When It Comes to Digital Transformation, Some FSIs Confuse PR with Business Impact

Also in this issue: FSIs Should Evolve Their Operating Model Before Accelerating Technology Spend; Is It Time for FSIs to Abandon Cross-LOB Synergies?

When It Comes to Digital Transformation, Some FSIs Confuse PR with Business Impact

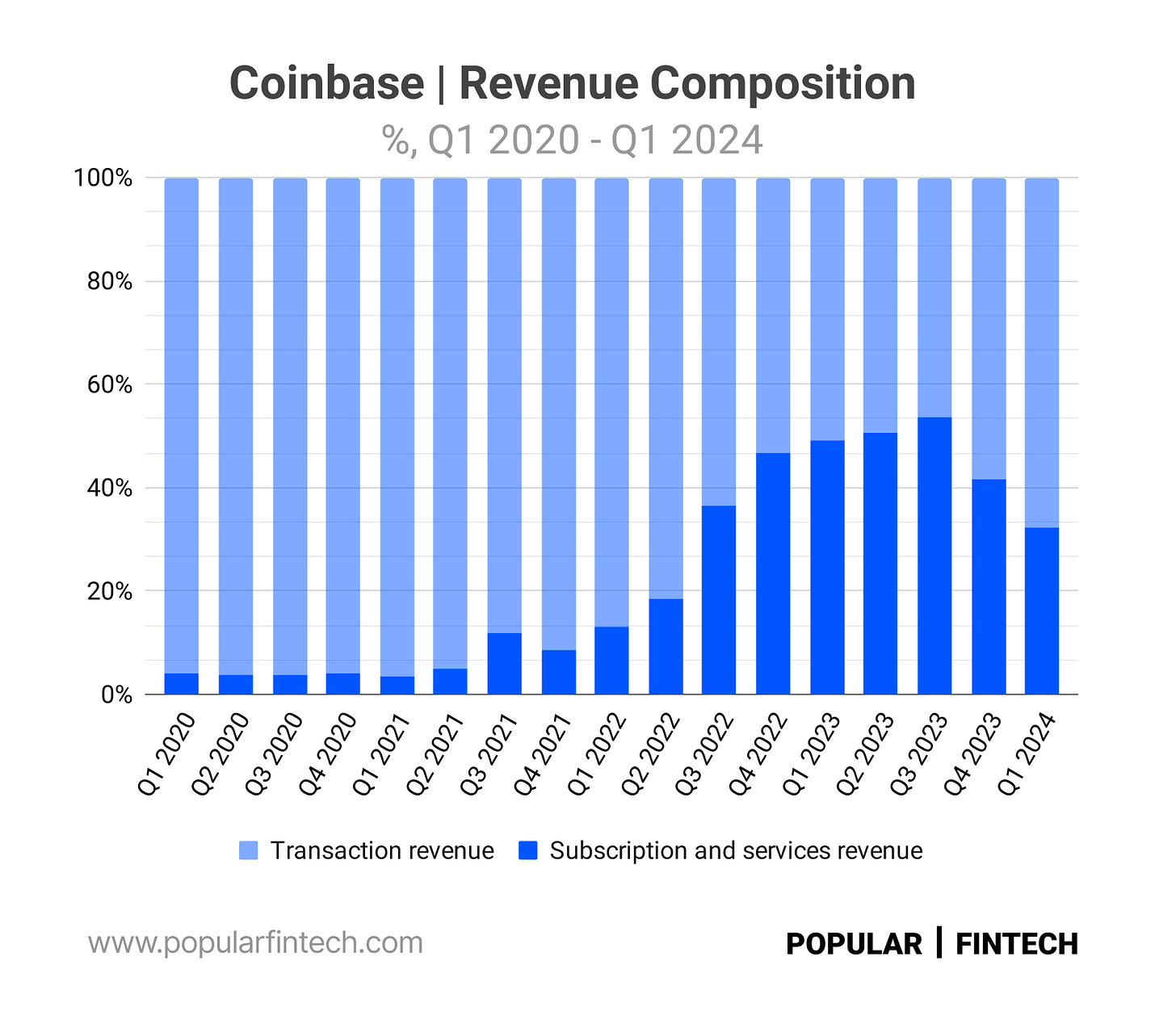

In 2012, Coinbase cleverly realized there were enough men in the US who had discretionary cash and enjoyed trading as much as playing video games, but there was no good product to let them have such fun with various crypto coins. That discovery led to what is now a $50 billion company with some other revenue streams, but the transaction revenue is still around 70% and has been increasing recently:

"We serve men who have nothing better to do" appears to be a great money-making machine, but it doesn't align well with the current zeitgeist among media, politicians, and regulators. Hence, Coinbase has to invent use cases that demonstrate caring about its customers' well-being or show efforts to improve the world as a whole. In its recent ad, the crypto fintech featured a young, well-off, and artistic Mexican who sends money to his grandmother either by visiting a bank branch or personally flying home:

Never mind that the predominant remittance user is a blue-collar, middle-aged Mexican who gets paid in cash and uses his favorite kiosk agent with spotty KYC. Coinbase's ad is not meant to generate more business; it is a PR effort aimed at other audiences.

Lemonade also plays a long PR game of AI-native superiority. Despite its stock collapsing 90% a couple of years ago and remaining stagnant since then, its CEO continues to evangelize that AI "transforms everything - from risk management to the cost to serve to the consumer experience." Saying this recently on CNBC's Fast Money while the screen displayed those devastating stock charts would hopefully serve as a profound inspiration to all traditional FSI CEOs:

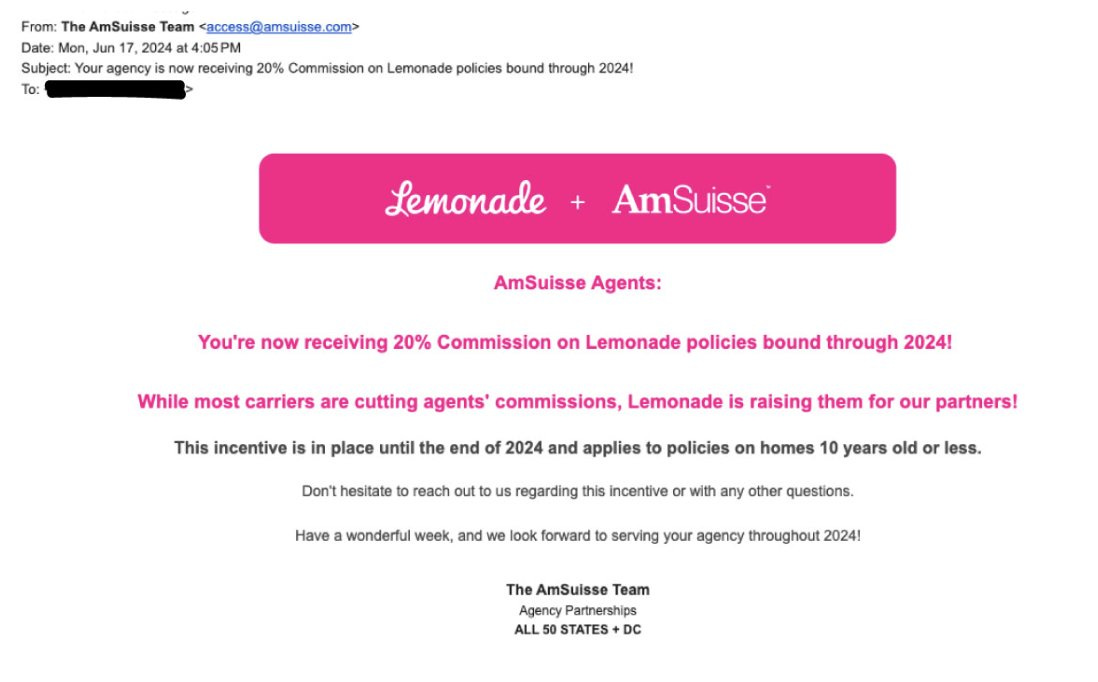

Like Coinbase making money from crypto trading, Lemonade also aims to increase earnings in the real world, regardless of its PR talking points. Insurance industry expert Matteo Carbone noticed a recent contradiction: instead of replacing agents with AI, Lemonade is actually increasing their commission:

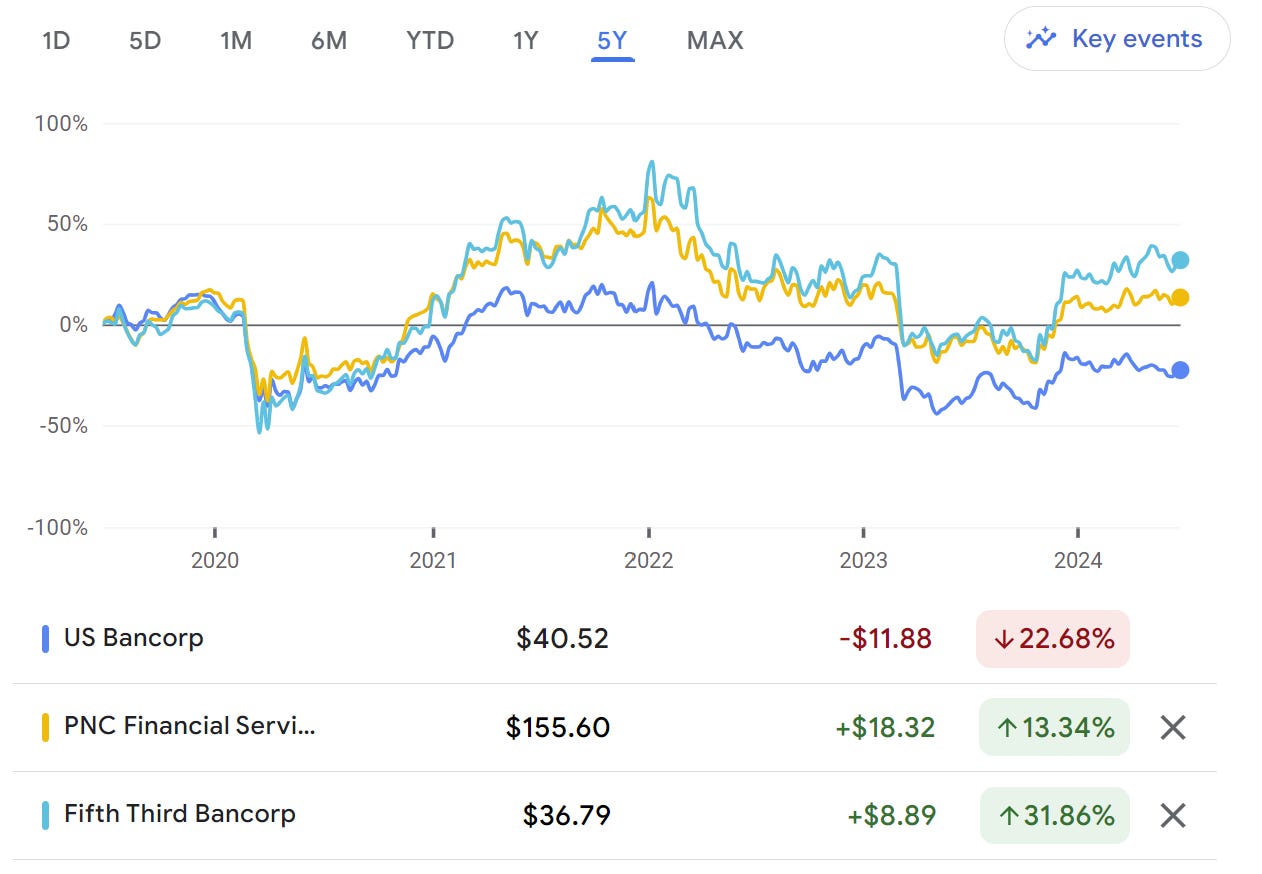

Some traditional FSIs fail to differentiate between the PR of startups and their actual business model. As a result, they over-index on innovation, as illustrated by one large Midwestern bank. Look at the 5-year stock performance of the three FSIs below and guess which one is called "pound-for-pound the most innovative bank in the US" with "the most advanced innovation process in banking.”

Naturally, it is U.S. Bank whose stock is 20% behind the regional banking index and 30-60% behind some of its peers over the same period. An industry expert, Jim Marous, recently interviewed the Chief Innovation Officer at U.S. Bank, Don Relyea. Don leads a group of 6 innovation teams that cover both company-wide innovation processes—applied foresight, scaling innovation, research facilitation—and specific innovation topics like fintech, AI, and blockchain.

As is standard in such interviews, there wasn’t a single question about ROI, likely because there isn't any. If Jim Marous had asked Don Relyea what the revenue and profit difference would be if U.S. Bank had never started a centralized innovation group, the answer might have been illuminating for both sides. After investing $8 billion in technology since 2019, the country’s fifth-largest bank is only now starting to see a payoff. Moreover, its digital strategy focuses on traditional efficiencies while measuring success with vanity KPIs.

The second law of digital transformation in FSIs states that organizational entropy grows over time. Having 6 centralized innovation teams only accelerates this trend. Instead, the key to fighting entropy is regularly culling ranks and removing units that don’t generate revenues or are not required by revenue-generating groups. While it’s tempting for FSIs to feel as cool as startups and maintain PR with made-up use cases or technological differentiation, they should remember to spend real money on what actually generates profits.

FSIs Should Evolve Their Operating Model Before Accelerating Technology Spend

It was already known in the 20th century that higher spending on technology does not guarantee FSIs a correlated improvement in long-term growth and profits. The notoriety of Big Bang implementations is specifically due to their failure to drive business impact. The insight in the 21st century is that coinciding digital transformation with higher spending makes positive ROI even less likely. Instead, starving teams that spearhead the transformation of the operating model in FSI are more likely to accelerate their leveling up.

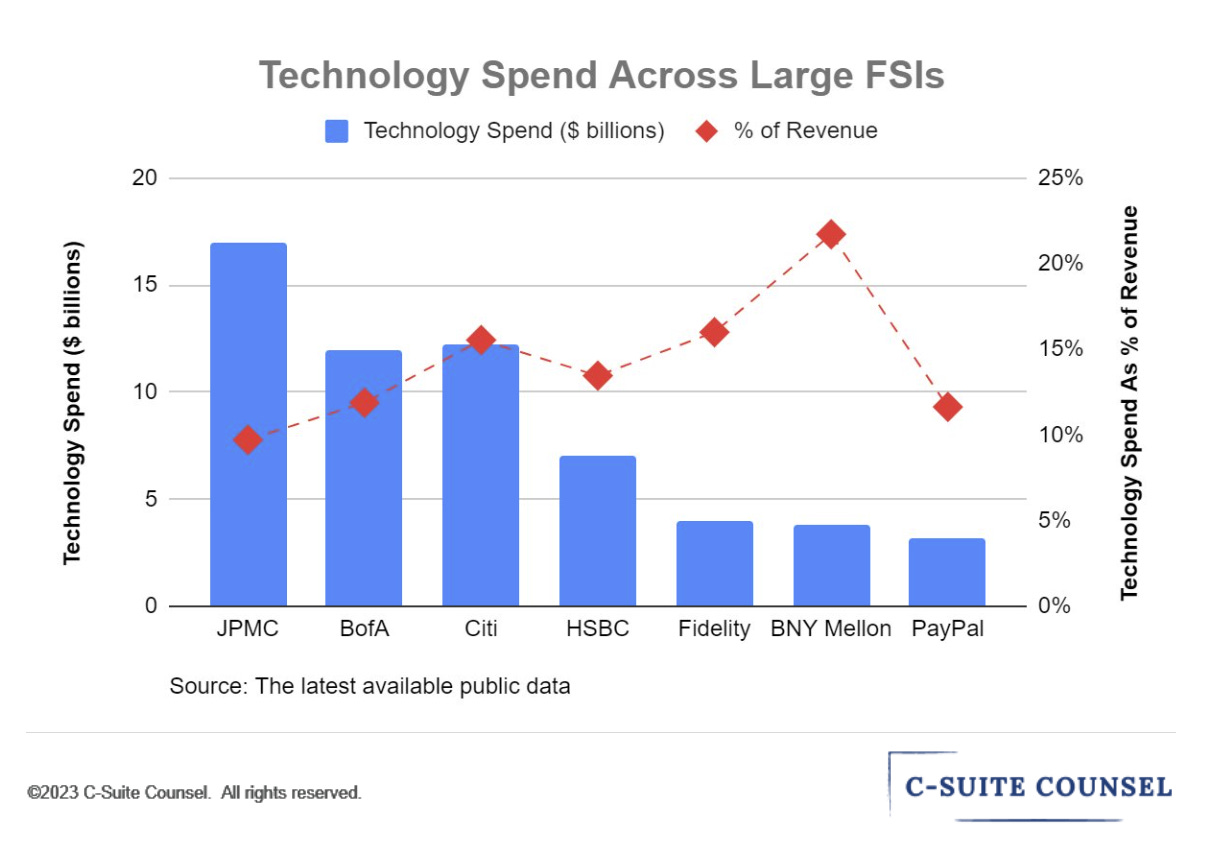

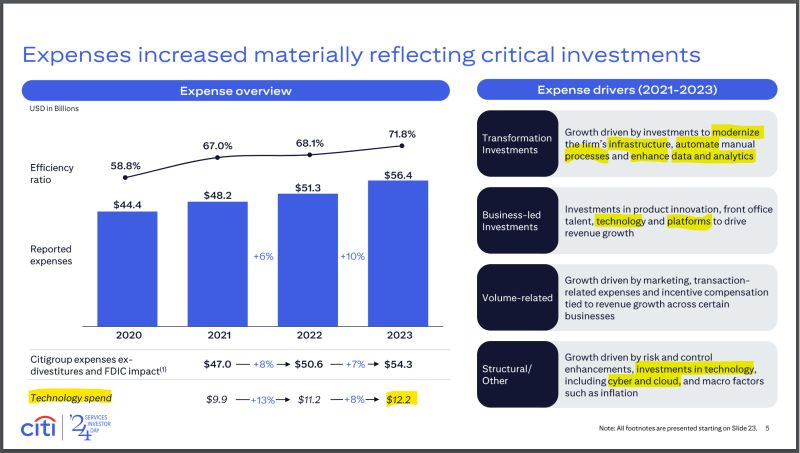

Many FSIs continue to defy these lessons by granting their groups lavish technology budgets, which are often used to hire consultants and purchase trendy tech, rather than facilitating genuine internal transformation. Citi demonstrates such risky behavior with its significantly higher relative spending on technology compared to its main competitors. It spends 60% more than JPMorgan Chase and 30% more than Bank of America as a percentage of revenue:

During the recent Investor Day, Citi justified its unprecedented technology spending (and surging "inefficiency" ratio) with the usual digital buzzwords: modernization, automation, platforms, cybersecurity, and cloud. More significantly, these expenses were labeled as "critical" despite their clear discretionary nature. And, of course, there was no mention of whether Citi aligns its increased spending with evolving its operating model (i.e., "transformation").

Labeling technology spending as "critical" is not unique to Citi. The hype is so strong that even the CFO of JPMorgan Chase, Jeremy Barnum, famously declared that he basically doesn’t know how to measure the impact of technology investments:

“I just think like it's sort of mandatory, right? … Otherwise, we risk getting severely disrupted.”

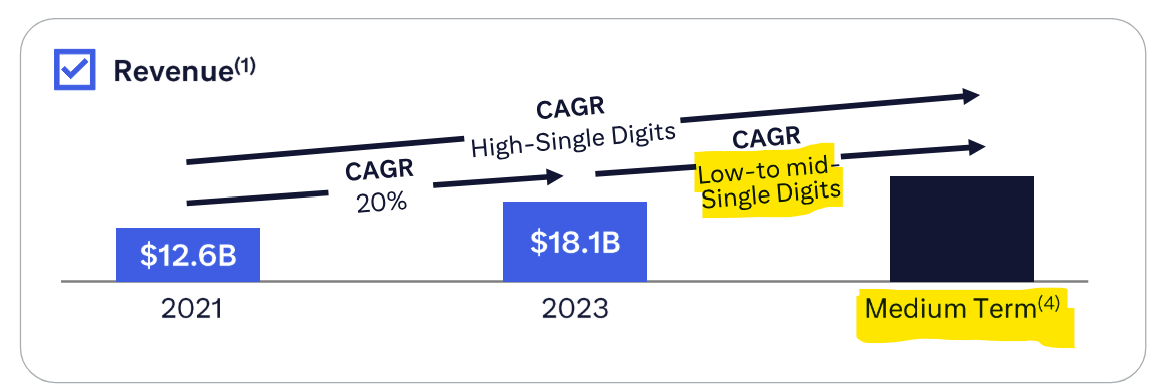

But Citi spends significantly more than JPMC per revenue while being years behind in maturing its operating model, with no plans to close that gap. Such rapid and widespread technological change in Citi's notoriously opaque environment is destined to fail. Ironically, Citi confirms this likely outcome by planning for growth in line with or slightly exceeding inflation through the foreseeable future (until 2026):

The same disconnect between the publicized vision and likely outcomes was illustrated by Citi's recent discussion of Generative AI. Forbes published the alarming prediction by Citi:

… the banking industry will be the hardest-hit by the deployment of AI, with 54% of roles at risk for AI-led job displacement. Additionally, another 12% of banking jobs could be potentially augmented by AI.

After recent rounds of layoffs due to another restructuring, is Citi signaling to its employees that more massive workforce reductions are coming? Of course not. In practice, Citi’s two main AI initiatives are personalized investment recommendations for its wealth management clients and the expansion of its cybersecurity offerings.

More effective FSIs with extra cash prioritize higher technology spending on products where the business could achieve medium-term ROI and there is a track record of value capture through collaboration between business and IT teams. Until then, companies would do better to lower ambitions and technology spending so digital transformation has a chance to succeed. Let competition burn through their war chest and waste years on innovation while growing in low single digits.

Is It Time for FSIs to Abandon Cross-LOB Synergies?

Ten years ago, there was a general consensus that Western incumbent FSIs would not survive due to a combined onslaught from highly competent Big Tech and fintechs. A charitable synthesis by now could be that it is still early days, but at least for Big Tech, the failure to make a significant impact seems fairly certain. Facebook's payment attempts have become a meme of failure, particularly with its crypto foray via Libra-Diem. Google's Wallet and Pay products have been reincarnated so many times that it's hard to keep count. More recently, Apple announced the shutdown of its BNPL product, Apple Pay, after more than a year on the market.

Fintechs are faring better, especially in simpler payment products, as long as they refrain from attempting synergies across multiple business segments. The recent announcement by Santander to build a global in-house core platform was shocking partly because it aimed to integrate consumer and commercial businesses, even as leading payment fintechs struggle to generate value from cross-LOB synergies.

PayPal is perhaps the most notable case, with its stock down 80% from highs three years ago, largely due to its inability to create synergies across numerous acquisitions. Its new CEO is assembling a leadership team from other single-digit growth giants, such as a recent Walmart hire for a CTO role. This may signal an end to attempts at creating a payment ecosystem but also implies that slow growth could become a permanent fixture.

One might assume that newer fintechs like Block are succeeding in driving cross-LOB synergies, but the reality is not much better, if at all. Fintech expert Alex Johnson highlighted internal conflicts across Block's core business lines, with Square and Cash App disagreements over customer data sharing and revenue splits. Despite Block's stock outperforming PayPal slightly over the past several years, its growth has slowed to low double digits with no breakthroughs in cross-LOB integration on the horizon.

The most recent casualty among leading fintech companies is Klarna's Checkout business. Bloomberg reported its sale after 12 years:

“Klarna is looking to divest the Klarna Checkout to remove the friction and completely focus on working with its distribution channels,” according to the documents. “Thus, creating a simple relationship to all partners without the PSP vs Checkout conflict.”

This is good news for traditional FSIs with multiple business lines. Whether it's data privacy concerns, platform integration, or channel conflict, their struggles are not necessarily due to lower competence but because overcoming these impediments may not yield a positive ROI or have a regulatory-friendly solution. Therefore, the next time a C-Suite executive proposes collaborating to develop a cross-LOB value proposition, it may be prudent to dissuade them from pursuing such initiatives.