FSIs Face “The Law of The Instrument” Bias When Pursuing Digital Transformation

Also in this issue: Uncloud Your FSI from Techy Signaling, Inevitability of Digital Transformation in FSIs

FSIs Face “The Law of The Instrument” Bias When Pursuing Digital Transformation

A psychologist Abraham Maslow (author of The Hierarchy of Needs) famously observed in 1966, "If the only tool you have is a hammer, it is tempting to treat everything as if it were a nail." Digital transformation in FSI has reached such a fever pitch that I frequently observe the Law of the Instrument in my client discussions. At the same time, growing competition and the increasing sophistication of players in financial services and insurance are making it increasingly difficult to find remaining pain points among consumers or businesses.

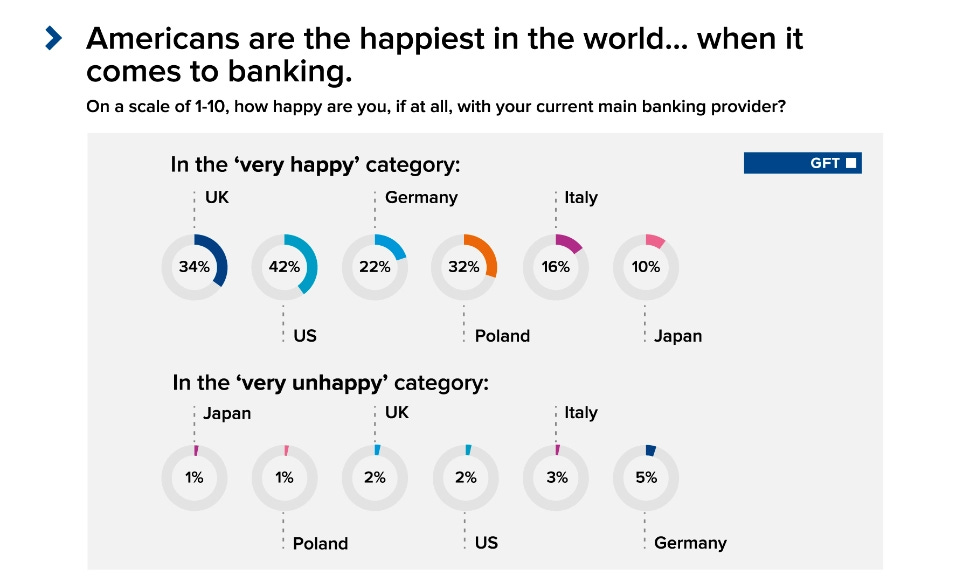

It is even less likely that addressing such pain points via digital transformation could be done profitable enough to justify associated risks. This challenge is especially pronounced in highly competitive economies like the US, where consumers are already quite satisfied with FSI products.

Over the last seven decades, the regular introduction of ever more sophisticated capabilities, from plastic cards to ATMs, websites, mobile applications, RTP, and Swift GPI, has improved the quality of the end-user experience to a point that further improvement might seem uneventful. There are still massive differences in the effectiveness of FSI players in providing these solutions, but the number of lower maturity outliers keeps shrinking.

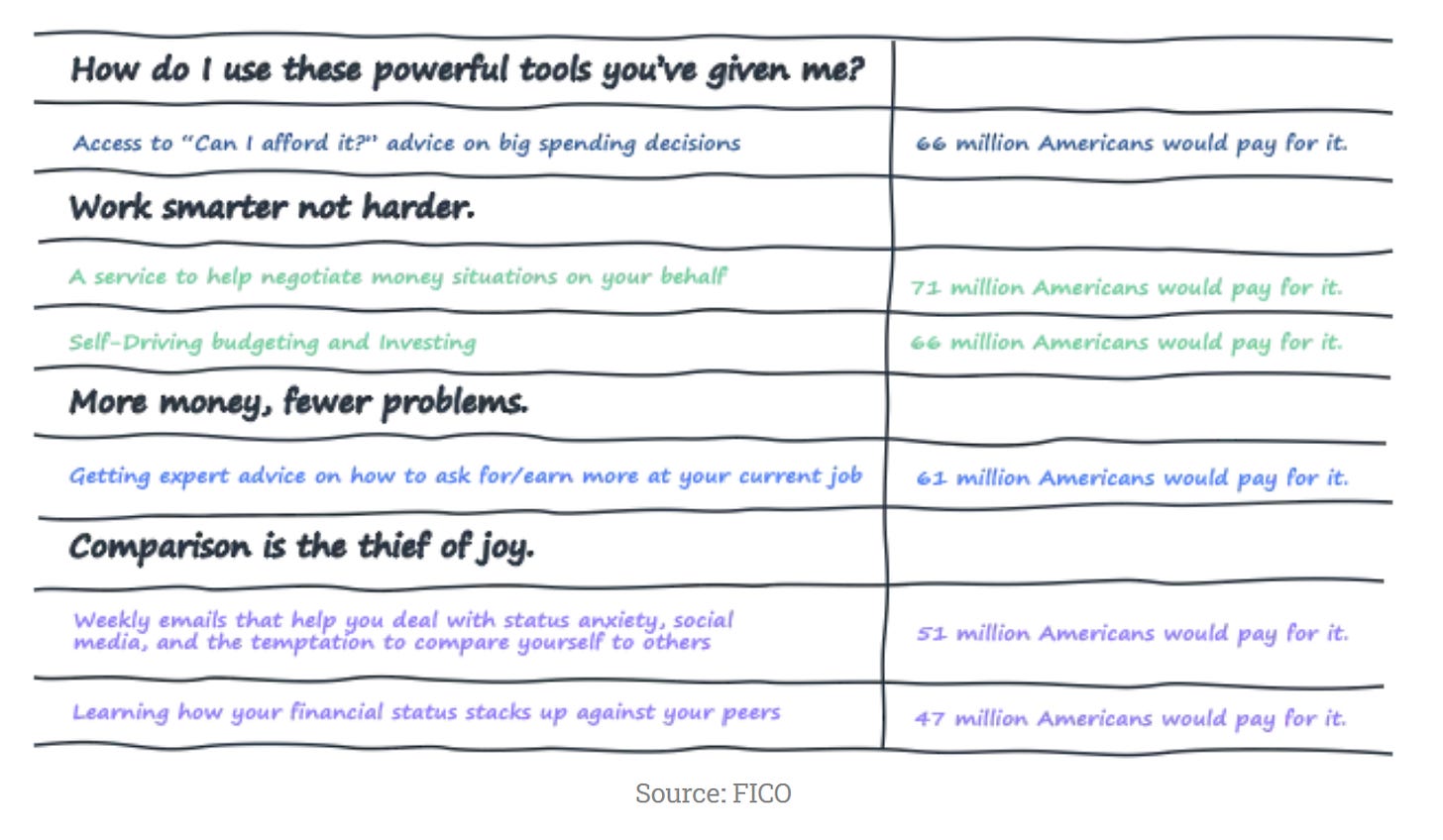

In a more decadent society like the US these days, consumers and businesses have unmet desires rather than pain points. Meaning, that they are not in pain without those features, but they might be willing to pay good money for a proverbial "avocado toast" in the FSI context.

The trick is not jumping to the conclusion that the solution has to be fully digital. For example, if your FSI footprint in the US includes a sizable Latino population, which capabilities could help in gaining a sizable market share? Digital transformation does not seem to be the necessary focus, as suggested by the American Banker interview with Stacy Armijo, Chief Experience Officer at Amplify Credit Union in Austin.

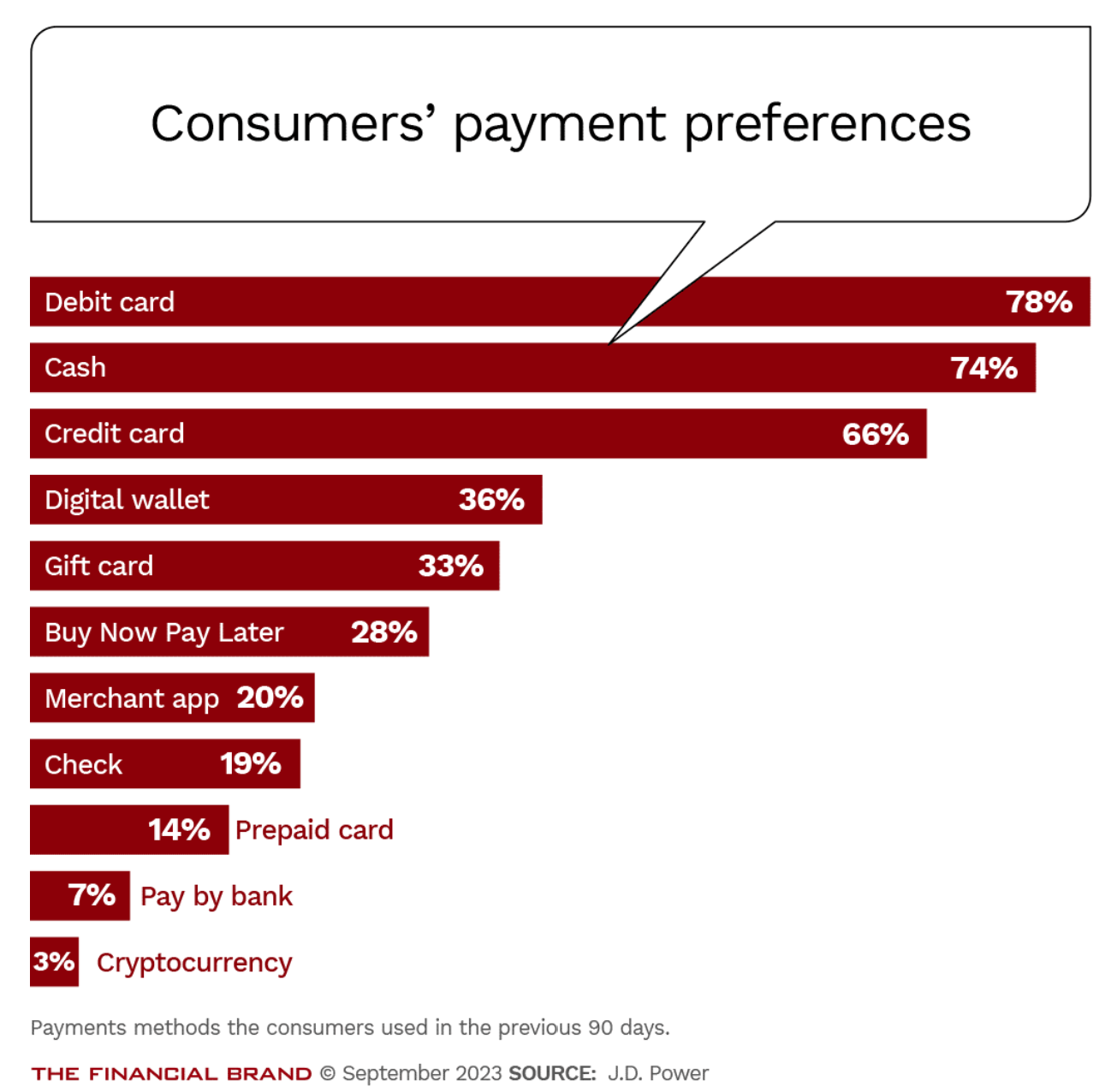

Before contemplating channels, this financial institution discovered that these consumers are more risk-averse and use debit cards more than credit ones. Additionally, they are more family-oriented and prefer homeownership over renting. A relevant value proposition could be to lead with a mortgage product and then cross-sell core checking and savings accounts. This strategy sounds similar to First Republic Bank but for low-income individuals, and hopefully with better liquidity management. However, what is the digital play here? Nothing major, as engaging this specific segment mostly requires a Spanish speaker in an in-person setting, ideally at their location.

Amplify's CEO Kendall Garrison said the credit union is actively working to improve its offerings to Latinos by deploying community bankers and lenders "who basically have the responsibility of taking our products and services to underserved communities, as opposed to requiring people to come to us."

Yes, digital capabilities might still play some minor enabling roles, but most of them are likely already implemented. Such cases are actually more common than those requiring digital transformation. Last week, I met with a Managing Director of one of the top global Wealth Management firms who, after two decades in the business, still differentiates with offline playbooks rather than relying on novel tech. He and his team are constantly visiting and calling clients in the $10+ million asset range, who perceive digital self-service as a common table stake capability.

They win clients based on understanding which personal life events or calendar milestones generate openness to discussing financial planning and which customized outreach resonates the most. The role of digital capabilities implemented over the last decade is to keep marginally improving the quality of preparation for each client interaction.

"We use analytics to identify an investment idea that is likely to resonate with this type of client. We also deployed a single-view dashboard where clients upload their holistic picture of investments, so my team can see if a client has some risks or missed opportunities with other parts of their wallet."

If you are an FSI executive with a passion for digital transformation, use your hammer to fix something that's truly broken or to design something entirely new. For everything else, a less invasive approach would likely be more effective.

Uncloud Your FSI from Techy Signaling

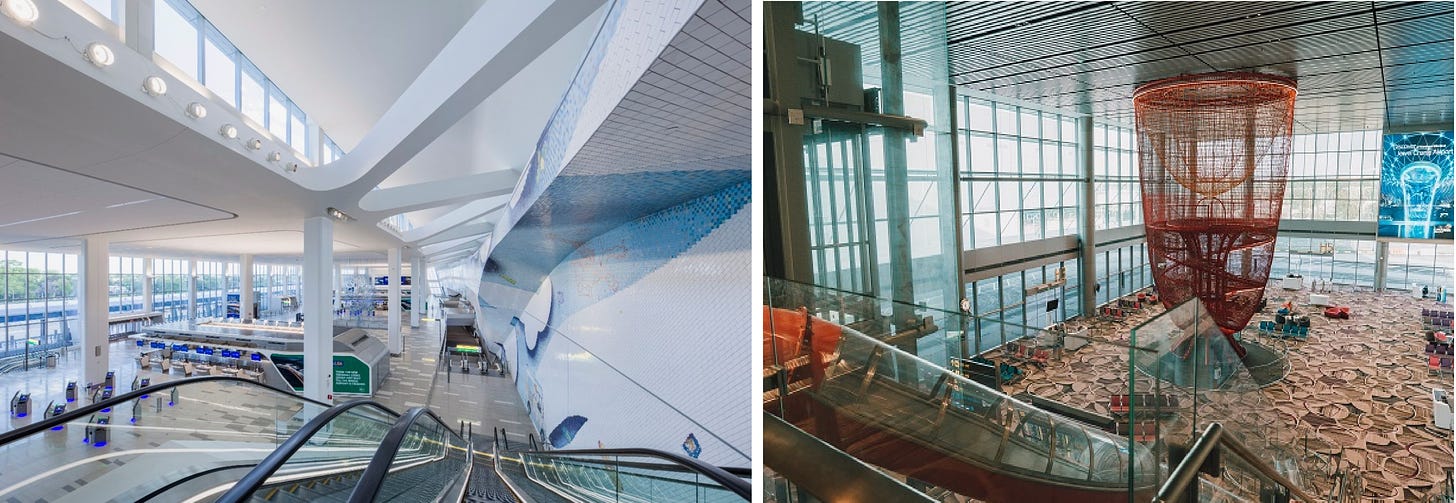

How can Singapore Changi Airport cost four times less to build than LaGuardia in a third less time while being capable of absorbing twice the passenger traffic and being so much more advanced and beautiful? In part, it could be due to higher corruption and bureaucracy in NYC, but more importantly, Singapore has much higher standards and competence.

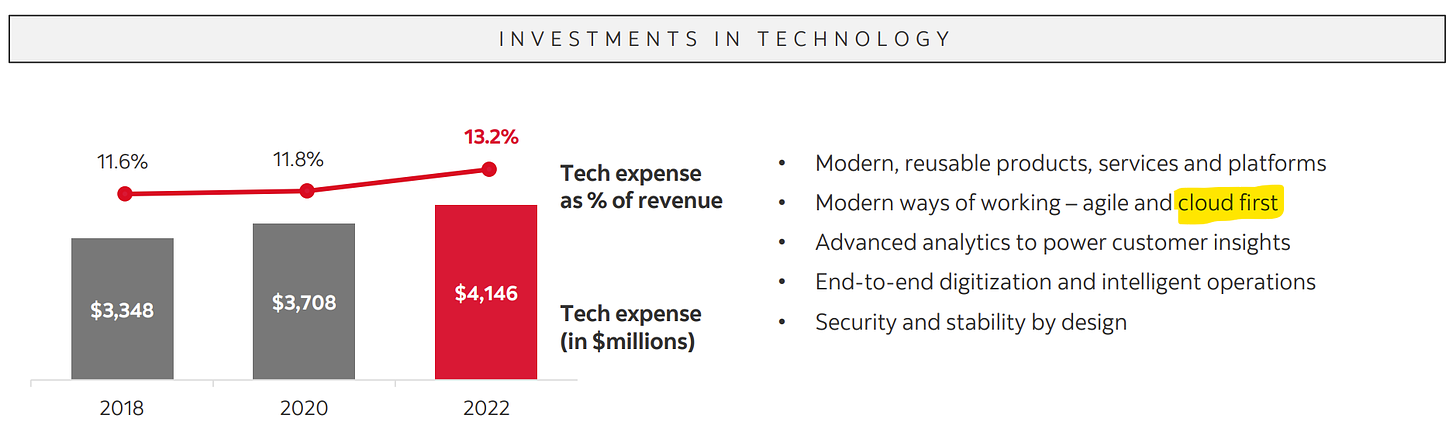

When a financial services and insurance company copies leading fintechs in announcing a "cloud-first" or “all in on cloud” strategy, they don't appreciate that they are a LaGuardia airport trying to execute like Changi. Like other digital pillars of the 21st century (Agile, AI, API, and DevOps), Cloud is a sophisticated capability that requires advanced operating muscles. FSIs are currently in the arms race for technology spending, cheered on by hype-driven investors. Boasting "cloud-first" like Scotiabank might be better for a valuation multiple in the near term, but the strategy itself is too risky.

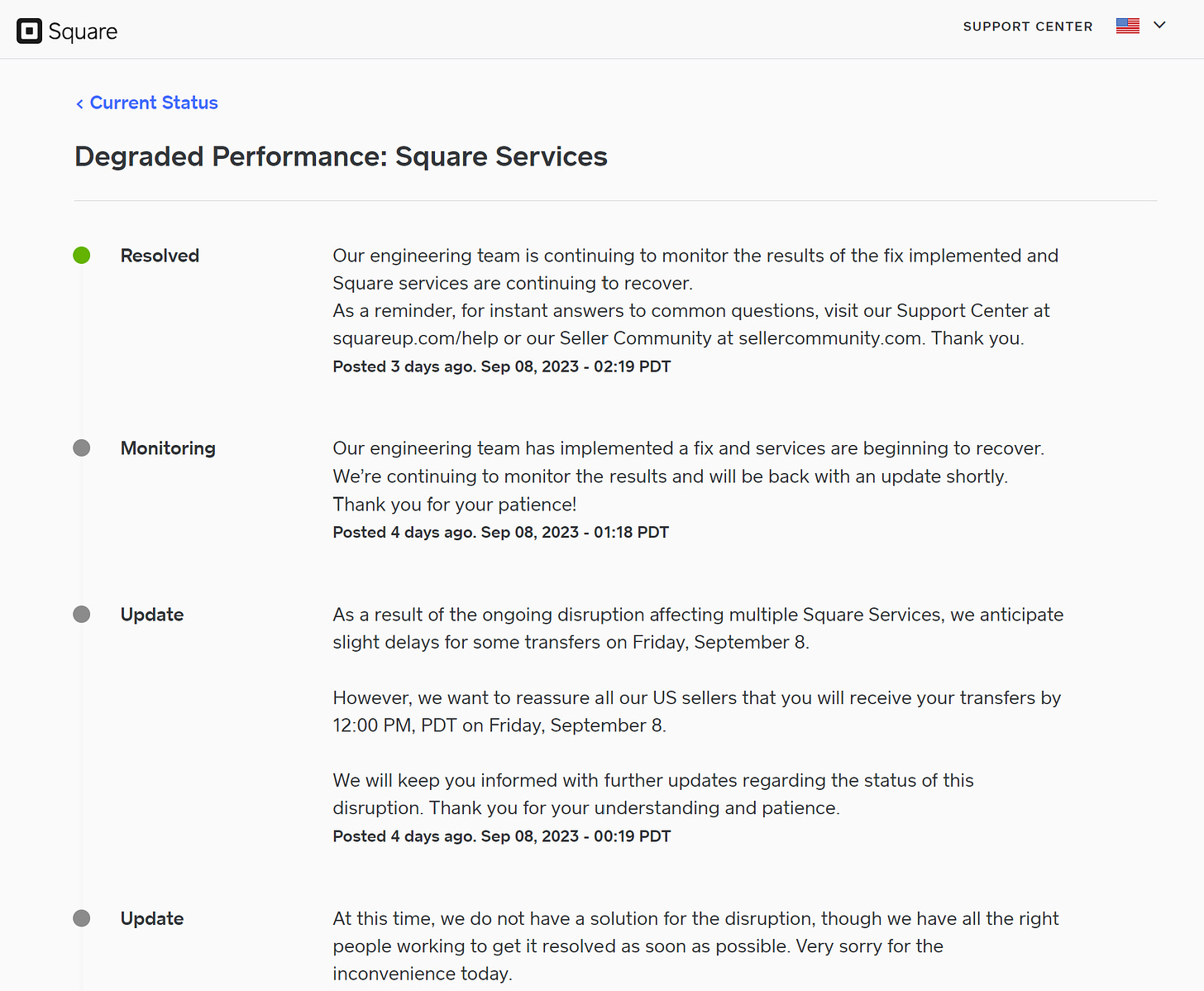

Even leading fintechs are taking a decade to fully transition to the Cloud while experiencing massive issues on that journey. Last week, Square took more than 13 hours to identify the root cause of an outage, leading to a 5% drop in its stock price.

When first encountering FSI IT more than two decades ago, I learned about the saying, “No one ever got fired for buying Cisco.” This meant that an executive who couldn't come up with a nuanced solution was instead solving for staying in trend, utilizing budget, and de-risking their career. Cloud migration has become such a phenomenon. Cheered on by investors and CEOs, CIOs today won't get fired for a full migration to the Cloud.

However, a full migration makes increasingly less sense as self-hosting tools become less complicated while SaaS solutions become comparatively more expensive. FSIs not wanting to be in the business of managing data centers is understandable, but giving up control while spending a fortune upfront and becoming less scalable in the long term doesn't seem like a great business decision either. Let’s uncloud our minds from signaling how tech-savvy we are and remember that our singular purpose is to make more money for our companies.

Inevitability of Digital Transformation in FSIs

As we often discuss, the pursuit of digital transformation is overhyped, and in many cases, FSIs will lose money pursuing it. Executives will spend much more than they think, and the benefits will be far less. However, the long arc of the FSI evolution bends toward transformation. The culprit is the geometric growth in the number of interconnections between customer-facing features and the internal capabilities needed to enable them. As you can see in this fresh consumer survey, only in the area of payments, banks have to support twice as many methods today as they did two decades ago.

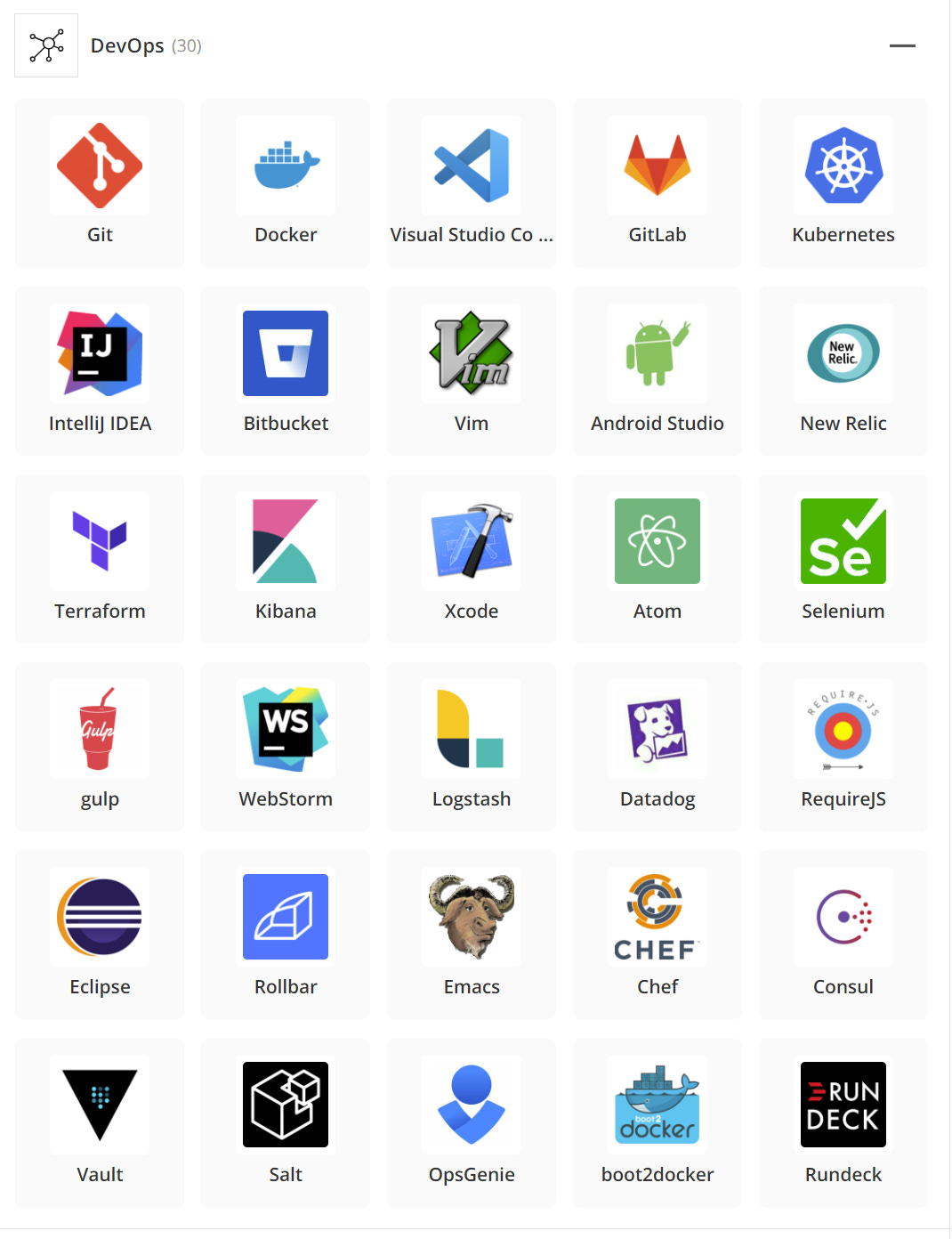

A similar fragmentation is transpiring on the enablement side of FSIs and fintechs, except the number of tools has tripled, not doubled, and not in two but in one decade:

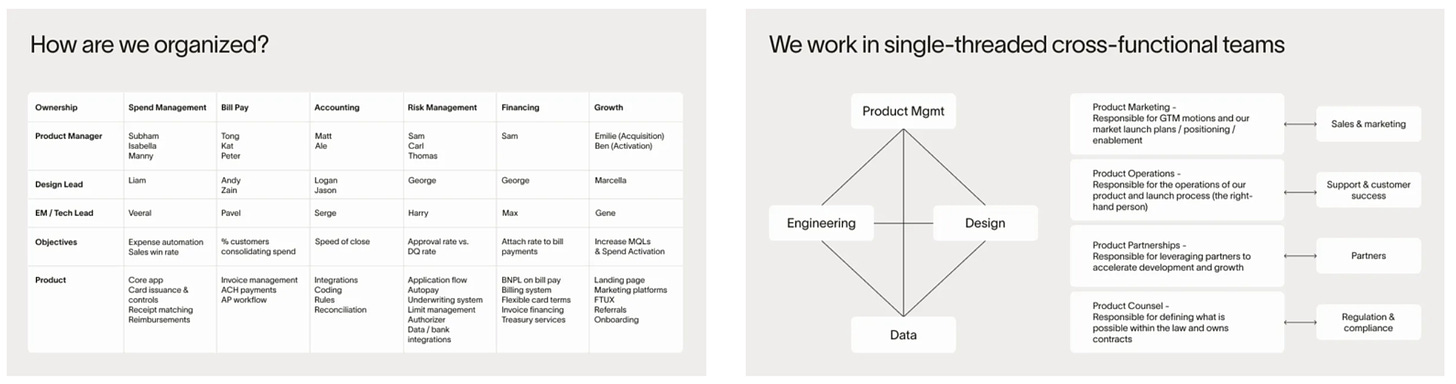

In a target state, a financial service or insurance company would have hundreds of client-facing features and hundreds of enabling engineering services that all need to be seamlessly coordinated with each other. For an FSI, this geometric growth in complexities makes top-down-silo-biased governance impossible at some point. There will not be enough project managers in the world to connect all those dots and not enough hours in a day for the executive to address all the drops through the cracks. A transformation to the autonomous operating model, chaos by design, is inevitable.

If your FSI doesn't yet have a single team operating in such a capacity, it might be fine as long as your target customers are not increasingly leveraging more features from your competitors and your competitors are not becoming more scalable by deploying more engineering tools. But time is not on your side.