Should FSIs Embrace DOGE?

Also in this issue: For FSIs, Gen Zers Are Like the Rest of Us—Only Better

Should FSIs Embrace DOGE?

The target state of digital transformation is an autonomous, cross-functional operating model driven by ‘10x’ employees. No traditional FSI will fully achieve this in our lifetime, and only a few top fintechs have successfully scaled it. Even for them, this model is not natural but a forced state.

Once founders step back or ease control, organizational entropy sets in, and low-to-no-ROI initiatives spread like a virus. Jack Dorsey had to return to running Block, implement multiple layoffs, and still struggle to reignite rapid growth. Using AI as a rallying cry, Klarna’s founder cut its headcount from 5,000 in 2023 to about 3,500 last year while maintaining 20%+ revenue growth.

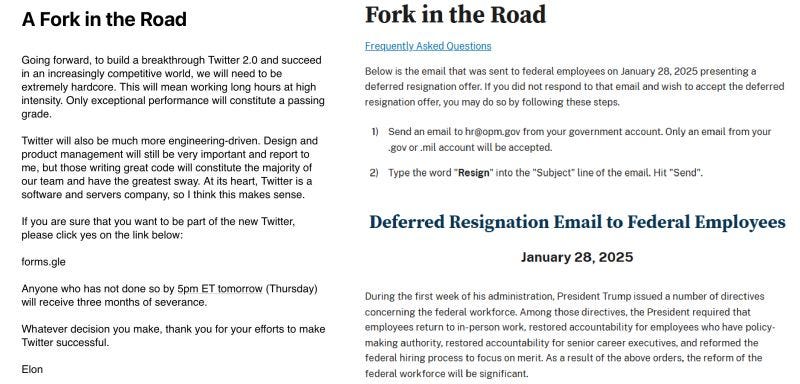

Even the best-known digital natives struggle to maintain this target state. Twitter became notorious after its 'Day in the Life' video showed an employee spending more time on meals and lounging than on work. After taking over, Elon Musk slashed 80% of the staff. Two years later, the company generated twice the EBITDA while drastically accelerating feature deployment. Former employees are likely still baffled by how this was possible.

The last place one would expect to attempt such a target state is the financial institutions of the U.S. government—except, of course, if that person is Elon Musk and his top associates. To everyone’s surprise, Trump’s push to unleash Elon on government waste wasn’t just campaign posturing.

Like a traditional FSI, the U.S. government already had layers of oversight functions with objectives supposedly similar to DOGE (Department of Government Efficiency). There was even a website tracking spending and a digital unit tasked with introducing automation. However, transparency was deliberately obfuscated, and spending cuts were viewed as politically risky, so efforts focused instead on expanding services—often with a strong ideological slant.

While DEI and regime-change-related spending drew the most headlines, financial services, such as the CFPB, had their own examples. Coincidentally, recently published data raises the question of whether DOGE might decide to unwind FedNow. Launched under pressure from smaller players resentful of a real-time payments system (RTP) owned by the largest commercial banks, FedNow processed just 0.4% of instant payments a year and a half later.

The operating effectiveness of a typical FSI falls somewhere between leading fintechs and the pre-DOGE-era U.S. government. I joined McKinsey at the start of the Dot-com recession, spending my first few years on IT cost-cutting projects for top FSIs. The waste we uncovered was so absurd that it seemed as if someone had to receive kickbacks to approve that spending on technology and systems integrators.

While more controls exist today, I still regularly hear from FSI executives about massive pet projects and poorly negotiated vendor contracts. Even BAU activities remain riddled with inefficiencies. Chase, a leader in AI adoption with digital ambitions to become a top-five European bank, recently sent me a Disney credit card offer. Having had no interaction with the brand in decades, I can only assume they blanketed all Florida residents—just in case.

This typically leads to decade-long cycles at FSIs, where CEOs and boards tolerate bureaucracy until a macro event or earnings collapse forces action. At that point, consultants are brought in to identify waste and malfeasance. Alternatively, a new CEO may be appointed with a mandate to cut bureaucracy and pet projects, as Georges Elhedery is currently doing at HSBC.

Many employees in traditional FSIs—from junior staff to the C-suite—want to break out of these cycles and move toward continuous improvement. Like employees at the U.S. Treasury, they witness wasteful strategies, flawed processes, and poor hiring decisions that should be addressed. Many even recognize that change would affect them personally, but their tolerance for it is usually limited—becoming the biggest impediment to digital transformation.

DOGE targeting the U.S. Treasury clearly illustrates the pain such change creates. Much like during the Twitter takeover, the majority of Treasury employees aren’t celebrating that the world’s most brilliant industrialist and his top confidants are working nights and weekends, taking massive pay cuts to eliminate waste on behalf of taxpayers.

Instead, their primary concern is how these changes will affect them—whether they’ll be forced to adapt or lose their jobs. A more dramatic moment came when the Treasury Department’s highest-ranking career official quit over concerns about DOGE’s access to payment systems, rather than mitigating supposed malfeasance or at least monitoring the situation and leaking it to the press.

As part of circling the wagons, there’s also an undercurrent of innuendo suggesting Musk might use confidential information for nefarious purposes. Yes, imagine the co-founder of PayPal and founder of SpaceX learning sensitive data. In addition to slashing wasteful federal spending and tackling the budget crisis, what if he uses that knowledge to start another revolutionary enterprise?

Like most experts and former employees who predicted Twitter’s implosion, many expect DOGE to cause irreparable damage. Five former Treasury Secretaries recently expressed alarm over the situation. After years of proudly rubber-stamping even the most outlandish spending, they were apparently baffled by the new Treasury Secretary’s attempt to break from that long-standing tradition.

DOGEing an FSI is not for the faint of heart. Employees and executives driving radical change are in the minority by design and are bound to hear subtle—and not-so-subtle—hints of career-ending consequences. Even with much less at stake, an executive at American Express once told me, “We hired you as a change agent, but it’s taking a large portion of my week cleaning up the dead bodies left in your path.” The CEO of another firm remarked, “In two decades, I’ve never heard as many complaints about anyone as I have about you in just two months.”

For someone like me, whose first business was a wholesale distributor of imported cigarettes and alcohol in southern Russia in the early ‘90s, such messages don’t shake my resolve. But that would be enough for a typical FSI professional to hit the brakes. The good news is that DOGE requires mostly resolve—not some exceptional brilliance like Elon Musk’s.

A couple of years ago, everyone assumed the P&C insurance situation in Florida would be as dire as in California. However, by focusing on the underlying root causes, Florida’s Governor had the resolve to overcome entrenched lawyer interests and implement tort reforms. This resulted in expanded carrier availability and decreased prices.

At Twitter and the U.S. Treasury, Elon identified two priority commanding heights that DOGE must overrun to succeed: HR and Finance. This prospect would unsettle many FSI CEOs, who have long relied on these groups for support and franchise protection. At least they have a playbook for communicating upcoming changes.

At Twitter and the U.S. Government, Elon invoked Robert Frost’s “fork in the road” analogy, stating in no uncertain terms that everyone now faces a moment of "two roads diverged in a yellow wood, and sorry I could not travel both." Which road will your FSI travel?

For FSIs, Gen Zers Are Like the Rest of Us—Only Better

The two key features of the U.S. age of decadence include catastrophizing over every news event and competing in the “victims’ Olympics.” By far, the funniest “victims” have been the younger generations, which has caused significant confusion for FSIs when selecting digital transformation use cases.

First, with Millennials and then Gen Z, media and experts have been telling us since 2008 how these young people would be nothing like the previous generation due to irreparable emotional scars. Even more shocking, according to the most popular TED talk of 2024, the U.S. is destroying young people’s future:

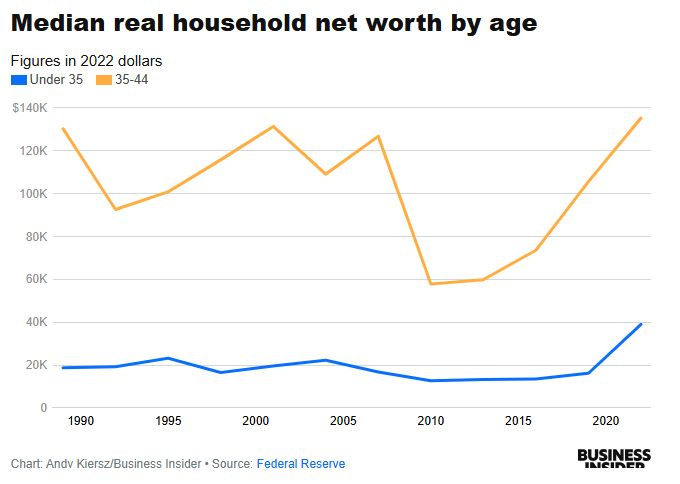

Of course, the annoying reality is that each successive generation in the world’s largest economy is becoming financially better off and savvier. The median real household net worth of those under 35 is now twice as high as it has ever been.

Successive improvement across generations is evident in most key factors. For example, a recent report by Experian showed that Gen Z’s average credit score was 668, compared to 641 for Millennials at the same age. Delinquency rates were also significantly lower, with 0.041 per Gen Zer versus 0.131 for Millennials.

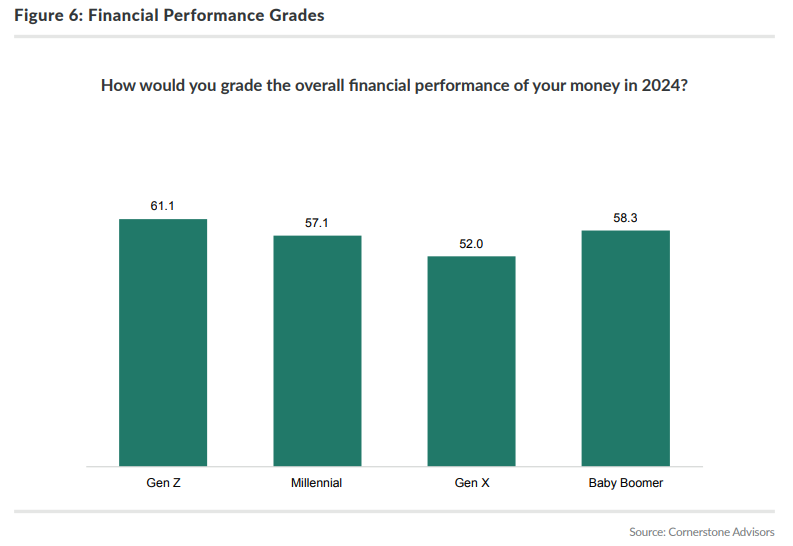

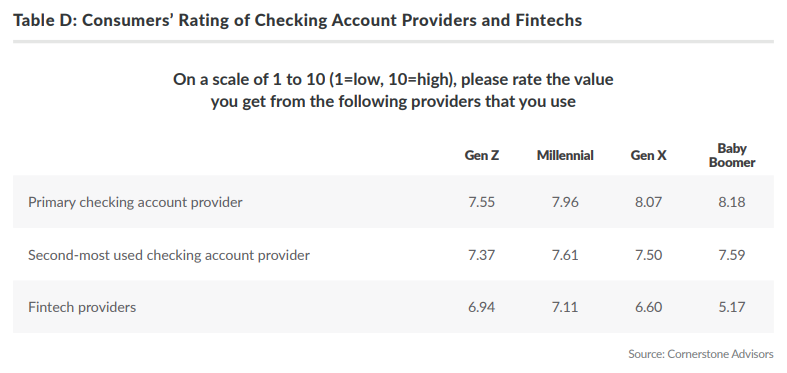

You might still feel sorry for Gen Zers because of the barrage of stories about how anxious and self-pitying they are despite the objectively positive environment. But that’s a myth, too. When asked about their perception of handling finances in a recent Cornerstone Advisors survey, Gen Zers gave themselves the highest grade among generations.

Another myth propagated by various experts is that younger generations can’t stand traditional FSIs and flock to fintechs at every opportunity. Not at all. While not to the same extent as older generations, younger generations still prefer established brands. In the same Cornerstone Advisors survey, Gen Zers didn’t view their fintech provider as more valuable than their primary or even secondary bank.

Leading traditional FSIs also confirm this with their new customer distribution by age. Fintech expert Jevgenijs Kazanins caught on the recent Charles Schwab earnings call that 33% of new-to-firm retail households were under 30.

Gen Z’s only significant difference is their channel preference. But even here, the myth of anxious youngsters wanting to avoid human contact isn’t true. According to a recent Oliver Wyman analysis, compared to previous generations, Gen Zers are:

20% less likely to value a physical branch

40% more likely to value access to 1:1 support

Basically, they are like us—just savvier and more efficient. This segment doesn’t want superficial responses from a GenAI chatbot, nor do they feel the need to visit a physical location whenever they have a complex question. For a gold standard on how to treat them, think less of Cash App and more like Wise or the American Express Platinum group. The kids are alright; they want you to solve their problems, not feel sorry for them.