Digital Transformation in FSI Starts with IT Modernization

Also in this issue: Why Are Customer-Facing Use Cases So Hard to Prioritize in FSIs?

Digital Transformation in FSI Starts with IT Modernization

For decades before "digital transformation" became a buzzword, FSI executives viewed technology initiatives as a black box. As long as IT gradually reduced relative technology costs while improving reliability, CIOs were perceived as performing well, and business leaders didn’t need to engage with the details. This mindset resulted in many FSIs creating well-run technology silos and interacting with business units through an IT project-based operating model.

This engagement model still works for FSIs focused on traditional client segments, where face-to-face interactions are preferred over self-service, and technology and data capabilities are more of a baseline expectation than a differentiator. As a Chief Revenue Officer at one such FSI recently told me, “I just want the CIO to tell me if any of my business plans with a technology enablement aren’t feasible. The rest is up to him.”

Traditional technology enablement can still deliver substantial business value. A decade ago, USAA exemplified this by creating an integrated customer journey for purchasing cars and insurance using a waterfall methodology. Even advanced technologies like AI can be deployed effectively without agile, cross-functional teams—even within government-operated financial institutions. Recently, Bloomberg reported Treasury Secretary Janet Yellen’s success in leveraging AI to combat government check fraud:

“I absolutely agree with the premise — which is that fraud is becoming a huge problem,” The Treasury Department is now using AI to tackle this issue, Yellen said. “It’s really made a dramatic difference in our ability to detect and deal with fraud.”

Rather than overbuilding technology and data capabilities, wise IT leaders understand the importance of waiting until the business is ready to engage. While it's beneficial to offer suggestions and share insights on what competitors are scaling, without explicit agreement from the business to drive the effort, digital transformation will ultimately be limited to mere IT modernization.

The good news is that 21st-century technological advancements present numerous opportunities for IT transformation in FSIs before the C-suite decides to change operating and business models. The worst-case scenario for a CIO is when the company finally seeks to embrace true digital transformation, only to discover that its technology model still operates as it did in the 20th century.

While there is a growing list of FSIs with divisions operating through cross-functional value streams and platforms, most companies, especially at the enterprise level, continue to focus primarily on IT transformation. A recent article by Fintech Magazine profiled Amit Thawani, CIO for Insurance, Pensions, and Investments at Lloyds Banking Group. He was brought on to oversee a straightforward transformation centered on technology upgrades:

“It was about engineering transformation, next-generation data centres, next-generation applications, simplification, modernisation and legacy transformation…”

CIO Online recently described the ongoing IT transformation at Marsh McLennan, which employs over 5,000 staff in its technology and data group. CIO Paul Beswick has prioritized migrating to the cloud and building a shared data environment across four divisions. As is typical with IT-centric transformations, the outcomes of such efforts do not significantly accelerate revenue growth or improve unit economics. In the case of Marsh McLennan, the results included:

Enabling the creation of new applications in under a week

Developing an in-house AI copilot for internal use at 1% of the cost of a Microsoft license

The main challenge with IT transformation is knowing when to pause and allow business counterparts time to catch up with their digital capability needs. As we often discuss in the newsletter, this stage is the most precarious on the digital transformation journey. With cloud, AI, and microservices capabilities, agile IT teams can become much more productive, generating far more functionality than the business is ready to own.

Cutting the lead time between code changes and releases to end customers to just days sounds excellent in theory, but it only adds value if there is a business owner who is closely involved in defining and validating new features. It may be tempting to adopt the latest CI/CD tool stack and embrace KPI trees from leading fintechs like Wise, but this should not interfere with the efficiency and reliability of IT.

While CIOs concentrate on IT transformation, CEOs and business leaders will determine when genuine digital transformation occurs. In the interim, they may make bold claims about the transformative impact of technology initiatives—particularly generative AI—provided they do not overpromise and expect the CIO to deliver extraordinary earnings growth.

Why Are Customer-Facing Use Cases So Hard to Prioritize in FSIs?

Cost-cutting through restructuring and automation has been a go-to strategy for FSIs for decades to capture business value. As markets evolve and new productivity tools are adopted, it’s not uncommon to see 3-5% of staff laid off annually. Recently, in an unbelievable coincidence, Visa and Santander both announced cuts of the same number of jobs on the same day:

Capturing the business value by introducing digital capabilities that customers are willing to pay for is significantly more challenging. This complexity is not due to the method of identifying such use cases, which is quite simple:

Identify a significant pain point that clients would be willing to pay someone to address.

Analyze the root causes of why it hasn’t been addressed yet.

Identify a digital solution, if any, to resolve those root causes.

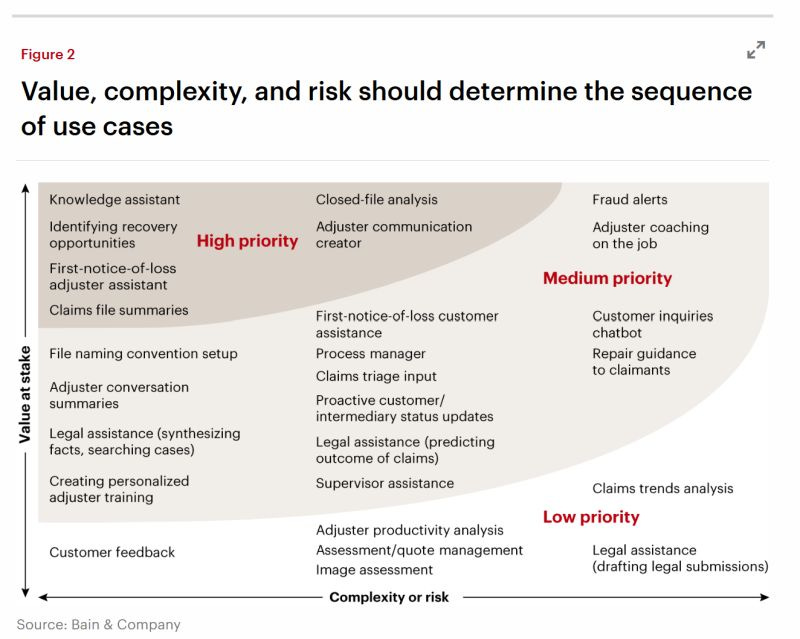

By following these steps, FSIs can effectively compare the cost-benefit of various use cases and prioritize a select few based on the limited capacity of fintech-grade talent required for these initiatives. The criteria for prioritization are also straightforward: 1) value (growth, savings), 2) complexity (data, model), and 3) risk (customer-facing, regulatory). Here is an example of Bain recently applying these three criteria across two dimensions for GenAI use cases in auto insurance:

Despite the straightforward methodology for identifying and prioritizing customer-facing use cases for digital transformation, many FSIs continue to avoid such rigor, hoping that customers will simply come. To be fair, many digital natives also share this build-it-and-they'll-come mindset.

Even the most brilliant industrialist of the 21st century, Elon Musk, thought it was a no-brainer to launch auto insurance for Tesla drivers, believing that access to proprietary car data would provide a significant advantage. However, the decades of diverse data accumulated by incumbents proved to be more valuable. Five years later, Tesla Insurance's loss ratio is 50% worse than the industry average:

Not surprisingly, financial regulators also lack such discipline. They champion digital currencies or open banking without truly understanding customer needs. Fintech expert Alex Johnson recently shared Rohit Chopra, Director of the CFPB's rationale for launching open banking in the U.S., which involves enabling consumers to share their financial data with third-party providers:

“We have never seen as a success factor actual switching velocity. In some ways, we’re gonna want to look at deposit account competition factors. What are APYs? How is customer service looking? Are we going to see more banks give funds availability days before a paycheck or direct deposit? Some of this will just occur if banks and fintechs perceive that their customers can leave.”

Rohit's success metrics are a good start, but they don't address the mixed results of open banking in other countries and the lessons they offer for a U.S. rollout—or even the question of whether it’s worth pursuing. For instance, what was the impact of Chase's rapid scaling in the UK on APYs compared to the effects of open banking, and did Chase even need open banking to achieve that scale?

The practical reason for the lack of this crucial upfront process is the fear that the results might be disappointing. One of the longest-running jokes in fintech is PayPal's struggle to find a monetization use case for Venmo. Both internally and then publicly after its 2015 IPO, the company has made this a top priority:

That hope will never die. Fintech expert Jevgenijs Kazanins shared the renewed commitment of new PayPal CEO Alex Chrisson during a recent earnings call:

“With Venmo, we're making progress in executing our strategy to shift from solely a P2P service to a central part of consumers' financial lives. We believe that Venmo will eventually have multiple monetization levers.”

The most recent financial product lacking proper identification and prioritization of use cases is stablecoins. Companies like Coinbase and Circle are investing significant PR and marketing efforts to position their solutions as the only mechanism to break the vicious cycle of consumer lives created by fiat finance:

The crypto founders prefer to remain in denial about the significant changes in domestic and cross-border payments across fiat ecosystems in the 21st century, with no slowdown in sight. The rise of domestic real-time payments, new Swift rails, and a plethora of proprietary networks are creating immense value for consumers and businesses worldwide. Instead of investigating the remaining pain points, it’s easier to keep proclaiming that payments should be instant and free, like email:

Naturally, launching a free and instant service to cannibalize the core business simply because it sounds appealing is as antithetical to crypto players as it is to traditional FSIs. On the contrary, their customers often complain about high prices, and the trend doesn’t appear to be moving in a “free” direction:

While fiat-based FSIs, fintechs, and government entities will find identifying new lucrative customer-facing use cases more challenging, crypto players have one surefire way to attract customers with lower prices without jeopardizing their profits. Have Coinbase and their peers considered switching entirely to fiat currencies in the back office to avoid charging their customers such a high take rate?