TD Bank Announces Real Agile, But Would Its Executives Do Hard Things?

Also in this newsletter: Cutting Enterprise Bloat is Essential for Digital Transformation in FSIs

TD Bank Announces Real Agile, But Would Its Executives Do Hard Things?

As discussed in another newsletter, there is no longer a debate among the most effective FSIs on the target state operating model. Regardless of the product line or country of operations, FSIs are moving toward a singular state, with the only unknown being whether it would take years or decades.

Hence, it is not surprising that we are going to see more announcements like the one by TD Personal Bank: TD introduces its Next Evolution of Work. TD’s vision for the target operating model is a synthesis of global best practices. Here is how the Head of TD Canada’s Personal Banking, Michael Rhodes, described their inception process:

“So, we looked to those organizations from Asia, Europe and Silicon Valley who have truly embraced innovation and elements of Agile project management, to see what made them successful. Our goal was to bring those best practices to TD and marry them with our relentless focus on the customer, to build a different kind of bank. And that's exactly what we're doing.”

While there are multiple naming conventions for the Agile-related organizational design components, TD's version makes the target state clear: an autonomous cross-functional team structure that requires back-office groups to enable business lines rather than pursue function-centric initiatives.

Michael is also correct about the mindset required for digital transformation – it's a fit-for-purpose construct meant for solving more advanced use cases, not for fixing what is already working well for simpler ones.

"We're not doing this to fix something that's broken; we're implementing NEW because the world around us is changing, and we believe that change provides opportunities for growth. When we ran just a few large projects, we supported strong delivery through an explicit operating model – one that involved specific organization structures, processes, and routines.

"Now that the pace of change has increased, we need a new way. That's what NEW is all about – we believe the speed of execution and the quality of our output depends on our working methods – hence the name of our program is the Next Evolution of Work."

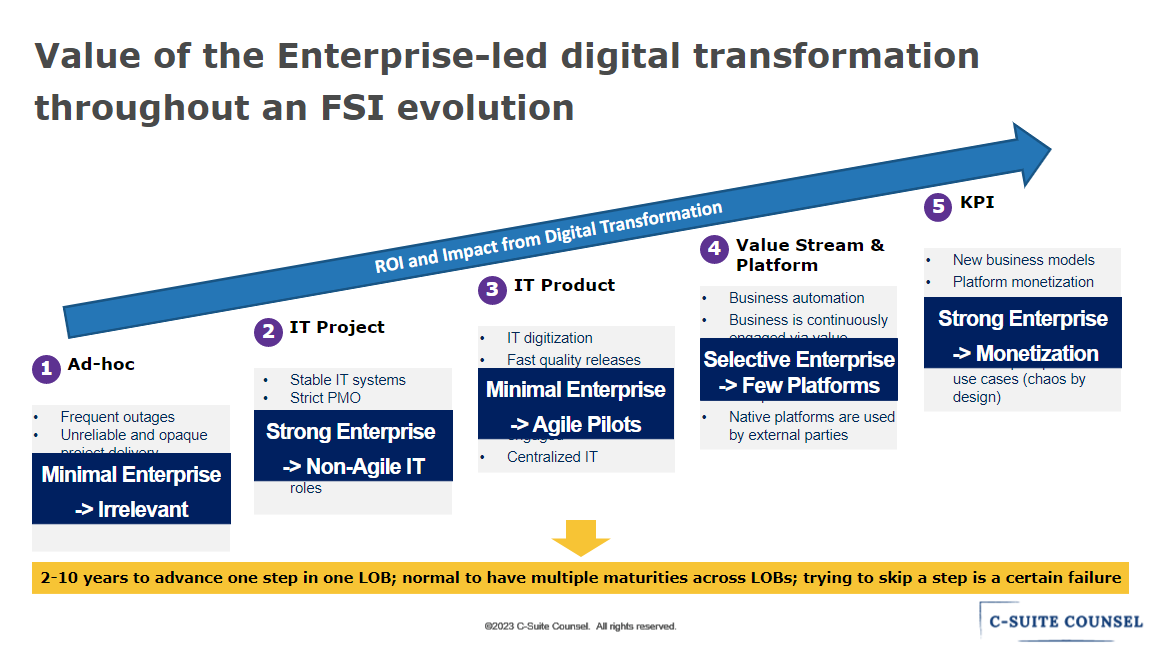

To illustrate Michael’s point, try guessing where TD Canada’s Personal Banking is today in its digital transformation journey:

The correct answer is between Level 2 and Level 3, and TD Canada's Personal Banking is now trying to get to Level 4. Only a few FSI divisions currently operate at this level, so TD is not far behind other institutions in North America. In the US, the shortlist includes Capital One's Credit Card division, USAA's Banking, and a few more. In Canada, some large FSIs have pilots on Level 4, but none have scaled to this level, despite what they may say in press releases.

Notice that TD's announcement only covers their Personal Banking group. It is typical for FSI's consumer division to be farther ahead in digital transformation since their users tend to be more demanding of digital features. Similarly to other large FSIs, TD's Commercial division is probably 5-10 years behind Personal Banking in its digital maturity.

What is unique about Michael's open sharing of his vision is the acknowledgment of TD's cultural constraints that he is trying to overcome with this new operating model. These cultural norms are fortified by many of his reports and peers who believe in the value of non-agile processes.

Meetings about meetings, endless review processes, months to reach even basic budgetary decisions, perfunctory employee development and training programs, siloed business units and a lack of empowered decision-makers with clear accountability – … the millstones tied around the necks… - … Banks like TD have not been immune. This slower, often inefficient approach to getting work done is known in some circles as “bank speed.”

There is also a hidden impediment to TD Personal Banking's success that is often shared as a positive enabler: leveraging enterprise-wide platforms. The allure of “efficiencies” and delegating complicated technology capabilities to the Enterprise groups entices not just consultants and vendors but many FSI executives. Unfortunately, such an approach only works if the enterprise platform teams both know what good looks like and are eager to lean in vis-a-vis LOBs, which is usually not the case. This has led the most effective FSIs in the US to let LOBs develop their own platforms, and Michael is likely to change his posture in the years ahead.

As part of the NEW transition, TD is doubling down on efforts to create enterprise-wide platforms to use the scale of the Bank to improve efficiency, move away from building one-off solutions towards a model where something is built once, used frequently across TD and evolved and improved on an ongoing basis.

Aside from technology support, will TD Personal Banking's digital transformation be successful? As discussed in the previous newsletter, the most important question is what role Michael would play personally. Having been with TD for twelve years, it is safe to assume Michael has a good understanding of the internal processes. The flip side of having a long in-house tenure is that Michael hasn't been part of more advanced organizations and, hence, cannot know what good looks like. Moreover, many of his reports and peers who are situated in roles critical to digital transformation might turn out to be lacking both the theoretical appreciation and eagerness to go through this. Would Michael act as a typical LOB head who presents at conferences while delegating (aka, inspiring) others to transform? TD already has teams of people specifically responsible for “driving” change, led by Christine Morris - it would be easy to let them own the transformation while providing a hands-off oversight.

Or would Michael consider this as a personal challenge to transform his own routines, then level up his reports, and then finally his peers?

Here are some other hard questions that Michael would need to address if he wants to achieve the target state in the next few years as opposed to a decade or longer:

would he require his direct reports to initially lead the journeys to gain momentum and learning?

would he push the middle managers in his group to become individual contributors on the journeys teams or move to slower-paced groups?

would he sequence teams into the new operating model by only including self-selection among top performers?

would he enforce for all participants to spend 2-3 days per week working in the office in a team setting?

Answers to the above questions in the next 3 months would make the long-term outcomes rather predictable. The easy steps like pilots and strategy are no more, the hard work starts now.

Cutting Enterprise Bloat is Essential for Digital Transformation in FSIs

“Our global leadership did not have the courage to lay off unnecessary or low-productivity staff. Instead, they opted to relocate the IT and Data groups to a different state with a completely different organizational design that didn't include those positions,” an FSI executive was explaining to me. I was brought in to establish a cross-functional agile pilot, but I noticed that the business and IT/Data groups operate from different locations and don’t have face-to-face interactions. Despite being huge in size and growing, those groups were getting negative feedback from the Business. This setup could have been acceptable for a low-maturity FSI, but it was bewildering for a company investing $2B annually in digital transformation.

As discussed in the first part of this newsletter regarding TD Personal Banking, enterprise-wide digital transformation efforts continue to be prevalent across FSIs. It is important to clarify that Enterprise groups do play a critical role in advancing through the initial phases of digital transformation. Without leadership from the Enterprise CIO, CDO, or CTO, it is highly unlikely that a low-maturity LOB would be able to transform on its own. However, there comes a point in the digital evolution where comprehensive Enterprise-level involvement becomes counterproductive.

The shift in mindset from Level 2 to Level 3 to Level 4 is challenging for everyone in an FSI, but it's particularly counterintuitive for Enterprise leaders. They have invested in cost-efficient shared services (partly by mandating LOBs to use them), and now they need to empower LOBs to develop their own solutions. As discussed previously, the good news is that only some LOB heads would desire this autonomy. However, it doesn't mean that the Enterprise groups should proceed on their own (also known as 'build-and-they-will-come').

To further complicate a more effective path, during the good times of the last decade, many FSIs allowed a sprawl of enterprise bloat across technology, security, and data domains. The leaders of those enterprise groups are usually eager to engage with shiny new tools but often struggle with identifying a similarly eager LOB sponsor, which leads them to self-propagate more services based on non-specific esoteric rationale (compliance, security, DEI, etc.):

For example, UBS Banking Group’s efforts on data protection were kickstarted by GDPR compliance but have since evolved to focus more broadly on data-management practices, AI ethics, and climate-related financial disclosures. “It’s like puzzle blocks. We started with GDPR and then you just start building upon these blocks and the level moves up constantly,” said Christophe Tummers, head of service line data at the bank.

And why shouldn’t Enterprise groups self-propagate? While many FSIs talk about a culture of ownership, in reality almost no FSI executives treat company funds as if there were their own. Being lean would also contradict the proclamation of CEOs to be “all-in” on digital. JP Morgan boasts of investing $12 billion in disruptive technology annually. HSBC is spending $6 billion on new technology. A simplified benchmark for technology investment across FSIs is 10% of revenue, so with about a $10 trillion global revenue by FSIs, about $1 trillion is invested annually in technology. Who could resist such money rain amplified by the perfected sales techniques of vendors and consultants?

Here is how Santander’s CEO described the company’s massive enterprise-wide transformation across multiple countries during a recent earnings call with investors:

“We are leveraging our global technology capabilities to accelerate digital transformation in Europe to make our processes fully digital end-to-end… we are migrating our core banking system to the cloud, a project, which we call Gravity, making it more efficient, modern and scalable… [Together with non-technology transformation initiatives] this should result in the annual efficiencies of around €150 million up on full implementation with a 67% return on investment and a payback of three years.”

After losing 80% of its value in the last 15 years, Santander needs a turnaround, and digital transformation is obviously the right vehicle, but a top-down multi-country approach is destined to be a failure for a typical Western FSI with low maturity, opaque governance, and hands-off executives.

Instead, after fixing the foundational IT gaps, a more effective approach pursued by the most advanced FSIs is to gradually shift ownership from Enterprise groups to LOBs while continuously trimming Enterprise-level capacity. After years of making significant investments at the Enterprise level, these FSIs realized that forcing digital transformation for many of their processes creates negative value. The traditional way of doing things is not inherently negative. It preserves decades of fit-for-purpose development that may still be sufficient for another decade or two. By keeping the Enterprise groups constrained in a traditional operating model for those areas, they can focus on learning how to gradually trim their capacity where digital transformation is necessary.