FSI CEOs Who Mandate Uniform Return to Office Don't Get Digital Transformation

Also in this issue: If FSI Has Doubts About Digital Transformation, It's Probably Fine As It Is

FSI CEOs Who Mandate Uniform Return to Office Don't Get Digital Transformation

"Has COVID-19 pandemic made your life better or worse?" It was an odd question to ask a group of professionals in their 30s-40s during the summer of 2021. The global pandemic is meant to be a horrible experience. Nevertheless, almost everyone reluctantly shared that their quality of life had significantly improved. Plenty got sick but fought off the virus, and luckily there were no deaths among their family members and friends. They also gained more financial resilience, but the most frequently mentioned aspect was the joy and convenience of working from home.

It took Covid to illustrate that the daily office routine was detrimental to employees' quality of life and financial well-being. But perhaps more pertinent to FSIs' bottom line, the global pandemic also provided a natural experiment that economists could only dream about — finally allowing us to learn how working from home impacts the office employees’ productivity.

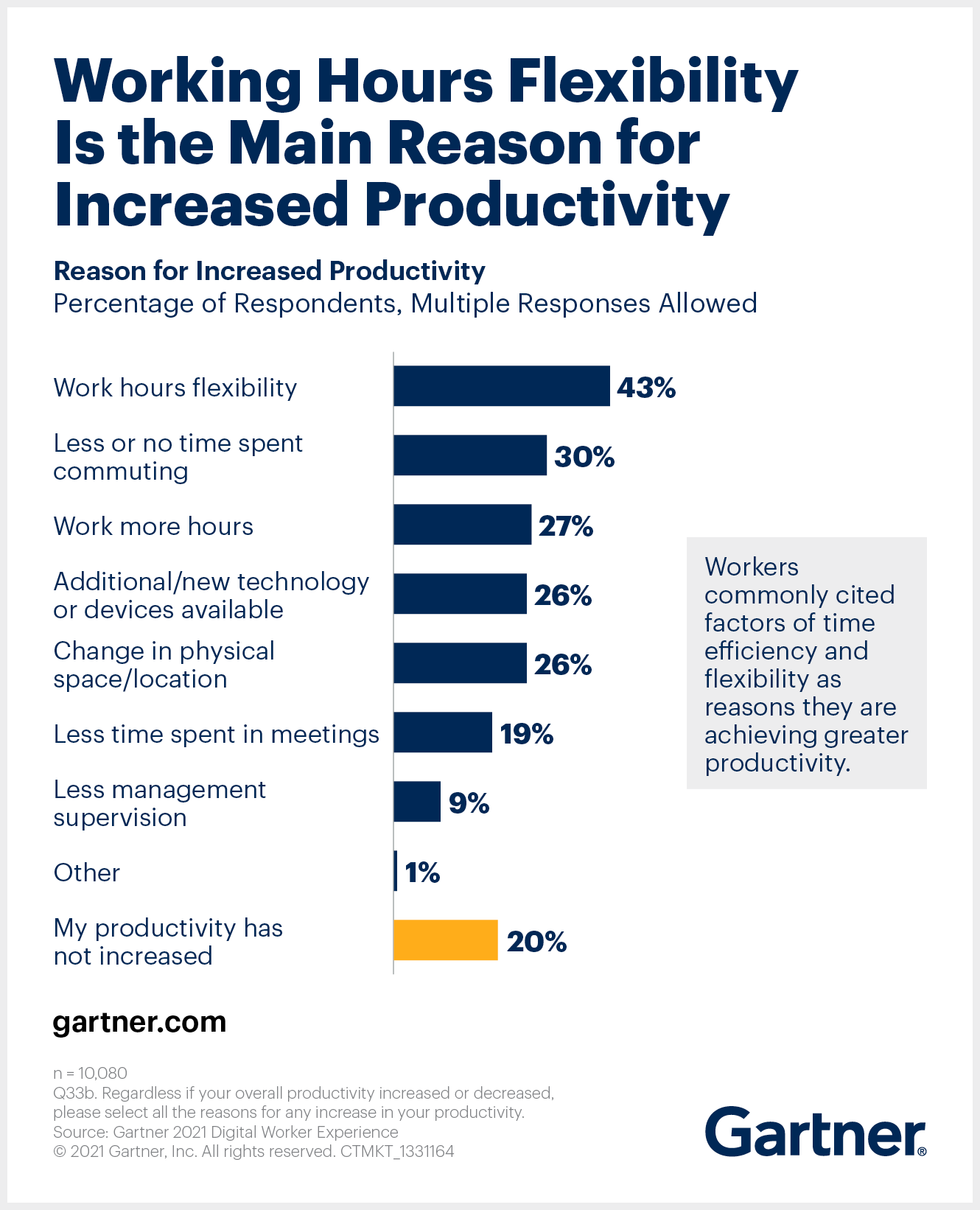

A year after Covid started, there was sufficient data to decisively conclude that working from home generally improves employee productivity. Who knew that the financial services and insurance industries actually involve a lot of repetitive processes that don't require ongoing in-person brainstorming?! On top of the obvious re-use of commuting hours, it was surprising to see that many employees were working longer hours from home. Therefore, albeit inadvertently rather than via forward thinking, FSI CEOs got themselves an incredible deal - more productive and happier employees with less office cost.

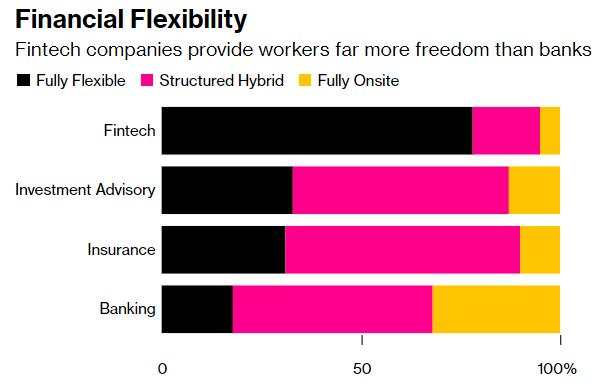

After a couple of months when Covid started, I began visiting FSI clients again and noticed a strange pattern: the most likely person one could meet in the office was a member of the C-Suite. They were genuinely miffed that junior staff were not joining them. However, it was still bewildering to hear about more and more prominent FSI CEOs demanding a uniform return to the office for their employees (data below as of early 2023) - why were they dismissing conclusive evidence?

Those FSI CEOs pushed for such a nonsensical policy partly because it mirrored the way they ascended the ranks themselves. During my days as an M&A intern, being constantly on call and enduring all-nighters was the norm. Additionally, in-person yelling was deemed more effective when surrounded by colleagues.

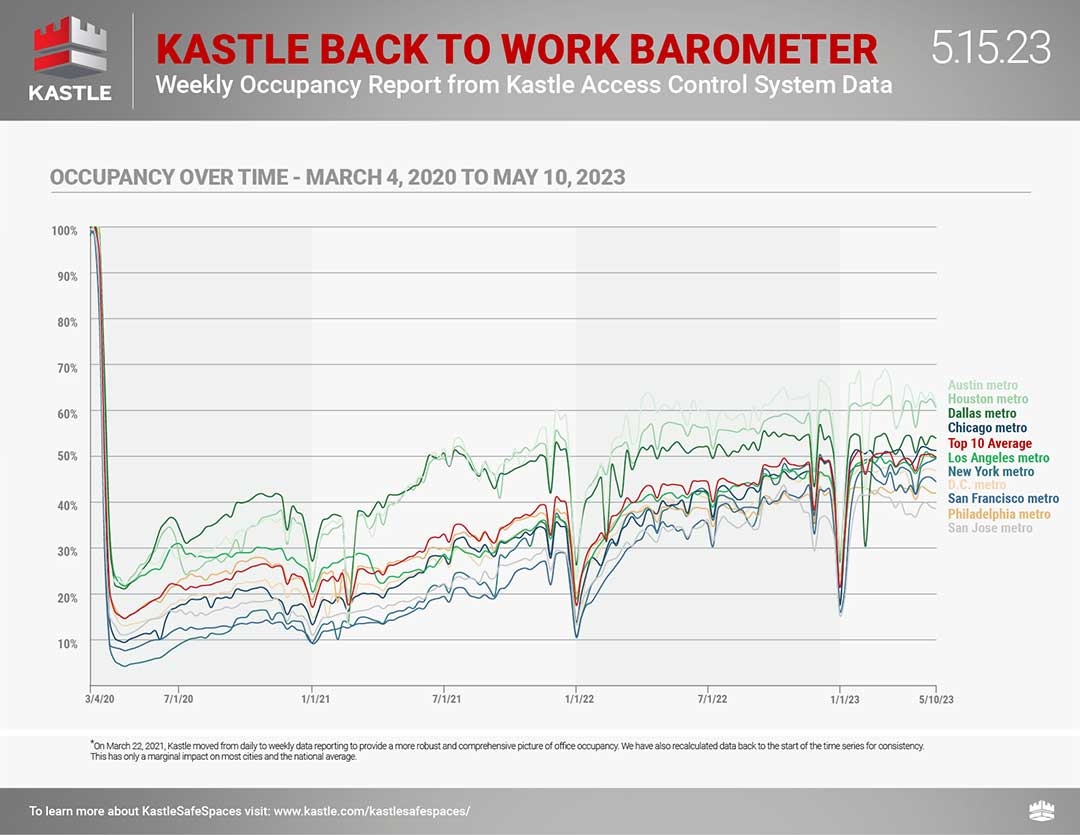

Many FSIs also possess extensive real estate holdings, both for their own utilization prior to Covid and as investments. Although the occupancy rate is improving, it still remains financially unsustainable at 50% across major US cities, where most FSIs are located. With the US Commercial Real Estate market valued at $20 trillion, certain FSI executives are understandably distressed by the possibility that half of that value may have already dissipated.

There is also an irony in FSIs advocating for a universal return to the office for 3-5 days per week while expressing concerns about a significant environmental impact of emissions. JPMorgan is attempting to reconcile this contradiction by justifying their impressive forthcoming headquarters with gizmos like AI for energy management, advanced water re-use systems, and automatic solar shades. Interestingly, akin to private jets, office commutes seem to be regarded as emission-free.

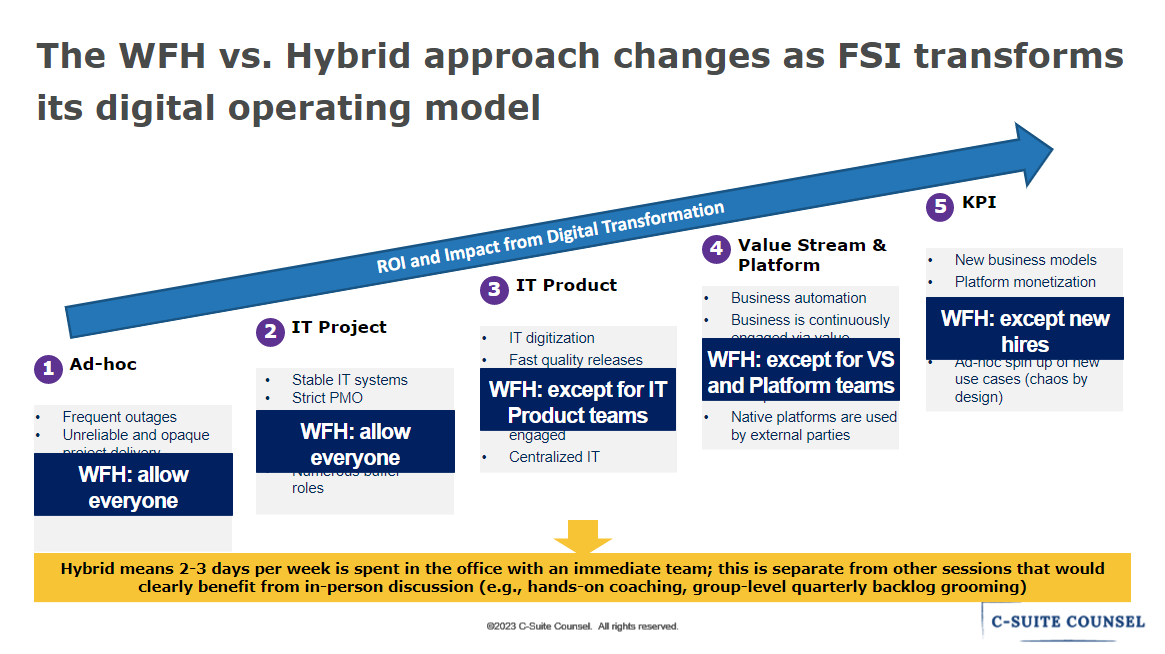

Let's now explore a relevant question for our newsletter: How should FSIs think of working from the office vs. home in the context of digital transformation? The answer is obvious—unless a particular group of people is developing new operating muscles, allowing others to work from home is a win-win (plus, it helps the environment for those who really care). And even for the teams/groups that are leveling up, 2-3 days per week is optimal for absorbing the change without feeling excessively overwhelmed.

This commonsensical approach is congruent with Citi’s return-to-office mandate for low-performing employees. Leveling up is designed to fail when done remotely, whether it involves high-performers who are learning advanced operating muscles or low performers struggling with basic ones. Conversely, FSIs embarking on digital transformation must enforce a hybrid work arrangement for specific teams. If ideal employees do not self-select into such an arrangement, FSIs would be better off exploring alternative staffing options, considering temporary-to-permanent arrangements, or even postponing digital transformation.

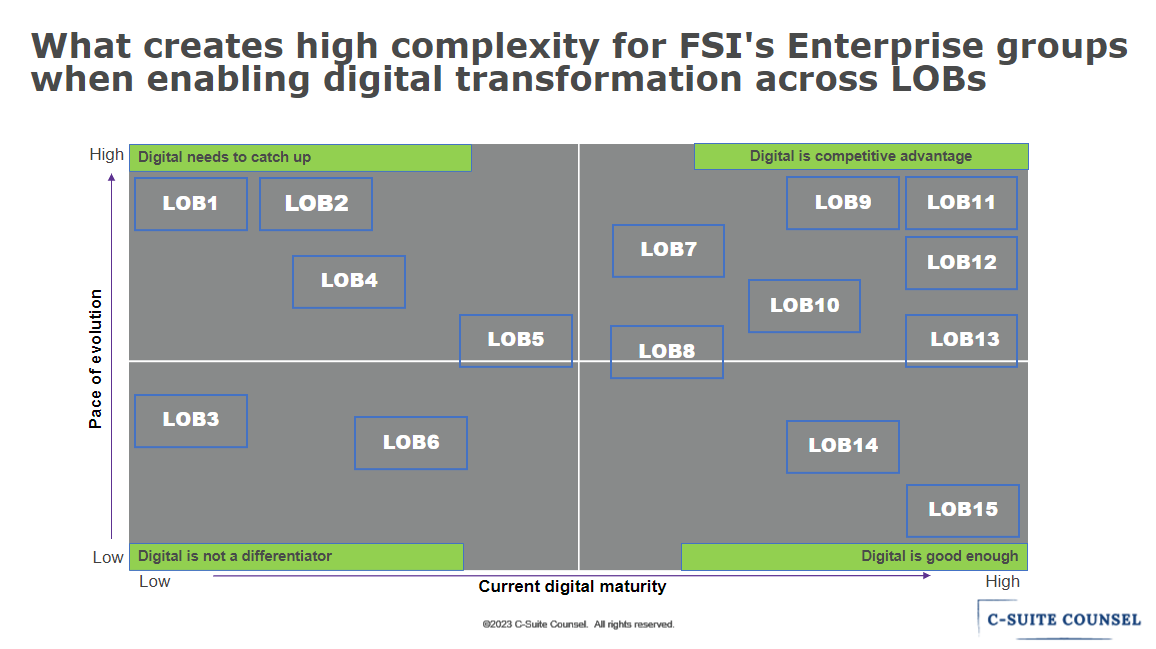

FSI CEOs who are unwilling to embrace such a nuanced mindset regarding work arrangements still don’t get the fundamental premise of successful digital transformation: a gradual, fit-for-purpose evolution of operating models across lines of business and functions, leading to multiple speeds of transformation within the organization (for more details, refer to this newsletter).

Depending on the stage of each LOB/Function in the digital transformation evolution, operating models differ fundamentally. It's akin to training for the minor league, then collegiate, and finally Major League Baseball. If all those teams are under the same owner, they wouldn't follow the same training regimen. By implementing a uniform office presence policy, FSI CEOs are undermining the development of new operating muscles in their organizations. The 20th-century model they are mandating may evoke nostalgia, but it is antithetical to the sophisticated mechanisms of digital transformation.

To FSI employees who are unfortunate enough to be subjected to such a nonsensical policy, don't give up. If Elon changed his mind after the Twitter employees revolted, who is to say that leaders like David, Jamie, Larry, and others wouldn't be more open to reason when faced with internal pushback?

If FSI Has Doubts About Digital Transformation, It's Probably Fine As It Is

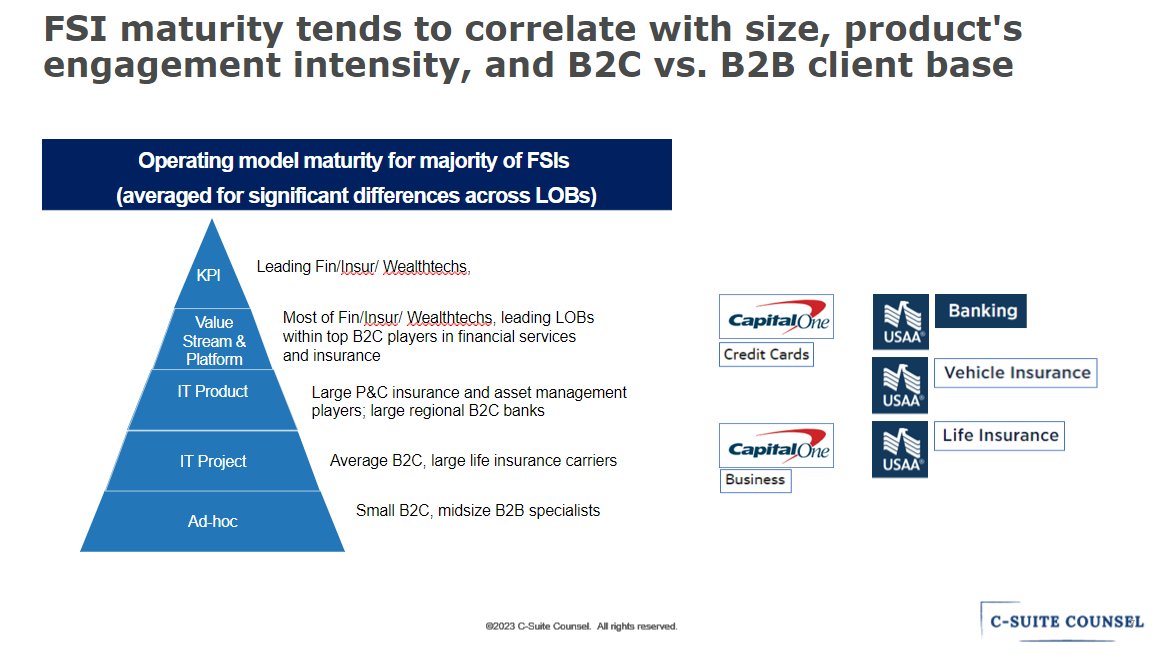

Our newsletters consistently explore the notion that traditional FSIs are not obligated to pursue digital transformation. Despite being bombarded with warnings for over a decade about the imminent collapse of their business models, many financial services and insurance companies find that their tried-and-true centralized IT operating model from the 20th century provides sufficient defenses. The catchphrase 'digitally transform or perish' may sound compelling, but it fails to reflect the reality for a vast majority of these companies.

Of course, if an FSI's business executives are determined to pursue new markets and business models, digital transformation becomes imperative. However, the majority of FSI leaders are content with an approximate 5% growth rate. Moreover, digital transformation is inherently challenging, as we highlight weekly. Therefore, sticking to the maturity lane of your FSI segment is often the optimal course of action (see this this newsletter for why “agility” is overrated).

But few FSI executives are willing to publicly acknowledge a slower pace of change without promoting some superficial digital attributes like being all-in on Agile or Cloud-first. Hence, it is always encouraging to see more honest reflections.

Let’s start with a Level 2 (“IT Project”) financial services firm, Sunflower Bank. Similarly to the majority of FSIs of its size (~$10 billion in assets), Sunflower Bank has been fortifying its foundational IT capabilities before rushing into the digital space. Here is how its CIO, Brian Mulcahey, illustrates the bank’s evolution from Level 1 to Level 2 of digital maturity:

“Five years ago, we had a very disjointed technology stack. In the last couple of years, we’ve shown the organization the benefits of an enterprise architecture approach and how much more efficient it is to have everybody on the same stack of applications… The business learned to trust me because there were fewer problems and their systems ran smoothly.”

Instead of prematurely diverting efforts towards shiny technology and startup-grade practices, Brian wisely directs the bank towards completing the foundational capabilities of IT during this year. These include data management, organizational change management, onboarding, and project intake (read the full case study here).

What would be a similar commonsensical evolution from Level 2 to Level 3? Here is how Sears Merritt, Head of Enterprise Technology & Experience at MassMutual, describes it in the context of data-related capabilities:

Instead of attempting to pull data from Excel using AI, Sears prioritized addressing the foundation of data management. Only afterward, he redirected resources toward enabling IT product teams (read his full interview here). This approach stands in contrast to the typical implementation seen across FSIs, as described by industry Data executive Julia Bardmesser:

“Too many companies jump to a currently fashionable use of data (APIs, micro services, data science, AI is the rage currently) without putting foundations of data management in place. The results are usually underwhelming - lots of money spent, not a lot of value achieved.”

As we discussed in another newsletter, Level 3 represents the most precarious phase of digital transformation. It is during this stage that many FSIs mistakenly believe they have established enough IT capabilities to double down on digital transformation before involving Business persistently. Some divisions of Tokio Marine are currently in this stage, and the global headquarters in Japan have deployed two initiatives to expedite digital transformation:

“Global Innovation Labs in 7 locations across the world with the goal of driving Digital Transformation in each region… also, the Global Digital Round Table, a global committee to share expertise and knowhow amongst group companies, which has been effectively accelerating Digital Transformation on a global scale.”

While well-meaning, in my experience, such top-down coordination efforts, coupled with budgetary support, often lead to excessive digitization. As we discussed in another newsletter, it is very challenging for global/enterprise leadership to strike the right balance between enabling vs. pushing digital transformation. However, Tokio Marine's CIO, Robert Pick, offers a refreshing perspective:

“… a lot of digital work simply doesn't need to be "transformative," either, to achieve meaningful business goals. There is nothing at all wrong or shameful in making digital progress through small, incremental changes.”

The next time a colleague, vendor, or advisor tells you that your FSI is lagging behind in digital transformation without providing supporting data, inform them that you prefer to be cautious and avoid premature attempts at leveling up, while your competitors squander their resources.