“Transformation” Has a Specific Meaning, Not Just Any Large Initiative in FSI

Also in this issue: FSIs Playing to Their Strengths Won’t Solve Societal Ills, Nor Will Digital Marketing Gimmicks

“Transformation” Has a Specific Meaning, Not Just Any Large Initiative in FSI

Like other large FSIs, Citi has been on a decade-long digital transformation journey. In 2016, Don Callahan, Head of Operations and Technology, highlighted Citi's digital lab, mobile apps, cloud, and machine learning capabilities. By 2021, the entire organization, across all divisions, was scaling its Agile operating model, as described by Michael Naggar, Chief Digital Officer of Citi’s U.S. Consumer Bank:

“Our business processes are also becoming Agile—not just our development processes—and I’m overseeing that. This fundamentally changes the way that the organization works. In the new way of working, you say, "We have an idea. How do we wrap up governance, ideation, and evolution all within a week-by-week cadence, such that every 28 days, we're rolling out something that has already been through our governance and risk management processes?”

Citi’s recent Q3 earnings showed stronger performance than its peers, with organic revenue up 3% and expenses down 2%, excluding divestiture-related impacts. Have the massive digital transformation efforts finally paid off, as one headline suggested? After all, Citi spends over 15% of its revenue on technology, ahead of its peers.

Not necessarily. Citi CFO Mark Mason explained during the earnings call that the improvement was due to traditional cost-cutting, while the benefits of digital transformation may not start trickling in for a couple of years.

“What's driving the reduction? So we've talked before about $1.5 billion in savings, largely related to the restructuring and driving down headcount reduction associated with that. We talked about another $500 million to $1 billion related to expense reductions from eliminating stranded cost. As we continue to exit, we're out of nine of these consumer countries already. And we talk about starting to see efficiencies and benefits from the investments in the transformation and technology toward the end of 2026.”

Moreover, despite massive efforts and overspending on technology, Citi is the only stock among its peers to have lost significant value over the last five years.

As our newsletter often discusses, massive investments in technology without transforming the operating model from IT Products to Value Streams & Platforms is a surefire way to burn through cash. Constant talk about an Agile culture is meaningless if it only means that product teams churn out features faster, while the C-suite operates with traditional multi-year milestones.

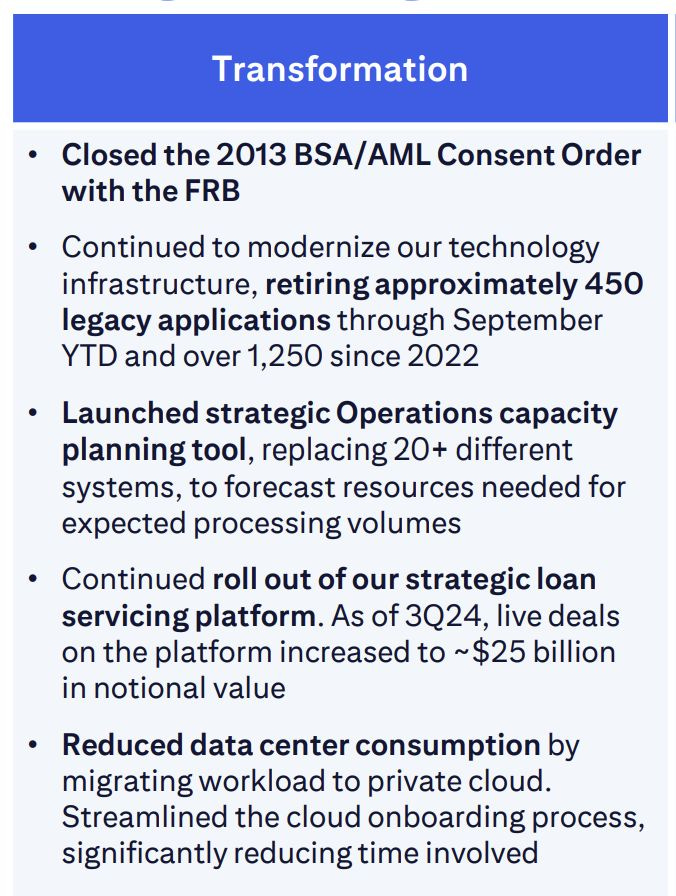

In addition to evolving the operating model and rapidly scaling novel technology pillars, the correct definition of “Transformation” also encompasses a significant change in the business model. One such example in 2024 was HSBC launching a fintech subsidiary, Zing, which charges ten times less than its parent company for cross-border money transfers, even undercutting industry leader Wise. In contrast, Citi's recent transformation priorities included mundane 20th-century projects, such as sunsetting applications and resource planning tools:

Why does Citi continue to overspend on technology compared to its peers while being unable to predict returns for at least another couple of years? It's not as if FSIs don't know how to estimate the internal rate of return (IRR) on large initiatives. As waves of Americans migrate to the Southeast, it has become a battleground for branch blitzscaling among national and regional banks. This naturally led to recent analyst questions about returns and an effortless response from Fifth Third Bank CEO Tim Spence:

“So the IRR of the branches in the Southeast has been running in the 18% to 20% range and the time to breakeven has been a couple of years, right? If you were to look at the small acquisitions we’ve made to support commercial payments, we were targeting IRRs in the 20s in those cases in part because you had a more nascent business and it’s less predictable after than when you built 100 branches and you know what you’re going to get out of the next location that you build.”

Unfortunately, the challenge and long delay in realizing returns from digital transformation stem from the fact that they are not harder to calculate, but rather harder to generate. During the same earnings call, Tim Spence questioned whether the substantial technology investments by big banks have actually translated into a better value proposition for customers:

“I completely agree the amount of money that is getting deployed into technology investment on the part of the large banks is eye-popping. But if you look at the value proposition, like go pull up the consumer — lead consumer checking account offering for any of those large banks and for Fifth Third or some other regional and tell me how that materialized into some substantially better value proposition. I actually think in many cases what you would see is the opposite as it’s been the regionals who led on consumer prep friendly product innovation.”

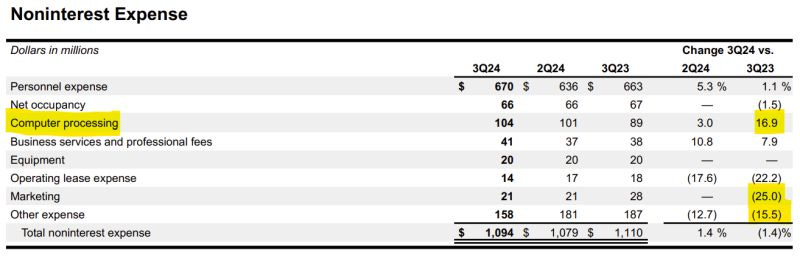

Unlike predictable branch build-out, technology initiatives can often yield unforeseen negative returns if an FSI lacks the operating model maturity to manage an “agile” spread. One of the most cited examples of such negative surprises in my conversations with FSI executives is the excessive spending on cloud services. Instead of achieving scalability gains from migration, the financial drain from cloud expenses has become pronounced for FSIs like KeyBank. As a result, they must make drastic cuts in other expense categories just to maintain financial hygiene:

A more recent overhyped spending category is GenAI-based chatbots. While they offer a better user experience than a static FAQ page and can help companies like Klarna reduce client calls from 11 minutes to 2 minutes by automating standard queries, what if an FSI has already digitized the basics? In that case, building a chatbot for every customer channel could become annoying unless it simplifies the process of requesting human support.

“Chatbots don't work,” said Better.com CEO Vishal Garg. “We've tried chatbots before and fundamentally consumers get tired of not being able to get a proper response to the inquiry that they have. They give up on chatbots. We knew that we had to really move the industry forward and build an AI voice assistant that is going to engage with consumers in a conversational way, and is fast.”

Digital transformation, implemented with shorter timeframes, would no longer be guesswork regarding its potential to significantly improve P&L. If the answer is unclear, FSIs should drastically cut the scope of their efforts until they achieve predictive accuracy similar to that of opening a new branch. It's worth noting that traditional cost-cutting and containment still work for Citi and other FSIs in the meantime.

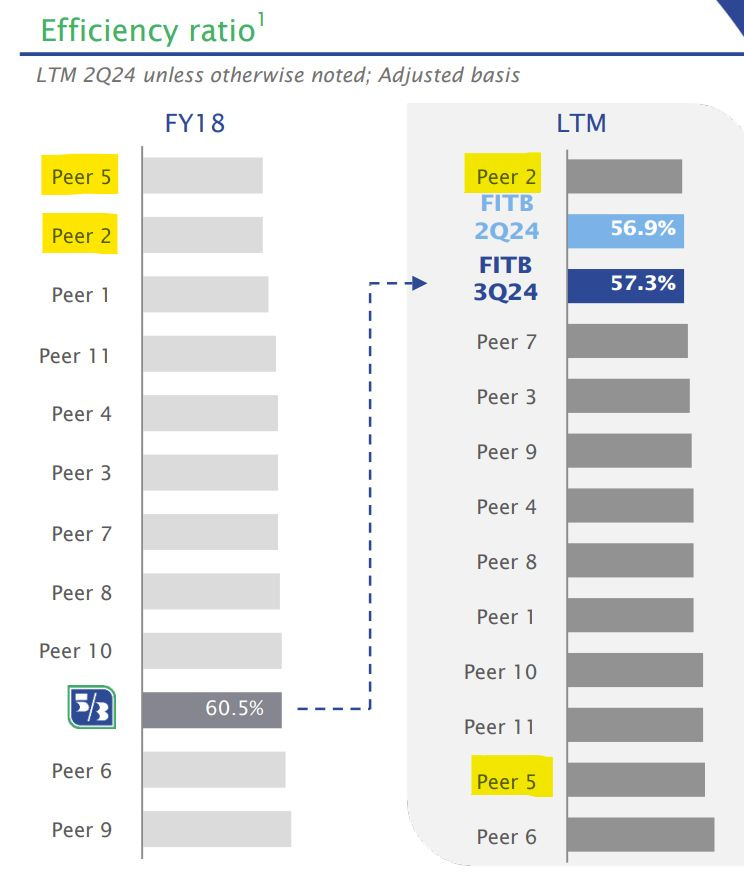

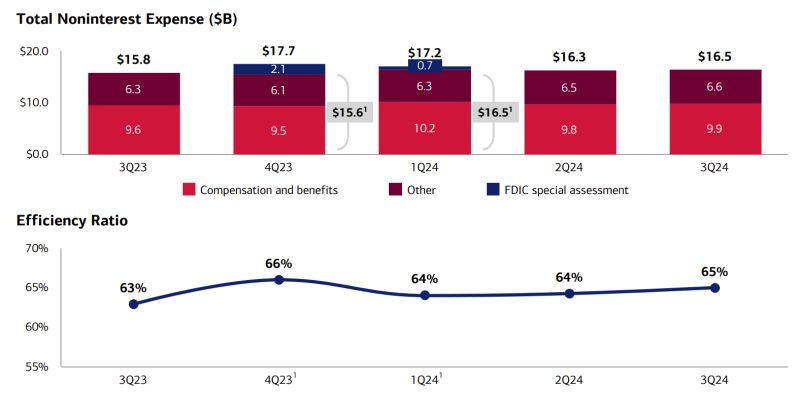

A recent efficiency benchmarking at Fifth Third Bank from 2018 to last quarter shows only one peer maintaining a top position, while the previous best performer has fallen to the bottom. Fifth Third's improvements have largely focused on expense containment, with revenue growing just about 1% above inflation annually during this period:

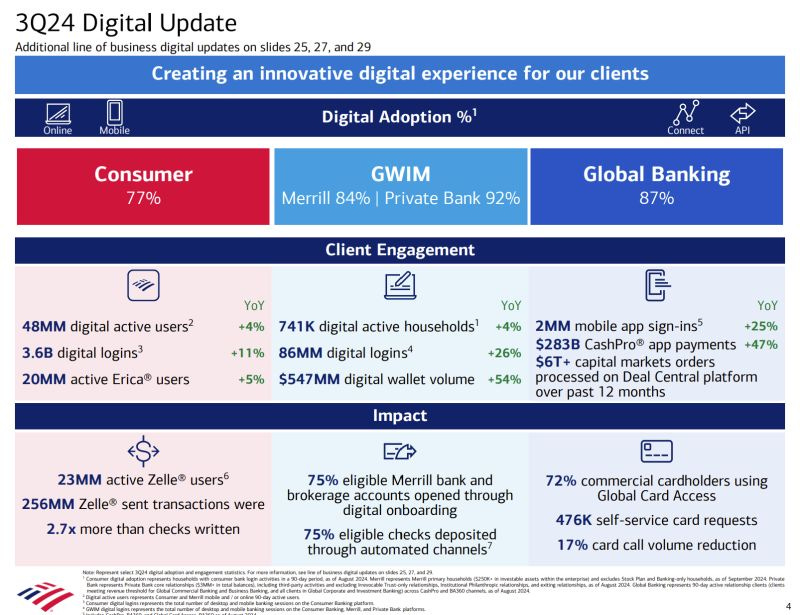

Ideally, an FSI would demonstrate market share capture, but in the absence of fast revenue growth, improving efficiency should be a bare minimum requirement for a respected CEO. How else could they prove to shareholders that their massive compensation packages are deserved? For example, with indefinitely stagnant expense ratios, the increasing questions about Bank of America’s CEO, Brian Moynihan, remaining at the helm are not surprising.

But maybe I am wrong in my cynical view of transformation and the build-out of digital capabilities as merely a means to grow revenues or profits. Is there a different meaning of transformation, perhaps an intrinsic beauty in these digital updates? One thing seems certain: such esoteric interpretations of “transformation” buy CEOs more time than simply announcing the opening of new branches.

FSIs Playing to Their Strengths Won’t Solve Societal Ills, Nor Will Digital Marketing Gimmicks

Paraphrasing Lenin’s famous quote, "Democratizing access to credit and building a more inclusive credit landscape is a rough business. You can’t do it wearing white gloves and with clean hands." Financial wellness tools are akin to weight-loss plans that rely on users' inability to perform the most basic tasks: lowering discretionary spending or eating less unhealthy food. Instead of acknowledging this fundamental requirement, experts, media, and fintechs often create a parallel reality where traditional FSIs push people into poverty, and being overweight is portrayed as an enigmatic disease.

When a fintech's raison d'être is to improve customer financial well-being without addressing the underlying issues, it often falls into a predatory business model. Unsurprisingly, promising customers a way out of recurring debt by locking them into more recurring debt is a short-term strategy embraced by both fintechs and gym chains.

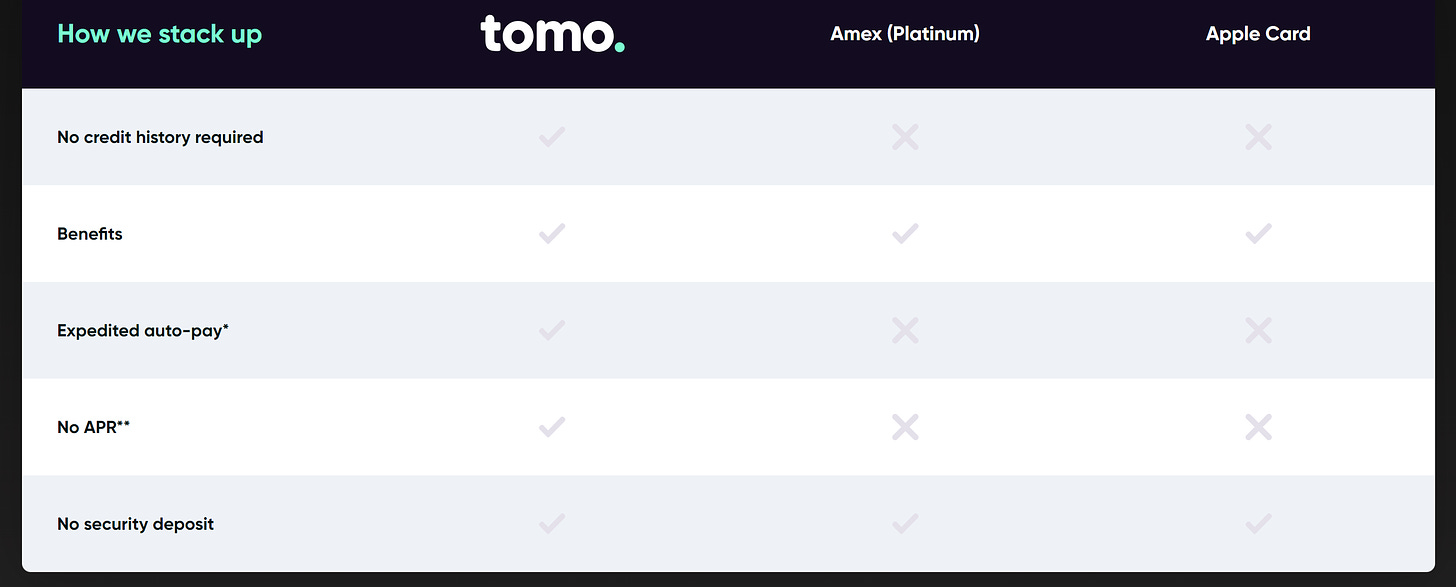

These business models are not for the faint of heart, as such approaches require a willingness to embellish beyond what could be considered reasonable by regulators and the media. In addition to its subscription-based credit-building product, Boost, Tomo offers a charge card that promises to help build credit. The audacious part is comparing this card to the Amex Platinum and Apple Card, claiming it offers the same benefits without any hassles, despite not providing any points or cash back for spending:

A much more effective approach is promoting a desire to help consumers level up financially while selling them profitable products for unrelated use cases. This leads to the world's two most guarded secrets: the percentage of BNPL users who improve their credit scores and the percentage of crypto users who use it for payments or transfers. BNPL fintech founders love to tout how they are saving customers from other types of debt, but they are astute enough not to make debt consolidation their core product.

Similarly, many crypto reports emphasize financial inclusion while players profit from trading, gambling, and free float. The latest report from a16z, of course, doesn’t specify who the crypto customers are or what they primarily do with crypto. It's reminiscent of leading crypto players discussing remittances as their favorite use case for a solid decade, yet failing to find even one blue-collar Mexican in the U.S. who sends monthly remittances home using their services.

Who can blame them? The allure of promising difficult long-term benefits while collecting easy short-term cash is too strong for any of us. For example, do you feel that no matter what your FSI does, it doesn’t seem to impact the future of finance? Issuing a token won’t change the outcome but might make you and your investors feel better in the meantime.

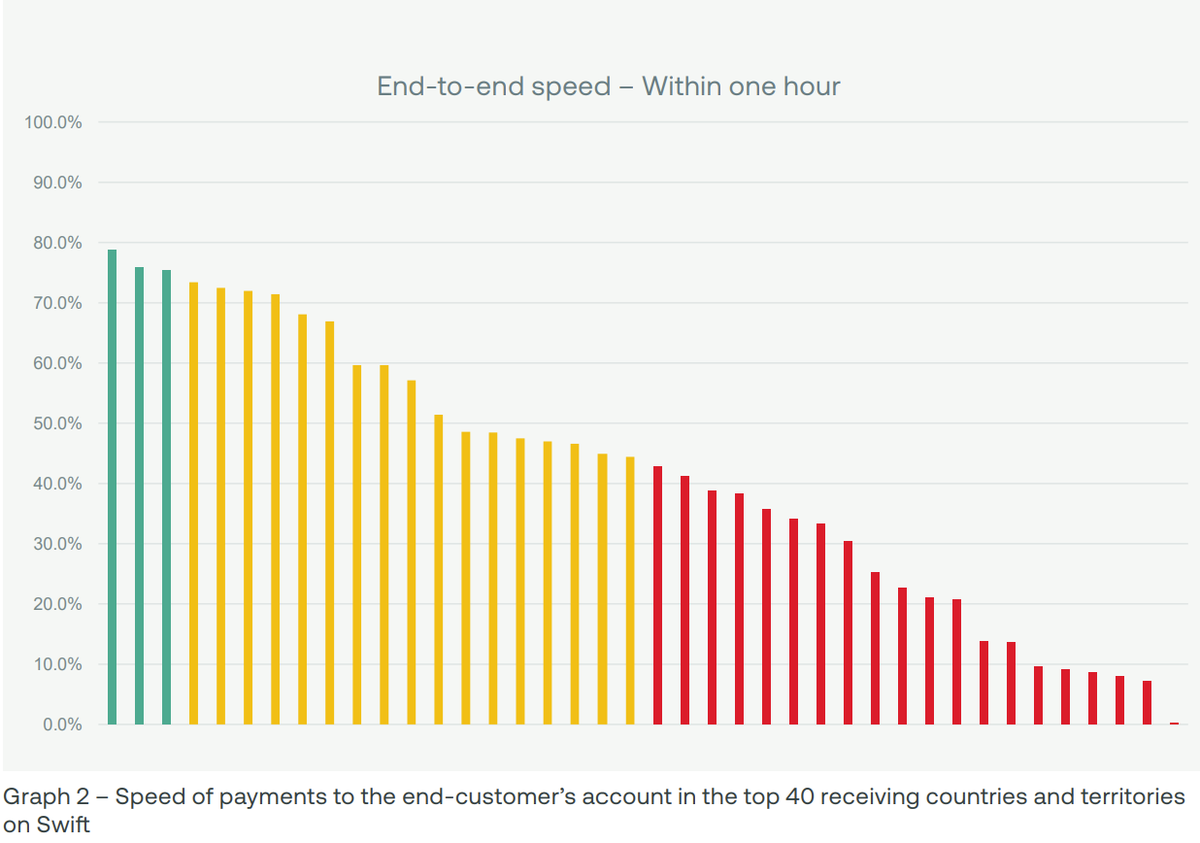

One could empathize with such efforts. Nobody necessarily wants to build a fintech that exploits customers, but it’s also much harder to identify real pain points. At least 15 years ago, crypto had a chance at improving remittances. Since then, Swift has been spooked by Ripple and now processes 90% of payments within an hour. Although only half are credited to customers within that time, the main reasons for delays in certain countries are batch processing and regulations—not something a magical cross-border blockchain could easily resolve.

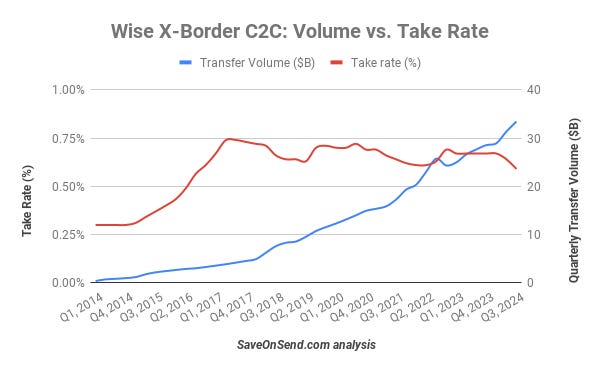

Wise just announced a record quarter, boasting over 20% growth in C2X cross-border transfers, solidifying its status as the industry leader on track to transfer $130 billion for consumers in 2024. How could a crypto firm possibly poach customers from such a customer-friendly and low-cost provider?

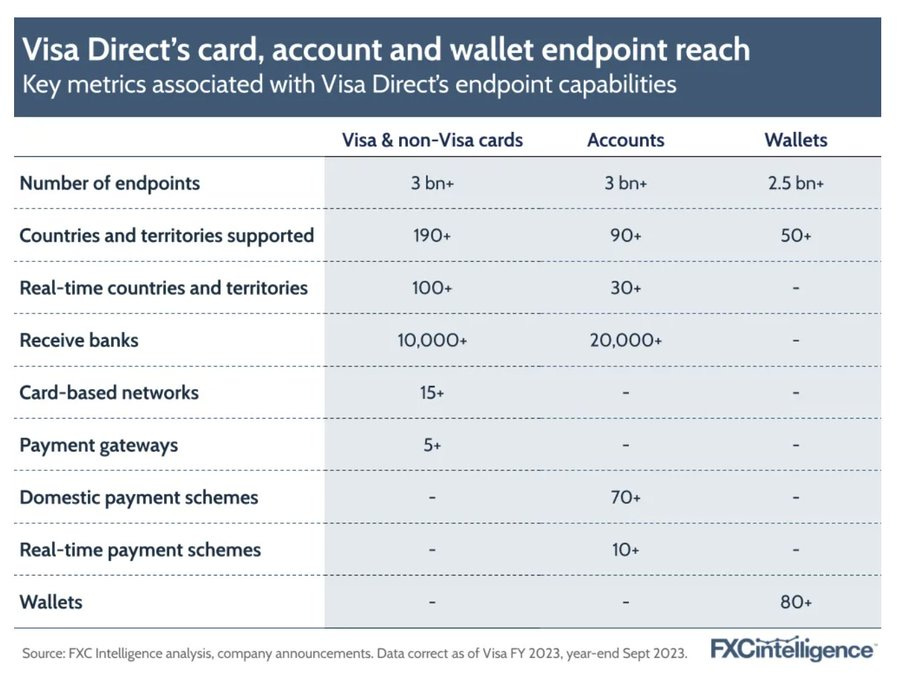

Visa and Mastercard are also rapidly innovating. As one fintech executive recently told me regarding the addition of cross-border transfers to their offerings: "Why should I bother with stablecoins and CBDCs when we already have Visa?" With billions of consumers, these companies effectively cover those with accounts and wallets, while crypto lacks a compelling value proposition for the remaining customers.

Besides BNPL and crypto, home insurance in the U.S. is another product starting to rely on sleight of hand. Traditional FSIs and their disruptors appear to be using unreliable data as supplementary evidence for decisions that have already been made.

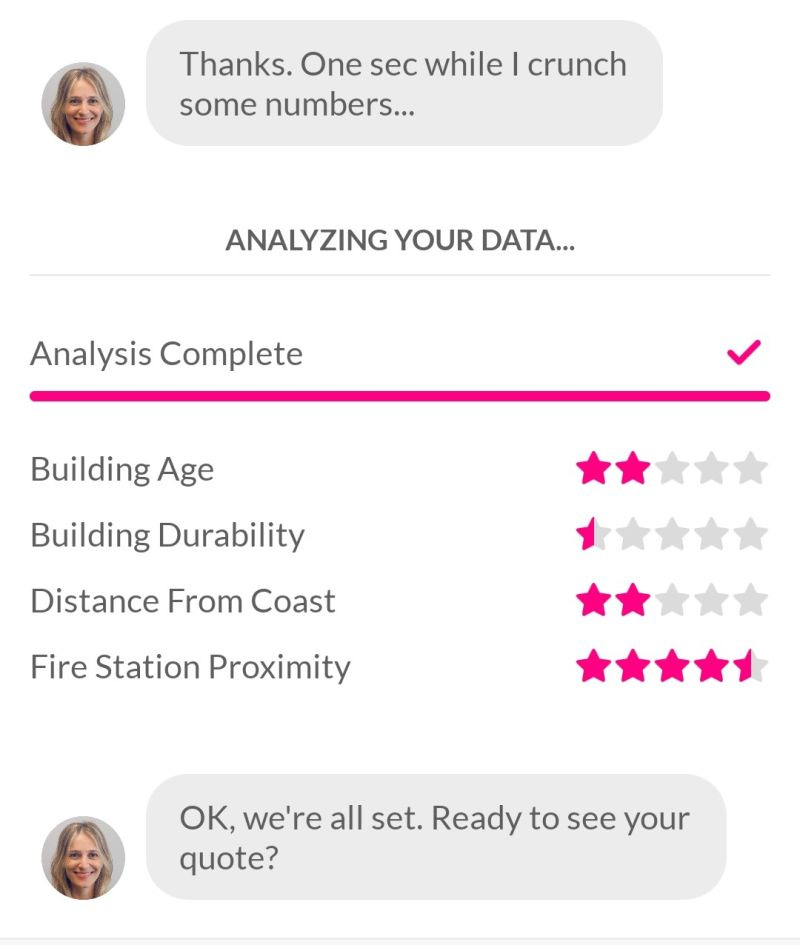

I was getting an online quote from Lemonade and was impressed by the user experience, which doesn’t keep pricing a black box for consumers, instead offering maximum transparency regarding the underlying drivers. That was until I noticed the data was completely off, showing an old, dilapidated building instead of a recent high-end construction.

When I confronted a Lemonade representative, they backed off and suggested that the data wasn’t actually driving the quote: "Our information regarding your building is based on a standard query of public external databases. We're constantly working on updating and improving accuracy. That said, the star rating system is more of an estimated representation of that data and does not influence your quote price for renters insurance." If that’s the case, then why show it to customers?

Though with less UX pizzazz, traditional carriers come up in a growing number of similar cases. Aerial imagery is increasingly being used to drop policyholders, often based on questionable data:

Rather than learning digital positioning tricks from fintechs and insurtechs, FSIs should continue to leverage their strengths in combining physical and digital assets. During a recent earnings call, Bank of America CEO Brian Moynihan addressed the surprise regarding the bank's ongoing significant investment in branches; out of the Q3 record net increase of 360,000 checking accounts, only about a third were opened digitally.

“And the truth of the matter is even though we're 54% sales across all the businesses in consumer all different types of products, a lot of the checking sales only digital are about in the 30s as opposed to the 50s, which means people still like to walk in a branch and start a relationship and that's why we're there.”

Similarly, JPMorgan Chase is refurbishing former First Republic branches to cater to asset holders with $750K or more, providing comfort and freebies. Jennifer Roberts, head of consumer banking, explained that with less than a 10% share of wallet, digital marketing alone doesn’t seem capable of moving the needle.

JPMorgan currently serves roughly 7 million such customers, but they keep less than 10% of their total deposits and assets with JPMorgan.

"We know we have a long way to go to become their primary financial partner," Roberts added, noting that "these branches are really meant to expose these customers to our breadth of services."

Of course, sticking with the basics might not solve the societal-level problems that many fiat and crypto-based fintechs promise to address, such as financial inclusion and the wealth gap. Kamala Harris probably understands this as well, so she is rightly thinking outside the box. Black men might finally capture the American dream, like White/Asian folk, with her proposal to empower them with a combination of crypto and weed ventures. Hopefully, this is not just a marketing gimmick.