For Whom the Aitomation Bell Tolls in FSIs, It Tolls for the Staff in Operations, Data, and IT

Also in this issue: Can FSIs Use Data & Analytics to Change Suboptimal Client Behavior?

For Whom the Aitomation Bell Tolls in FSIs, It Tolls for the Staff in Operations, Data, and IT

"The business value of technology" has been a popular discussion topic in financial services and insurance for decades. It is as a way of holding IT leadership accountable for the business impact of their growing budgets. However, there has never been a good way to explain this value because the premise is flawed. In a recent interview with CIO Online, Sathish Muthukrishnan, Ally Bank’s Chief Information, Data, and Digital Officer, demonstrated the difficulty in responding to this tricky question:

“We have made it part of the process. We identify the value we are creating and capturing before we kick off a technology project, and it’s a joint conversation with the business. I don’t think it’s just the business responsibility to say my customer acquisition is going to go up, or my revenue is going to go up by X. There is a technology component to it, which is extremely critical, especially as a full-scale digital-only organization. What does it take for you to build the capability? How long will it take? How much does it cost and what does it cost to run it?”

The answer conflates accountability and responsibility. IT is responsible for satisfying business demands through scalable, rapid, dependable tech solutions. The business is accountable for defining and capturing the value that such support creates. While IT executives like Sathish can assist their business counterparts in leveling up their digital operating muscles, they shouldn’t be accountable for identifying the business value of faster-growing acquisition or revenue.

The same mindset is imperative when discussing another popular topic, "technology advantage." While IT leadership is in full control and accountable for changes in technology capabilities, without a clear connection to business outcomes, technology advantage is meaningless. This was illustrated in a recent debate between traditional FSI and fintech, moderated by Bain: “Incumbents vs. Challengers: Is There Still a Technology Gap?”

Wendy Redshaw, Chief Digital Information Officer at NatWest, and Jason Maude, Chief Technology Advocate of Starling Bank, debated which entity has a better technology stack or faster release capabilities. However, it felt more like an exchange of talking points from press releases. As often happens, the debate among technology leaders about "advantages" wasn’t grounded in comparing North Star metrics.

For support functions like Operations, Data and IT, there are always two: higher satisfaction and scalability when enabling business growth. If Starling Bank’s technology costs less per supporting revenue while its business leaders are more satisfied with that support, then it indeed has an advantage over NatWest. Otherwise, they just have a bunch of engineers tinkering quickly with cool gadgets for fun.

Aitomation (AI + Automation) Enters The Chat

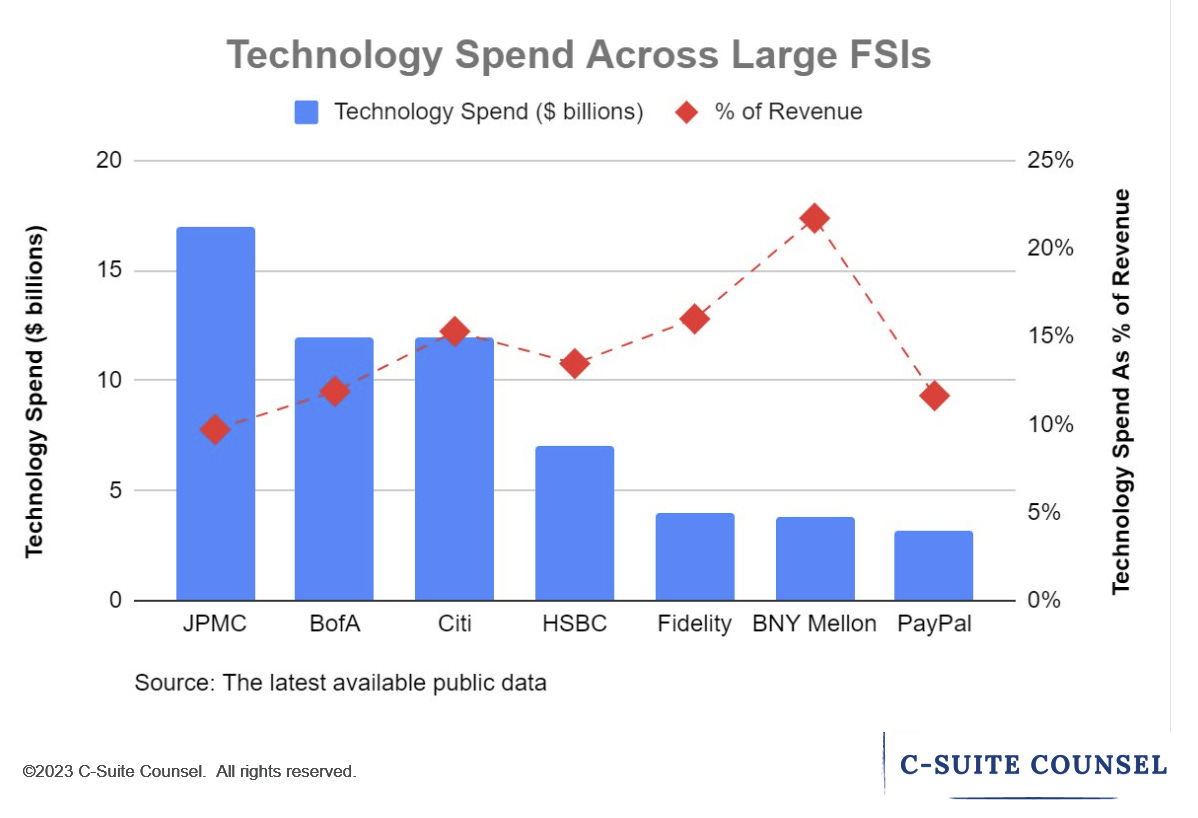

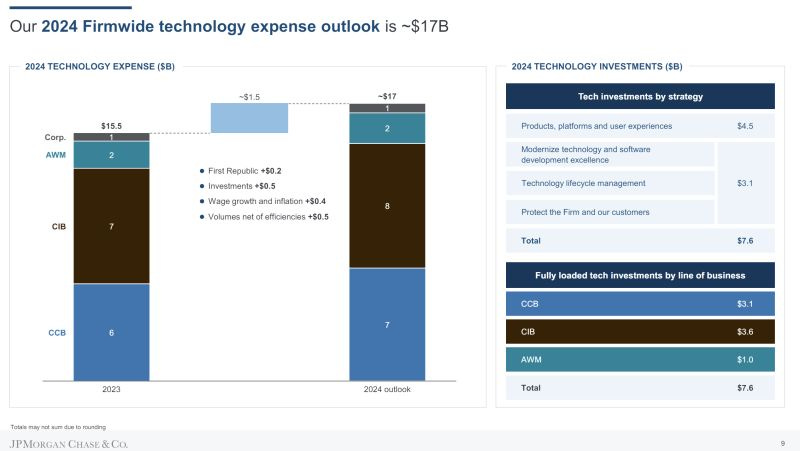

Such an understanding of the value provided by its function is especially important among support chiefs (COO, CDO, CIO) during the current spending bonanza on technology. JPMorgan Chase's CEO recently confirmed that the company will continue spending 10% of its revenue on technology, reaching $17 billion this year. This staggering absolute amount is actually on the low end in relative terms among leading FIs and fintechs:

It will be another year before leading FSIs know the ROI of their latest AI investments, but the focus on efficiency (rather than top-line growth) is clear. I call it "Aitomation" (AI + Automation). Rather than a breakthrough in a business model, this is an ongoing, decades-long trend of automating manual tasks using increasingly sophisticated technology.

Focus Areas for Aitomation

Differently from Blockchain or Metaverse, which have been mostly PR efforts, the current wave of GenAI-related investments is massive and creates unprecedented expectations for business benefits in terms of scope and timing. What should be the end result of cost savings after the current spike of technology investments is over?

During the recent Investor Day, JPMorgan Chase’s COO, Daniel Pinto, estimated the end benefit at $1-1.5 billion, primarily from 80,000 staff in operations and 60,000 in engineering. KYC remains one of the most popular areas among FSI leadership for aitomation, with a projected 20% reduction in JPMC’s staff between 2022 and 2025 from a baseline of 3,000.

How Likely is AI-Related Payback?

Would JPMC’s COO's expectations for significant staff reduction materialize? While I was already skeptical a year ago, it now seems obvious to most of my FSI network that GenAI’s reasoning abilities have plateaued. The best we could hope for is increasingly marginal improvement in text/image recognition. In other words, GenAI improves data cleansing but not data synthesis or creation. Of course, data cleansing is helpful, but it might not result in a large layoff.

Until now, in Compliance alone, even the best fintechs have retained 10-20% of their staff, which hasn't been decreasing. Citigroup recently agreed to pay £28 million in fines to the UK regulator for a “fat finger” mistake. Its trader entered the wrong trade details and ignored most warnings. Despite having multiple circuit breakers and manual overrides as part of the process built on decades of similar mistakes, the trade went through because it happened to be a novel use case. Without AGI, such manual updates and oversight will persist as trading instruments become increasingly complex.

Call center/branch staff reduction depends mostly on whether chatbots improve significantly, and there's no sign of that yet, quite the opposite - complaints are growing. In the 9 years since Ally Bank launched the first chatbot, similar to how Citigroup deals with risk management, FSIs have perfected how to feed customer chatbots with each bit of new data manually. The WSJ recently illustrated such a process at NatWest:

To help people who wanted to transfer money into their individual savings accounts, U.K.-based bank NatWest had taught its chatbot, Cora, to understand phrases including, “I want to put some money in my ISA,” and “Let me transfer money into my ISA,” says Wendy Redshaw, chief digital information officer at NatWest. But as more people started using the phrase “top up my ISA,” Cora was unable to complete the transaction. So the company added that phrase to Cora’s vocabulary.

Such gradual progress gets in the way of the PR game sometimes. Klarna made waves in March with a claim that its GenAI chatbot does the equivalent work of 700 customer service agents. But the fintech then had to clarify that it didn't reduce staff: “We chose to share the figure of 700 to indicate the more long-term consequences of AI technology.”

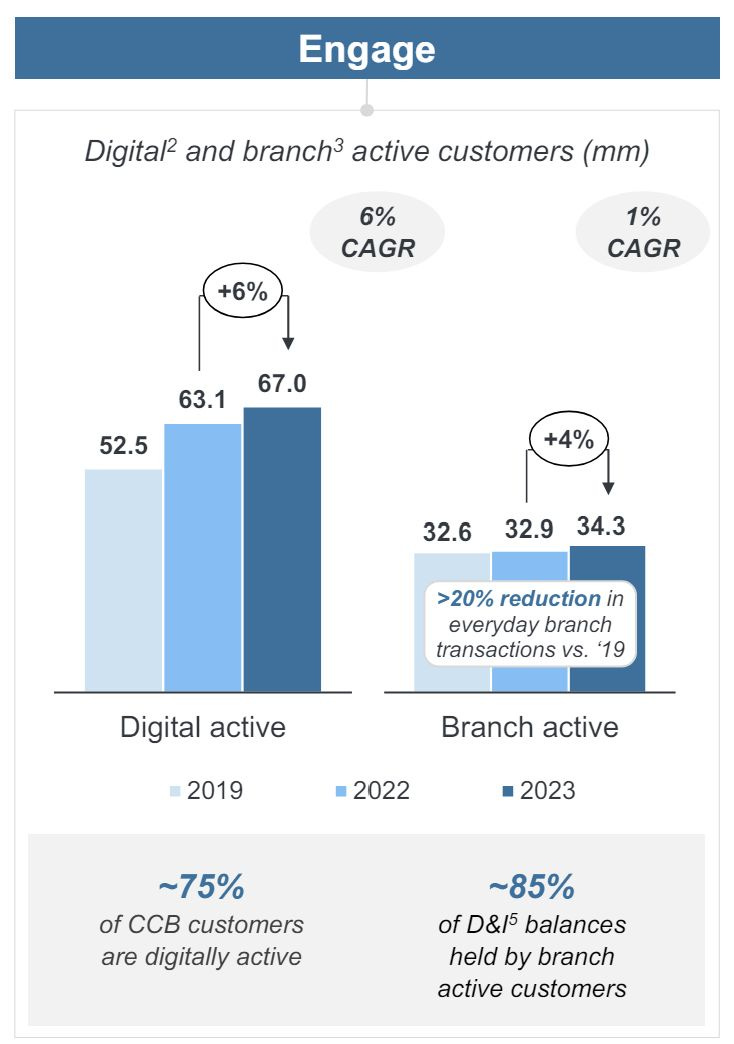

While the quality of AI supply is improving gradually, the demand is also not changing rapidly. FSIs continue to rightly ignore the "branch-is-dead" influencers because not only is the branch-active customer base stable, but they also hold the majority of funds. How would massive spending on GenAI get these consumers to stop doing what they prefer?

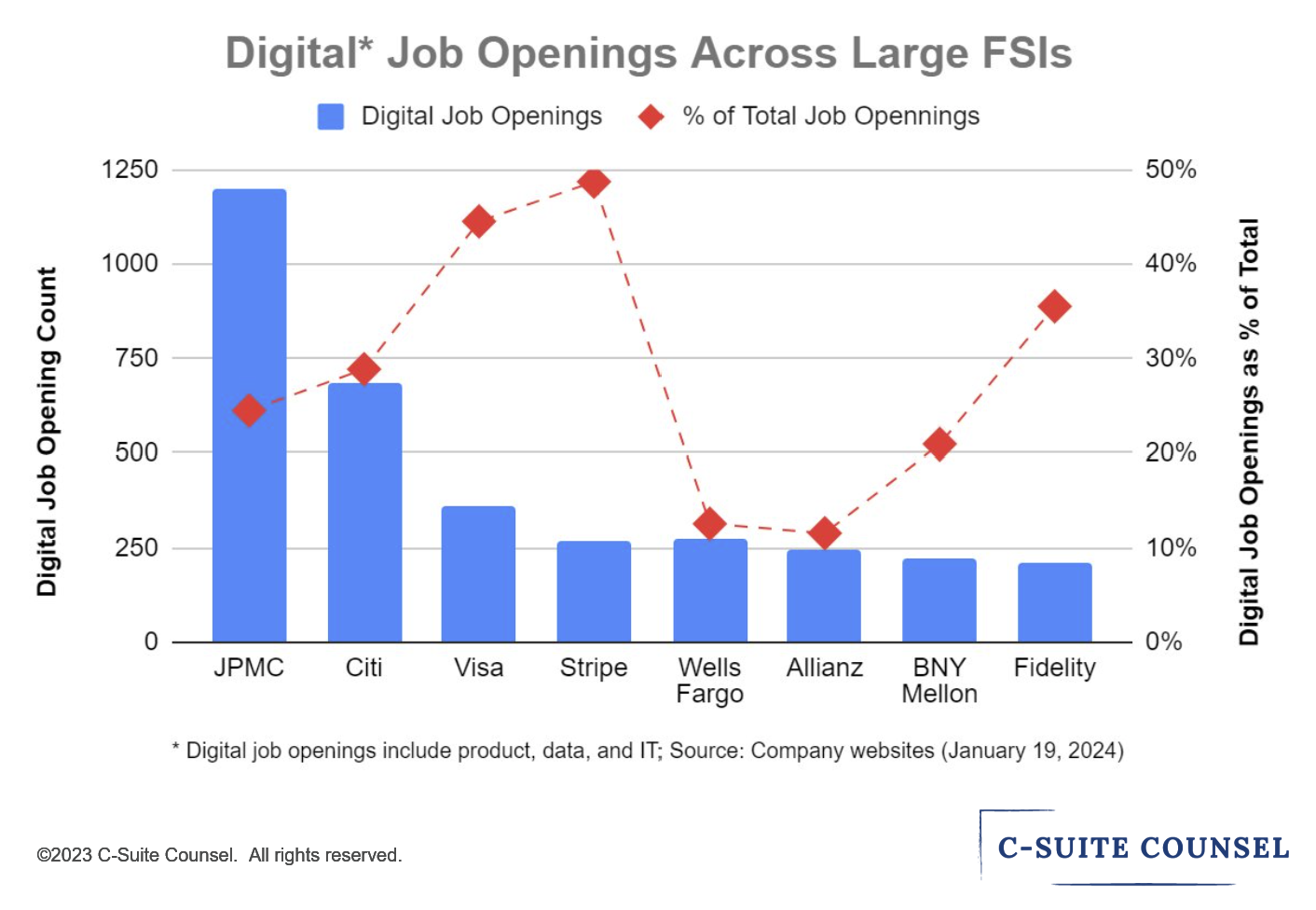

Finally, the expectation for massive staff reduction from GenAI investment is also complicated for in-house data analytics and software development roles. Those digital job openings are in the 25-50% range among leading FIs and fintechs as captive talent is correctly viewed as a competitive advantage. Elon Musk proved that 50-80% of such staff could be cut while increasing release velocity. However, building a company based on 10X employees is only possible with 10X executives, and such drastic cultural change is not planned among large FSIs.

COOs, CDOs, and CIOs of financial services and insurance companies championing aitomation still have a year to figure out where the cuts would come from in their functions. But make no mistake, the AI bell tolls for their staff.

Can FSIs Use Data & Analytics to Change Suboptimal Client Behavior?

My favorite aspect of digital transformation is the application of data and analytics to change customer behavior. I am not talking about the pseudoscience of “nudging”, but rather if the FSIs can use data to identify real incentives that would compel customers to improve how they deal with finance and insurance-related decisions.

We as consumers make bad decisions all the time. Making wrong investments, buying the wrong insurance, spending money we don’t have, and borrowing when we shouldn’t. The same is true for small businesses that don’t have governance in place to stop suboptimal decisions by the owner. Until now, the industry has been focusing mostly on monetizing bad behaviors, staying true to the first rule of capitalism: “Give customers what they want.”

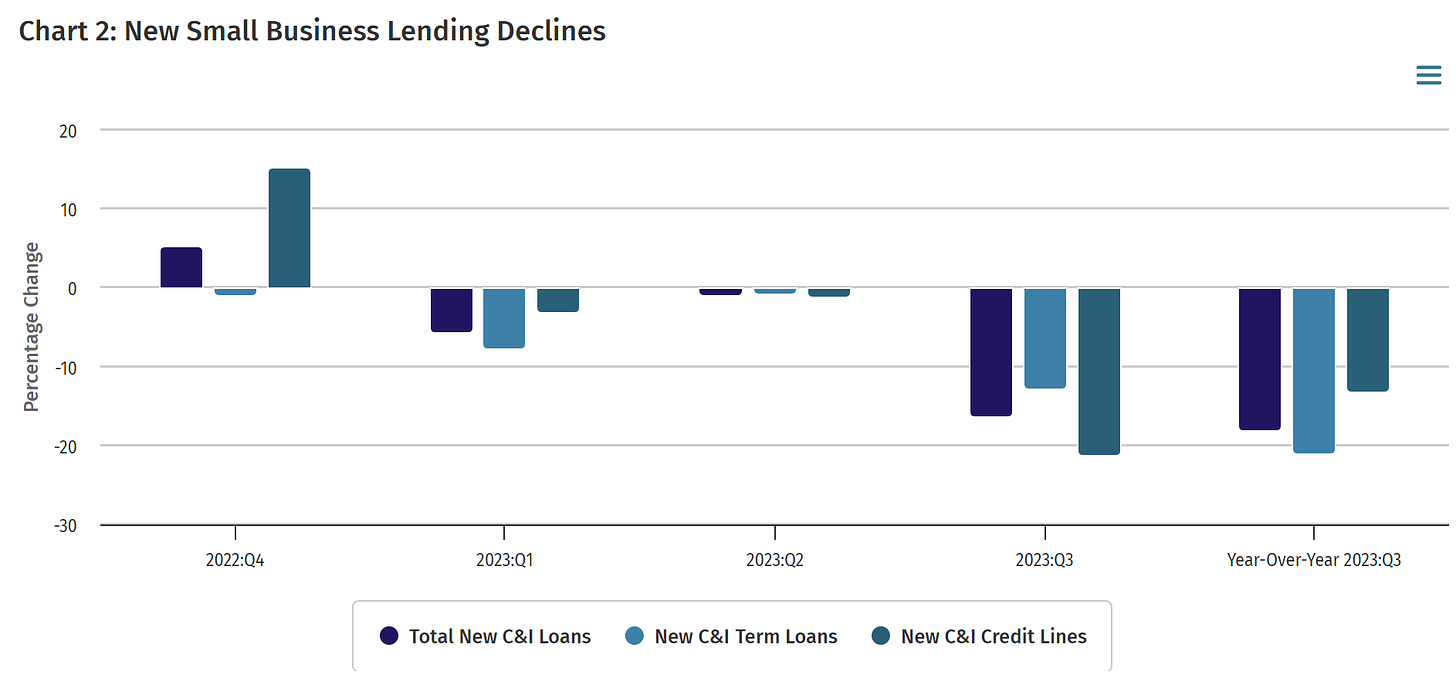

As Jevgenijs Kazanins recently noted in his Popular Fintech newsletter, Square apparently has been originating more loans to small businesses than Chase for at least a year. Yet, somehow, this is not huge news, not celebrated as a seminal moment of disruption. Not only that, but Square’s parent company stock has been trending much lower than JPMorgan Chase:

The answer partly lies in monetizing (enabling) potentially suboptimal client behavior. High interest rates in the US have resulted in a collapsing demand for loans starting in early 2023. This has led to a "the odds are good but the goods are odd" situation on the dating scene between lenders and borrowers. Yes, Square is lending at higher rates to more desperate clients, but whether it is a win or bad analytics will only be clear when those cohort delinquencies come through in the next year or so.

One interesting exception to enabling customers to do whatever they want is fraud. Technically, FSIs and fintechs shouldn’t be liable for it, especially with the proliferation of authorized fraud, including by first parties (First-party fraud). Ideally, the industry should create a database of such repeat first-party fraud offenders and report them to authorities for prosecution.

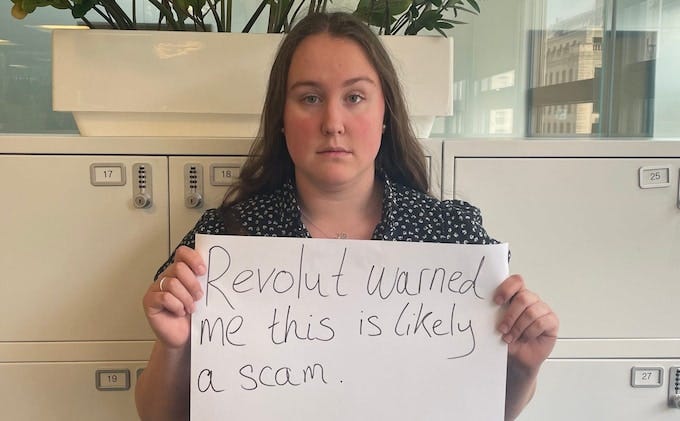

Yet, such a database doesn’t exist in any country. Similar to stores not pursuing repeat offenders of return merchandise, financial services and insurance firms are reluctant to punish customers with bad habits. Revolut is tougher than typical FSIs or fintechs, so they have added novel steps for likely victims (or willing participants) of fraud. It asks them to take a selfie and explicitly acknowledge that they are likely to participate in a scam and won’t expect Revolut to recover their funds.

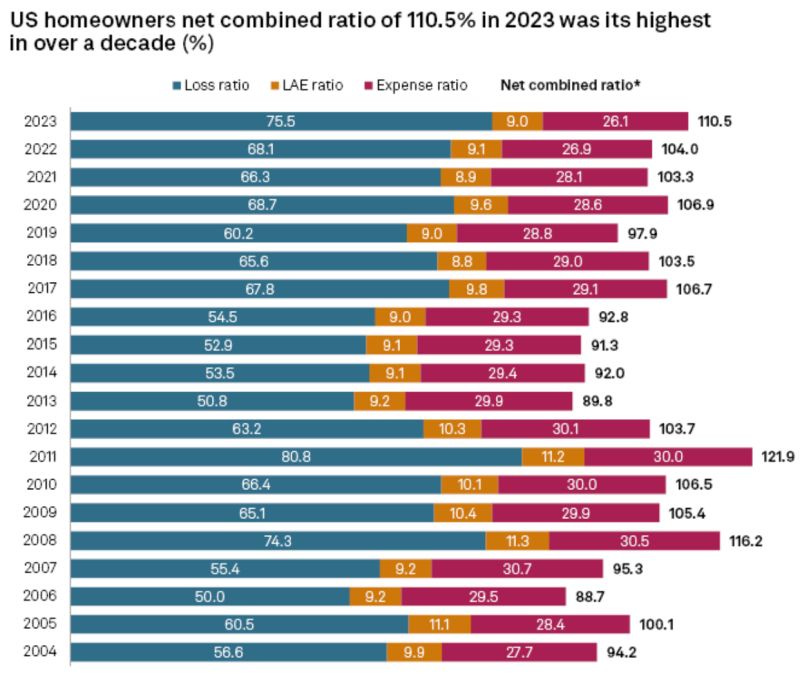

Such proactive behavior correction from FSIs and fintechs is even likelier for products where they don't make money (e.g., domestic payments), and especially for where they are losing money, like home insurance in the US:

P&C carriers are increasingly superseding customer representation of their property, instead using data and analytics to identify behavior gaps and suggest proactive changes. It is becoming common for a customer to receive a list of improvements with a timeline (2-12 months) to fix them, with verification and actions taken without the customer’s direct involvement:

So far, FSIs and fintechs trying such novel techniques to modify client behavior have mostly faced media scrutiny without heavy regulatory intervention. If politicians and regulators stay distracted, we might get to see if such experiments result in both lower losses for companies and better behavior from clients.