Which FSI Segment Just Received a Wake-Up Call to Get Digital Transformation Right?

FSIs B2B vs. Insurance B2C vs. Retail Banks - different trends and different implications for digital transformation.

Which FSI Segment Just Received a Wake-Up Call to Get Digital Transformation Right?

When pursuing digital transformation the most important question should be “What North Star metrics would indicate success of failure?” Despite spending 5-10% of their annual revenues on related initiatives, many FSIs don't have a clear answer. Instead, their executives use vague consulting terminology like "modernization," "future proofing," or "competitive advantage." As discussed in a previous newsletter, the right North Star metrics for digital transformation are P&L impact and ROI. However, even if an FSI is aiming for suboptimal metrics, it is still better than having none at all. Having at least an intuitive metric allows FSIs to pivot if it starts moving in the wrong direction.

For example, in recent years diversity, equity, and inclusion (DEI) has gained the level of popularity among FSIs similar to digital transformation. However, the official rationale behind DEI initiatives is often vague, using phrases like "business performance," "customer understanding," and "social impact." Intuitively, FSI executives recognize that the true North Star metric for DEI is positive publicity among employees, customers, and politicians. As a result, DEI is often treated as a discretionary PR budget. When FSIs in the US faced backlash and had to reduce marketing spending due to a potential recession, the DEI function became an obvious target for cost-cutting.

If Digital Transformation lacks even an intuitive North Star metric, it becomes more vulnerable to being cut during recessions or when the focus shifts to other topics. You might wonder why this matters. Since digital transformation is often not directly linked to a P&L impact, whether it consumes 1%, 5%, or 10% of annual revenue shall not fundamentally alter the company's competitive position. Up until recently you would be entirely correct, and it is still largely true, but with one significant exception.

1. Digital transformation and B2B FSIs

As we frequently discuss in our newsletters, digital transformation has the potential to drive a fundamentally different impact across FSI segments, company sizes, and client bases. That's why some FSIs have been strategically developing digital capabilities for two decades, while others are just beginning their journey.

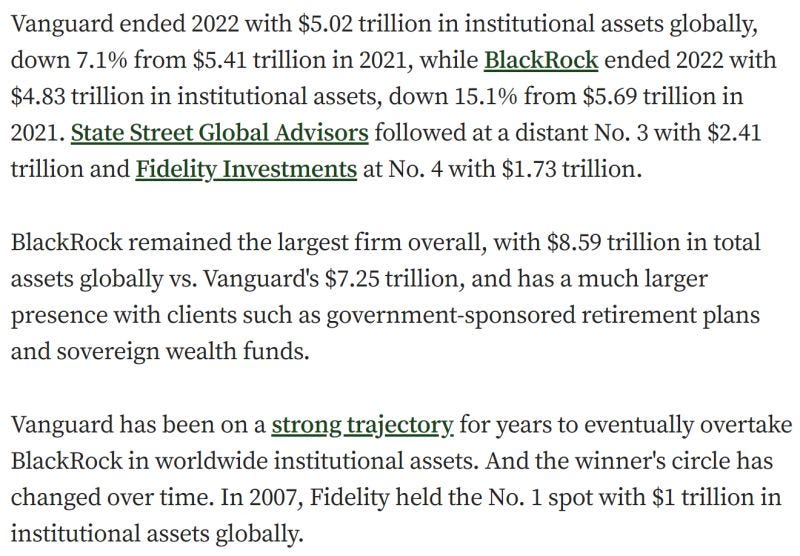

The limited impact of digital transformation is particularly noticeable in the B2B divisions within FSIs, where relationships and product performance still hold more significance than the surrounding digital capabilities. As an example, in the asset management sector, Blackrock stands out with its exceptional digital capabilities. It has transformed its internal application into the outsourcing platform called Aladdin, which generates nearly 10% of the company's total revenue and counts competitors as its clients. Fidelity is also recognized for its strong digital and data capabilities within the FSI landscape. It boasts one of the top-rated mobile apps among traditional asset managers and has one of the most advanced operating models compared to other traditional FSIs. In contrast, Vanguard has been slower to adopt digital advancements and is known for its lean approach when it comes to investing in digital capabilities. Consequently, Vanguard's mobile app has one of the lowest review scores among FSIs:

So what would you expect the performance of Blackrock, Fidelity, and Vanguard to be when it comes to institutional clients? If digital transformation were a key factor in the B2B sector, one might guess that Blackrock and Fidelity would be vying for the top spot. However, the reality is quite different. Vanguard has emerged as a leader, surpassing Blackrock, while Fidelity, once a leader 15 years ago, has fallen significantly behind:

2. Digital transformation and P&C/Life Insurance

On the consumer side, the potential impact of digital transformation is more nuanced. Unlike the B2B sector, there is a significant presence of well-funded insurtechs that could potentially pose a risk to traditional carriers if they fail to undergo transformation. Currently, these insurtechs are still in the early stages of figuring out their business models, as they entered the market a few years after fintechs.

Moreover, insurance companies like Progressive and Geico have been pioneers in the insurtech space, with their data and user experience (UX) capabilities often surpassing those of startups.

When it comes to the most visible feature for consumers, which is product pricing, insurance incumbents typically offer competitive or even better rates compared to insurtechs. As an example, for a real home in Indiana, Liberty Mutual and Progressive provide a more favorable deal than Lemonade and Hippo:

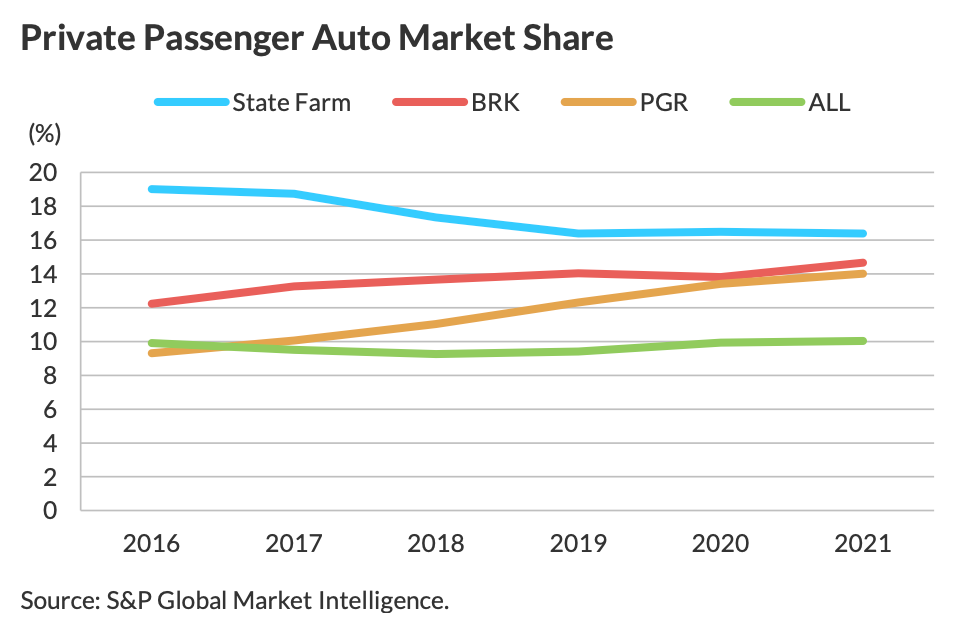

Where digital transformation does matter in the realm of P&C insurance is in the competition among B2C incumbents. For example, in auto insurance, Progressive's strong data analytics capabilities and effective operating model have enabled it to gradually gain market share. As a result, Progressive is expected to become a market leader for this product in the US by around 2023-2024.

If you are an executive in a B2C insurance division, it is crucial to effectively address the North Star metrics and the scale of investment in digital transformation in the coming years. Failure to do so may result in Progressive and other leading players eventually finding ways to attract your profitable customers, leaving you with the remaining customer base.

3. Digital transformation and Retail Banking

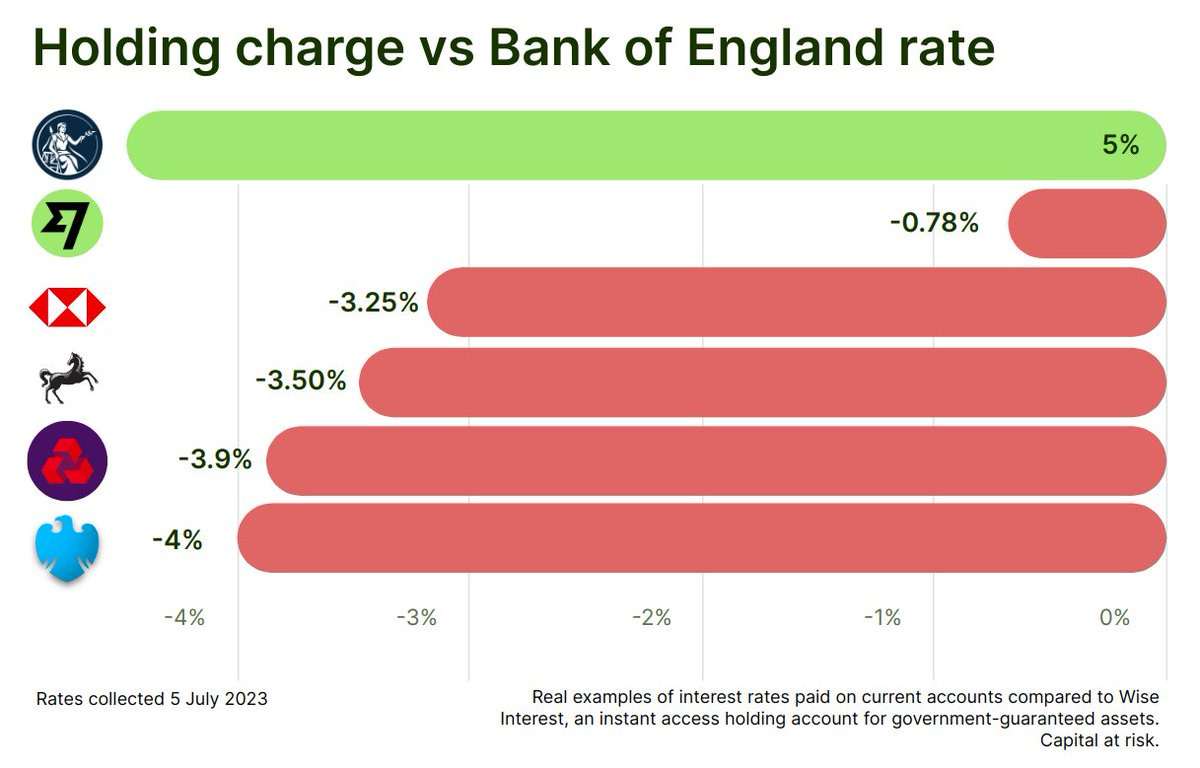

Are retail banks different in this regard compared to P&C consumer carriers? Until 2020, customer turnover in retail banks was less than 10%. But why would customers switch their banks at all? The decision of where to keep their money is crucial, and customers perceive large banks as safe. In fact, the largest banks have been designated as systemically important financial institutions (SIFIs), also known as "too big to fail." Moreover, banks have been spending big on digital capabilities, resulting in the development of features comparable to those of fintechs. Additionally, in a low-interest-rate environment, the pricing offered by fintechs is not significantly better than that of traditional banks. While a 0.5% savings rate is 50 times higher than 0.01%, a typical consumer with a few thousand dollars in a bank may not find it worthwhile to move their money for the extra 0.5%.

From a fintech perspective, they haven't discovered a secret sauce for retail banking either. Even in their favortie segment of underserved consumers, recent research indicates that fintech lending puts poor people more in debt and doesn't seem to be based on unique scoring models. Essentially, due to scrutiny from US financial regulators, media, and politicians regarding banks offering higher-priced products to the poor, banks have kept their distance while fintechs have seized the opportunity.

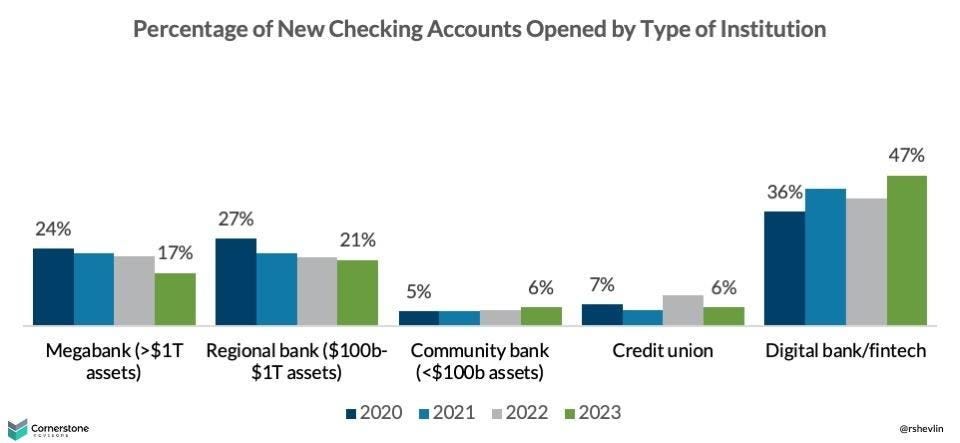

However, consumer behavior has undergone a fundamental change since 2020. The turnover rate has started to increase rapidly and is expected to surpass the 20% mark by 2023. This doubling of attrition in just three years can be attributed to digital players perfecting their marketing strategies and consumers becoming increasingly comfortable with the concept of branchless banking.

This doesn't necessarily mean that banks are not experiencing growth. In 2022, Bank of America opened approximately 1 million net new checking accounts, representing a 3% growth. However, during the same period, there were approximately 40 million new checking accounts opened in the US, with Chime and PayPal each capturing around 4 million of those accounts. While Bank of America is still experiencing growth, it is also losing market share in the realm of bank accounts.

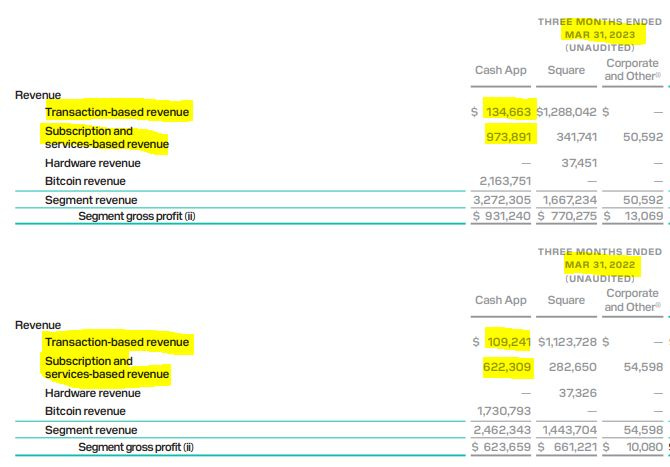

Since digital banking players have only emerged in the past decade, they are just now reaching a scale where they can noticeably impact the market share of traditional banks. For instance, Cash App's revenue is approaching that of a top-15 consumer bank in the US, and it has already surpassed Fifth Third Bank's consumer business. If interest income is not taken into account, Cash App would even be among the top-10 consumer banks. Cash App’s growth should be particularly concerning for retail banks, as it continues to expand at a rate of 50%:

As a result of rapid scaling, consumers of all generations have increased their accounts with digital players by 2.5-3.5 times between 2020 and 2023:

For now, digital players have primarily targeted younger and less affluent demographics. The majority of well-off consumers still prefer large banks when opening new accounts. However, the banks have a significant vulnerability that has made them susceptible to effective marketing campaigns: their products offer poor pricing. Digital players have yet to fully exploit this opening as well-off consumers prioritize service and safety over pricing. Nonetheless, digital players have more effective operating models when it comes to marketing strategies, bringing them closer to finding a solution.

Some retail banks are aware of this risk and are taking steps to mitigate it by establishing digital subsidiaries with improved pricing. However, as digital players gain more traction in the market, it becomes crucial for retail banks to accelerate their digital transformation in order to effectively utilize comparable budgets for customer marketing and service delivery.

4. Two ways to lose market share

In the dialogue from Ernest Hemingway’s book, "The Sun Also Rises," one character asks another, “How did you go bankrupt?" The response is, “Two ways. Gradually, then suddenly." The good news for retail banking executives is that there is no risk of bankruptcy this decade, even if their digital transformation is non-existent or has vague objectives. As we discussed in another newsletter, banks have historically faced failures, including in 2023, due to greed and excessive risk-taking, rather than being slow in their adaptation.

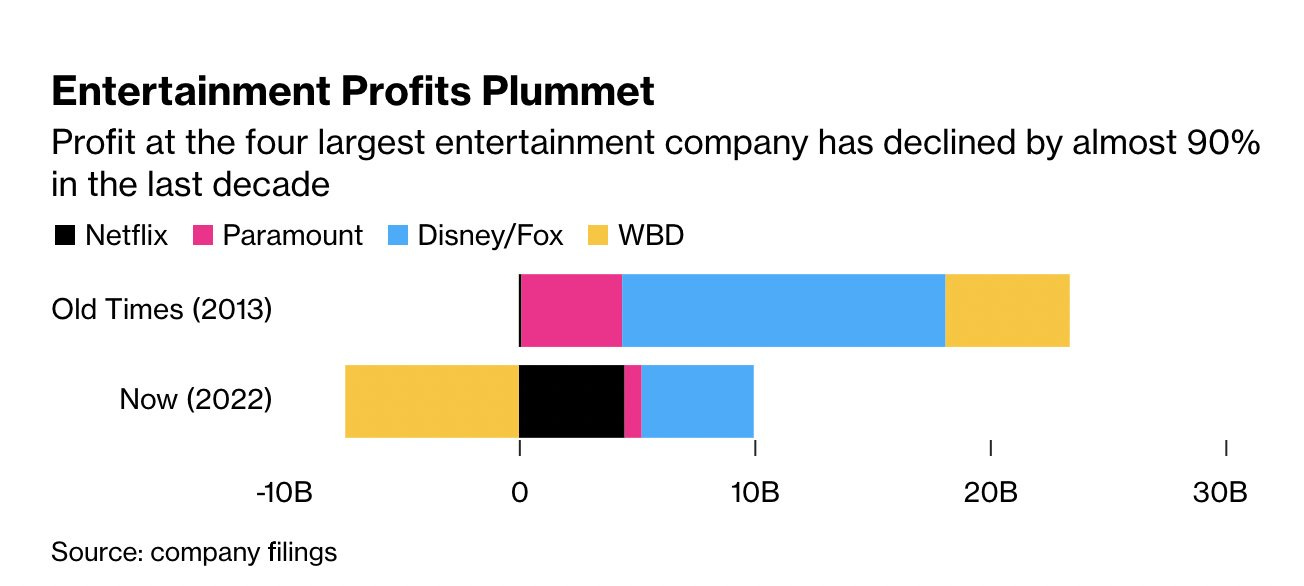

But remember, for a disruption to occur, it only takes one determined startup with a long-term vision spanning two or more decades. The disruptive force of innovation only required one Amazon for books, one Spotify for music, and one Netflix for entertainment. It is still too early to determine which digital player will be the disruptor for retail banks. However, the years of lavish digital transformation budgets and vague North Star metrics in retail banking are drawing to a close.