JPMorgan Chase's Ongoing Transformation: Current State and Remaining Gaps

Also in this issue: The Myth of "Gradually, Then Suddenly" in FSI Disruption

JPMorgan Chase's Ongoing Transformation: Current State and Remaining Gaps

Over the last 15 years, it has been fascinating to watch how fintechs are becoming diversified FSIs while incumbents are trying to digitally transform and catch up to fintechs in effectiveness. And while some expected by now that there would be at least some casualties among large traditional FSIs, so far it has remained a disruption fantasy. The recent annual letter to shareholders by JPMorgan Chase’s (JPMC) CEO Jamie Dimon illustrates that dynamic.

The letter, which began prominently featuring digital transformation 8 years ago, identifies several attributes of what good looks like, and it also helps to see the remaining gaps to the leading fintech. While aspirational for most FSIs, Jamie offers them a proven set of practices so they don’t have to learn from less relevant fintechs or even more so digital natives.

Data and Data Models

Data and data models serve as the only sustainable moat for traditional FSIs. In the advanced stages of digital transformation, such as at JPMC, it makes sense to elevate the CD&A role to the CEO's report. In such a prominent capacity, this executive has a chance to break organizational silos to create shared pools of data and identify enterprise-wide and external monetization opportunities:

The elevation of data & analytics capability coincides with JPMC's recent announcement to launch its advertising business, Chase Media. Like many other large card issuers, Chase previously partnered with firms like Cardlytics to provide its customers with Chase Offers. In theory, Cardlytics could already have been using customer transaction data to personalize its offers:

In practice, such offers mostly benefit savvy customers who might be making the same purchase anyway. With Chase Media, the bank could now independently analyze its customer data for better targeting and get paid by merchants for this extra analytics effort.

Cloud Journey

JPMC's cloud journey is obviously meant to drive higher velocity and flexibility but also includes cost reduction. The latter has become an increasingly debated topic as costs and the ease of in-house computing become increasingly favorable compared to the rapidly growing price and higher constraints of the public cloud. JPMC addresses this with:

A mix of private and public clouds, investing $2 billion to build new data centers in the US alone.

Refactoring legacy applications before moving them to the public cloud to ensure savings of up to 30%.

JPMC is also avoiding 100% Cloud or Cloud-native pronouncements - instead, it looks at this journey as an ROI-driven decision targeting 70-75% of capacity on private and public clouds in the short-term. This ratio is compatible with leading digital players like Rocket Mortgage, which has 60-70% of applications running on the cloud.

Scaling Winners, Downsizing Losers, and Sustaining Others

Being already one of the largest FSIs globally, JPMC continues to grow market share in several of its businesses. In the last 15-20 years, it has 2-3Xed its market share of deposits, business banking, and investment banking.

At the same time, JPMC is constantly re-evaluating the business lines where investing in digital transformation wouldn’t make sense. For example, in mortgage originations, its share is down to 3%, declining 0.5% in 2023. Due to low profitability and excessive regulation, Chase prefers non-banking providers to lead in this space. Their market share has grown almost eightfold to 69% since 2009.

While JPMC is investing in cross-border payments with the blockchain-based JPM Coin, on the consumer side, it is taking a more defensive approach. Despite competition from successful fintechs like Wise and Remitly, Chase has more than doubled its transfer volume in the last decade. It achieved this by only making minor adjustments to its pricing structure and user experience - neither being best in class.

The Remaining Gap

JPMC has more resources and data than leading fintechs. By now, it has achieved comparable UX quality and customer satisfaction in Chase’s mobile application. Some of its products, like credit cards, are already best in class in terms of looks and value proposition. Perhaps fintechs haven’t started reinventing branches yet, but they are definitely eager to have as cool cards as the leading traditional issuers. Recently, Robinhood came out with its Gold Card, and then Revolut began looking for a new card design:

Fintech-shmitech, mission-shmission aside, digital-only FSI is an apparent myth, while JPMC's combination of physical and digital assets represents the best target state for financial services and insurance.

However, there is a clear gap between JPMC and leading fintechs. While Jamie Dimon personally exhibits the right executive behavior of being hands-on, empowering, and continuously learning, a large portion of JPMC executives still operate in a more traditional 20th-century sense.

To understand what the right behavior looks like, they should start comparing their capabilities and preferences to their peers in leading fintechs such as Revolut. In a recent interview, a former Santander executive who became a regional CIO at Revolut offered three unique characteristics of a fintech-grade executive:

"the focus on actions and ‘let’s get things done'... not to be perfect"

"spend a lot of time with the product teams and their products to see what they are planning, prioritizing change management and understanding the risks and dependencies"

"managing by influence... most of the technologists are not part of the technology department"

A leaner, hands-on executive culture permeated into even less digital areas like private banking would enable JPMC to identify more digital transformation opportunities to further its leading role on the global scale. For example, its private client banker recently received a 4-year sentence for stealing $2.4 million from six client accounts over the course of 21 months. The data-driven internal fraud solution seems like an obvious fix, but only if there is an executive who is willing to get into the weeds and learn with front-line employees how to scale it.

The Myth of "Gradually, Then Suddenly" in FSI Disruption

For more than a decade, true believers of fintech disruption have used a phrase to explain the imminence of digital-only adoption by consumers and businesses. They would usually highlight one piece of news about a new fintech product and its high growth rate and then proclaim: "Gradually, then suddenly."

The implication has been that humanity is standing on the precipice of a fintech tsunami where consumers and businesses en masse will finally understand their mistake of using traditional FSIs and switch to startups. The premise was straightforward: there are novel technologies (mobile apps, blockchain, AI, etc.), and traditional FSIs would struggle to deploy them.

The irony lost on those prophets is that such phrasing comes from the following dialogue from Ernest Hemingway’s The Sun Also Rises: “How did you go bankrupt?” “Two ways. Gradually, then suddenly.” The lesson here is that making small wrong decisions could eventually lead to big bad outcomes.

For example, it could be really bad to keep overindexing on novel technology as a key differentiator. Guess what is common among these startups: a) "AI Lending Network", b) "AI Native Insurtech", and c) "AI-Powered Financing"?

Their stocks are 90-95% off their highs. Paraphrasing a meme, “Never go full AI.” (Pagaya, Lemonade, Upstart)

Novel technology could backfire in unexpected ways. Instead of wowing customers, the replacement of human agents with chatbots has become the biggest source of customer complaints. Getting novel technology to work is especially difficult when it is meant to address malicious intent of a well-equipped counterparty. When arguably the 21st century's most prominent digital industrialist, Elon Musk, purchased Twitter in 2022, his main customer experience concern was bot infestation. Elon promised to bring his most brilliant engineers from Tesla and apply the most revolutionary AI technology to fix it… and it has only gotten worse since then.

In another example, Amazon recently announced the removal of its "Just Walk Out" payment technology from its convenience stores. I was wowed by that experience and was hoping that it would scale to other brands, but I guess some customers just kept walking out without paying.

It was also not based on some magical AI system - Amazon called it as such to make it sound cooler, but in reality, it relied on a thousand employees in India adjusting its machine learning model by observing customer behavior. That, in turn, created a hilarious conspiracy theory that "Just Walk Out" payments were done fully manually by those Indian workers and required Amazon's refutal:

Overreliance on novel technologies is especially risky when it comes to complex but barely profitable verticals like consumer property insurance. Not only Amazon, Google, but now Tesla have struggled to build a sustainable model in this space despite substantial investment and technology know-how. Even dedicated insurtechs, with a supposed advantage in telematics or AI, have remained insignificant compared to fintechs in more profitable or less complex product niches.

In many ways, traditional financial services and insurance players have exhibited a more sensible approach when scaling novel technology. For example, with generative AI tools, the most popular use cases seem to be in saving costs of software engineers by making the best ones more productive and firing the rest. Some FSIs expect tens of millions of dollars in savings, but it might take another couple of years before we see the first actual staff reductions.

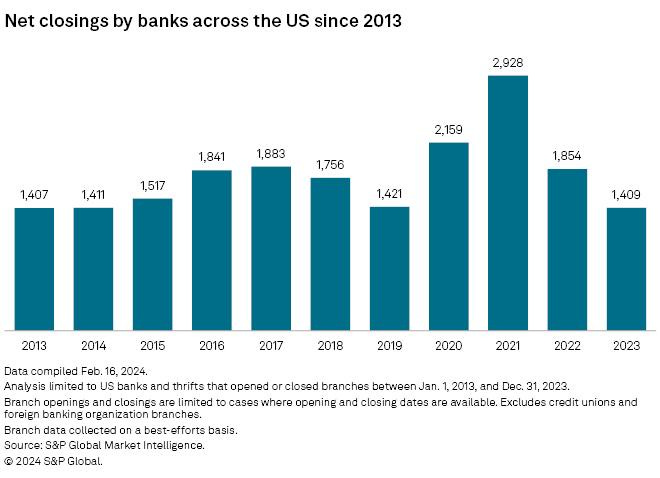

Such a gradual approach from traditional FSIs rather than expecting a sudden revolution is also due to their first-hand knowledge that client preferences also change very gradually. For example, in the last 11 years, the number of bank branches in the US has declined by only 20% with no acceleration. Why is there no sudden rush with branch closures?

Because consumers still place almost twice as much value on branches compared to digital user experience when selecting a primary account.

Other Insightful Reads

Santander UK: Laying the Groundwork for a Digital Future (Santander UK’s Head of Transformation and Financial Crimes Director describes his approach to digital transformation)