The Most Perplexing Waste in the Digital Transformation of FSIs

Also in this issue: Two End-States for Fintechs: Becoming Part of Traditional FSIs or Legacy Vendors, FSIs Should Forget About AGI and Treat Generative AI as Enhanced Machine Learning

The Most Perplexing Waste in the Digital Transformation of FSIs

For the last decade, many large FSIs have spent hundreds of millions, sometimes billions, creating their digital subsidiaries under different names. The hope was that a new brand would profitably attract younger customers who wouldn’t consider a traditional FSI otherwise. Why would the executives think that a decade ago? Because the media kept telling them how millennials were unique in their dislike for traditional finance and the use of legacy financial services and insurance products:

Moreover, setting up or buying a fintech subsidiary is more enjoyable than digitally transforming core operations. In a way, FSI executives were outsourcing the hard work of leveling up organizational muscles to a separate entity, effectively buying time to observe the outcomes from a distance.

And it worked from a political perspective. The executives got to engage in something cool and rarely faced any consequences for the failure of those initiatives. If you examine the graveyard of such attempts, how many of the mothership executives lost their jobs for deciding on those initiatives and burning millions and sometimes billions of company funds as a result?

BBVA stands as the most perplexing example of waste, repeatedly buying and setting up fintech and insurtech subsidiaries under different brands, only to shut them down. However, those executives might not have known better a decade ago and simply followed the hype. Learning from these disasters, FSIs like Chase began leveraging their brand the next time they wanted to expand into a new product in 2019 (JPM Coin) or a new country in 2021 (Chase UK).

Chase UK is still expected to incur losses exceeding $1 billion until eventually breaking even after 2025. Even if it reaches that point, the digital-only subsidiary would still face challenges in making a significant impact on Chase's $23 billion annual net income in the US. Nevertheless, it is contributing to building awareness for the core brand among consumers.

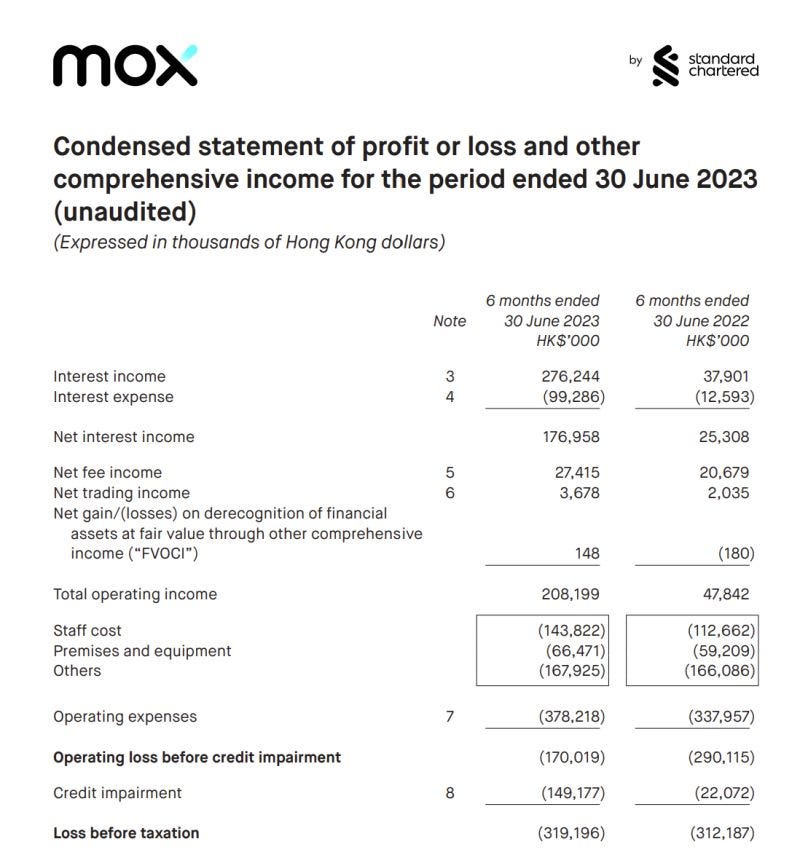

However, not everyone seems to have learned the lesson yet. Standard Chartered, a $16 billion revenue global FSI, first launched a digital-only subsidiary, Mox, in Hong Kong in 2019, which has been losing around $80 million annually (as converted from Hong Kong dollars to USD):

Instead of observing whether this experiment reaches break-even and could generate a significant P&L impact on the core business, Standard Chartered inexplicably launched a similar subsidiary in Singapore in 2020, oddly naming it "Trust Bank." By 2022, the entity was still in the early stages of ramp-up, but it was already incurring losses close to $100 million annually (as converted from Singapore dollars to USD):

Here is how the bank's CIO, Rajay Rai, recently described their differentiation as a cloud-native banking platform:

This is a common fallacy with such digital subsidiary attempts. The ability to deploy features quickly at a low cost has not been a differentiation for a long time. Without significant pain points in a developed market like Hong Kong or Singapore, launching more customer updates might be cheap but doesn't create enough impact to win profitable customers away from larger competitors.

Hilariously, Trust Bank claims a 12% market share after a year, despite tiny revenue because it measures by the number of customer sign-ups, akin to how startups in the late '90s were measuring their success based on pageviews. If Trust Bank was meant as a cheaper alternative to acquire customers for the main company, losing $100 million annually in a country with 5 million adults demonstrates how unlikely it is to happen.

If your FSI must proceed with digital transformation and can afford millions or even billions of dollars of investment, the better way is to prioritize the improvement of internal capabilities until achieving fintech-grade maturity. Then, maybe you will be in a position to pilot a digital-only subsidiary to tackle a new product, customer segment, or region. And do that by expanding your well-known FSI brand, not starting a new one.

Two End-States for Fintechs: Becoming Part of Traditional FSIs or Legacy Vendors

With 2023 putting the myth of disruption firmly to bed, the natural question is what happens to thousands of well-funded fintechs. The most likely answer is that they will become boring companies, indistinguishable from traditional financial services and insurance firms. That, of course, is far away from the startups' aspirations. Many of them were founded to disrupt FSIs and become towering incumbents, or maybe even become a platform to be used by traditional FSIs (a-la Blackrock’s Aladdin) instead of their legacy vendors.

But that is not what we see playing out. Fintechs are hitting the wall when they try to grow both fast and profitably at scale while leading FSIs and legacy vendors are becoming increasingly capable of building their own solutions. Because the types of people running startups usually give up on a stagnating company, most fintechs will end up in one of two states: 1) mid-size firms indistinguishable from the digital arms of traditional peers, acquired by large FSIs, 2) a niche vendor to traditional FSIs, acquired by large vendors.

For the second path, in a recent interview, Dr. Joseph George, Group Chief Digital and Information Officer at Doha Bank, illustrated that hesitation with fintechs: some of them are great, but because they get funding from VCs, they intend to drive valuation and then sell the company (starting at 8:15).

When your FSI engages with a fintech, consider them from a decade-long perspective. Which of these two paths are they more likely to follow:

Disruptor -> Growing Competitor -> Stagnating Competitor -> Acquired by a Traditional FSI

Disruptor -> Competitor -> Partner -> Unreliable Vendor -> Acquired by an Incumbent Vendor?

Set up parameters for your engagement with that long-term thinking in mind. Would it be someone your FSI might acquire eventually or one of your legacy vendors would buy? If neither of those options seems likely, your FSI is probably going to unwind that engagement a few years later.

FSIs Should Forget About AGI and Treat Generative AI as Enhanced Machine Learning

The easiest way to tell if a new technology is overhyped is by the lack of quantitative details behind the use cases. At best, you would find a high-level description with some suspiciously high improvement percentages, with no supporting evidence. Mobile-first, Cloud-first, Blockchain-based, and Codeless have gone through such a stage where the audience's perception shifted from curiosity to annoyance to ridicule.

By now, you could easily guess that any story exalting the financial impact of those technologies would lack any evidence behind such claims:

In 2024, Generative AI will join the list of technologies that are increasingly ridiculed for being overhyped. FSI executives will see fewer articles that describe this technology in catastrophic or game-changing terms, as was the case in 2023:

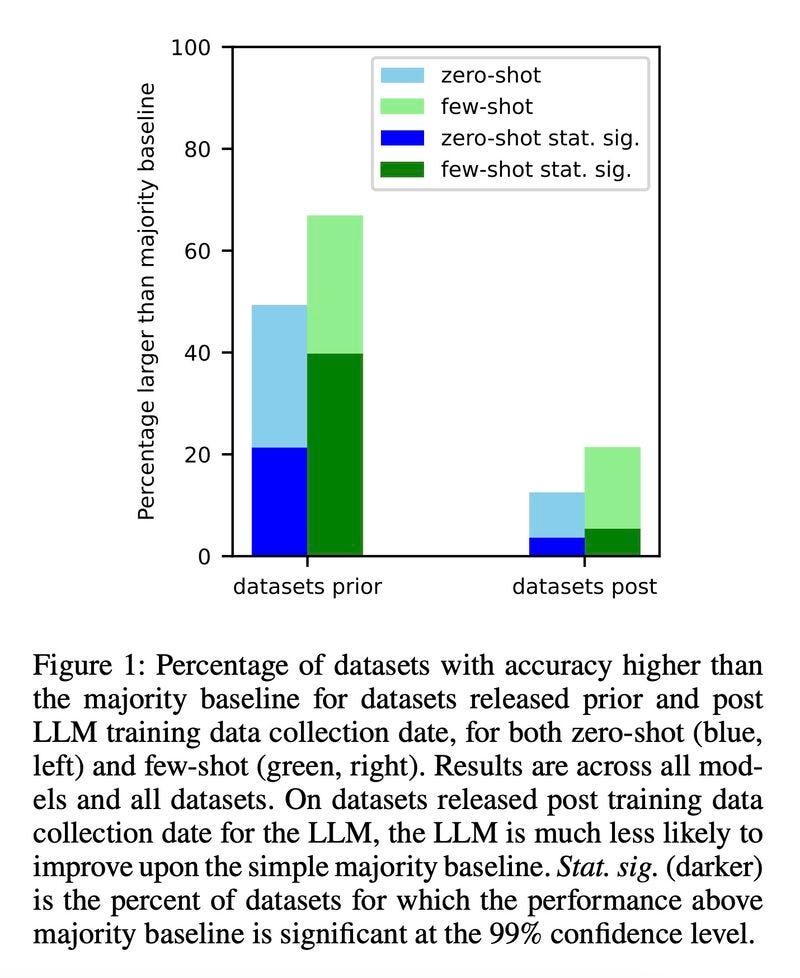

AI Skynet is not taking over homo sapiens, neither in 2024 nor in the foreseeable future. Recall that just a year ago many experts believed we could be on the verge of achieving Artificial General Intelligence (AGI) by now. However, another study explains why GenAI deteriorates over time: it functions like machine learning without the ability to learn on its own, and there has been no progress on that critical dimension. Therefore, adding more data without supervision will continue to worsen the output:

That is the reason why being AI-native fintech or insurtech has no differentiation compared to traditional FSIs, and why those stocks are down 90% from their highs:

Of course, there will be more attempts to get PR mileage from AI capabilities. The latest example comes from bunq, a European neobank that already made people smile having recently announced plans to enter the US market. Apparently, bunq just made a "giant leap forward" with its GenAI platform, called Finn:

What is the bigger caricature of GenAI hype - claiming it could automate 90% of the operations of a fintech in 2024 or that it could surprise customers by placing their favorite restaurant? The former is nonsensical, and the latter is superfluous, but coaching those activities under the banner of helping humanity is a real kicker.

For traditional financial services and insurance firms, a sensible approach to GenAI in 2024 is figuring out how to enhance machine learning capabilities that have been deployed over the last decade. If your vendor or consultant touting GenAI cannot explain it, tell them to come back after AGI is achieved.