When FSIs Launch Digital Products for Growth, It’s Execution Muscles That Matter Most, Not Innovation

Also in this issue: Crypto Use Cases Aren’t Meant to Be Overthought, They’re an Opportunity for FSIs to Adventure

When FSIs Launch Digital Products for Growth, It’s Execution Muscles That Matter Most, Not Innovation

Half a century ago, Vanguard pioneered index funds in the US, recognizing that the S&P 500 outperforms “smart money” over the long term. By offering low fees and broad access, Vanguard delivered returns that consistently beat active asset managers. The debate ended in 2017 when a hedge fund insider bet Warren Buffett he could pick the best funds to outperform the S&P 500 but lost.

Some S&P 500 index funds literally cost zero these days. Yet many consumers and businesses still prefer active management, often for reasons that are not entirely rational. From a rational perspective, each decade makes it harder for FSIs to find new business cases driven purely by innovation, as business, operating, and technology models become more effective. As a result, wealthtech startups have shown little digital innovation beyond minor UX improvements.

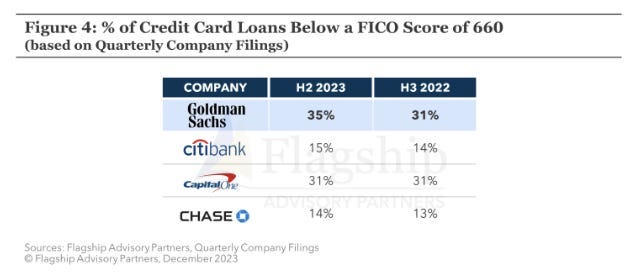

The credit card, which also took off in the 1970s, is another example. After five decades, breakthrough products are scarce. For still unclear reasons, Goldman decided to act as a disruptor and experience firsthand what it means to go all-in on a competitive financial market without a real edge. In what might be the amateur show of the century, Goldman entered a new customer segment with a new product and a new partner. To please Apple with their joint credit card, the bank agreed to a high approval rate, causing its share of below-prime consumers to surpass Capital One by 2023. Goldman suffered billions in losses and now struggles to unload its portfolio.

In the history of lopsided partnership economics, the only comparable case to the Goldman-Apple credit card is Wells Fargo’s partnership with Bilt. One would expect a major consumer bank familiar with credit cards to have done better. However, constrained by long-standing regulatory limits on growth, Wells Fargo aimed to make a big splash but seemingly lost its in-house expertise, signing a deal reportedly burning $10 million a month.

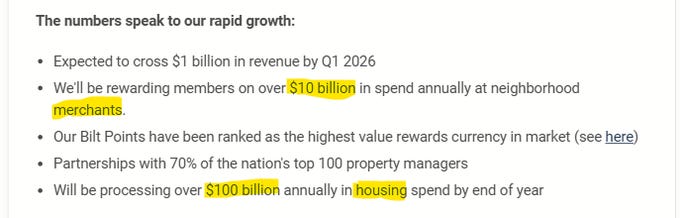

Our newsletter has been following Bilt since May 2024, sparked initially by a CNBC interview where Bilt’s CEO, Ankur Jain, and Chairman, Ken Chenault, struggled to provide clear answers during ten minutes of questions on unit economics. Calling Wells Fargo a sucker would indeed have been impolite. Since then, Bilt has grown into an even bigger story, with a valuation of over $10 billion, approaching $1 billion in revenue, $100 billion in annual housing spend, and $10 billion in other spend.

Rent spending is roughly ten times larger than merchant spending, with revolvers representing only a small portion, making Bilt's growth bad news for Wells Fargo. When the bank finally hired executives with Amex and Chase experience in charge of its credit card business, they attempted various strategies to increase revolvers, but none succeeded without changing the core value proposition. Bilt resisted, so the card will be discontinued, and the portfolio will be transitioned. Without a sucker, Bilt plans to launch alternative cards through Cardless, with fees ranging from no cost to $495 annually.

Not all financial and insurance markets have reached the efficiency of US consumer investments and credit cards. In consumer cross-border money transfers, Wise has become the clear global leader because large banks have mostly treated this product as a cash cow, neglecting digital growth and scalability. Oddly, HSBC recently tried to challenge Wise with its Zing venture, and the only good news is that it was shut down quickly.

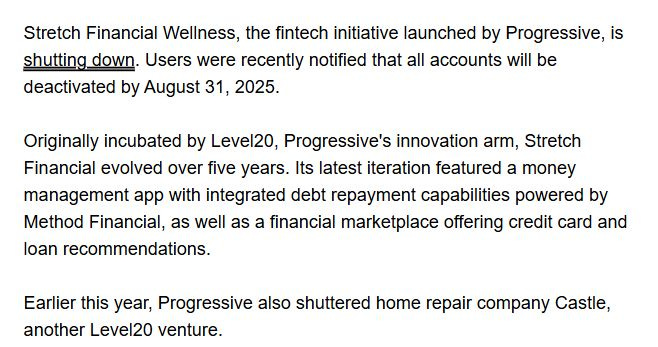

You might think Zing failed mainly because HSBC is not known for digital leadership. Fair enough. But what about Progressive Insurance, a global leader in digital consumer capabilities for over a quarter century? Its two attempts to launch startups through its incubators were also shut down. Like HSBC with Zing, Progressive made the cardinal mistake of launching those ventures under separate brands, which did not help.

If you find yourself like Goldman and Wells planning to launch a digital product with an incredible value proposition, the most likely reason is not innovation but ignorance. Financial and insurance markets have reached a high level of efficiency, so when a product seems too good to be true, it usually is. At this point, rapid growth through digital use cases is mostly possible by quickly ramping up operating muscles.

Crypto Use Cases Aren’t Meant to Be Overthought, They’re an Opportunity for FSIs to Adventure

Take a wild guess — out of all publicly known legitimate crypto stablecoin payment or transfer companies worldwide, how many have disclosed their core users, use cases, economics, and volume data? None. Even after achieving full AGI and uncovering the dark matter, humanity still won’t know the true volumes of legit crypto payments, much like the taboo around BNPL’s impact on indebted consumers. The incentives to keep this hidden are stronger than the Big Bang.

If your FSI is riding the crypto hype train to fool investors and candidates or monetize trading vices, go ahead. Your CEO just needs to master the buzzwords, such as “Once every bank and company issues its own stablecoin, room-temperature superconductors will trigger a singularity, and all payments will become universal, instant, free, and riskless.” To create real value in payments and transfers, ask your vendors and consultants to identify a company with transparent data. Don’t waste time waiting for their response either.

Beyond crypto players who are directly incentivized to obscure the actual state of payments and transfers adoption, there are more objective industry insiders, like Artemis, who genuinely want to uncover these details, but have not yet. Outside the crypto ecosystem, organizations like the Bank for International Settlements (BIS) have begun publishing research, though also without in-depth analyses of specific entities, volumes, or use cases.

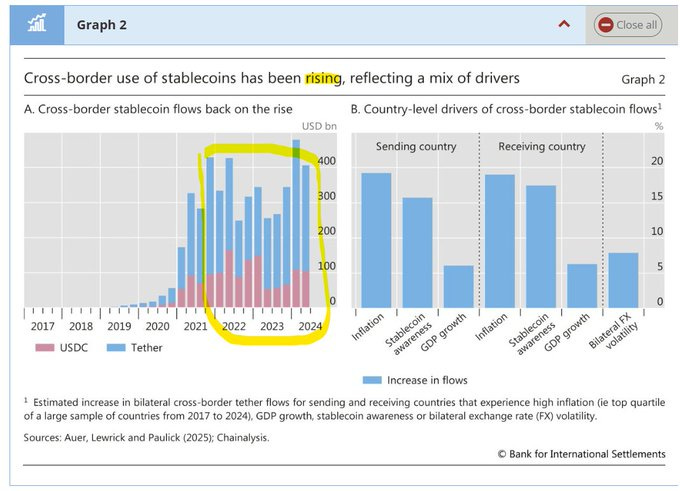

Without comprehensive global deep dives, no one truly knows the legitimate adoption levels across major stablecoin blockchains. This means any opinions on programmability trade-offs between public stablecoins and proprietary ones like E-CNY and JPM Coin remain speculative. In an ironic twist, BIS likely wanted to appear supportive of innovation, so it released a chart mentioning rising stablecoin volume that shows no growth since 2021.

This beyond-parody situation, where everyone talks about crypto and stablecoins eating into fiat payments and transfers without a single company disclosure, has two exceptions: the regulatory gray area and clear-cut violations. If your FSI or fintech is willing to pay and transfer money without full KYC, the market is already huge. Illegal migration, capital controls avoidance, money laundering, tax evasion, sanctions evasion, terrorism financing, and similar flows already depend on crypto and stablecoin rails for hundreds of billions in volume. Crypto absolutely cuts into fiat profits, much of it in areas where bankers once either enabled or ignored those activities.

Crypto proponents often highlight their unique value for underserved segments overlooked by traditional financial services. Consider elderly Americans, who tend to use digital financial services less frequently than younger generations. The main reason they haven’t transformed their financial lives is the supposedly outdated fiat system. Bitcoin-related use cases for this forgotten group have grown twentyfold in the last four years, but with one nuance.

Some traditional banks and fintechs are trying to avoid gray-area use cases by issuing stablecoins and leaving exchanges and intermediaries to handle what happens next. PayPal has taken this approach with mixed results. Nearly two years after launching PYUSD, it has attracted buyers for a fluctuating $0.8-1 billion market cap, adding about 0.1% to overall revenue, but with no growth. Now it plans to offer rewards to boost usage.

It’s not that PayPal knows less about payments and transfers than more successful crypto players like Coinbase, Tether, or Circle. It knows much more, and that’s the problem. PayPal’s mistake was trying to add value to already highly efficient fiat rails. Success in crypto comes from the opposite approach: profiting from gray-area or fringe use cases. This involves flooding the market with exaggerated claims and esoteric hype that stoke FOMO among restless younger males.

Of course, the most intriguing company in the crypto world is Tether. It’s by far the largest global issuer of stablecoins, frequently linked to enabling all kinds of adventurous use cases. Yet, surprisingly, Tether has faced no fines since 2021, sparking countless conspiracy theories. Will we ever see an article titled “How Tether Became Fine-Proof Since 2021”?

Even when some crypto players get fined, the amounts are usually much smaller than fiat fintechs face. Wise, one of the more by-the-book fintechs, recently faced a multi-state fishing expedition in the US, exposing theoretical gaps under subjective standards. With a US banking license worth far more than $4.2 million at stake, Wise paid the fine and moved on. Monzo was fined £21 million for failings in financial crime controls, but there was no indication that actual money laundering occurred.

When the UK regulator fined Coinbase’s UK arm for repeated control breaches, the fine was six times smaller than Monzo’s and similar to Wise’s, which had no proven exposure. If your FSI wants to launch new business models or growth use cases within digital transformation, try crypto for the most adventurous ones. Don’t overthink it, follow the vibes from crypto OGs, and enjoy the wild ride.