Easily Measuring Digital Transformation Progress in FSIs

Also in this issue: Modernizing Technology: Adoption, Expense Reduction, or Increased Scalability?

Easily Measuring Digital Transformation Progress in FSIs

Many executives struggle to accurately measure the progress of digital transformation within their financial services or insurance companies. Often, they focus on the "digital" aspect because it's easier to define and more appealing to publicize, such as the percentage of digital transactions or the adoption of cloud-based applications. However, "digital" is just an adjective describing the main operative word, "transformation." How can they measure whether the transformation is progressing effectively?

A recent survey by Cornerstone Advisors of banking and credit union executives has highlighted this widespread confusion. Most executives believe they are moving towards a final goalpost, and some think that this might be a never-ending journey, consequently not bothering to measure it:

The correct approach lies in the middle and is much easier than FSI executives imagine. First and foremost, the ultimate measure of digital transformation outcomes (not the process) is the ROI of digital initiatives and their impact on the baseline P&L. As an FSI becomes more digitally mature, those metrics would significantly improve at each step of the transformation:

The key point to remember is that effectiveness in a particular area does not always require maximum leverage and further evolution. Even the most advanced FSIs and fintechs sometimes implement initiatives that fail to achieve significant digital impact. They do so because they can, hoping for the best outcome, only to discover that many product features remain unused by end customers.

With that end outcome in mind, once a year, the FSI C-Suite determines whether and where it should continue pursuing digital transformation and allows the rest of the organization to make only marginal operating improvements. With this operational model, digital transformation is evaluated through annual snapshots of how its business lines and functions are progressing toward greater digital maturity and at what rate:

Using the above picture, an FSI's response to the question, "How far along in your digital transformation strategy is your institution?" would be that it's about halfway through a multi-decade journey. The success of digital transformation lies not in rushing to the destination at all costs, but in effectively leveraging favorable conditions to reach it. When a particular organizational unit is ready to transform, measuring its progression through digital maturity stages is easy.

Modernizing Technology: Adoption, Expense Reduction, or Increased Scalability?

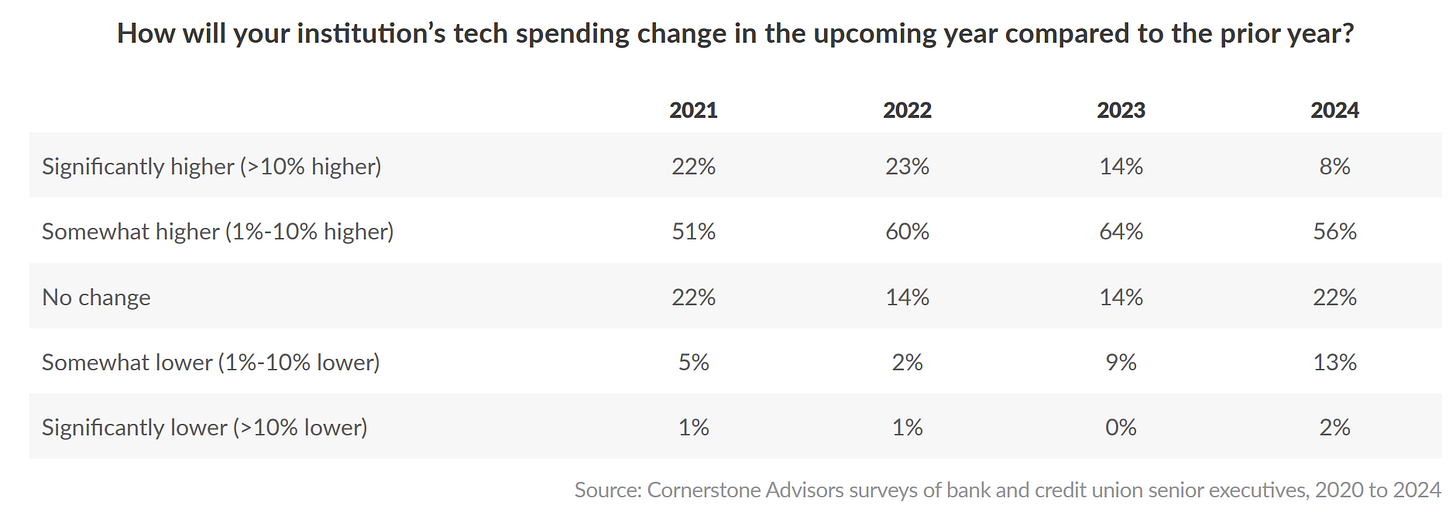

Over the last two decades, the perception of technology within FSIs has shifted from being viewed as a cost center to a business enabler. This shift has led to a significant increase in technology spending, reaching unprecedented levels. Leading FSIs now consider it beneficial for technology spending to comprise 10-20% of revenues. This trend shows no signs of changing anytime soon, as the majority of banks and credit unions are planning to further increase their technology spending this year:

Yet, surprisingly, when it comes to explaining the benefits of technology investments, even the most forward-thinking FSIs tend to focus on 20th-century metrics, such as expense reduction. Fifth Third CEO Tim Spence illustrated this prevalent thinking on a recent call with analysts:

“Expense discipline, strong returns and positive operating leverage remain core areas of focus for Fifth Third. Supported by our technology modernization investments and a focus on leaning out key value streams and reduced full time equivalent employee headcount by 4% from our peak in 2023 to the end of the year without the need for a company-wide expense program.”

In a recent interview, JP Morgan’s Technology COO, Arvind Joshi, offered a similar explanation in the context of cloud spending:

“We track KPIs on execution (on-time delivery, cycle time for adoption), risks, outcomes for benefits (time to market, change failures, major incidents), and costs (TCO before and after adoption). This approach to cloud metrics… influences the mindset and behaviors of our application teams to balance speed, cost, and stability.”

Notice what is missing in both cases: whether the reduction in employee headcount or cloud costs is making those FSIs overall more scalable. In other words, are those FSIs growing revenues more effectively, or are they at least cutting overall costs with stable revenues:

Option 1: Revenue-Centric Scalability = Revenues Increase Faster than Costs

Option 2: Cost-Centric Scalability = Costs Decrease with Stable Revenues?

It’s much harder to justify digital transformation in the second case; the effort is too expensive and risky to make a high ROI likely if it is only done to reduce costs. 20th-century techniques of cutting costs by simplifying processes, cutting new initiatives, vendor renegotiations, etc., still work just fine for that. However, such cost-centric scalability improvement is still better than cutting expenses in some narrow areas and not knowing whether it resulted in costs growing somewhere else.

Of course, the worst approach is when an FSI doesn’t try to quantify the P&L impact of digital initiatives at all. It is understandably exciting to see the adoption of all kinds of advanced technologies, but scaling AI often does not translate into scaling the company.

Even more narrowly, scaling chatbots does not equate to scaling FSI. You could easily confirm this by measuring whether the rollout of chatbots in the last few years has resulted in a significant reduction in the percentage of your customers reaching out for support. You would likely discover that these days, customers tend to need support with relatively complex questions that chatbots are not yet capable of addressing, even in leading fintech companies such as Wise:

In the extreme case, chasing technology modernization could become a risky goal in itself, as demonstrated by Capital One and DBS's experiences. More recently, Valley Bank COO Russ Barrett shared that 75%-80% of its operations are already on the cloud, and the nirvana is only a couple of years away:

Except for a few leading FSIs, such a pace of cloud adoption makes Valley Bank one of the global frontrunners for winning the Cloud Olympics. Could you imagine what advantages this move must have been creating for them?!

It is hard to say, to put it mildly. In the most recent quarter, Valley Bank's revenue was down 13% year over year, profit down 50%, and efficiency ratio worsened by 23% (from 49% to 61%). Additionally, its stock price is at the same level as three decades ago:

Scaling Cloud ≠ Scaling FSI, and, counterintuitively, it might be making your company less scalable in financial terms, and those terms are the only ones that matter.