What Five Things Should an FSI Executive Accomplish for Digital Transformation Each Week?

Also in this issue: Crypto Is the Most Entertaining Product in the History of Financial Services and Insurance

What Five Things Should an FSI Executive Accomplish for Digital Transformation Each Week?

“Our top product team is modernizing the finance function,” explained the head of digital transformation at the asset management division of a $50 billion FSI. Noticing my surprised expression, he added, “The CFO was keen to pilot a cross-functional team, so we prioritized that area.” Despite frequently publicizing its digital transformation successes, this division struggled to assign its best team to a revenue-generating use case.

In discussions with FSI executives who aim to accelerate digital transformation, I often observe a striking disconnect: They are eager to learn about leading fintechs’ business and technology models but show little interest in how their counterparts operate daily. It’s like a Lexus driver wanting to master a Formula 1 car but only focusing on the vehicle itself, ignoring the essential skills of the driver and support team.

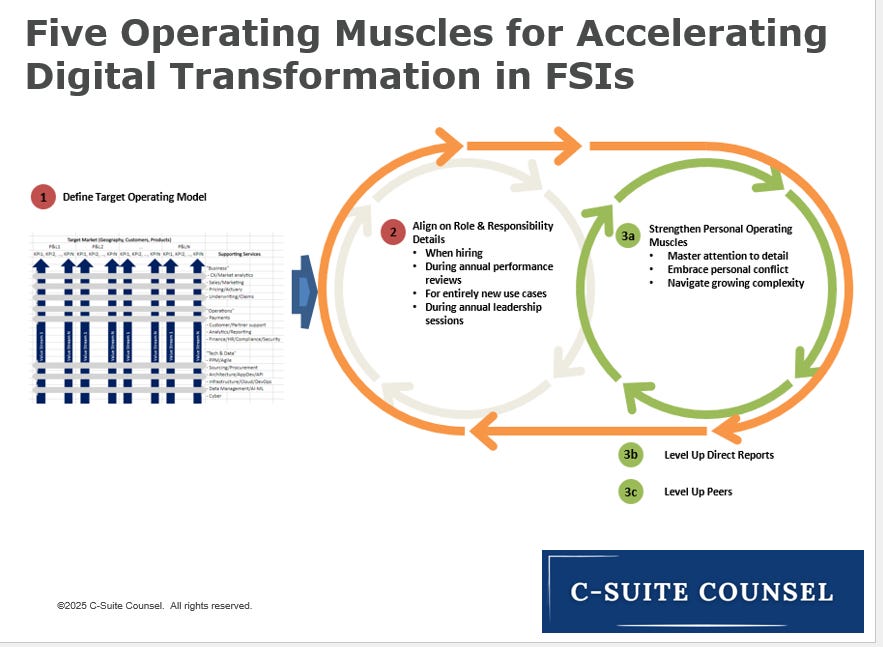

The actual "secret sauce" lies in the more effective operating model and the individual operating muscles of managers and employees at top-performing FSIs and fintechs. This translates into a fundamentally different set of activities compared to average companies. Achieving this involves five steps, reinforced daily: defining the target operating model, aligning roles and responsibilities, strengthening personal operating muscles, and leveling up direct reports and peers.

If Elon Musk’s infamous “5 bullets of what you accomplished” email were sent to managers in a typical FSI, the response likely wouldn’t include any of these five steps. Instead, managers might highlight digital strategy planning, product launches, or tool purchases. Struggling traditional FSIs and fintechs also engage in such “digital” activities because they don’t represent true “transformation.”

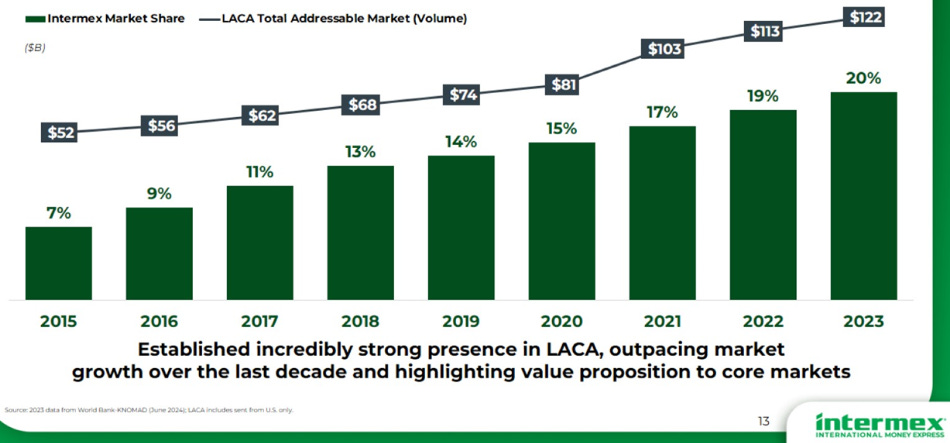

The supremacy of operating models and execution over flashy tech capabilities is apparent in B2B verticals, where some financial services firms and P&C insurers have achieved remarkable growth without relying on AI or APIs. Even in consumer sectors like remittances, it has been possible to capture significant market share without a mobile app. Over the past decade, Intermex has tripled its offline market share from the U.S. to top LatAm corridors with a 9X LTV/CAC in a market that more than doubled during that period.

The lack of a digital "silver bullet" is also evident in the absence of truly innovative business models over the past few decades. Cash App charges for instant transfers, Stripe charges per transaction, and Wise uses a fee-only model without an FX spread—but none of these feel as groundbreaking as the business models of Amazon, Netflix, or Spotify. Instead, these successes embody Charlie Munger’s principle: “Take a simple idea and take it seriously.”

Overreliance on flashy business models and hyped-up tech can backfire. The core thesis behind "AI-natives" like Pagaya, Upstart, and Lemonade was that their tech-driven models would provide lasting differentiation. However, their stocks have plummeted 80-95% from their peaks. After a decade, Varo, one of the lucky recipients of a U.S. bank charter, remains unprofitable, and its founder, Colin Walsh, was recently replaced as CEO.

Our 2023 newsletter highlighted the flaw in Walsh's vision of targeting low-income customers with various products and creating a superior integrated solution. Walsh’s background at Amex and Lloyds led him to focus too heavily on a business model designed to upgrade Walmart-type customers to a complex Whole Foods-style experience—even though Whole Foods itself disproved that idea:

“Whole Foods has opened up stores in inner cities. We’ve opened up stores in poor areas. And we see the choices. It’s less about access and more about people making poor choices, mostly due to ignorance. It’s like a being an alcoholic. People are just not conscious of the fact that they have food addictions and need to do anything about it.”

Meanwhile, the winning fintechs also make strategic mistakes but stand out through more agile operating models and higher-intensity talent. As a result, 2025 could be a pivotal year for neobanks in developed countries, with some reaching 10% of the revenue of top incumbents: Cash App (consumer fiat-only) compared to Chase, N26 against Deutsche Bank's Consumer Bank, and Monzo Bank competing with HSBC's UK Personal Banking division.

One of the most successful consumer fintechs globally was founded by an entrepreneur with prior experience in the restaurant, dumpling, and beer businesses. Oleg Tinkov launched Tinkoff Bank, specifically replicating Capital One’s business model. His key innovation for a Russian market with little consumer financial history was delivering cards in person and observing applicants for red flags of creditworthiness. Tinkov is now advising dozens of his best former employees on how to scale a similar playbook in Mexico (Plata Card).

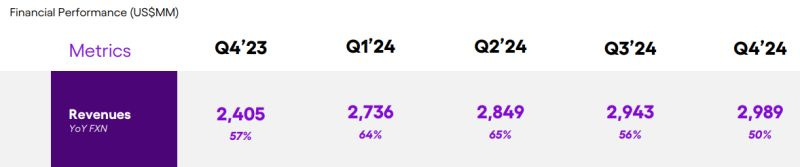

Of course, the biggest neobank success story outside of China is Nubank. Like Tinkoff but a decade later for Brazil, it was founded with a no-fee credit card aimed at an underserved segment. Nubank then built a core banking platform across a typical product line that could scale globally. Similarly, it continues expanding its target segments, products, and countries, on track to catch up with the regional incumbent, Itaú, in the next couple of years.

If your FSI believes the market is too saturated and that transforming the operating model and talent intensity can’t generate billions in value, consider the example of Ramp in the U.S., which was launched in 2019 and is already worth $13 billion. What’s its “secret sauce” for reaching $100M in annualized revenues within three years and then continuing to double its payments volume annually in a market dominated by SAP Concur and numerous fintechs? One key factor is that, in its early years, a third of Ramp’s team were former founders.

An effective operating model with high-agency talent also requires fewer staff, not an opaque abundance of resources. The combination of the 2021 fintech bubble and COVID-related stress led to JPMorgan’s $175M fiasco with the acquisition of fintech Frank. Apparently, a 350-person due diligence team relied on third-party representations and a few Zoom calls with the fintech founder.

Even if your FSI’s effectiveness declines, restarting the transformation is never too late. Of course, shifting the trajectory from downward to upward requires even more effort, which digital natives often refer to as “founder mode.” For example, after multiple rounds of massive layoffs, Brex is rapidly growing again:

So, if your executive, CEO, or board member asked for five bullets of what you accomplished last week, could you name at least one activity related to transforming the operating model, yourself, or others in the company? To accelerate digital transformation, resist the temptation to deploy solutions with the same effectiveness. Otherwise, your FSI could face a 5% revenue drop, an efficiency ratio stuck at 67%, and yet still celebrate having 100% of apps in the Cloud. And then what?

Crypto Is the Most Entertaining Product in the History of Financial Services and Insurance

Since banking began three millennia ago, when grain was stored and lent in lieu of money, no product has existed like crypto. And it's not due to some technological or cryptographic breakthrough—fiat products like this existed before. Crypto is the only financial service or insurance product for which providers are so embarrassed by its use cases that they fabricate adoption scenarios and willfully ignore the reality of traditional alternatives.

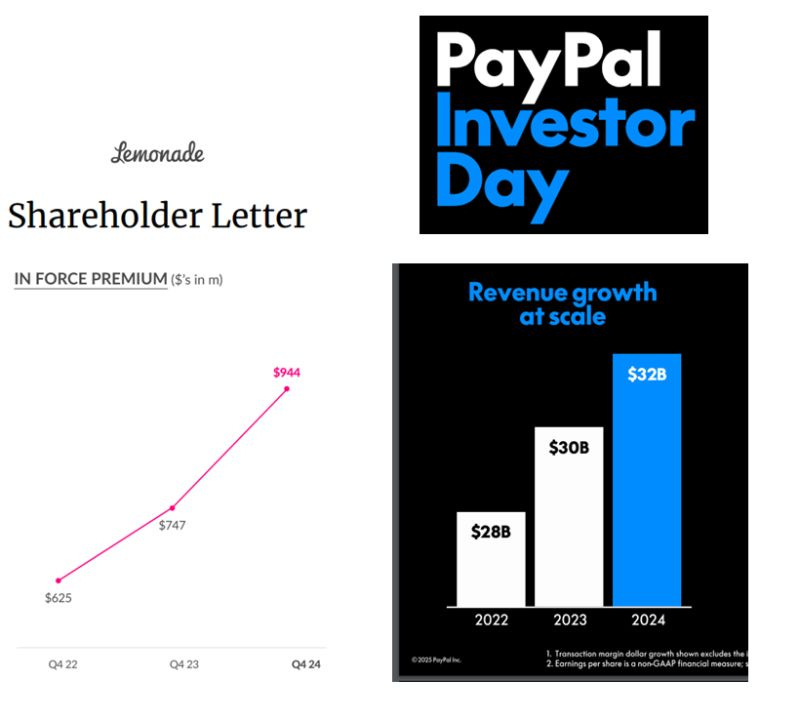

Crypto firms go far beyond the standard shade-throwing or nebulous misdirection that fintechs use as part of their "growth hacking." In those cases, observing the timeless tradition of tweaking narratives to mislead investors is almost endearing, a practice carried forward by each new generation of financial services and insurance startups. PayPal and Lemonade thoughtfully showcased this best practice on the same day.

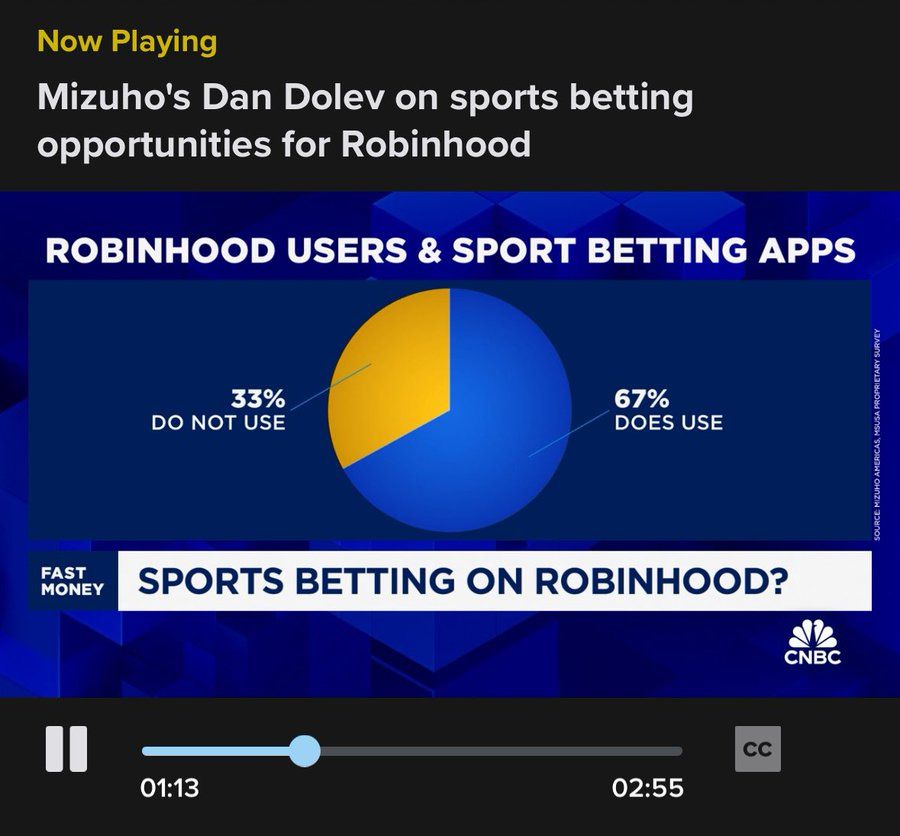

It’s also common for fintechs to claim a broader mission of democratizing finance and transforming the lives of underserved communities in places like Sub-Saharan Africa while actually catering to well-off individuals in the world’s most developed economies. For example, Robinhood identified millions of young men in the U.S. and other wealthy countries with more time and money than they knew what to do with. Instead of spending all their time on video games, sports betting, or trying to impress girls at bars, they could do something equally exciting—trading.

Robinhood capitalized on this desire by incorporating gaming hooks, cleverly realizing that the end goal was entertainment. Fintech expert Jevgenijs Kazanins recently shared a report showing that two-thirds of people who trade on Robinhood also use sports betting services. Naturally, Robinhood’s mission is “democratizing finance for all."

Crypto has become an even more lucrative trading and custody business because clients are willing to pay higher margins. Coinbase doubled its revenue to $7 billion in 2024. By simply taking customer fiat in exchange for its private coin and investing that into U.S. Treasuries, Tether generated $13 billion in net profits in 2024—more than American Express and double BlackRock's.

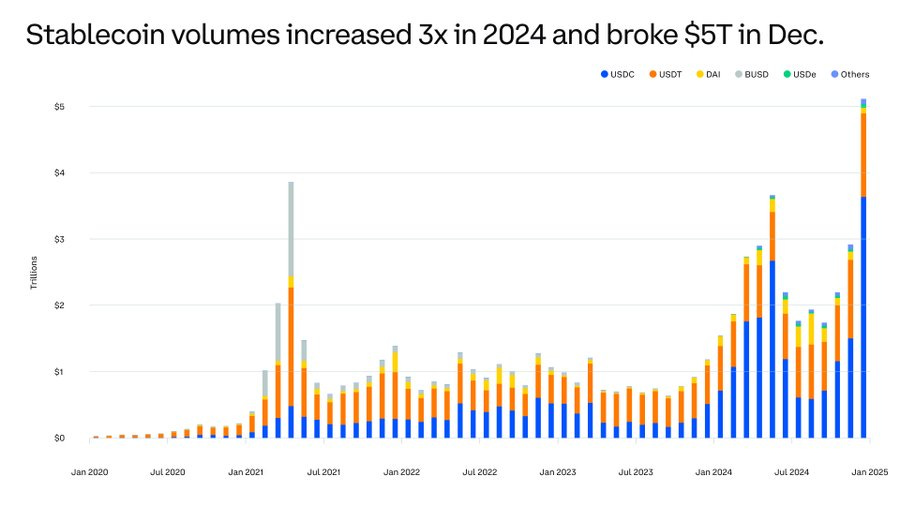

But, strangely, these firms don’t want to make peace with how they make money and who their repeat client segments are. Instead, they desperately wish for customers, partners, and regulators to believe that crypto adds real economic value. Coinbase’s founder, Brian Armstrong, recently made a fascinating statement, suggesting that its payment processing volume was twice that of Visa, with perhaps only a tiny bit not tied to purchasing goods and services:

“If you think of us like a payments company…TBH i'm not sure where we rank on that list. There are various ways to measure it, but there were about $30T in total stablecoin payments last year (not all of those were goods and services though).”

Circle took a safer approach to implying broad adoption, recently announcing, "With a year-over-year growth rate of over 100%, USDC adoption is accelerating globally, and today, it reached $56 billion in circulation. The future of money is here." The problem with using coin market cap as a proxy for market adoption is that it periodically skyrockets and collapses, which would be abnormal for a payments company in Web2. But maybe that's how things work in the Web3 universe.

Another amusing aspect of their embarrassment with core use cases is that crypto players highlight the supposed horrors of using fiat rails. For example, Coinbase’s advertisement last year featured an artistic Mexican allegedly flying home from the U.S. to deliver cash to his family. Sling Money’s recent ad had someone claiming that he could finally send money to his family in the Czech Republic, as if the Iron Curtain had just come down. A recent commercial from another crypto player hired actors to pretend that paying with fiat wallets and credit cards in stores is unbearably difficult:

A decade-long willful ignorance among crypto founders, who pretend that payments and money transfers today work as poorly as they did in the 1970s, is one of financial history's most fascinating anthropological phenomena. They would rather believe that remittances cost an average of 6.65%, not because 70% of migrants still prefer cash kiosks for their intimacy and relaxed KYC processes but because of a lack of fast and cheap fiat rails.

Moreover, it’s not as if cross-border money transfer providers haven’t been trying for a decade to make blockchain technology useful. Putting a $1 billion global pre-funding pool and a couple of FX desk experts to better use would be nice. However, neither traditional players like Western Union nor fintechs like Wise have found a positive trade-off for switching rails. Remitly outlined several reasons for this in its recent annual report:

“… those utilizing blockchain technology and digital or crypto assets often claim benefits of lower cost transactions and higher transfer speeds relative to incumbent money-movement providers. However, price volatility, various fiat conversion fees, user friction, lack of trust, legal and regulatory uncertainty, and other factors have limited the utility of cryptocurrencies, as well as digital assets broadly, for remittances.”

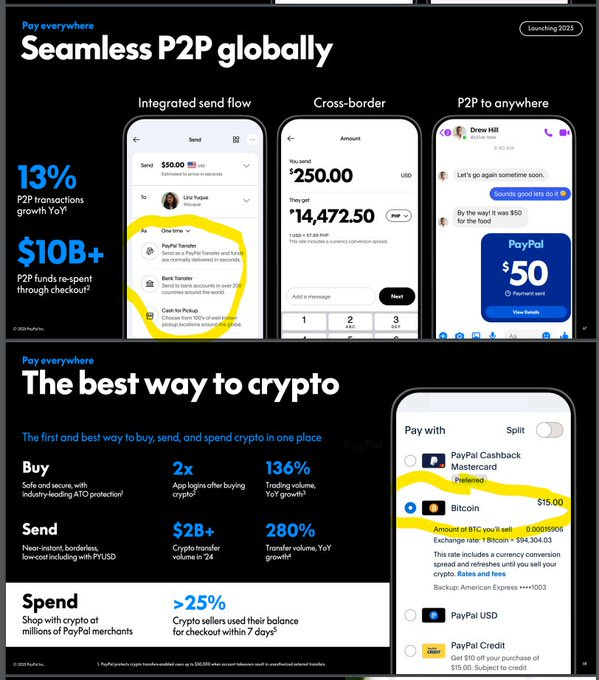

Some payment and money transfer providers have launched their own stablecoins, like PayPal with PYUSD. However, screen space on a mobile app is too valuable to display options that customers don’t use. Not only did PayPal omit PYUSD as a remittance option in its recent Investor Day presentation, but even on the crypto-specific slide, it highlighted a paid Bitcoin transfer over PYUSD.

The allure of blockchain technology has even seduced some fintech experts. The better ones at least acknowledge that fiat rails are becoming faster and cheaper. However, when inefficiencies persist in specific niches, their conclusion is often the same: the problem must be the rails themselves—enter crypto payments to the rescue. Each new expert arriving on the scene seems to have the exact lightbulb moment: If only 8 billion people connected directly to one proprietary rail, built on blockchain because it's cool, they could transfer money instantly and for free. How has no one else thought of this brilliant idea?

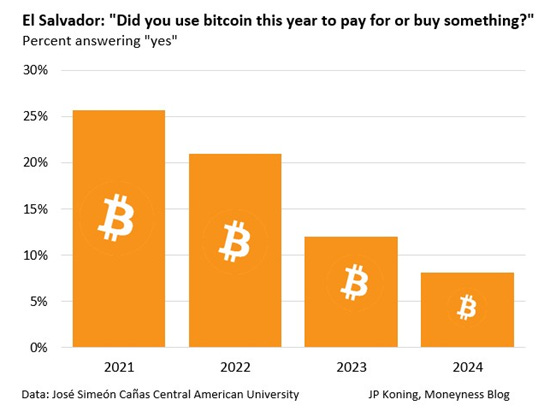

The lack of interest from crypto providers in truly understanding payments and money transfers became evident when El Salvador launched Bitcoin as legal tender. Having a strong-willed president willing to back the cause with both incentives and coercion seemed like a once-in-a-lifetime opportunity. And yet, no major crypto player provided any material support.

With the Trump administration, crypto’s entertainment value has skyrocketed. In one recent episode, traditional crypto players were outraged that groups kept launching major memecoins tied to political figures, including the president and first lady—only to see them collapse, tarnishing the sector’s reputation. It is as if the first 10 million coins were all groundbreaking projects aimed at financial inclusion, and now they suddenly can’t recognize what their industry has become.

The Trump administration recently announced a "crypto strategic reserve" stocked with various coins—including some that can be minted at will, with no extra costs, energy, or otherwise. Essentially, this means swapping U.S. dollars for volatile, highly correlated cryptocurrencies. Naturally, this is supposed to transform finance and help pay off the U.S. government's $36 trillion debt. Even Coinbase’s founder, of "$30 trillion in mostly payments" fame, had to take a moment to process that one:

Not surprisingly, amid the crypto bonanza, even more conservative fintechs like Klarna are now ready to jump on the gravy train. After dismissing crypto as a “decentralized Ponzi scheme” in the wake of the FTX fiasco, Klarna’s CEO now seems to recognize that such schemes have effectively become legal—as long as customer funds are parked in U.S. Treasuries.

And, of course, traditional FSIs aren’t far behind. Bank of America recently announced it’s ready to fire up the printing press as soon as lawmakers clear the formalities. Ah, yes, the banker’s dream—minting their own money, exchanging it for fiat, and sidestepping any yield in a moderate interest rate environment. As more FSIs hop on the money-printing bandwagon, it’s best to see this as entertainment rather than a typical financial service or insurance product. That way, even if it all goes up in flames one day, at least the journey was good for a few laughs.