FSIs’ Return on Data and Technology Investments: The 99% Fallacy

Also in this issue: Are FSIs and Fintechs Past the Hype Phase of GenAI Impact?

FSIs’ Return on Data and Technology Investments: The 99% Fallacy

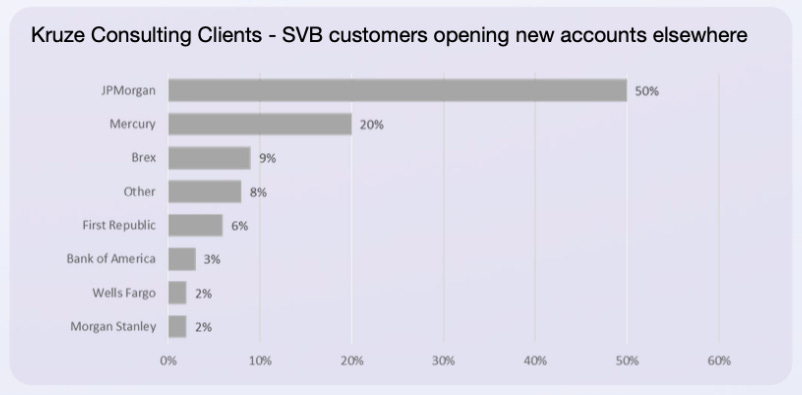

When Silicon Valley Bank collapsed in 2023, two banks captured an outsized share of clients urgently searching for a new home. By some estimates, JPMorgan and Mercury accounted for 70% of all new accounts. The fact that the bank investing most heavily in technology and the most advanced SMB-focused neobank attracted far more clients than Bank of America and Wells Fargo seemed to offer a clear case that technology-driven differentiation delivers outsized returns.

However, the reasons might have been more traditional. For JPMorgan, it was essentially brand trust, regulatory confidence, and aggressive outreach. For Mercury, the answer may have been looser KYC practices. Banking compliance expert Jason Mikula, in a recent Mercury exposé, shared specific insider examples:

Not mentioned publicly was Mercury’s willingness to onboard Virgin Islands- and Cayman Islands-incorporated entities, popular with VCs and investors, despite lacking policies, procedures, or a defined workflow for doing so, people familiar with the situation said.

How do you assign value to data and technology investments when many other factors can decisively shape business outcomes and profitability? Taken holistically, the ROI of data and technology differentiation is undeniable — firms like Capital One and Progressive Insurance have built clear capability advantages that consistently translate into meaningful value creation. Their data and analytics allow them to offer largely standard products at prices that competitors either can’t match or would lose money trying to.

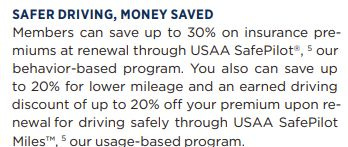

Innovative data and technology solutions also unlock a constant stream of valuable new use cases. P&C insurance, in particular, stands out for its cutting-edge use of data analytics. Leading carriers now dynamically monitor customer behavior in cyber, auto, and home insurance, flagging risky actions in real time. Instead of relying on the theatrics of nudges, they deploy material incentives — from dropping customers or doubling premiums to offering 30% discounts.

Consider the analytical precision required for this scenario: launching a feature that initially reduces revenue but ultimately improves profitability and customer retention. Your models must be highly accurate to justify such a counterintuitive decision.

On the other hand, the failure rate of data and technology programs in FSIs remains stubbornly high, typically exceeding 50%. Some firms might claim an average payback period of five years, but post-mortem ROI calculations are rare, and the few that exist often unravel after a couple of probing questions. Yet, FSIs continue to expand their tech investments. It’s especially ironic when the loudest voices warning of the world’s imminent collapse are also the industry’s most aggressive spenders.

Will Dimon slash $18 billion from JPMC’s technology budget in light of those cataclysmic risks and a five-year payback? Of course not. At the recent Investor Day, he answered that question much like he and his CFO have for years:

It's table stakes. It will be for the rest of eternity.

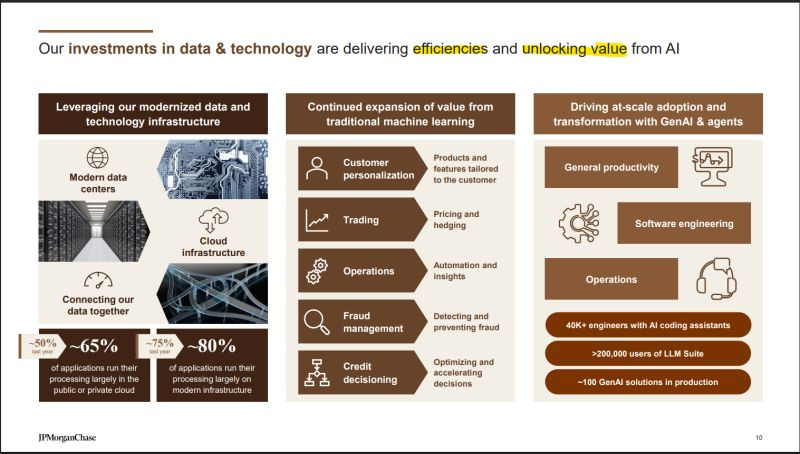

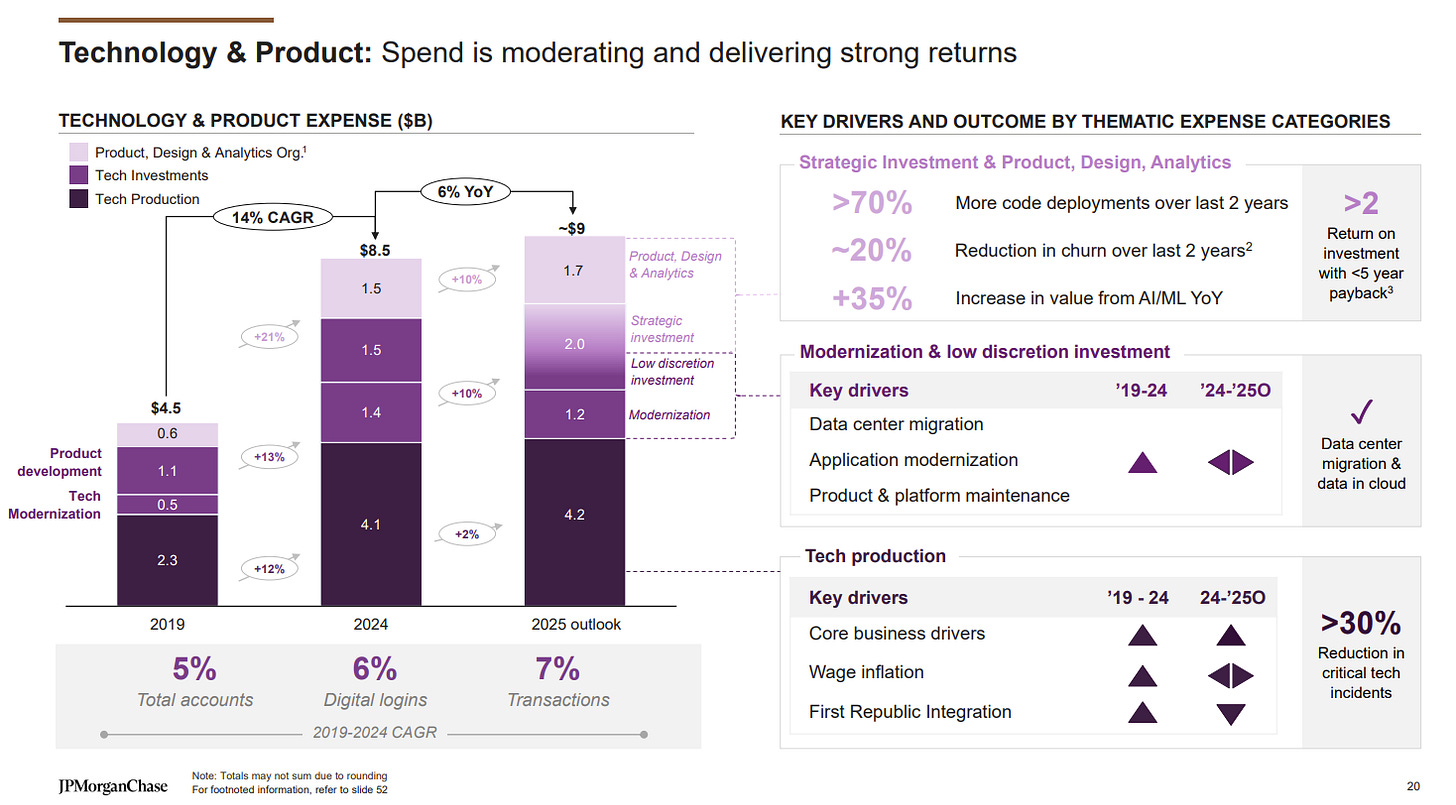

To give Dimon some credit, after years of brushing off questions about the ROI of JPMC’s massive technology investments, this time, there was at least an attempt to tell a story with numbers. Unfortunately, the slide on data and tech investments delivering efficiencies and value showcased five metrics — none of which actually demonstrated that point. All five measured how much had been invested in data and technology.

On a more detailed slide, the “I” component of ROI was clear — between 2019 and 2025, technology and product expenses are set to double. The “R” was much harder to discern. Although the slide claimed to deliver “strong returns,” the only evidence provided was a set of relative technical metrics.

The likely reason for the lack of clear ROI evidence—even among digitally advanced FSIs—is not that they don’t want to share it but that they don’t know it themselves. In a recent interview with American Banker, Sherry Graziano, head of digital, client experience, and marketing at Truist, described spending 18 months building an in-house omnichannel customer sentiment dashboard. The key return? “Upwards of $35 million in cost savings” expected from a 10% drop in customer complaints.

But why would customers complain less? The dashboard is meant to help bankers spot complaint patterns faster and then persuade product leaders to change processes. Tellingly, two years after the initial rollout, the only example Graziano could provide was hypothetical:

"Maybe you're having a challenge with how quickly you're able to deliver a replacement card to a client. You will see that pop," said Graziano, referring to client sentiment analysis. "It's bringing that full view together to be able to go back to your payments leader and say, 'Hey, based on what we see happening, we might need to go and revisit a process.'"

In my experience, FSI leadership loves such top-down “dashboard” initiatives. Like politicians, enterprise executives assume that if employees (or voters) have accurate information, they’ll change their behavior accordingly. In reality, Truist bankers and payment leaders could have been collaborating cross-functionally and pivoting poorly launched products for years without that new dashboard. More likely, a siloed operating model—not a lack of information—has caused issues like the long card replacement cycle in that hypothetical example.

With the right operating model, FSIs have value stream and platform owners who can clearly explain the ROI on all data and technology investments. More importantly, that structure ensures return is the only metric that truly matters. In a typical FSI, launching a new product is seen as “work done.” But at top fintechs like Revolut, that mindset is called the “99% complete fallacy.” On a recent episode of Lenny’s Podcast, Dmitry Zlokazov, Revolut’s head of product, explained that 99% completion is actually closer to 0% than 100%, because that’s when the real challenge begins—scaling usage and driving profitability impact.

Are FSIs and Fintechs Past the Hype Phase of GenAI Impact?

For decades, a well-oiled machine of consultants, advisors, analysts, and vendors has routinely convinced FSI IT and data leaders that they face the latest existential threat. Those talking points get passed to the C-suite to stir urgency and unlock funding. This approach works because everyone's complicit, with little incentive for post-mortems or meaningful operating-model changes.

That’s why it’s so rare to see a CIO at a large FSI consistently pushing back against innovation hype. In a recent interview with diginomica, Robert Pick, Tokio Marine NA CIO and global deputy CIO, emphasized a by-design flaw of generative AI—its key difference from ML—the lack of explainability:

“AI at present is not auditable and it's not accountable. Yet I hear analysts say not being agentic is an existential threat to your business. Well, the reality is putting agents into a regulated transaction is a B-line to an audit.”

But hasn’t GenAI already scaled across some large financial services and insurance firms and is driving visible improvements in financial performance? Only the former is certain. In a recent interview with Tearsheet, Citizens’ Chief Data and Analytics Officer Krish Swamy described the typical circa 2025 collection of use cases in production: contact center employees can perform faster searches, while software engineers can code, test, and document more quickly. Whether Citizens has reduced contact center staff or engineers as a result remains unclear.

FSI CEOs and senior business executives have even less insight into what GenAI actually delivers for their organizations. This often leads to discussions framing it as an esoteric game-changer with grand visions of impact. The latest example comes from a regional CEO at BNP Paribas, whose evaluation criteria for AI use cases apparently include their impact on peace in Ukraine.

More practically, accelerated software engineering is a particularly popular GenAI use case among FSIs. However, the problem with faster coding is that it presumes code quality stays the same and that the rest of the company can handle the increased velocity. In my conversations, reality is far more nuanced. Many FSIs publicly claim higher productivity but don’t see internal proof. Those who do could still face unintended consequences due to uneven talent quality.

First, no code release pleases all end-users. The goal should be to keep that ratio strongly positive. When a top-notch engineer gets more productive with GenAI, users enjoy cleaner, more elegant code. But if 80% of engineers at an FSI are mediocre and suddenly faster without tight oversight, end-users get overwhelmed with half-baked features.

To be fair to FSIs, the ease of accelerating releases with GenAI has also challenged leading software companies. Google and Microsoft may have more top talent than the average FSI, but not enough to prevent less experienced engineers from shipping GenAI-generated slop.

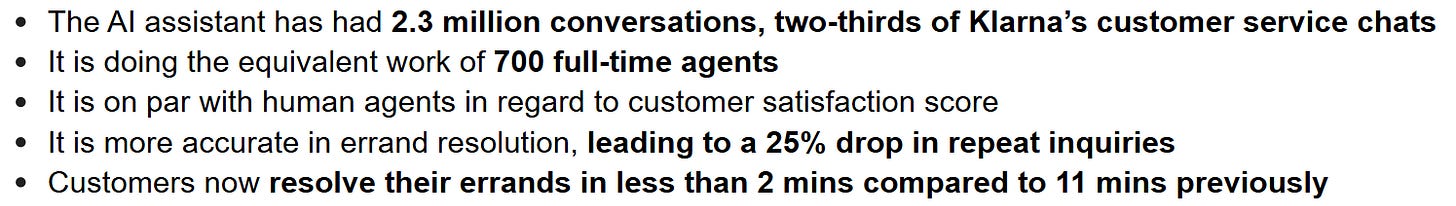

The use case of contact center productivity is also questionable. Even some of the world’s 15 largest fintechs, like Klarna, find that scaling GenAI can bring unpleasant surprises. In its IPO drive, CEO Sebastian Siemiatkowski repeatedly claimed, starting in early 2024, that GenAI would have a marvelous impact on customer service, not just by cutting human agents but by improving customer experience:

With IPO plans now on hold, Klarna’s CEO has begun reconsidering the strategy. GenAI chatbots did generate significant cost savings by replacing customer service agents, but with one major caveat: lower quality. In a recent Bloomberg interview, Siemiatkowski acknowledged that the strategy no longer fits their needs:

“As cost unfortunately seems to have been a too predominant evaluation factor when organizing this, what you end up having is lower quality,” he said. “Really investing in the quality of the human support is the way of the future for us.”

Even more concerning for a fintech that has boasted for over a year about its AI-driven hiring freeze were its Q1 results. Unlike traditional FSIs, which can sustain low growth for decades as long as profitability improves, leading global fintechs are expected to conquer new geographies and segments rapidly. For them, a hiring freeze is only impressive if growth matches peers. If they’re the slowest, lagging even behind PayPal, then scaling GenAI starts to look like a gimmick.

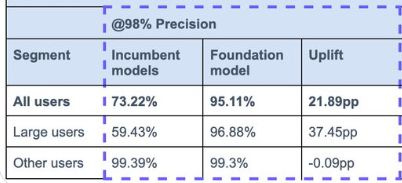

While productivity gains continue to evolve, fraud detection appears to be more advanced among GenAI use cases. That wasn’t obvious two years ago, given the substantial value machine learning has delivered to FSIs over the past decade. For example, global payments leaders have cut overall fraud by 30–50% over the last ten years, with even larger reductions in specific areas, such as an 80% drop in card-testing fraud at Stripe. On Remitly’s Q1 earnings call, CFO Vikas Mehta highlighted the ongoing impact of ML:

“Provision for transaction losses was $17,900,000 and as a percentage of send volume was 11.1 basis points. This was in line with our expectations, as we improved machine learning risk models and at the same time minimize unnecessary friction for customers.”

GenAI could still deliver additional value, but for a specific subgroup within the use case. Stripe’s AI/ML leader, Gautam Kedia, recently shared on X that sophisticated fraudsters learned to mask attack patterns within the transaction volumes of large enterprises. While traditional ML struggled, LLM-based transformers delivered significant gains in detecting these hidden threats for those clients while offering no incremental value for other segments.

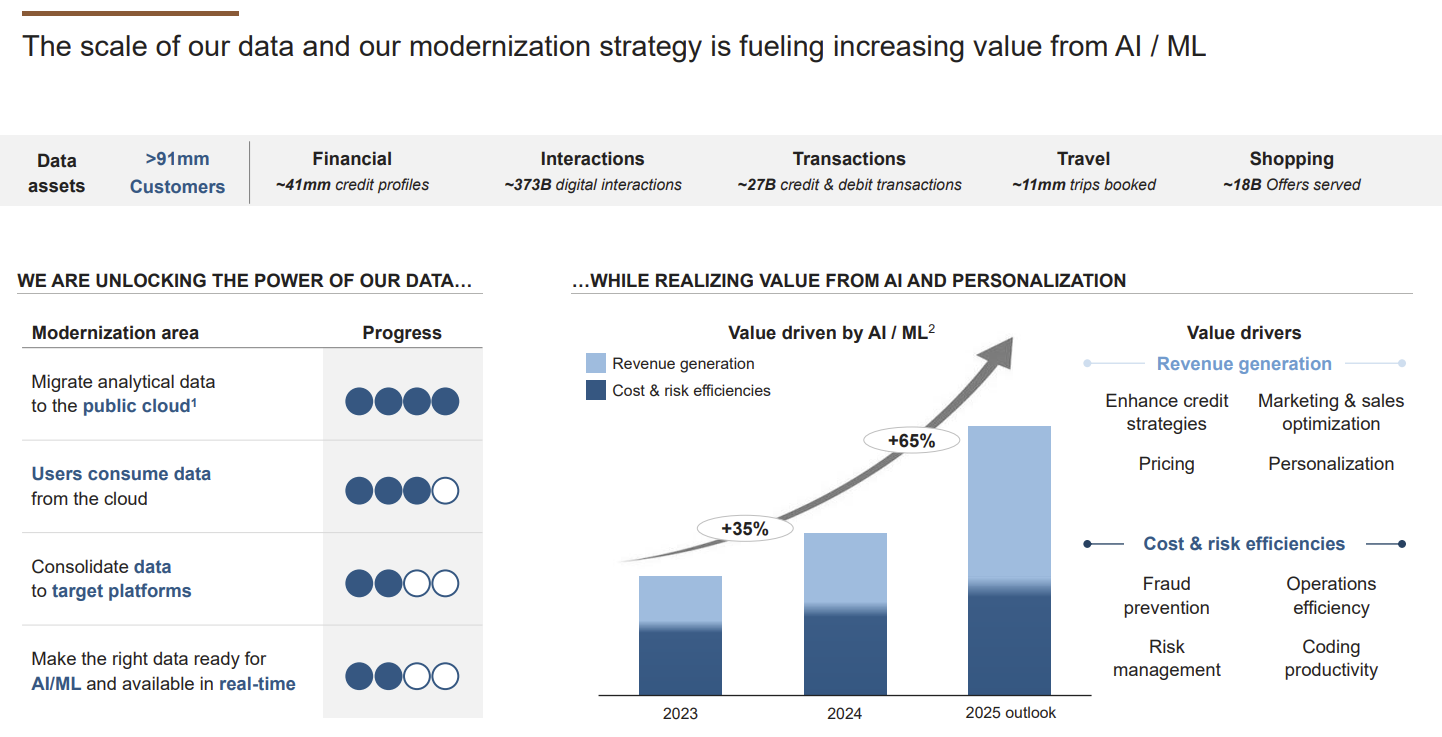

By now, in my conversations, FSIs generally understand the highly selective relevance of GenAI versus ML, which is why they rarely single out GenAI’s impact. Publicly traded FSIs are even more cautious in avoiding regulatory scrutiny and investor lawsuits. Discussions of impact are usually framed under the broad “AI” or at least “AI/ML” umbrella. In a recent Investor Day presentation, JPMC discussed value drivers on revenue and expense sides—but only in relative terms and without explicitly mentioning GenAI.

In each FSI vertical, roughly 5–15% of companies see themselves as digital leaders compelled to invest in GenAI even without a clear financial impact. A recent American Banker survey highlighted this and also showed a natural, demand-driven variation in AI adoption across product verticals. Not surprisingly, a significantly larger share of wealth management firms either have no plans to use AI or are just beginning adoption compared to banking and payments.

If FSIs and fintechs are truly past the phase of inflated GenAI impact claims, what should CEOs do when those claims resurface from their subordinates or vendors? They should treat it as a signal to cut internal budgets or renegotiate vendor contracts by the same percentage as the claimed impact. It will quickly become clear whether those claims were empty boasts never to be repeated, or signs of genuine outperformance that deserve to set a new standard for everyone else.