital transformation:

Compare the nuanced operating muscles required to handle the challenges listed in the above slide with Jamie Dimon’s focus in JP Morgan’s recent company town hall. It will be remembered for his views on work from home, employee activism, DEI, regulators, and the threat of AI. But these are banal topics that most people could pontificate about for hours. What is Dimon doing to level up his own operating muscles and those of his direct reports to accelerate JPMC’s sluggish revenue growth?

Focusing on banal topics drives banal results. CEOs of some large FSIs, like JPMC, expect a productivity boom from full-time office teamwork alone, without any transformative change in how they and their reports engage with office staff. Instead, they get sneezing and chatting Babel, with everyone trying to outshout their neighbors on Zoom calls.

For traditional FSI CEOs interested in leveling up, a recent interview with Revolut CEO Nikolay Storonsky offers a good overview of what success looks like. Consider where you could visibly expand your operating muscles across the following dimensions:

Every process is evaluated through the lens of a software solution.

Comfort with both highly complex structures and minute coding details.

Preference for high-IQ, tenacious talent over “resume harvesting” managers.

Rapid sorting and firing instead of endless managing.

Solving complex problems to lead markets, rather than fostering a “how are you” culture.

The essence of true leadership has been understood for millennia. While it does require immense talent to identify the right vision and strategy, the hardest part lies in the implementation—managing strategic pivots and driving change. Like John the Baptist’s “which shall prepare thy way before thee,” only an FSI CEO can personally pave the way for others and guide their organization to the next level of digital operating maturity. And if they’re unwilling to focus on that, perhaps it’s time for the board to consider a winning fintech executive instead.

Do FSIs Truly Understand the Difference Between Scaling and Cost-Cutting?

FSI executives love throwing around the word "scalability" but often struggle to provide proof when asked. The formula is simple: revenue increases rapidly while the cost of the supporting functions decreases as a proportion of revenue. Without rapid revenue growth, it’s just old-fashioned cost-cutting. The digital transformation hype didn’t just confuse definitions; it also made even achieving traditional cost-cutting much more difficult.

It’s been a year since PayPal began touting its 70% cloud cost reduction by switching from CPU to GPU. As a major component of the overall technology and development budget—and with little revenue growth—imagine what that means for spend reduction! But PayPal’s Technology and Development expenses were $770M in Q4 2023 and $773M in Q4 2024.

I recently had a personal window into FSI's struggles with cost reduction. After spending 5 minutes online purchasing business insurance from a top-3 U.S. carrier and submitting payment, the company emailed me asking to call them. I then spent 15 minutes dictating the same information to a company representative and ended up paying 5% less than online. When I asked the rep about this bizarre underwriting process, he explained that too many applicants select the wrong items from online drop-down menus.

Historically, the CFO has been the executive responsible for ensuring ROI on digital investments. Instead, many have resigned themselves to rubber-stamping questionable business cases. I once tried persuading the CFO of a $50 billion FSI not to launch a massive business platform buildout. The strategy included every textbook mistake—her response was, “You’re probably right, but we don’t know how to work another way.”

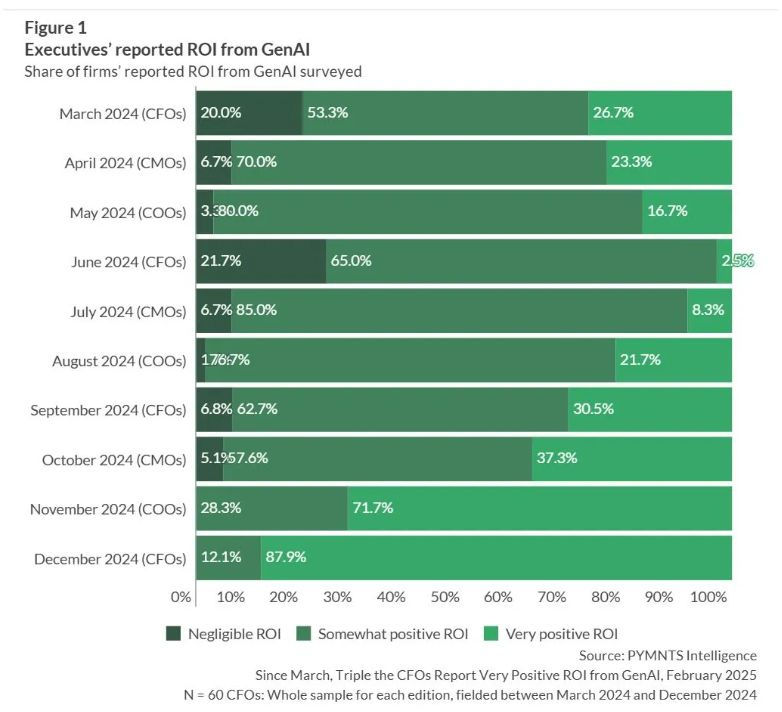

When JPMC CFO Jeremy Barnum publicly declared in 2023 that 10% of revenue spent on technology was mandatory, the contagion became unstoppable. By now, FSI CFOs seem to have completely given up on their #1 job as the last line of defense for ensuring that digital initiatives generate high ROI. Instead, they’ve become the loudest cheerleaders. A recent PYMNTS Intelligence report found that 88% of CFOs claimed that GenAI has already delivered a "very positive ROI" in their companies.

What a fascinating evolution of technology in FSIs over the last few decades! Technology has shifted from being an out-of-sight black box cost center to CFOs becoming more bullish about novel technology than even heads of IT. I was recently asked by the CIO of a $10 billion FSI to meet with the CFO to stop an enterprise data warehouse project that business lines didn’t need so they could use limited talent on staffing product teams. The CFO insisted, explaining that he was aligned with the CEO’s mandate to be AI-ready. Is it any surprise that FSIs increasingly view the CFO as a redundant stakeholder, merging the role with that of the COO?

Even leading fintechs are not immune to cost sprawl from ineffective technology investments. Block recently realized it had acquired too many developer tools without easy access to their documentation. Like traditional FSIs in the 20th century, it prioritized the most common tools and disconnected the rest. The difference? It branded the solution as the "golden path" for engineers under the guise of accelerating software development velocity.

Most fintechs are rushing to grow, viewing the resulting sprawl in code monoliths and the proliferation of similar tools as temporary evils. A more nuanced question that isn’t as relevant to most traditional FSIs is how to strike the right balance between rapidly building products and optimizing architecture.

Klarna’s CEO recently shared that the company shut down 1,200 SaaS tools and plugins. The fintech stood out last year by also drastically reducing headcount while maintaining 20+% revenue growth. While impressive, its main global BNPL competitor, Affirm, has 10x more open roles and is growing twice as fast.

Scaling cost centers while maintaining rapid revenue growth is ideal; scaling with a slight growth reduction is acceptable. Cost-cutting without revenue growth is the final acceptable option. A stagnant revenue and efficiency ratio means a CFO either doesn’t know or isn’t allowed to do their job.