Why Digital Transformation in FSIs Isn't Keeping Pace with the Rise in Fraud

Also in this issue: What’s the Alternative to FSIs’ Customer 360 Programs That Fail to Deliver Value for LOBs?

Why Digital Transformation in FSIs Isn't Keeping Pace with the Rise in Fraud

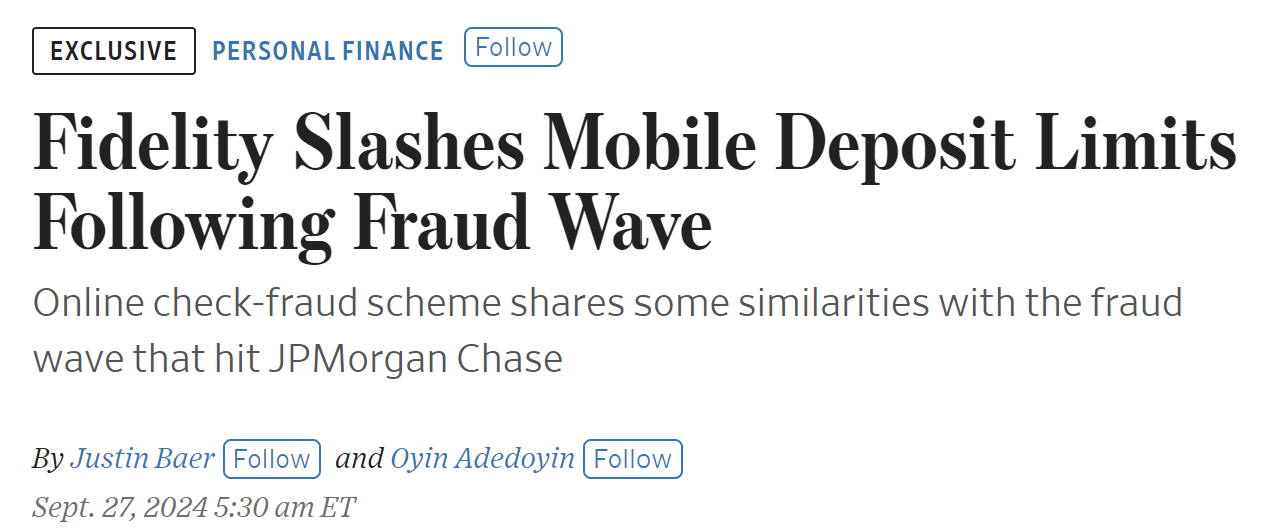

I recently started long-term advisory work with two top-10 US banks. After a week of trying to get access to their systems, with countless hours spent by all involved, we gave up, and both banks ended up sending me their laptops. Credit card usage is becoming more cumbersome due to multi-factor authentication, and cards are still getting declined when used in new locations. FSIs are also cutting deposit limits in response to a wave of fraud. What factors are contributing to increased friction in FSI engagement despite advances in digital transformation?

The threats aren't new. Both recent fraud waves at Chase and Fidelity involved centuries-old check-kiting schemes, with the only difference being that they were promoted via social media. Unscrupulous vendors have had access to FSIs for decades, and stealing credit card details for use overseas became popular last century as well.

One reason for the increased friction in combating fraud is the rapid expansion of products and services. Both FSIs and fintechs face pressure to constantly release new features, even at scale. While this approach makes sense for new product launches, most customers are already satisfied with existing ones. Consequently, many of these new features go unused, with fintechs seeing less than 5% customer penetration and traditional FSIs even lower at 1%. However, each new feature can introduce a fraud risk, stretching resources too thin to effectively address both internal and external threats.

Technology and data were meant to compensate for the lack of resources, which are often diverted to handle manual regulatory compliance. Forbes recently highlighted this common aspiration in an interview with Discover Financial Services' CIO, Jason Strle:

He points out that many financial institutions handle regulatory compliance through manual processes, employing thousands of people to ensure adherence to constantly evolving laws. At Discover, the focus is on using technology—specifically AI—to automate and streamline compliance. Strle envisions generative AI as a tool that can help financial firms parse unstructured data, such as complex legal texts, into actionable insights. “AI can help us differentiate ourselves by driving world-class compliance while moving quickly for customers,” he declared.

Unfortunately, as Revolut and others have discovered when regulators are the end-users, automated processes can raise suspicion. In contrast, an army of bodies and complex procedures often reassures regulators.

Another reason is the spread of bureaucracy within FSIs at the enterprise level. Those groups often adopt a one-size-fits-all mindset, rather than helping product lines address their specific challenges and allowing others to operate freely. This was recently illustrated in a Reuters report about Citi’s internal memo warning of fraud risks involving contractors:

"Citi has zero tolerance for fraudulent and unethical behavior from our employees, non-employees and suppliers," according to the internal Citi memo seen by Reuters.

“Citi is looking at heightening our controls on how we source work," to ensure suppliers match its needs and that they are paid appropriate rates for the hours they work, the memo showed.

The bank declined to comment, and the memo provided no specific details on why it was being sent.

As is typical with "zero tolerance" memos, an FSI enterprise-level executive—in this case, Scott Sigal, Citi's global head of procurement—implies widespread abuse without offering details on which group faces the most issues.

Ironically, the main reason FSIs continue to fall behind is their tolerance of fraudulent behavior. Unless an employee or customer commits fraud on a massive scale, they rarely face jail time. The spread of fraud is fueled by the media, which tends to focus on the victimhood of fraudsters, rather than addressing legal loopholes. These loopholes are exploited not only by crime syndicates or individuals but also by law firms. For example, Florida has become a haven for lawfare against home insurance companies. In 2022, the state had 15% of the nation's homeowner claims but 71% of lawsuits.

Instead of increasing engagement friction for all customers, employees, and partners, FSIs should implement harsher and more public punishments for fraudsters. While the overall volume of fraud in the industry may continue to rise, it will likely shift to FSIs that prefer issuing "zero tolerance" memos. The tougher FSIs could even benefit from fraudsters' legitimate business—similar to street gangs that operate in New York but spend their money in Florida.

What’s the Alternative to FSIs’ Customer 360 Programs That Fail to Deliver Value for LOBs?

Digital transformation aims to accelerate business value capture, ideally through faster top-line growth, but at the very least through increased scalability of cost centers. The key to unlocking this additional value often lies in better data, hence the popular slogan "data is the new oil." This data can be leveraged to uncover new revenue streams or reduce costs, but the ultimate win is accumulating enough data to achieve virtually unlimited pricing power.

There is nothing new about leveraging data for competitive advantage. For decades, leading FSIs like Progressive Insurance and Capital One have used data to direct undesirable customers to competitors or underwrite riskier segments. Leading fintechs have further pushed the envelope, extracting value from data to create unprecedented business models. Nubank is renowned for its low cost of acquisition, while Wise is known for its low cost per transaction, thanks to their ability to identify minuscule data points and monetize them for competitive advantage.

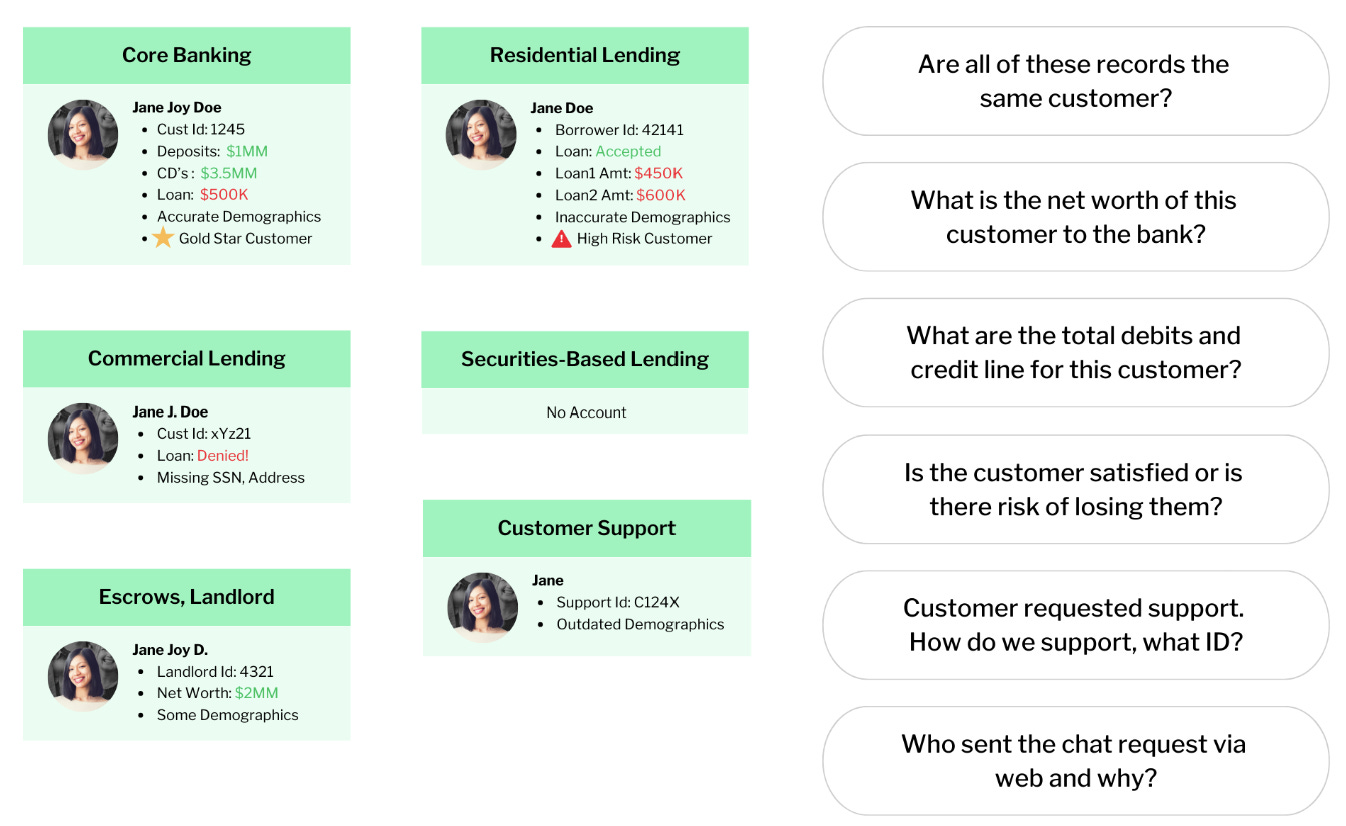

One of the most intriguing uses of data over the last decade has been the concept of Customer 360 (C360). In an FSI with multiple product lines, it seems commonsensical to identify customers who are undersold and then target the right person with the appropriate cross-sell offer through the right channel. Furthermore, this same process has been successfully implemented manually by many FSIs for decades, targeting affluent customers through relationship managers covering all products.

Even small FSIs are now implementing C360 platforms, while larger institutions have prioritized them for a decade. Yet, despite spending hundreds of millions and employing over 100 staff across tech, data, and portfolio domains, no FSI appears to present any ROI successes. I met with the head of IT and Data for a C360 program at a top-10 bank that has 50 employees in that group alone. When asked how much money this effort has generated or is expected to generate next year, the response was around, “Once we build it, business heads will have to figure it out.”

Instead of focusing on revenue and profit metrics, FSIs typically measure C360's success in more esoteric terms, such as data quality, customer insights, or streamlined processes. The primary reason for the lack of financial gains is an ineffective operating model. Typically led by enterprise Data or Digital Heads, the C360 groups are not held accountable for demonstrating scalability in terms of generated incremental revenue. Often, they don’t even see themselves as serving P&L leaders across product lines.

This often results in massive solution-oriented programs involving numerous dedicated Product, Portfolio, Data, and Technology teams. These teams are moving hundreds of applications, designing processes, and deploying new technology stacks, then approaching business lines to seek engagement. Generative AI has further complicated this effort, offering the long-term promise of unique insights while incurring steep short-term costs.

Not surprisingly, a common piece of feedback I hear from P&L owners is that after years of enterprise-wide efforts, they are not receiving the most pertinent information. On a basic level, each P&L owner wants to know which customers within their internal peers should be targeted and what insights from those groups could assist with sales. Instead, they are provided access to vast data repositories and must figure out how to extract the relevant insights on their own.

Julia Bardmesser, former Head of Data at Voya Financial, recently offered a practical alternative: Product360 (P360). The key reason P360 is much more likely to generate significant profit than C360 is that, in a typical FSI, P&L is assigned to products, not customer segments. Instead of abstract enterprise-level ownership, product heads are more likely to value data that can help grow their product's top line.

Much simpler than C360, P360 could mine the critical product-level data that a typical FSI still lacks. Imagine if your FSI could assign the real costs of all enterprise groups to each business product on a regional level, similar to how Wise has operated for years as a global leader in cross-border money transfers. The CEO and CFO would finally understand where enterprise-wide costs are making certain products unprofitable, enabling them to decide where to cut efforts or increase prices. Business heads would also be more likely to push back on enterprise-wide initiatives that do not yield short-term ROI.

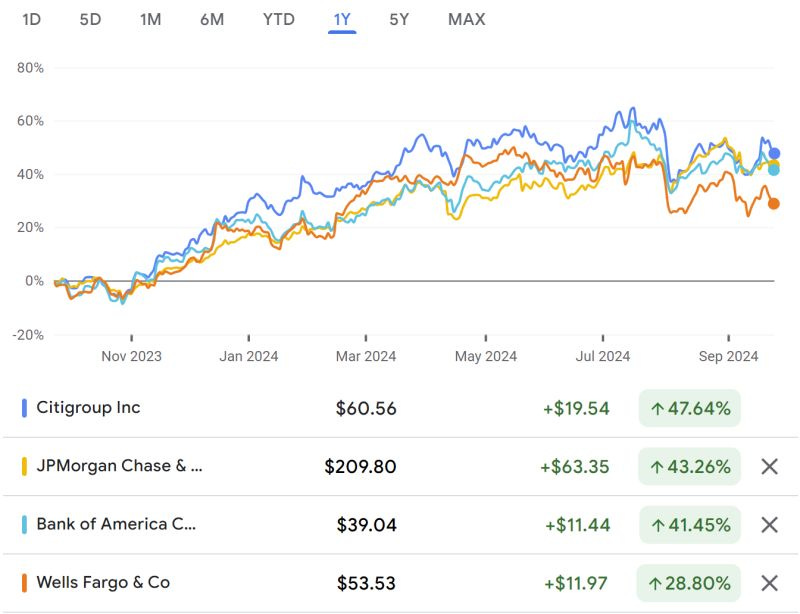

In the current environment, the removal of complexities created by C360 programs would be especially welcomed by the stock market, as illustrated by Citi. When Jane Fraser took over as CEO in early 2021, she declared a new strategy to create a competitive edge: "Leading with empathy." This approach led to increased operating opaqueness, organizational silos, and numerous enterprise-wide programs. By September 2023, Citi's stock had plummeted by half, significantly lagging behind its peers, including Wells Fargo. The strategy then shifted to simplification with a new slogan: “Get off the train.” Coincidentally, Citi has since outperformed its peers.