Annual PSA: The Most Perplexing Waste in the Digital Transformation of FSIs

Also in this issue: FSIs Perfect the Art of Sleight of Hand to Justify GenAI Investments

Annual PSA: The Most Perplexing Waste in the Digital Transformation of FSIs

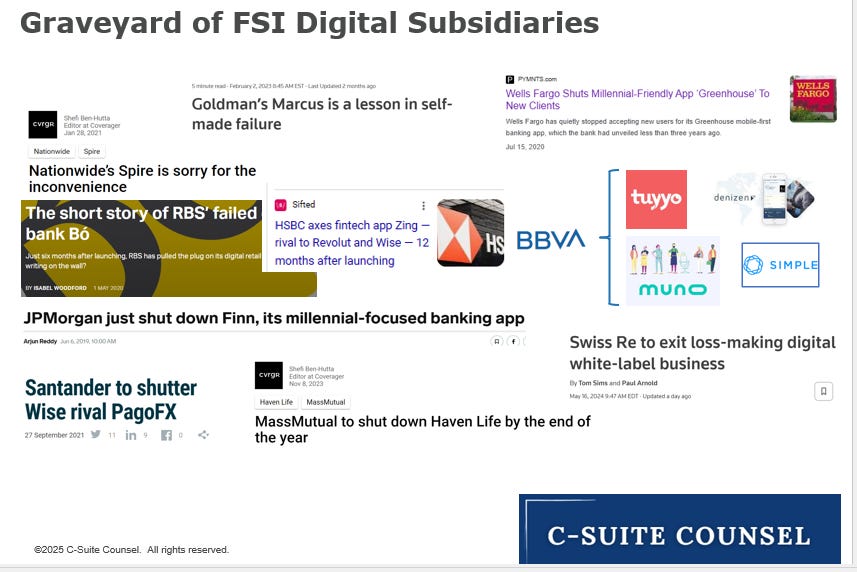

When publishing “The Most Perplexing Waste in the Digital Transformation of FSIs” on January 2, 2024, I hoped other FSIs had learned the lesson and would avoid such an obvious and costly mistake. Little did I know that just hours later, HSBC would announce the launch of its cross-border money transfer subsidiary, Zing. Within a year, it was shut down, joining the long list of similar failures:

In the weeks following Zing’s launch, I outlined why it was destined to fail—not due to unique foresight, but because these subsidiaries consistently fail for the same reasons: 1) razor-thin margins in a highly competitive market, 2) operating under a separate brand, and 3) relying on a big-bang launch approach.

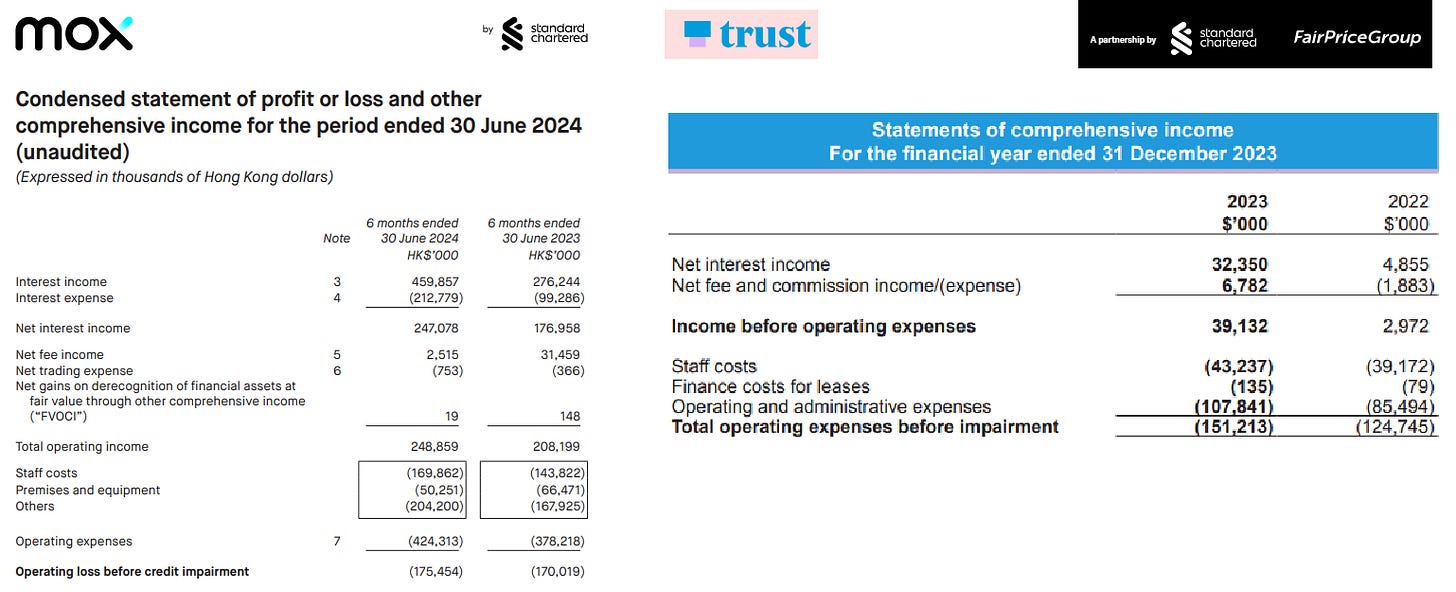

Though perplexing to many, some CEOs of leading FSIs seem irresistibly drawn to repeating the same mistakes. Take Standard Chartered, for example: After years of losses from its fintech subsidiary Mox in Hong Kong, the CEO launched another subsidiary in a different country under yet another brand, Trust.

Like the Trump assassination security debacle in Butler, Pennsylvania, FSIs pursuing these doomed strategies appear so inept that you almost wish it were a conspiracy. Could Goldman’s leadership indeed be so shortsighted as to big-bang launch a novel product aimed at an unfamiliar segment with an untested partner? Or would it be less disheartening to think Apple bribed or blackmailed Goldman executives into it? The deal was such a fiasco that, even a year and a half later, Goldman is still struggling to offload its credit card portfolio.

Among strong contenders for poor decision-making, HSBC-Zing might take the crown for the worst fintech subsidiary attempt by an FSI. After two years and $100 million spent on preparation—blitzscaling across multiple products and 100 corridors, combined with lavish promotions through traditional channels—they reportedly neglected basic fraud controls in their home country, as highlighted by Financial News:

In the summer of 2024, executives ordered a sweeping restructuring of Zing’s compliance controls. This was codenamed ‘Project Green’ and followed a series of audits by HSBC and Big Four professional services firm, PwC.

Staff were ordered to stop work on international expansion and slow down onboarding new customers to focus on fixing issues identified during the audits, according to a person familiar with the matter and an internal memo seen by FN. PwC declined to comment.

Internal documents reveal nearly 200 tasks assigned to Project Green. They ranged from defining and enforcing KPIs, and enhancing internal and external fraud controls to aligning the business with requirements from the Financial Conduct Authority and HSBC’s internal anti-money laundering policies.

HSBC is no stranger to financial crime compliance—or, shall we say, non-compliance. The bank has been known for some of the biggest violations spanning two decades. One former compliance manager said, “They were so highly matrixed – it was the best-organized chaos I’ve ever experienced.”

HSBC also knows how to launch fintech subsidiaries. In 2017, just as P2P payments emerged, PayMe, a mobile wallet, was launched in Hong Kong and became a space leader. The bank also understands the challenges of cross-border C2C, being one of the most prominent global players outside the top three U.S. banks, with over $10 billion in annual transfers. So, the mystery remains: Why did HSBC’s C-suite ignore all this accumulated knowledge?

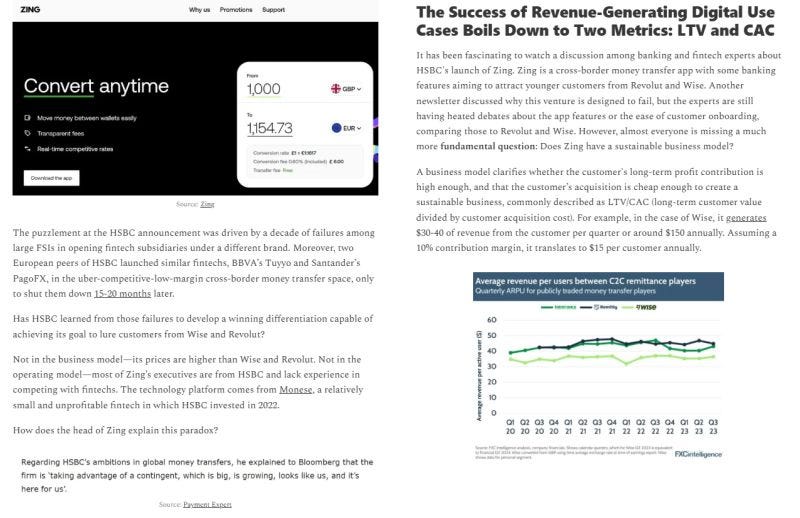

Even more bizarre is that HSBC began working on Zing after two of its European peers failed with their fintech subsidiaries in the same product niche: C2C cross-border transfers. And, of course, they also launched under different brand names: BBVA’s Tuyyo and Santander’s PagoFX. At least those FSIs had a bit of an excuse—when they launched, fintechs in this niche hadn’t reached full scale. But by early 2024, Wise was already transferring more money than Western Union.

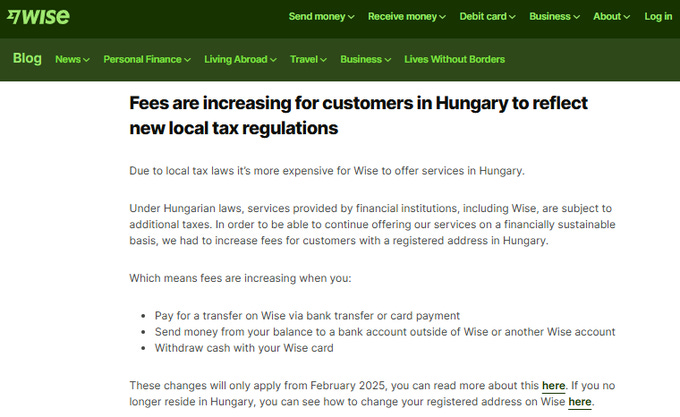

HSBC decided to compete directly with one of the most effective fintechs in history. When Zing was shut down after a year, it had around 400 employees. In contrast, Wise took four years after launch to reach a similar headcount and was approaching $10 billion in annualized transfer volumes by then. Wise’s business model is built on being the industry’s leanest, with cost-plus pricing. It’s so agile that even a change in tax regulations is immediately reflected in its pricing. Yet, HSBC thought it could create a sustainable business model by undercutting Wise’s average pricing by two-thirds.

There is a commonly-held view that traditional FSIs are too conservative in innovation. This couldn’t be farther from the truth, at least among the more prominent players. Every month, we see examples of massive bets that contradict proven lessons or even common sense. In a way, FSI CEOs are incentivized to take significant risks, as their bonuses are often tied to stock performance, and investors may assign a higher multiple to a risk-taking FSI.

Fine, if your FSI has too much money and doesn’t know how to increase its multiples, go ahead—spend hundreds of millions on AI and Cloud, sign a money-losing deal with a sexy partner, or even start your fintech subsidiary. Just please, don’t do it under a different brand.

FSIs Perfect the Art of Sleight of Hand to Justify GenAI Investments

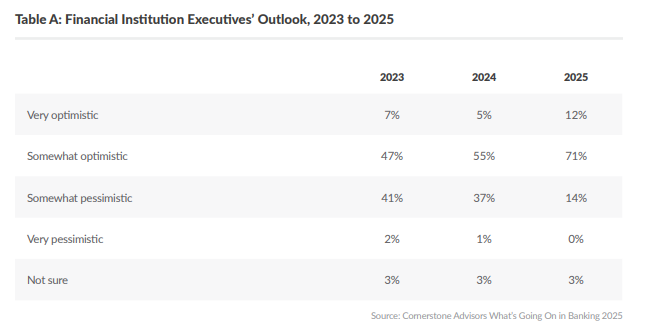

The intensity of digital transformation in FSIs remains strong. Citi is already spending nearly 20% of its budget on technology and transformation, and its Head of Technology has just completed a leadership shakeup to "position Citi as a top destination for engineering talent." The overall enthusiasm is not limited to large FSIs. In a recent Cornerstone Advisory survey of smaller U.S. financial institutions, the general industry outlook was overwhelmingly positive, continuing the trend seen over the last couple of years:

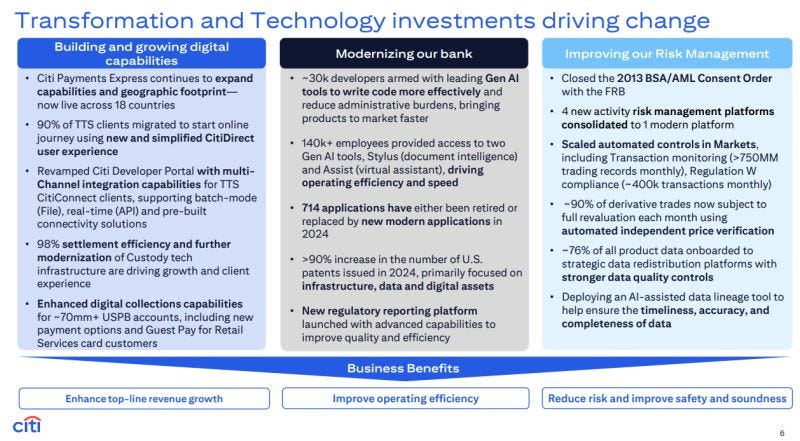

The only nervous Nellies seem to be the investment analysts, who continue to press CEOs with questions about the timing of returns, especially for GenAI. Their concern is understandable. For example, in 2024, Citi allocated an unprecedented 18% of its revenue to technology and transformation, with GenAI tooling highlighted as a top modernization priority:

In response to prying analysts, leading FSIs have been practicing a new sleight of hand. Bank of America’s CEO pioneered this technique, and now peers at Capital One, Charles Schwab, and other FSIs are following suit. The magical act involves praising the scaling of technology over the past year and then highlighting cost reductions over the decade, subtly implying a causal link. Rick Wurster, CEO of Charles Schwab, illustrated this approach on a recent earnings call:

“ In 2024, we captured 100% of the Ameritrade run rate expense synergies. We invested in new technologies and capabilities that help our employees do their jobs more efficiently. We increased usage of Schwab Knowledge Assistant by 90% in 2024, which is our AI technology supporting the efficiency of our service -- professionals.

Through these efforts and others, we're able to drive down our cost per client account, which has decreased more than 25% in the last decade. On an inflation-adjusted basis, cost per account has decreased nearly 50%.”

Charles Schwab’s CEO shouldn’t even discuss efficiency in the context of technology investments in 2025 as if it were still the 20th century. There's no need to endure the enormous pain of testing new business models and transforming operating modes just to cut costs—proven playbooks for that have been around for decades. For a leading FSI, revenue acceleration—not efficiency—should be the primary focus.

But what if top-line results are just okay? For example, Capital One's 2023-2024 revenue growth of 6% outpaced Chase’s 2%, yet still lagged far behind Cash App’s 20% (a top-10 consumer bank). As a result, CEO Richard Fairbank felt the need to offer a rambling justification that stretches back to 2013:

“So, you know, we -- I think the operating efficiency ratio has really been -- you know, hopefully, our investors share our excitement that, you know, this 700 basis-point improvement that has happened since we began our tech transformation in 2013 has, you know, certainly been a very -- there are multiple things behind that, but the biggest driver is the technology transformation. And even as we invest a lot, there are also ways to create savings, savings through, you know, reduced vendor costs, that really high cost of a lot of legacy technology, the benefits on the cloud, and really the ability to then, on the other side of the technology transformation, sort of rebuild the company and how it operates, you know, on a foundation of modern technology. And so, that's a journey that continues, and so, we see, you know, benefits there. I do want to say, though, also, you have -- you know, we've had a lot of beneficial increase in the ratio in the last couple of years.

How has Capital One’s efficiency ratio changed between 2023 and 2024? It went from 55.23% to 54.93%.

In addition to massive technology spending, CEOs are partially to blame for analysts’ impatience by regularly setting expectations of a breakthrough impact. Financial Times recently shared Goldman Sachs CEO David Solomon's remarks, which went viral with headlines claiming that GenAI could cut 95% of manual labor in a bank:

Solomon, Goldman’s chief since 2018, also spoke about the impact AI would have on his company’s businesses and those of his clients.

The bank now has 11,000 engineers among its 46,000 employees, according to Solomon, and is using AI to help draft public filing documents.

The work of drafting an S1 — the initial registration prospectus for an IPO — might have taken a six-person team two weeks to complete, but it can now be 95 per cent done by AI in minutes, said Solomon.

Another popular vanity metric related to GenAI returns is coding productivity. The logic goes that if thousands or even tens of thousands of software engineers code faster… yada, yada, yada… FSIs will make a lot more money. A decade ago, CIOs of leading FSIs were already complaining that their business counterparts couldn’t fully leverage IT capabilities. Some CIOs even lost their jobs for creating shadow business units within IT out of frustration with delays and constant pleading. It will be interesting to see how using GenAI to accelerate coding plays out in such an environment—where many business groups are already barely keeping up, and IT has no plans to lay off 20-50% of its software engineers.

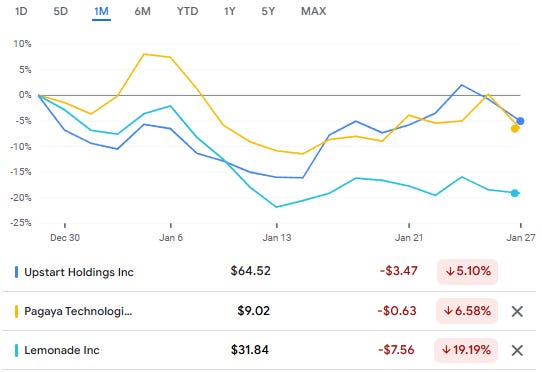

To be fair to traditional FSIs, the impact of GenAI on fintechs and insurtechs is also hotly debated. Klarna’s incredible claims aside, the ideal proof would have been if at least one of the so-called AI-native players showed a breakthrough performance. Yet, their stocks remain 80% or more off their highs. Even in the last month, with news of much less expensive LLMs in production, it hasn't benefited their stocks at all:

Concerns about the gap between expectations and results in top-line growth or scalability are also amplified by a similar lack of progress, even among technology companies. A stereotypical example is Salesforce, which touts its GenAI sales software while hiring thousands of salespeople to sell it and driving revenues through price increases.

The good news for FSIs is that technology is becoming cheaper, so hopefully, the burden of ROI on GenAI will become more reasonable. The latest breakthrough came from DeepSeek. As all AI experts know, the simplest way to test the IQ of any LLM is to ask it to tell a joke on some obscure topic where there aren’t many to copy from, like “Tell me a joke about digital transformation in FSIs.” DeepSeek is not only 93% cheaper to use but also seems to have a better sense of humor than ChatGPT and Claude:

ChatGPT: Why did the FSI executive bring a typewriter to the digital transformation meeting? Because they heard it was about "streamlining processes" and thought they'd need to "backspace" a lot!

Claude: Why did the bank's digital transformation project feel like déjà vu?

Because they kept having the same legacy issues in the cloud!

DeepSeek: Why did the bank hire a magician for its digital transformation project? Because they needed someone to make their legacy systems disappear!

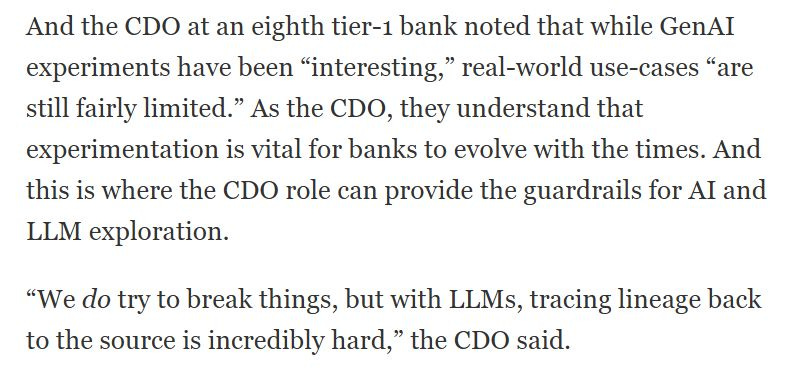

Of course, the most sensible way to scale a novel technology is through focused and gradual pilots until high ROI is demonstrated. While some FSIs continue to take a kitchen-sink approach to GenAI in 2025, the industry increasingly recognizes that the set of proven use cases is limited and that inherent data and model constraints won't disappear with the next version. WatersTechnology recently shared those concerns from the Chief Data Officer of a tier-1 bank:

It’s easy to succumb to the drums of a technology arms race and FOMO, hoping to impress analysts and secure a higher stock multiple, but Aesop's fable "The Tortoise and the Hare" might be pretty relevant. While banks have increased technology spending to 10-20% of revenue with unclear returns, P&C insurance remains at levels similar to a decade ago, in the 3-5% range. For example, Travelers allocated 3% to technology in 2024 yet achieved 12% revenue growth and a 67% increase in net income. Despite constant news about climate and other property-related catastrophes, its stock is near an all-time high.

For CEOs who don’t want to copy the sleight-of-hand technique from some industry titans, it’s wise to wait with big technology bets until you can offer a quality response: “Due to the technology investments over the last couple of years, our organic revenue growth has accelerated from 5% to 10%, with much higher scalability as expenses declined by 10%.”

In the meantime, the freed-up capacity should focus on technology fundamentals, such as resilience. Even the most digitally advanced FSIs, with generative AI leadership, 100% public cloud adoption, and a decade of digital transformation, could face a five-day outage from something as simple as a local power loss at a core vendor—just like an average FSI.