PayPal: Almost a Disruptor, but for a Critical Missing Factor

Also in this issue: Generative AI Has Become an Even More Obvious 'Shiny' Distraction

PayPal: Almost a Disruptor, but for a Critical Missing Factor

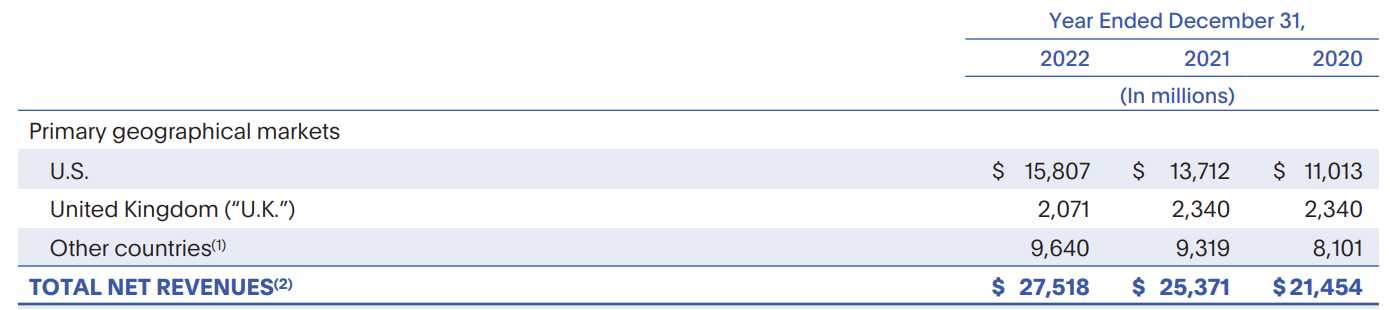

Despite experiencing an 80% drop in value since the fintech cyclical peak in 2021, PayPal still maintains a strong presence in the payments sector, boasting a higher valuation than both Stripe and Block. However, its growth has slowed to less than 10%, and according to the latest annual report, PayPal's revenue share outside of the US, including its crucial UK market, has been decreasing.

PayPal's leadership has effectively maintained the company's operations, but it was too tired to pursue the transformation required to disrupt traditional financial services and outcompete leading fintechs. Instead, its former CEO, Dan Schulman, who likes to discuss financial inclusion, spent billions on myriad acquisitions while struggling to integrate them.

PayPal's slowdown ultimately led to his replacement in the Fall of 2023. Why has digital transformation been a critical missing factor, and is it likely to occur under a new CEO?

1. Better Than Leading Banks Worse Than Leading Fintechs

Twenty-five years ago PayPal had one of the most advanced executive teams in the West, on par with Amazon. Their brilliance was later symbolized under the moniker of the “PayPal Mafia” due to the countless successful enterprises they started afterward. While almost all of those initial members are long gone from the company, the culture of excellent standards and hard work is still present.

Compared to large banks, PayPal's operating model is superior in three regards:

Continuous improvement - the goal is to be the best rather than benchmarking against other players, which means their playbooks and tools tend to be years ahead in maturity.

Learning over politics - every crisis is generally viewed as an opportunity to improve playbooks rather than instinctively saving jobs by shifting blame, resulting in faster iterations.

Accessible leadership - executives are more hands-on and eager to engage in tactics, resulting in higher-quality decisions.

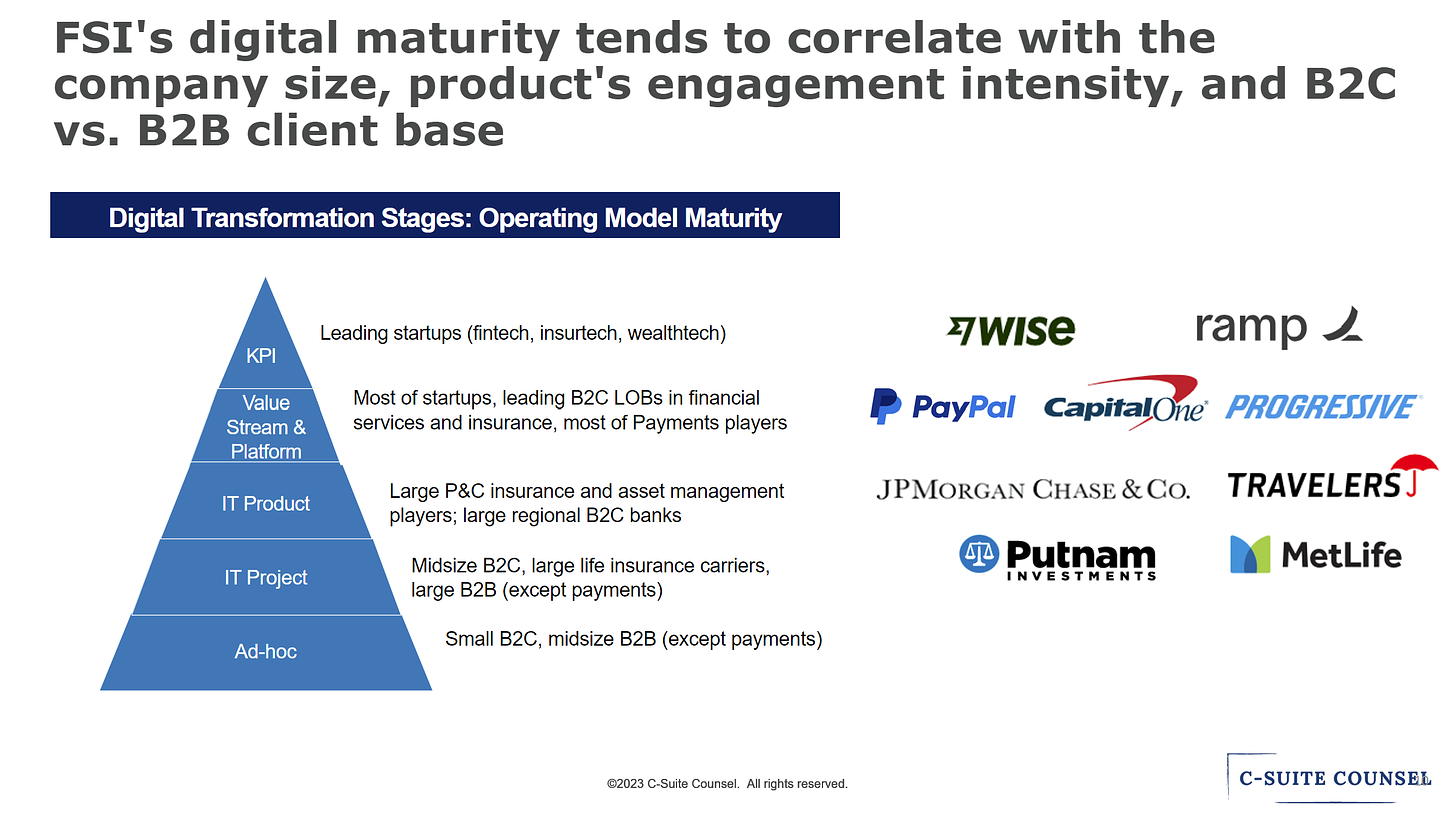

While a great majority of Retail and Commercial Banks are between Level 2-3 of digital maturity, PayPal has mastered the Level 4 components, Value Streams and Platforms. Its digital effectiveness is on par with only a few of the best divisions from traditional finance and insurance, such as Capital One's Credit Cards or Progressive's Auto Insurance.

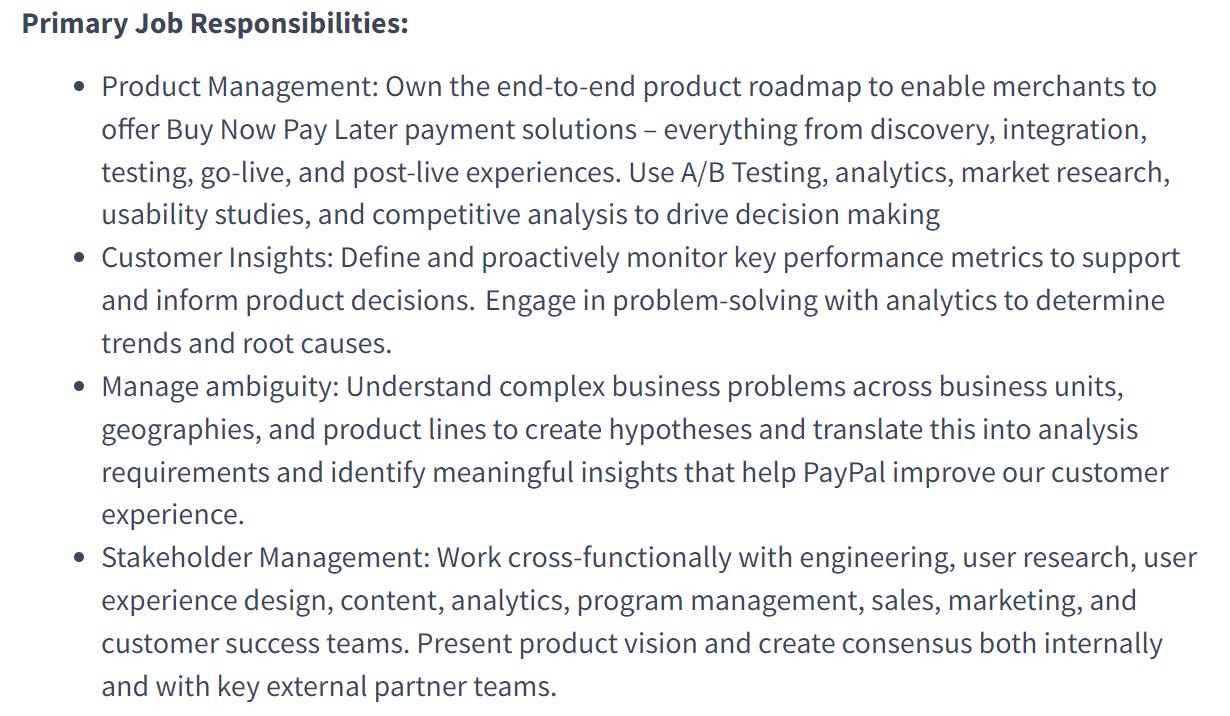

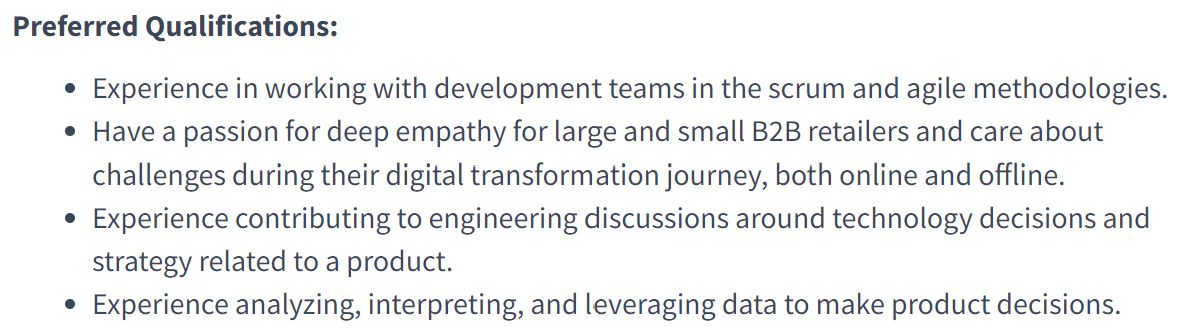

At this level of digital maturity, PayPal understands that a product management role necessitates expertise in the business domain and the ability to drive business impact in a cross-functional setting. However, PayPal has not yet made quantifying that impact a requirement…

… and it is not actively seeking talent with a history of generating such impact, as is typically seen in Level 5 fintech companies.

2. Unfortunately, There Are "Only Two Ways to Make Money in Business: One Is to Bundle; the Other Is Unbundle"

When almost three decades ago the CEO of Netscape came up with his prescient quote, he forgot to add that M&A is not a great way to make money. Global disruption stories of Amazon, Spotify, and Netflix were driven by the organic growth of complementary businesses, not counting on acquiring and integrating companies. But doing deals is more fun than transformation, so PayPal went on an increasingly rapid shopping spree, spending around $15 billion on 26 companies.

Since most acquisitions tend to fail due to overpayment and lack of integration, PayPal’s “kitchen sink” approach was even less likely to generate material synergies. Even the simple integration of the back-end platform was taking PayPal years before the workarounds in Excel macros could be replaced with automated solutions.

We often discuss in our newsletters that the lack of focus is one of the two main reasons why there has not been a major disruption of traditional financial services and insurance companies (the other one is the lack of a sustainable business model). PayPal’s rapid acquisition strategy helped create a short-term smoke of growing top-line payment volumes, but eventually, investors understood that game and called it out.

3. PayPal Technology Strategy

Since PayPal is not trying to disrupt traditional finance organically, its technology strategy tends to be more reactive in nature. In his recent interview, Sri Shivananda, PayPal's EVP and CTO, highlighted five goals

Security

Stability

Speed of innovation

Scalability

Efficiency

This list of goals appears typical of a CTO from a leading traditional financial services or insurance company. It becomes especially apparent in how PayPal's CTO defines successful outcomes for Speed, Scalability, and Efficiency:

Speed: greater productivity and creativity for developers

Scalability: growth without requiring heavy engineering and re-architecture

Efficiency: the lowest cost per transaction

If you regularly read our newsletters, you already know the main nuances from the above points vs. the mindset of a CTO in a leading fintech. Priorities there would revolve around enabling business-led teams, scalability of platforms with all costs included (not just IT), and external monetization of in-house platforms.

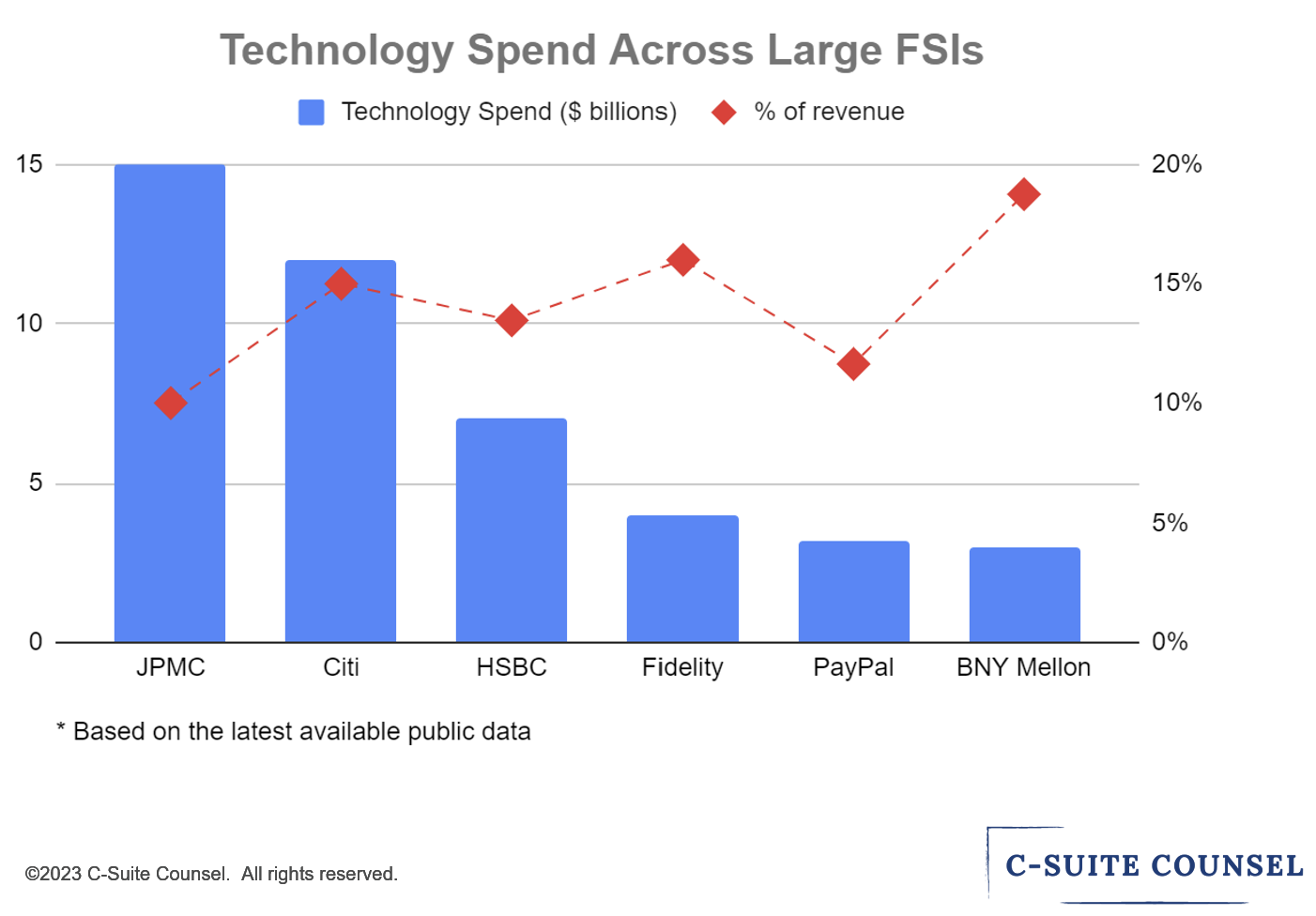

For the same reason, PayPal's spending on technology tends to be around half of what leading fintechs invest, and even lower than some of the traditional financial players. Without transforming to a KPI-centric operating model predicated on in-house platforms, there is no justification for overinvestment in IT. Plus, since PayPal was founded as a digitally native business, it doesn’t need to pursue massive cloud or core migrations just to appear digitally savvier to investors.

4. What is Next?

PayPal is an apt illustration of why digital transformation is inevitable in the long run, but it is optional in the short term for many FSIs. Both PayPal and Venmo rank among the top 5 most used and downloaded Finance apps in the US, a remarkable achievement given the fierce competition in this sector. Gradual improvements alone could make a solid business, while transformation is only critical for grabbing new markets or stealing away market share from stronger competitors.

PayPal's trajectory is unlikely to undergo significant changes, as illustrated by the appointment of its new CEO, Alex Chriss. He previously served as the Head of Intuit's Small Business and Self-Employed Group, overseeing a business with a valuation similar to that of PayPal and achieving a comparable growth rate of around 10%. Without knowing how to sustain rapid growth at scale and lacking deep expertise in payments, how can Alex level up his new reports to operate like their peers in leading fintechs?

Nevertheless, a promising early indicator of PayPal's transformation potential would be if a new CEO begins divesting marginal products like Xoom and discontinuing recent initiatives like PayPal's stablecoin. This move would free up PayPal's executive team's time to learn new operating muscles and send a clear message that the days of chasing easy money are in PayPal's past.

Generative AI Has Become an Even More Obvious 'Shiny' Distraction

The very first newsletter of FSI Digital Transformation Weekly covered the likely marginal usefulness of generative AI. Seven months later, the results are still disappointing. The model itself seems to be becoming “dumber,” still can’t perform basic logic, and even the promotional use cases are underwhelming.

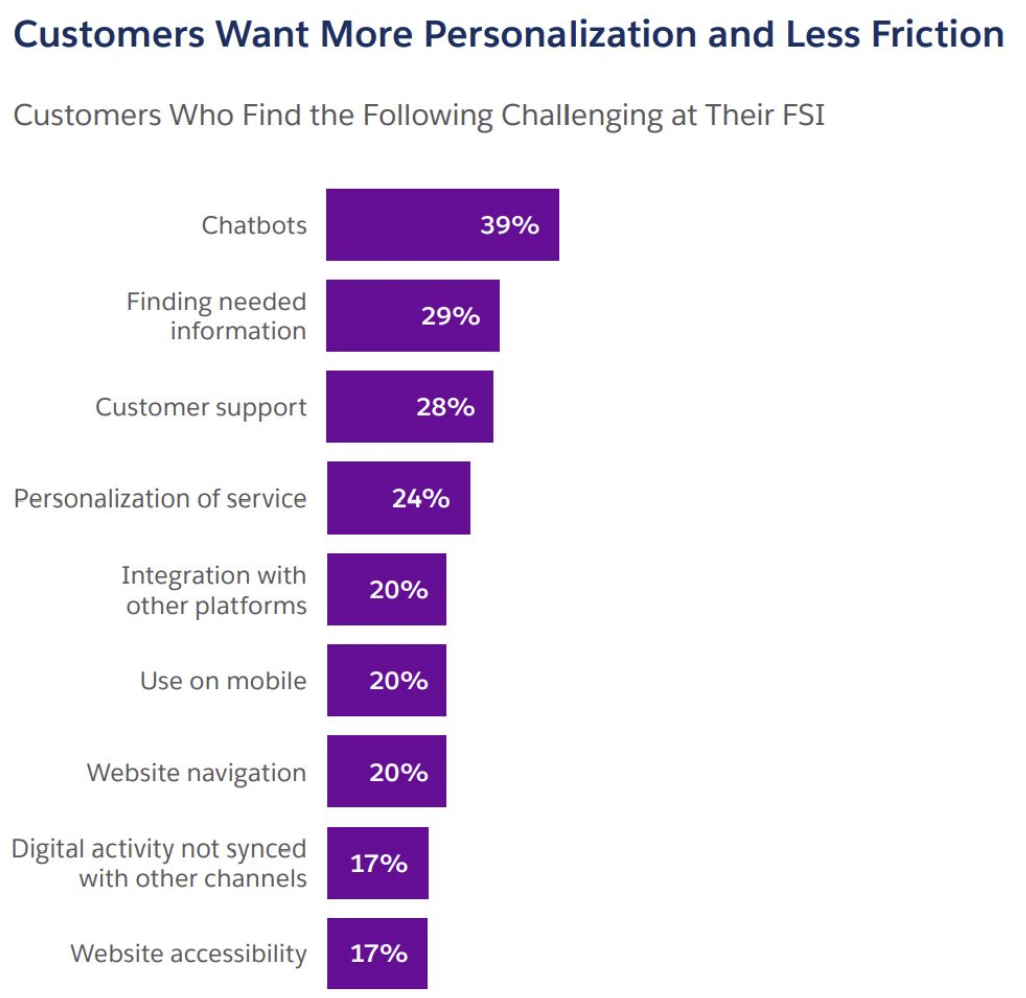

For example, a Financial Brand publication recently profiled two use cases for Banking: a customer-facing chatbot and a training resource for employees. Essentially, excessive digitization has made it excessively difficult for customers and employees to find information, so the previous version of AI resulted in more friction, and now FSIs are hoping that the latest version of Generative AI will be much more accurate.

1. Revolution vs. Evolution

A more holistic predicament is that Generative AI is following in the footsteps of a decade-long evolution of AI/ML solutions. Their impact on the pain points from a decade ago might have seemed revolutionary, but the remaining issues now appear to be too marginal to expect a game-changing impact.

For example, PayPal already reduced the loss rate by almost half between 2019 and 2022 by leveraging AI/ML capabilities. Expecting a similar improvement from Generative AI would be unjustified, considering it uses the same underlying data and has been optimized for value with advanced analytics for years.

“We’ve been working on this for over a decade, including transformer-based deep learning,” says Shivananda. “Today we apply AI and ML across our business, including for fraud reduction, risk management, customer protection, personalized services, and global trade empowerment.”

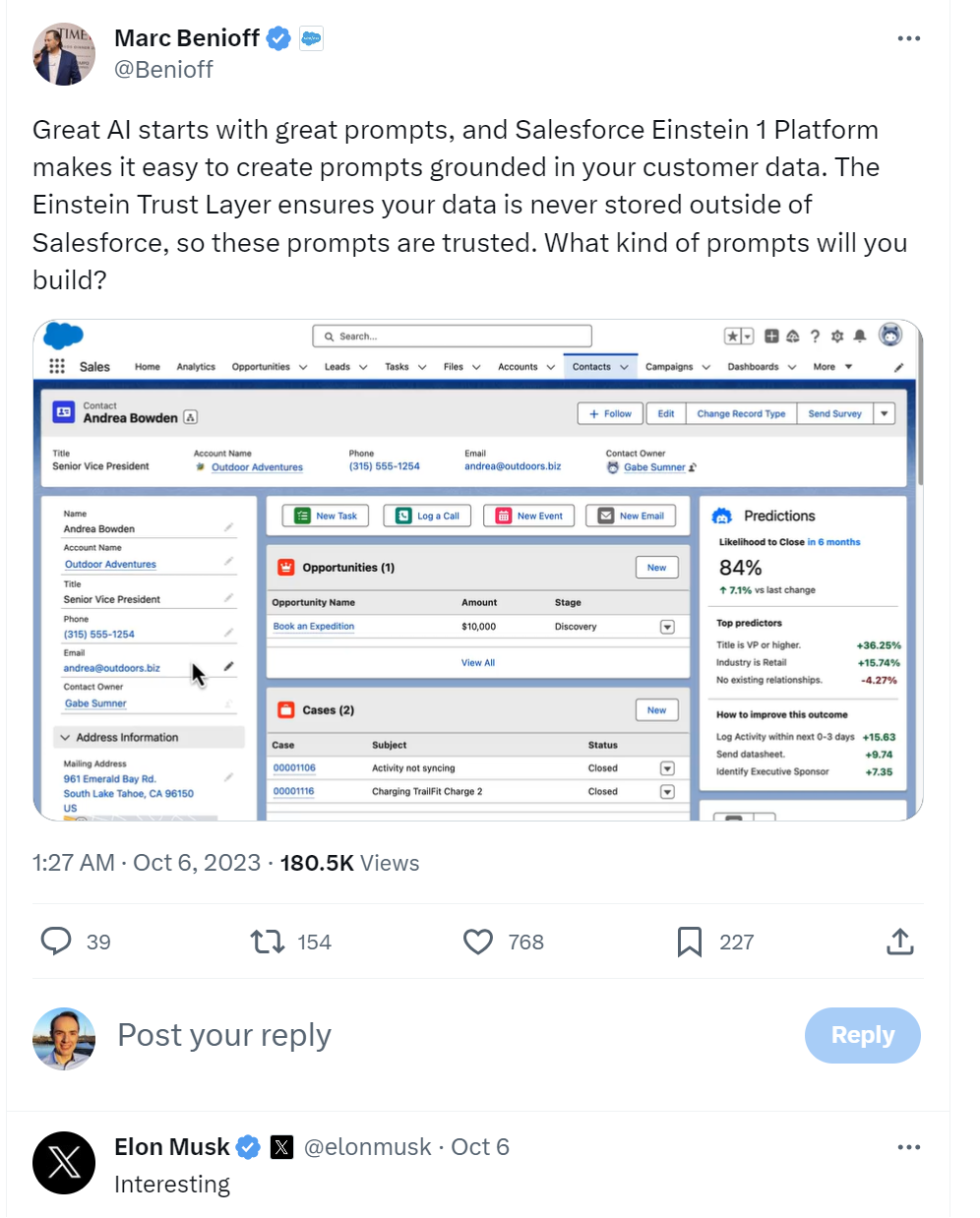

But perhaps digital players outside of financial services and insurance have uncovered something more remarkable. Salesforce recently made a PR splash with its generative AI platform, Einstein 1, showcasing its customer outreach customization capabilities.

If Elon Musk found the demo interesting, it must be something groundbreaking. Even if it doesn’t work in production, hopefully, the demo itself provides a “wow” vision of Generative AI possibilities. But no, the final output looks like a sleek automated version of the mail merge function from the 80s. Instead of uncovering hidden gems in the client’s data to suggest creative engagement, this Salesforce widget simply speeds up the process of compiling an outreach email.

This is obviously helpful, similar to how ChatGPT can help non-native speakers refine their writing. But would a sales rep using Einstein 1 really see a 10%+ increase in the open rate of outbound emails? Maybe if it is a struggling sales rep who uses a generic template. But why keep such sales reps in the first place?

2. Bugs vs. Features

Besides limited use cases, the fundamental challenge with Generative AI is that it is designed with six major flaws, which are features, not bugs, for the "generative" part of AI to function properly:

Trivial content

Made-up facts

Made-up sources

Made-up solutions

Biased by its programmers

Easily manipulated

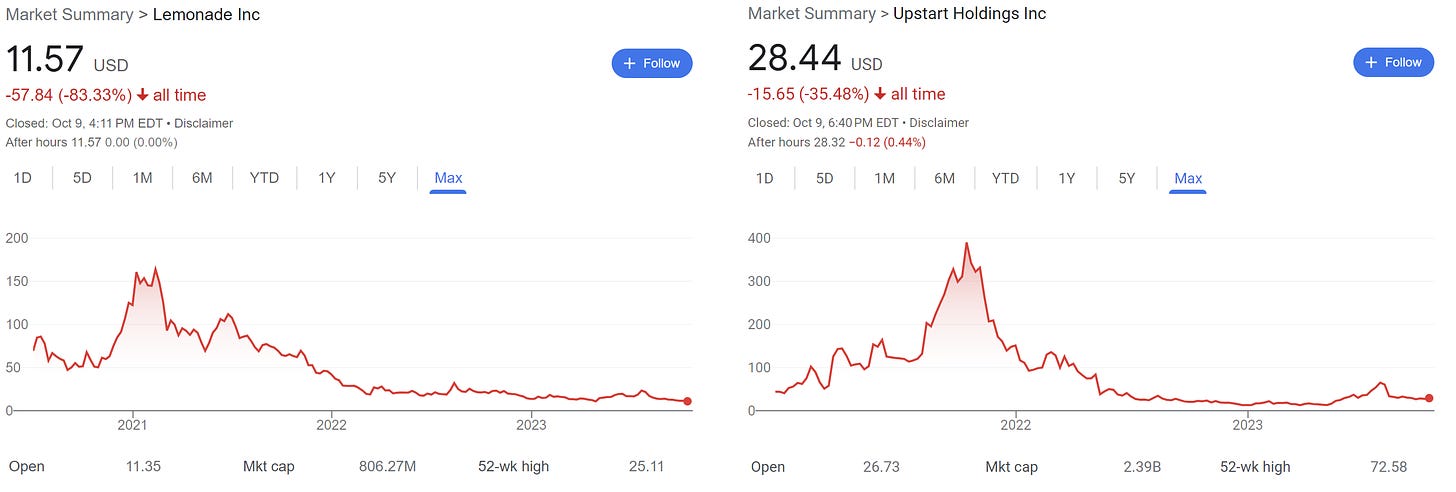

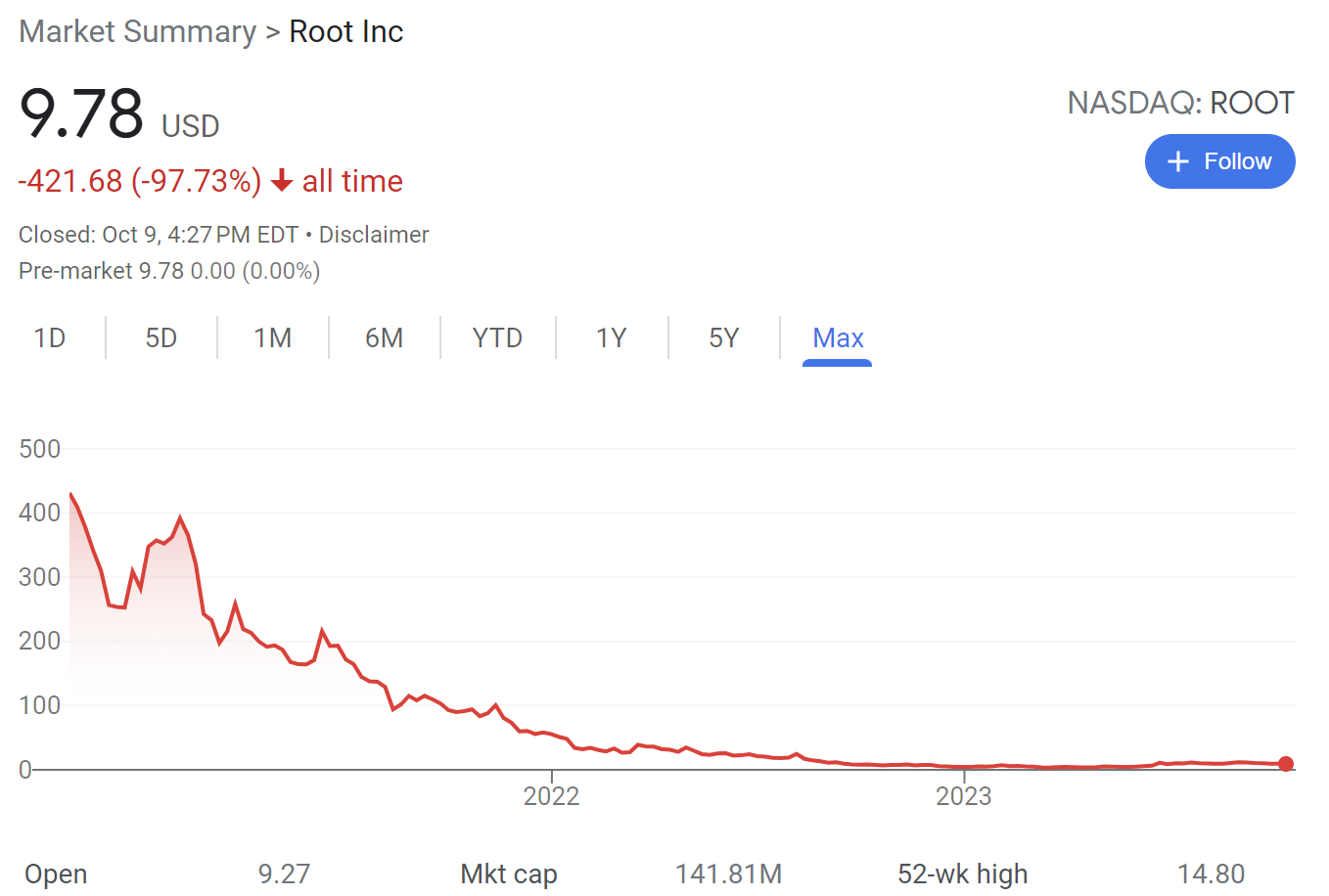

Due to these features, certain well-known AI-native fintechs and insurtechs have continued to experience stock declines throughout 2023. If Generative AI was indeed revolutionary, wouldn't these be the first companies to apply it to reverse the 90+% drop from their highs?

Unfortunately for them, if proven machine learning capabilities cannot salvage suboptimal business and operating models, Generative AI is even less likely to make the difference. The world's best chatbot may be appealing to some customers, but having an additional decade of underwriting data is what acquires those customers in the first place.

3. Years vs. Decades

Based on the above points, for an FSI executive who isn't motivated by spending the most budget, a healthy skepticism is more than warranted. Time and time again over the last few decades, FSIs have overinvested in new technologies and underappreciated the transformation needed in their business and operating models.

One of my favorite examples is the telematics use case for promoting positive changes in driver behavior and, consequently, reducing auto insurance costs (while increasing profits for the carriers). The logic behind Usage-Based Insurance (UBI) is quite intuitive: drivers are informed about what they are doing wrong, such as hard brakes or distracted driving, and rewarded for improving their behavior.

It seems like a no-brainer, but after almost three decades, there is no conclusive study demonstrating that scaling this use case has led to a significant ROI and P&L impact. Even the most prominent direct-to-consumer UBI insurtech in the US is struggling to survive.

One of the more comprehensive studies on this subject makes a typical and intuitive claim that changes in driver behavior lead to changes in accident frequency. However, without the actual number of drivers who improved or worsened their behavior after using telematics, how can an insurance executive be confident in the impact of such an initiative?

When faced with a technology like Generative AI, it's prudent for an FSI executive to reflect on why they are investing significant resources in it. They may discover that they are hoping for a "silver bullet" solution to avoid addressing systemic issues in their business and operating models. It often takes decades for such "silver bullets" to become "no-brainers." In the meantime, it's more impactful to tackle the fundamental challenges with proven solutions.

Other FSI Digital Transformation Reads

Transforming Your Business? How Process, People, and Technology Will Guide Your Path.