Cloud-First in FSIs: Staying Power Amid Critiques

Also in this issue: The Pinnacle of Digital Transformation Theater in FSIs – Continuous Restructuring

Cloud-First in FSIs: Staying Power Amid Critiques

In the nearly two decades since cloud computing was first introduced, one thing has become abundantly clear: the cloud is not a panacea. Migrating to the cloud alone doesn't inherently make an FSI more scalable or likely to create new revenue streams. In many cases, the cloud introduces complexity without yielding sufficient returns. Moreover, at a certain scale, the cloud can become prohibitively expensive and restrictive.

A decade ago, when Capital One started considering a 'cloud-first' approach, it was a novelty among traditional financial services and insurance companies. Today, it's considered passe, with an abundance of data proving that an 'all-in' approach to the cloud is nonsensical. Nevertheless, many well-known FSIs continue to proudly announce their unwavering commitment.

What are the facts behind this, what drives FSIs' apparent stubbornness, and what does the proven approach entail?

Cloud As The Epitomy of Digital Indulgence

From a cost perspective, the Cloud represents the culmination of the other four digital marvels of the 21st century: Agile, AI, API, and DevOps. For a cloud-first company, the more of these digital enablers the company utilizes, the greater the demand for computing, storage, and data transfer. In 2022, public cloud services revenue exceeded half a trillion dollars, with a growth rate of over 20%. Even concerns about a global recession haven't dampened the cloud bonanza, as Gartner has recently projected a 20% growth in public cloud spending in 2024:

Are There Compelling Success Stories of Organizations Going 'All-In' on the Cloud?

FSIs like Capital One are often depicted as 'all-in' cloud success stories, which implies two assumptions:

This approach has yielded substantial returns compared to a flexible path; and

Repatriation away from the cloud won't provide significant benefits.

Neither of these assumptions holds true. Capital One's stock price is currently trending at levels similar to those of 2006, and completing cloud migration in 2020 has not yet improved its performance trajectory.

The move to the cloud with AWS resulted in at least one significant security breach for Capital One in 2019, leading to fines and settlements costing the company $270 million. A former Amazon employee explored AWS misconfigurations, in which databases were left open to the Internet without authentication. This led to the theft of data for over 100 million Capital One customers and the hijacking of computers for cryptocurrency mining.

This reflects a broader point of our newsletters. We frequently emphasize Capital One’s credit card division as second to none in digital transformation among traditional financial services and insurance companies. However, similar to struggling fintechs and insurtechs, being highly advanced in digital capabilities doesn't guarantee results; it simply makes an FSI more effective in pursuing its business goals. What truly matters is whether those aspirations generate substantial profits to justify significant investments in digital transformation, such as 100% cloud migration.

On the recent earnings call, Capital One's CEO, Richard Fairbank, mentioned the company's technology differentiation a dozen times. However, when it came time to prove that this differentiation was creating a top-line impact or at least scalability, he presented an odd set of facts: 1) declining revenue, 2) expenses declining slower than revenue.

“Powered by our modern technology and leading digital capabilities, our digital-first national direct banking strategy continues to deliver strong results. Consumer Banking revenue for the quarter was down about 7% year over year, driven by the higher rate paid on deposits and lower auto loan balances and margins. Noninterest expense was down about 6% compared to the third quarter of 2022.”

To summarize, Strong Results = Negative Growth + Negative Scalability.

Why couldn't Capital One's CEO offer a more sensible justification for the cloud-only differentiation? He probably doesn't have one. For instance, as we discussed in another newsletter, Capital One has harbored ambitions of monetizing its platforms for a decade, even establishing a distinct business group named Capital One Software. This could have been a significant differentiator, as very few FSIs have the digital capability to accomplish this. But what did Capital One choose as the priority use case? A generic spend management tool, which is unlikely to generate significant revenue.

Do Cloud-Native Disruptors Exhibit Any Distinct Advantages?

Perhaps the approach is working as a differentiation for cloud-native disruptors like Shopify. Nope. From the overall perspective, after a short influx caused by Covid-related government stimulus, the stock price is at the same level as 4 years ago:

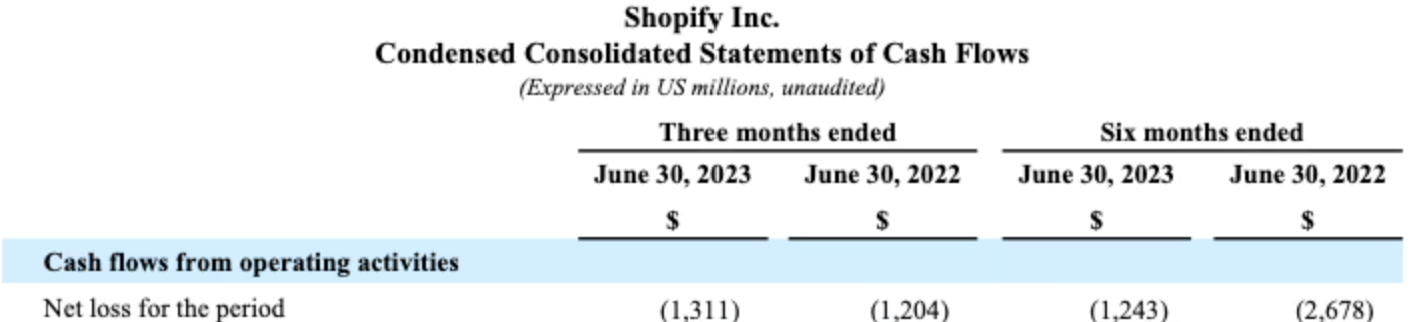

After almost two decades since its launch, Shopify remains unprofitable:

Specific to the Cloud question, one of the most problematic areas in Shopify’s P&L remains Research & Development that includes technology costs. In the recent quarter, it grew 3 times faster than revenue:

What Drives the Continued Surge in 'Cloud-First' Announcements?

The persistence of a "cloud-first" approach among FSIs seems increasingly odd given the growing refutation. Not only are there consistent indications of no benefits and significant downsides, but there is also an increasing trend of companies repatriating from the Cloud to on-premises solutions. In just one year since Elon Musk's takeover, X (Twitter) saved 60-75% of cloud costs by transitioning to on-premises infrastructure while deploying times more products with 80% fewer staff:

“… doing much more on-prem. This shift has reduced our monthly cloud costs by 60%. Among the changes we made was a shift of all media/blob artifacts out of the cloud, which reduced our overall cloud data storage size by 60%, and separately, we succeeded in reducing cloud data processing costs by 75%.”

At least, Capital One signed its "cloud-first" agreement in 2016 when the scalability limitations were poorly understood, and the tools for managing the same services on premisses were cumbersome. Capital One could even plead ignorance in 2020 when it completed the cloud migration. But why do other well-known FSIs like KeyBank, MassMutual, and Allstate persist with such a nonsensical approach these days?

Zulfi Jeevanjee, EVP and CIO at Allstate, provides an explanation:

… the best way to build and align next-generation business processes and modern IT platforms is to build anew, and so he is taking a cloud-first approach to digital transformation, dumping out all legacy infrastructure along the way. The result, Jeevanjee says, is a technology-driven business strategy “that’s a very empowering thing.”

Zulfi sees the next-generation business process and IT platform as the ultimate objective. This mirrors the traditional approach of IT executives who deploy cutting-edge technology with the expectation that it will help the business generate revenue and reduce complaints about IT.

Sherriff Balogun, the Head of Product and Platform Technology at MassMutual, provides his rationale for their cloud-only strategy:

The company has two tech priorities: “One is achieving the ultimate objective of moving everything to cloud,” Balogun said. “The other, in the spirit of efficiency, is to lower our data center expenses through colocation strategy and working with vendors on product support while we do this big cloud migration.”

Once again, notice the traditional IT-centric nature of this mindset. Why would MassMutual's Board and CEO establish such simplified technical priorities for one of the leading life insurance companies in the US?

The reason is the incredible branding of the Cloud as a game-changing technology and the reluctance of FSIs to pivot based on new information. As we discussed in another newsletter, if you want a moment of silence in an FSI leadership meeting, ask the audience to recall the last time they shut down a failing initiative.

A Proven Approach To Cloud Migration

The good news is that most FSIs already practice the proven approach to cloud migration. The same Allstate's CIO describes a gradual path since 2019, adding ~1% of customer transactions to the cloud annually, one-product-one-state at a time.

… filing claim time — a key measure of customer satisfaction — has been reduced from four minutes to 43 seconds, according to the company… with only 3% to 4% of claims “on the book” are currently processed on the cloud.

MassMutual's IT executive also embraces the gradual evolution:

“It can be disruptive to move an application,” Sherriff Balogun, head of product and platform technology at MassMutual, told CIO Dive. “We’re always balancing business needs against where are our biggest opportunities to move to the cloud.”

MassMutual's IT team practices intense cloud prioritization based on a multitude of factors. They drive change focused on user interfaces and refrain from migration until the right talent is in place on the receiving end.

Hence, the solution for these FSIs may not lie in reversing completed cloud initiatives but rather in reevaluating their unwavering long-term commitment to the Cloud. They should refrain from additional migrations unless a clear ROI is evident. Business executives should prioritize which applications justify the expenses and disruptions associated with Cloud adoption, with success metrics encompassing ROI, scalability improvement, and heightened business satisfaction with IT.

Otherwise, a few years down the line, the same IT executives are likely to embark on publicity tours to extol the benefits of Cloud repatriation for their FSI.

The Pinnacle of Digital Transformation Theater in FSIs: Continuous Restructuring

Real transformation necessitates the actual evolution of the operational muscles of FSI executives and their teams. This is extremely challenging, which is why some FSI executives gravitate towards alternative paths. The more work that these alternatives generate the better, as it may take years or even decades before the Board and investors realize that effort doesn't necessarily equate to impact.

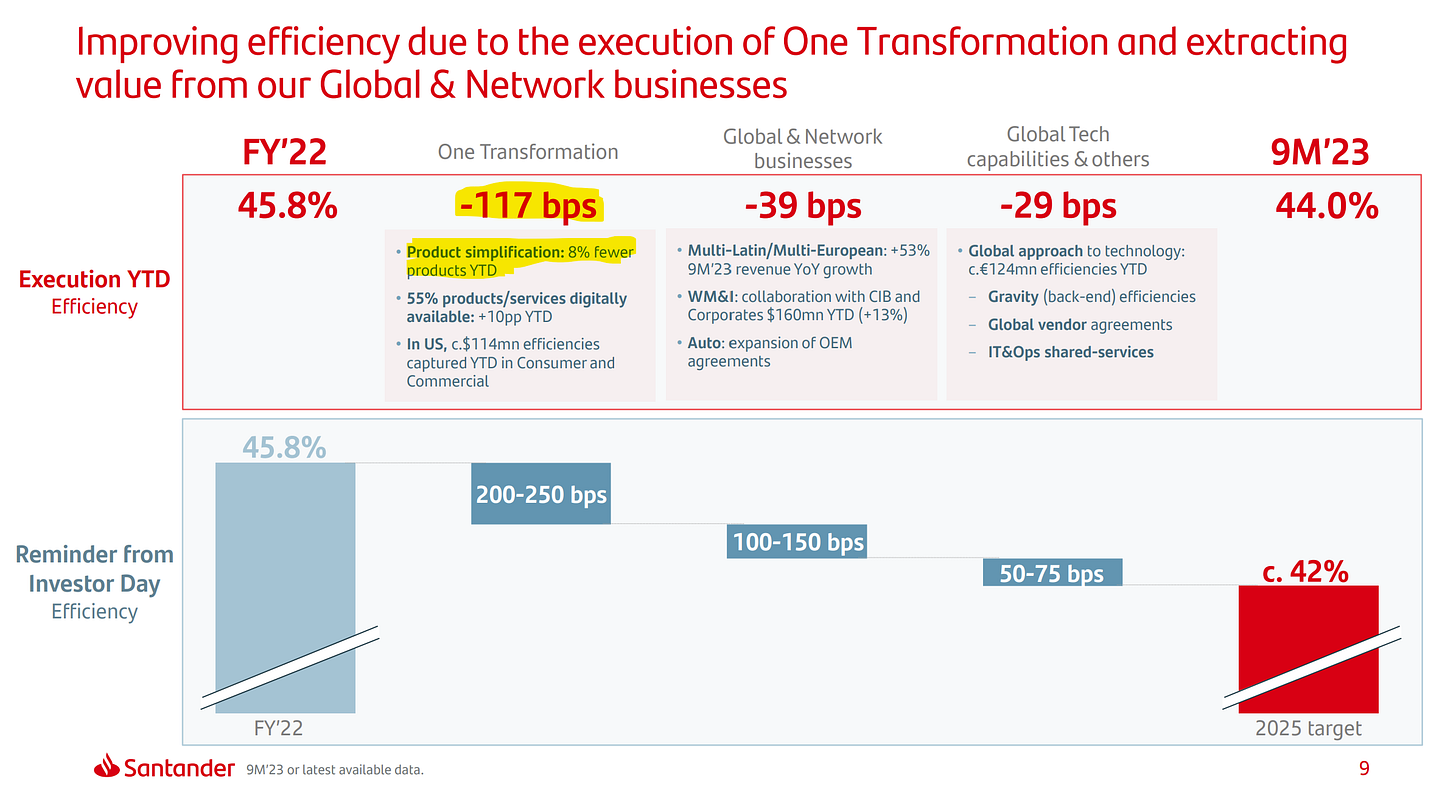

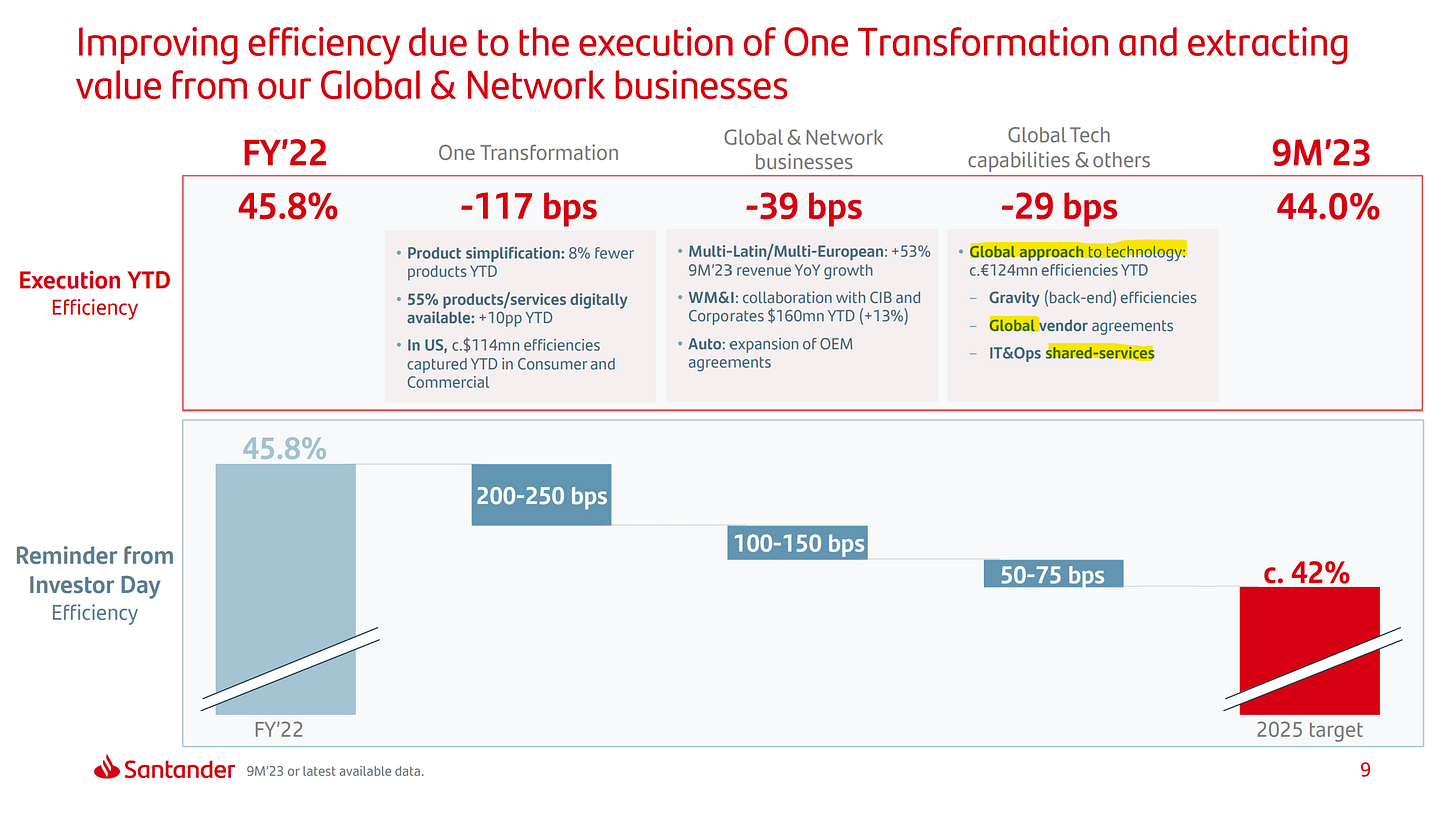

For example, Business executives love launching new products in hopes that one of them would work. Then years later, they would cut them calling it a transformation. Santander just did exactly that cutting 8% or almost 800 of its products, making it the most impactful initiative of its “transformation.”

Within IT, a similar phenomenon exists in lieu of genuine digital transformation: an unceasing cycle of restructuring, involving splitting, relocating, outsourcing, selling off, repurchasing, and consolidating various IT components, and then repeating the process every several years. Each step involves the continuous change of playbooks and training programs, creating the illusion that the organization is improving without the challenges of actual evolution. The key to this approach is to blur the line between constantly changing vs. evolving operational models.

For example, on the same page of Santander's recent earnings presentation, it highlights 'more of the same' 20th-century techniques, promising efficiencies through the consolidation of IT across business lines and regions.

A $60-billion-revenue FSI operating in 16 markets with thousands of products is aiming to reduce costs by implementing global shared services and vendor agreements. It appears that Santander is disregarding the consistently painful lessons acquired from similar attempts over the last two decades.

Maximal Effort: FSI Restructuring Edition

While a typical FSI might engage in digital transformation through IT reorganization, outsourcing, or relocation, BBVA has set the gold standard for how to combine every possible activity into a never-ending restructuring loop. Its most recent announcement unifies three separate technology firms under one brand: BBVA Technology.

Interestingly, they've made this significant effort to regroup 3,000 employees, specifically aimed at attracting and retaining talent:

“… the evolution towards a single brand intends to foster the attraction of new talent and the creation of a new value proposition, aiming to reinforce satisfaction and loyalty of current teams.”

Let's start with the most basic entity, BBVA IT España. It was 'founded' six years ago, apparently because merely having an IT department wasn't considered cool enough to attract talent.

Around the same time, BBVA, in partnership with the technology startup Stratio, co-founded Datio to lead digital transformation in the field of data.

For BBVA's IT, such partnerships appear to be a standard practice. In 2001, Accenture and BBVA co-founded Solium as a joint venture, which Accenture later acquired in 2015.

BBVA Next Technologies has a more intricate history. It emerged just five years ago from the merger of two existing group companies: BEEVA, specializing in cloud computing and big data, and i4S, which focuses on cybersecurity. What prompted this restructuring?

“… to fast track the Group’s digital transformation process and boost the company’s appeal in attracting highly specialized tech talent.”

Do you notice a recurring pattern here? Now, take a guess, when did BEEVA emerge, and how? If you guessed that it happened five years earlier through the renaming of another group within BBVA, you're quick to catch on:

But there's an intriguing twist to the reason behind the renaming:

Among the services that BEEVA will provide are consulting to make the leap to the cloud, development of cloud applications and managed services, as well as the commercialization of Amazon and Google solutions.

If BBVA's internal turnaround a decade ago wasn't challenging enough, it was also aiming to provide services to other companies.

Of course, BBVA wasn't merely relying on the renaming of its own divisions and the creation of startup ventures with 3rd parties to expedite digital transformation. In 2021, the bank entered into a 10-year deal with Accenture to enhance its digital transformation and use artificial intelligence to enhance the customer service experience.

With such love for restructuring, is it any wonder that BBVA's current stock price is on the same level as a quarter century ago?

Can IT Restructuring Ever Generate Value?

The answer to that question is "unlikely" because value is created through more effective operating & technology models of IT, not via re-branding or partnerships (see more details on partnerships in this newsletter). FSIs gravitate towards reorganization and deal-making because it is easier and more fun.

The avoidance of leveling up is apparent in survey after survey of FSI executives who consistently rank the lack of digital operating capabilities as the least of their challenges. Ironically, most of their restructuring initiatives claim that the attraction and retention of stronger talent is one of the key reasons.

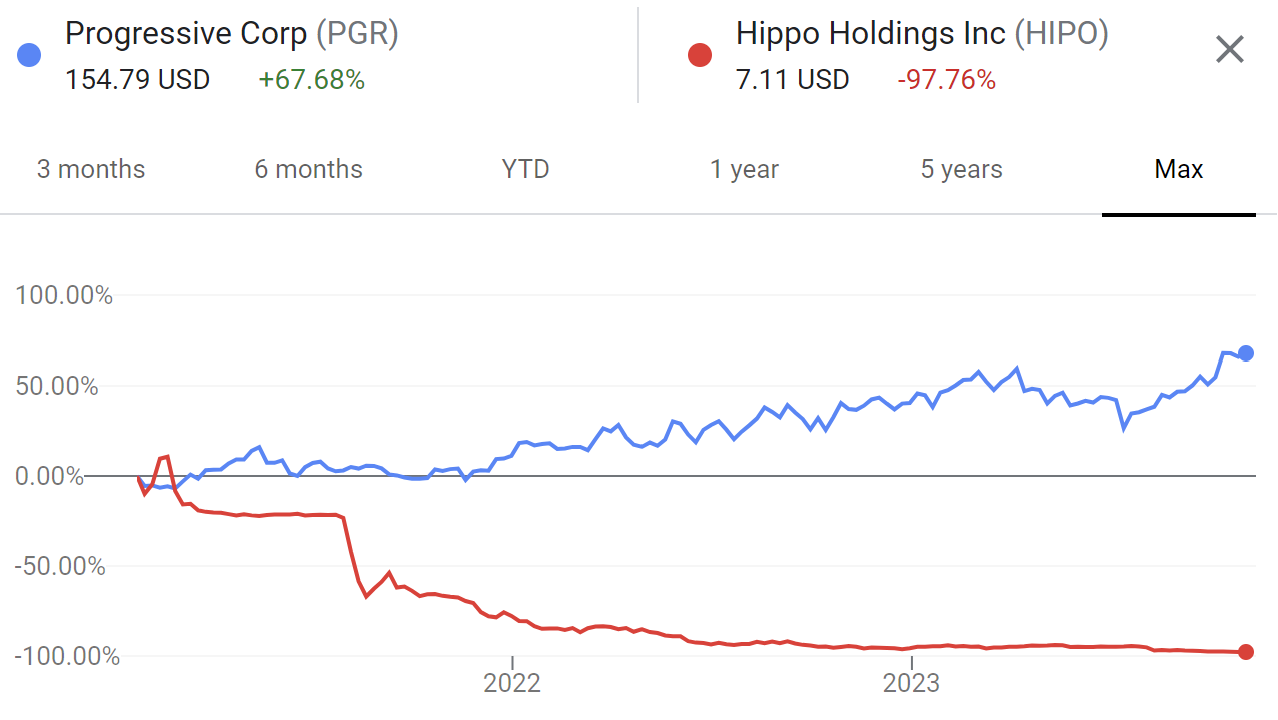

Even if a traditional FSI acquires stronger talent through restructuring alone, without effective business and operating models those individuals will build a lot of innovative capabilities but with little impact. As an example, at its peak, Hippo, a P&C insurtech, reached a valuation of over $5 billion. During that time, the startup was confident in its innovative differentiation:

However, a couple of years later, Hippo was struggling to survive, having announced a 20% layoff last week. Meanwhile, incumbents like Progressive have been quietly moving forward without much fanfare and the restructuring carousel:

Before embarking on another restructuring, FSI C-Suite should consider which customer segment, and with what product, they can acquire much more profitably as a result of such a massive initiative. Over the past five years of asking such questions, I received insightful responses in less than 10% of the cases, and half of those would fall apart under further scrutiny.

The spectacle of periodic restructuring is likely to continue, but at some point, there won't be enough corporate 'kool-aid' to justify spending years of time and so much company funds on what is virtually certain to fail.