Can Employee Training Help Accelerate Digital Transformation in FSIs?

Also in this issue: 250 Million Reasons Why Bank of America is Not a Technology Company.

Can Employee Training Help Accelerate Digital Transformation in FSIs?

“Let’s wait with a pilot till our employees complete the Agile training," suggested to me a Head of PMO of a $15 billion revenue FSI. "What type of training is it?" I asked. "It will be a company-wide 3-day event for 12,000 employees with a large training firm." As part of the digital transformation evolution, FSIs have been relying on training in Agile, Data, and Technology topics. Yet, when spending time with the best product teams in FSIs, there are often critical elements missing in their Agile routines and in how they leverage data and technology capabilities. These are gaps on the foundational level, forget the fintechs.

My obvious question to those teams is how they learned their routines. A typical answer falls into one of three categories:

by themselves through taking online courses and speaking with peers;

from an internal training group that has digital certification; or

from a company-wide employee training with a 3rd party.

We already discussed the challenge of self-learning and internal trainers in another newsletter - digital transformation is counterintuitive for many FSI employees, and the transformation of personal operating muscles requires external coaching and pressure from a line manager or someone who successfully scaled (not built) digital products.

That is a high bar, but the difference between qualification and expertise is critical. I regularly interact with executives who spent years in digital transformation without creating a significant P&L impact. They usually have lots of insights to share, but they can't really know what works since they never got there themselves. Their experience makes them 'qualified' to discuss digital transformation, but they lack proven expertise to coach their teams without joining them in the trenches. That is why our newsletter interviews are only with FSI executives who achieved a conclusive P&L impact (examples here for Retail Banking and Life Insurance).

1. Why FSI executives love digital transformation training for their employees

With digital transformation at its peak hype in FSIs, technology spending keeps rapidly growing, reaching 10% for the largest players. In the most recent quarter, Citi grew its tech spend by 12%, while Wells Fargo - by 19%. As FSIs spend close to a trillion dollars on technology worldwide, investing in employee training seems like a no-brainer. Compared to the employee and technology cost, training doesn’t cost much, usually less than 1% of the total IT budget. The idea is simple, 'Investing a little extra in training can ensure that 99+% of your digital transformation spend is used most effectively by employees.'

Plus, employees tend to like training on topics related to digital transformation. It makes them feel like they are future-proofing their careers and gives them hope for a more effective work environment. Training is also fun and easy, much easier than the actual work, especially if the work involves painful learning of new skills with real-life deadlines - training’s motto is 'no pain, just gain.' Finally, true to the stereotype of “the trophy generation”, many employees like showcasing various digital training certificates on their CVs and LinkedIn profiles.

More importantly from the FSI executives’ perspective, training is meant to create leverage. Many FSI executives love employee training for the same reason they like buying new technology and hiring more expensive staff. They hope that digital transformation could transpire without transforming their own operating muscles, aka, leveling up.

2. The unique challenge of training employees on digital transformation

As we often discuss, any enterprise-wide attempts to accelerate digital transformation in LOBs/functions are excruciatingly challenging due to a conflict between:

Enterprise-wide vision: efficiency and standardization; and

The reality of LOBs/functions: a significant variability in the baseline digital maturity and required pace of change.

Therefore, any enterprise-wide effort, including employee training on digital transformation, would be relevant only for a subset of employees. Imagine the best-case scenario that a company conducting digital transformation training is the world’s leading coaching expert on how to develop IT Product-level operating muscles, Level 3 of digital maturity. In a typical FSI today, 10-30% of employees actually need to transform to that level from the IT Project operating model. Most of those employees are in IT, software engineers, and project management types, but some are in Business in the areas which are moving closer to integrating with IT. A successful training initiative would have to include such nuanced assessment which is rarely the case.

3. Is training for digital transformation simply ineffective or is it harmful?

Fine, you might say, but what is the big deal either way? Management and employees like training, maybe even for superficial reasons, and it doesn’t cost much. Could we just view training as something akin to a mini-conference, or to a sponsored part-time education? Less of a digital transformation accelerator and more like an employee perk that eases candidate recruiting and improves employee retention? No harm done after all, right?

Unfortunately, ineffective training that is meant to establish new behavior could be harmful. For example, the diversity, equity, and inclusion (D.E.I.) training is also popular among FSIs with a well-meaning objective to make employees more open-minded when it comes to recruiting and engaging underrepresented demographics. Counterintuitively, those trainings create the opposite effect. By zeroing in on people’s skin color, ethnicity, and gender, DEI training makes up differences among those groups where none exist or are not relevant for achieving FSI goals. As a result, previously color-gender-blind employees become more biased after such training.

The unfortunate outcome comes down to how difficult it is to create a change in a person’s behavior. Especially, since training offers a misleading sense of knowledge itself being sufficient, not the practice of transformation. Would knowing the nutritional value of junk food compel overweight people to buy healthier options? No. Would knowing a safer street crossing would make reckless people more careful? No. Within financial services, would knowing their spending patterns make profligate consumers more judicious with their money? No, they spend even more.

The next time an executive in your FSI excitedly announces digital transformation training, you could politely inquire if they have already mastered those playbooks or would be joining you in training. For digital transformation to succeed, a personal transformation of the executives is the key success factor, so every employee training should start with them. Then, with likely ineffective outcomes, at least that executive would think twice before sending their team to another digital transformation training.

250 Million Reasons Why Bank of America is Not a Technology Company

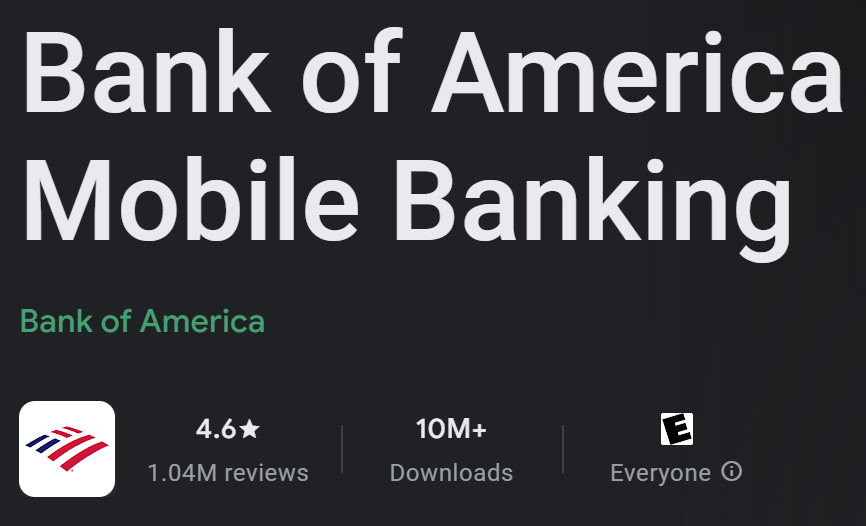

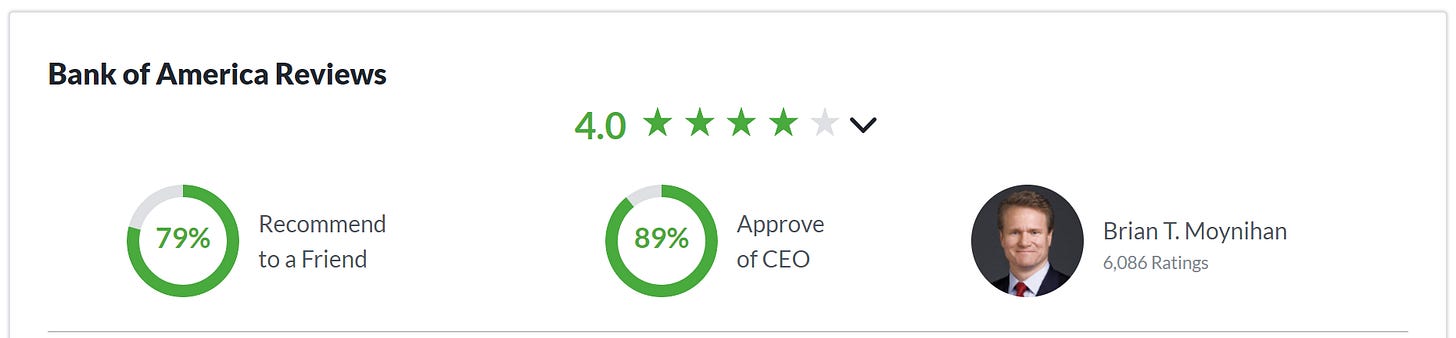

When Bank of America's CEO declared in 2021 that 'We're clearly a technology company,' his intended audience was institutional investors. At that time, fintechs were getting much higher valuation multiples than banks. The CEO was hoping that the investors would start viewing his bank in the same group, and the stock price would go up.

The CEO's rationale was based on three reasonable supporting factors:

a large degree of sales comes from digital channels

many client-facing processes are digital

billions are being spent on technology annually.

By 2023, the valuation multiples of top banks and leading fintechs became similar, and celebrating billions spent on digital transformation became common across top FSIs. But is Bank of America clearly a technology company?

1. What Is A Technology Company?

Digital channels, digital internal processes, or a large portion of expenses spent on digital are obvious, one might say necessary, attributes of a technology company, but they are not sufficient. By those criteria, every credit card company was already a technology company two decades ago. What differentiates a technology company from a traditional FSI is the unique operating model which became singular in its design a decade ago.

When CEOs of a technology company describe its effectiveness, they highlight three factors of the operating model:

Front-line decision-making autonomy with flat organizational design;

10x employees who are both superb individual performers and collaborators; and

Intense prioritization and grooming of initiatives driven by P&L impact.

A technology company CEO also knows the names of their best software engineers and views it as normal to join them for late-night brainstorming sessions.

2. How far behind technology companies is Bank of America?

The closer an FSI gets to that target state operating model, the closer it is to becoming a “technology company.” None of the traditional FSIs today are operating that way, and only a few fintechs are functioning on that level. Can you imagine a Bank of America CEO brainstorming with his software engineers? At the same time, the evolution is happening, and most of FSIs including Bank of America have made clear progress on their digital transformation journey over the last decade.

Among large banks in the US, Bank of America is in the middle of the pack, mostly trying to master the IT Product phase and catch up to JPMorgan, Capital One, and rare few other FSIs in the US that are a bit ahead on a digital transformation journey.

If not for a recently emerging threat of disruption from digital banks, Bank of America might not even have to worry about becoming a technology company this decade. They already have a good digital experience for their customers and satisfied employees.

3. Implications of $250 Million Fine for Striving to Become a Technology Company

Closing the gap to a technology company won't be easy for Bank of America. It will likely take more than a decade. Just one example - in mid-2023, Bank of America was ordered to pay $250 million for opening fake accounts, charging double fees, and not paying promised rewards:

During 2012-2020: in response to sales pressure or to obtain incentive rewards, Bank of America employees submitted applications for and issued credit cards without consumers' consent.

During 2018-2020: the bank practiced charging multiple NSF fees on represented checks or ACH transactions.

During 2012-2021: the bank advertised online the sign-up bonuses for its reward credit cards without expressly stating that the offer was limited to online applications and not paying them to in-branch and over-the-phone applicants.

Of course, a technology company and the most advanced fintechs pay fines sometimes and have significant misses in internal processes. For example, also in mid-2023, Revolut discovered $20 million of its funds being stolen via a sophisticated online scam. But a technology company would not spend years trying to mislead its customers to make money off them. Misleading advertising - yes. Making up customers, charging customers twice, not paying them incentives - no.

The pressure in a technology company is immense: just imagine being surrounded by 10X employees and hands-on executives. Plus, technology companies are known for growth hacking techniques, playing in a gray zone a bit to get some edge. So why wouldn't they try going a bit further leveraging some of the Bank of America 'techniques'? Because their operating model is predicated to be infinitely scalable while those practices are only profitable in the short term.