The Inflection Point for FSIs in the Value of Digital Channels

Also in this issue: Is Your FSI Gaining Efficiency via 20th Century Playbook or by Transforming Operating Model?

The Inflection Point for FSIs in the Value of Digital Channels

Building a digital financial services or insurance company is straightforward. You create a product that consumers or businesses love. Raise funds to market it. Use social media and referrals to get the word out on the cheap. Then keep adding features, products, and client segments. Rinse and repeat.

However, most traditional FSIs don’t have a digital product that their clients "love". You could easily imagine a customer recommending Wise or Next Insurance, but it's less likely that someone will tell their friends to try the Bank of America or State Farm mobile app. That is not an issue for FSIs concerning their existing customers, as they are not attriting in high numbers. According to a recent McKinsey survey in Canada, over 60% of respondents stayed with their bank for 10+ years, with attrition (to another bank or fintech) even slightly declining between 2021 and 2023. Even for auto insurance in the US, which is very easy to switch and has seen unprecedented price hikes, attrition has been low. According to J.D. Power, the annualized switch rate was only 4% in March 2024.

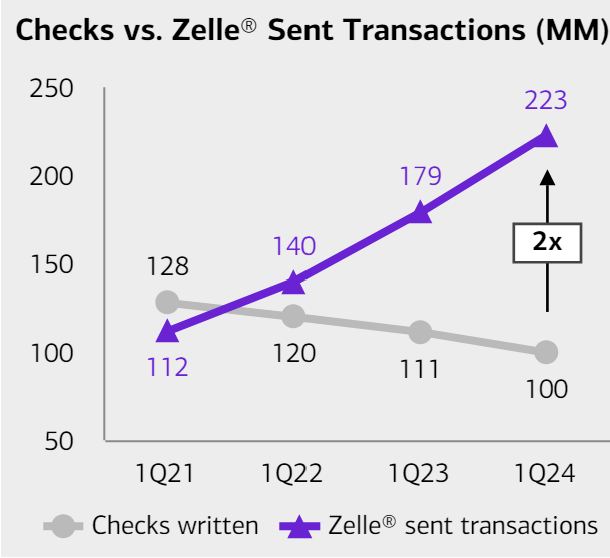

Existing customers also don’t need to be wowed to embrace digital features for formerly manual operations. Sending a manual check is a hassle, so when banks introduced a digital solution in the US called Zelle, customers embraced it wholeheartedly, and even started making more transactions as a result:

However, Zelle dashed the hopes of many bankers during its launch who called it the "Venmo killer." Not only did Zelle lack any features more exciting than Venmo's, but it also had a clunky user experience.

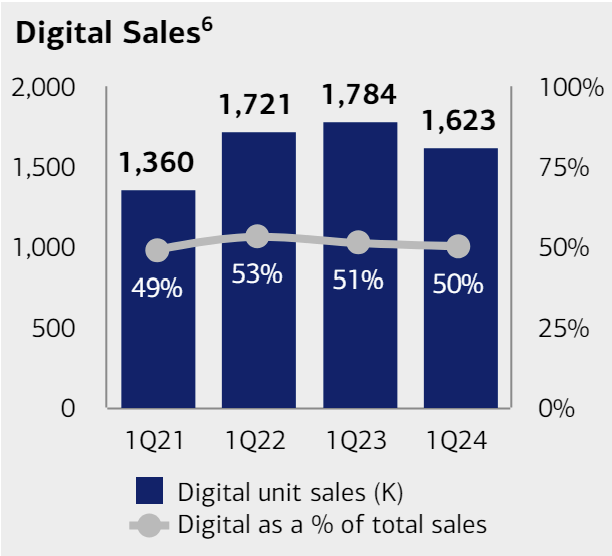

Many traditional FSIs missed those lessons, relying on digital capabilities to aid in customer acquisition indefinitely. It mostly worked until a few years ago when FSIs didn't need to compete with fintechs and could poach clients from their smaller or outdated peers. But now, the wave of startups launched around 2010 has reached scale, and most traditional FSIs have leveled up, so even incumbents like Bank of America are hitting a wall in the share of digital sales:

Progressive Insurance, the OG of insurtech that sold through a website in 1997, is on track to overtake State Farm as the US largest personal auto insurance company. Out of the top 9 players, six lost most of their business to Progressive in the recent period. Was this success due to Progressive’s digital channels?

Barely. The carrier only recently crossed the 50% threshold of digital sales share, like Bank of America. For now, its digital channel is still gaining share by just 1% annually, from 52% in 2021 to 54% in 2023.

The reason for startups not driving higher attrition, or for incumbents barely growing their digital sales share might be the same. Customers' expectations for personalization are gradually increasing, and digital capabilities alone can’t fulfill them yet. Rivel’s Q1 2024 Banking Research, which surveyed 280,000 consumers across the US, demonstrated that banks outperform fintechs in understanding customer needs and providing personalized advice:

48% of bank customers vs. 34% of fintech customers agree that their institution understands their financial needs.

37% of bank customers vs. 29% of fintech customers receive personal advice.

This, of course, is opposite to what we have been hearing from the experts for years, especially with the advent of Generative AI. Digital capabilities were supposed to be superior to human FSI associates in mass customization of engagement and targeted offers. And yet, a typical digital offer remains irrelevant, and a chatbot is still a glorified version of FAQ.

Why has AI not been a game changer recently for FSIs in ensuring the best offer to clients at the right time, highlighting the right product feature? The problem, of course, is not in the lack of analytics capabilities. Players like Capital One were already running hundreds of thousands of tests two decades ago, tracking what font size and envelope color move the needle on customer acquisition rates.

The main issue is insufficient data. Traditional FSIs and large startups are at the inflection point in digital acquisition due to a data conundrum:

Can’t procure additional data points cost-effectively at scale to generate a positive ROI for digital acquisition.

Could find such data points, but can’t procure them consistently and are not able to adjust core data models on a whim.

Can procure cost-effective and consistently available data points, but regulators won’t allow it out of fears like disparate impact.

Until your FSI can find a solution to this data puzzle or build a digital product that customers truly love, keep investing in your traditional channels. They will be around in your lifetime.

Is Your FSI Gaining Efficiency via 20th Century Playbook or by Transforming Operating Model?

“We used to make a few hundred thousand dollars on licenses from a typical insurance company, but with the transition to SaaS, we are making 5X from the same clients,” explained the Head of Sales of a leading policy administration systems (PAS) vendor. Similarly to the Cloud a decade ago or On-Demand Computing two decades ago, the FSI's hopes of saving money by adopting novel technology models like SaaS have usually resulted in disappointment.

Like the sun and wind not being consistently available, a vendor managing everyone’s application or hardware has big usage spikes that someone else has to pay for. Add to that, constant pressure on vendors to grow revenue by all means possible, including higher prices, and the efficiency gain might not be as scalable as FSIs were led to believe. Without proof of scaling from deploying new technology models, FSIs' CEOs have been facing more impatient questions from investors and analysts about their efficiency programs. In many analyst calls for Q1 2024 earnings, CEOs had to explain why the expense ratios haven’t improved yet and what would change by the end of this year to see the real scaling trend.

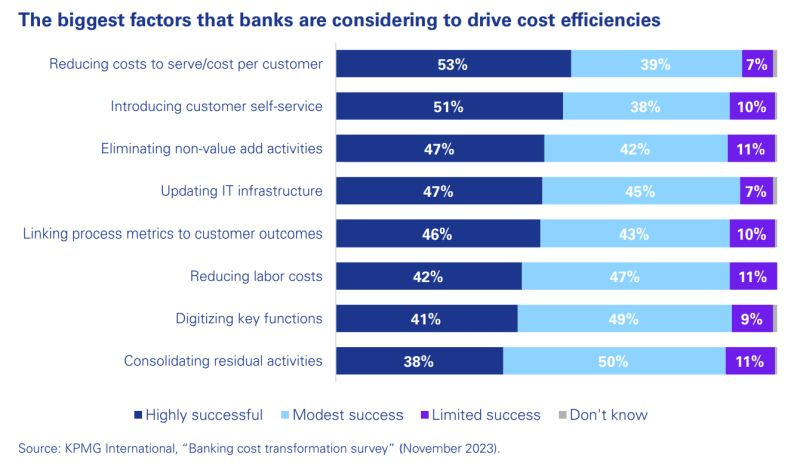

A recent KPMG survey of global banks offered a telling insight into how executives think about the most successful drivers of efficiencies:

Take a moment to reflect if some category of efficiency drivers is missing from this list. Here's a hint: Would this chart look much different in 1994, especially if we replaced "digitizing" with "automating"?

Like deploying Cloud, AI, or SaaS applications, most FSIs continue to rely on efficiency levers that don’t require the transformation of the operating model. Automating customer service is as straightforward today as it was in the 20th century because it could be done by treating support functions and IT as silos that don’t affect other groups in the FSI. The same goes for automating operations via RPA over the last decade. For example, KeyBank has implemented hundreds of RPAs, replacing hundreds of employees as a result.

Only when FSI executives internalize the "transformation" component of digital transformation do they begin to appreciate that a radical change in the operating model, including their roles, can drive much more scale than 20th-century practices. As FSIs move from IT Projects to IT Products to Value Streams and Platforms constructs, they require categorically fewer executives and frontline employees to enable the same business scope and trajectory due to:

Drastically reduced enterprise-level bloat and LOB's middle management

Forcing remaining enterprise and LOB management into hands-on responsibility.

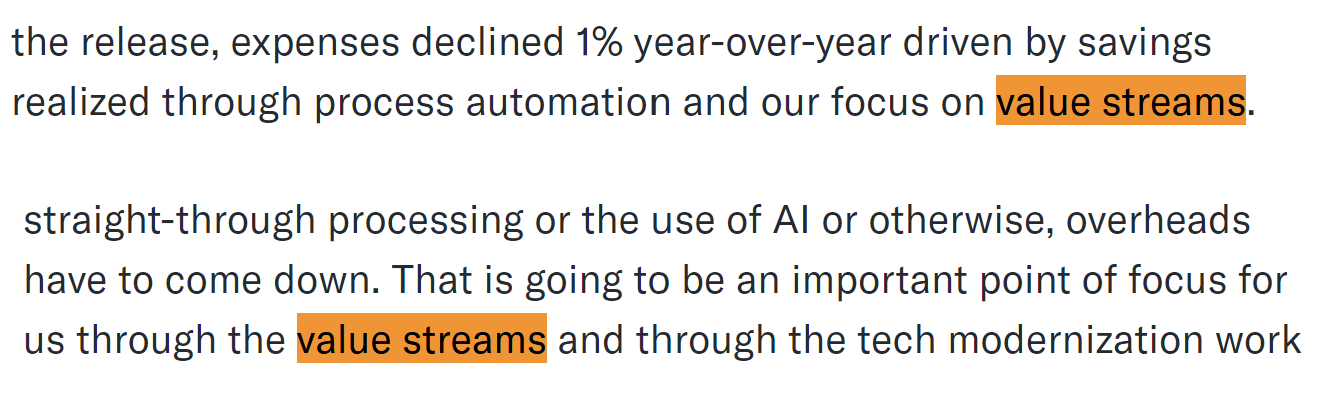

Such operating model transformation is very painful, so FSI CEOs typically emphasize the digital aspects of digital transformation (channels, Cloud, AI). However, some FSI CEOs are correctly making the operating model the explicit driver of expense reduction, like Tim Spence from Fifth Third Bank in a recent call with analysts:

Of course, such drastic change is what makes real digital transformation so risky. Only time will tell if FSIs like Fifth Third can effectively apply a more advanced operating model, or if it will become a bureaucratic charade. On the other hand, the 20th-century efficiency playbook is popular among FSIs because it is straightforward, but it won’t create lasting differentiation. Does your FSI aspire to achieve leading industry efficiency, or is being average good enough?