FSIs Often Mask 20th Century IT Efficiency Playbook as Digital Transformation

Also in this issue: Is There Still Hope for Innovative Digital Business Models in Financial Services?

FSIs Often Mask 20th Century IT Efficiency Playbook as Digital Transformation

What is digital transformation, really? Digital transformation is the rapid evolution of the operating model to scale digital capabilities more effectively, accelerating the delivery of business value. The rapid evolution of executive talent and organizational design is painful, so "digital transformation" often equates to "IT modernization" from the 20th century. In this regard, even a merger of two banks is somehow categorized as a digital transformation gain.

BBVA’s leadership attempts to justify merging with Banco Sabadell through a digital transformation lens: “The larger scale would allow the new entity to face the structural challenges of the sector in better conditions and reach a greater number of clients, efficiently addressing investment needs associated with digital transformation.”

Translating the above explanation from corporate speak: "Digital transformation costs a lot of money, but the spending would appear relatively smaller when divided between two entities." Replace “digital transformation” with “ IT modernization,” and FSIs had the same justification 30 years ago. It is a good old centralization playbook.

Even a tiny bank might have 100 product vendors and many service providers on top of that. The hope for a larger FSI is to consolidate hundreds or even thousands of vendors to simplify and then cut internal support costs due to subscale and get a volume discount on top of that.

While unrelated to digital transformation, such cost savings could happen. For example, after a couple of years of such centralization on a global scale, Banco Santander now claims to save €50M per quarter. On a recent analyst call, its CEO, Mr. Héctor Grisi, offered specifics:

“… our proprietary and unique global technology capabilities have already generated 63 basis points in efficiency savings so far. Our global approach to technology has allowed us to capture €50 million in additional savings in Q1 for a total of €237 million since 2022.

This has been mainly driven by the deployment of Gravity (cloud-based core banking), by new global agreements with vendors and process optimization in operations, and the implementation of the new IT and Ops shared services.”

While not a small amount, that represents <5% of the annual technology spend, so it is hardly transformational. Factoring a typical upfront cost of hundreds of millions, the ROI of such centralization might still be positive but not particularly worth the risk of failure and years of effort.

An even bigger challenge with such IT modernization masquerading as digital transformation is that efficiency from centralization is the opposite of effectiveness from enabling business units to make money. What is the price of regional businesses that now have to coordinate with HQ? In each solution category, there is no single vendor that could serve equally effectively regional businesses regardless of size and financial services or insurance products.

If the leadership of BBVA and Santander are interested in real digital transformation, they should focus on how their HQ actions impact the business lines rather than celebrating centralized efficiencies. For example, BBVA could look at less digitally mature Banco Sabadell for significant opportunities where it is losing business or has worse unit economics. Santander could try identifying use cases where HQ could help business lines generate €50 million in additional revenue via the introduction of new digital capabilities.

Mergers, vendor renegotiations, and shared services are familiar and fun for FSI executives who began their careers in the 20th century. Each initiative results in countless fancy dinners and VIP seats at sports events. But let’s be honest, they are also a distraction from real digital transformation.

Is There Still Hope for Innovative Digital Business Models in Financial Services?

After an FSI completes the initial phases of digital transformation, it is ready for the ultimate prize: deploying new business models. That is a rocket science level of difficulty these days - even the most effective business might not be in the market segment or product that is conducive to disruption or without excessively harsh competition. This applies not just to traditional FSI but even to leading fintechs, as we recently learned from Chime’s rare disclosure of its financial performance.

It has been years since Chime disclosed its performance, but the expectations were very high, in part fed by consumer surveys of Cornerstone Advisors which just in March proclaimed that the neobank became bigger than Chase by the number of primary customers. That is a coveted metric pertinent to the topic of disruption since most neobanks claim to have millions of customers but with little revenue to show, representing only a niche solution.

That groundbreaking news was based on the consumer survey extrapolation that “Of Chime’s 38 million customers, about half consider the neobank to be their primary checking account provider.”

Having 15+ million primary banking customers is indeed an incredible achievement. Unfortunately, just a few weeks later, Chime's CEO gave an interview disclosing that “most of its seven million active users have set up direct deposit.” While having 5+ million primary customers is still better than other fintechs like Cash App with 2 million, it falls far behind the incumbents like Bank of America with 34 million. Moreover, in the last 5 years, both Bank of America and Chase added (net) about the same number of primary checking accounts as Chime did in total over its 12-year history.

Differently from top incumbents, with its core focus on the lower-income segment and without lucrative lending products, Chime generates only $200 per year from a customer to $1.5B in revenue. Digital business models that attempt to win in any type of lending products are even harder, as Goldman Sachs’ Marcus learned the hard way once it expanded from collecting deposits into loans and credit cards. Such a model requires not just positive unit economics that make up for a typically high acquisition cost, but also extensive underwriting capabilities.

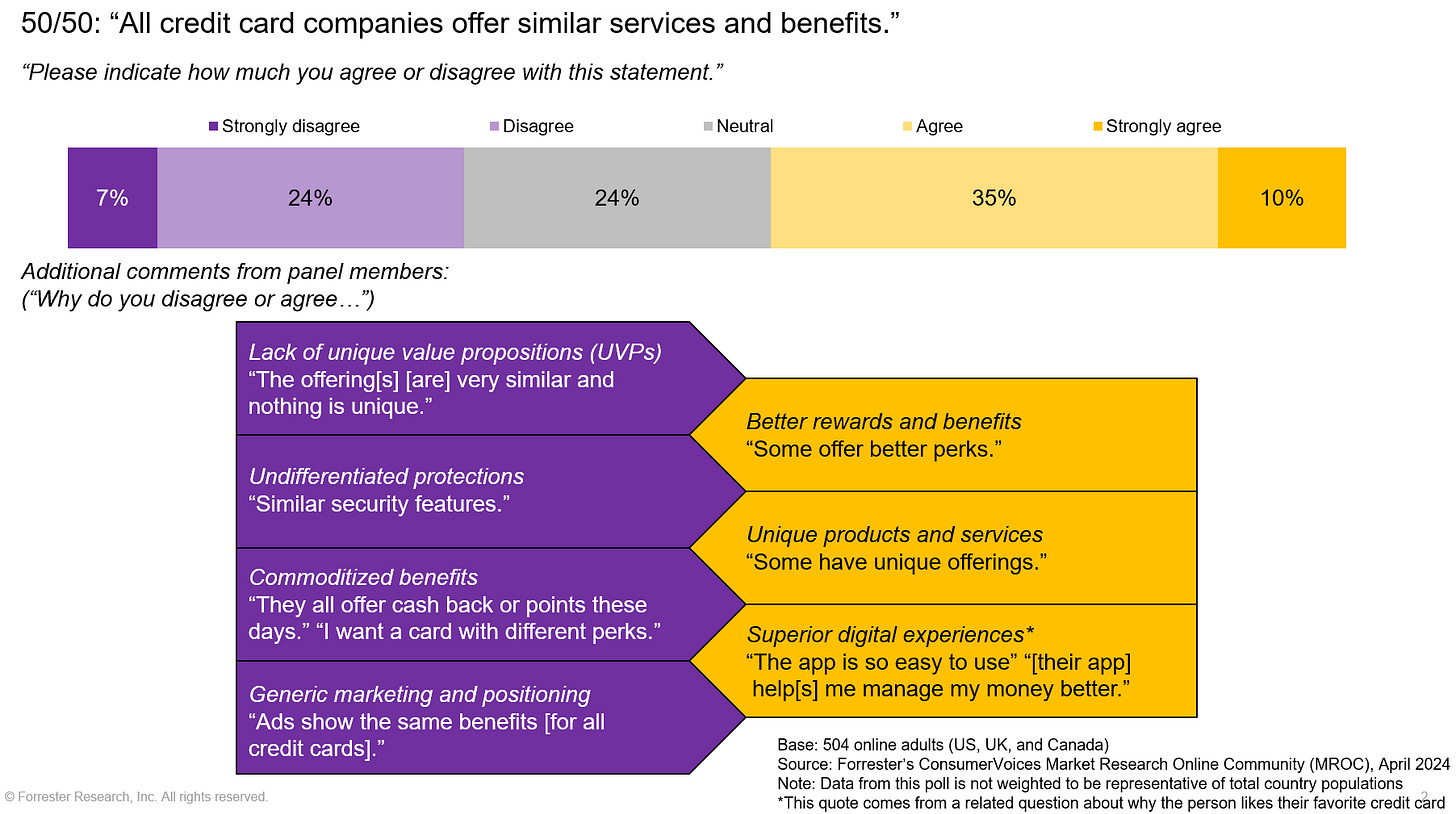

How to accomplish that today, when FSIs have become adept at replicating winning features of leading incumbents and fintechs, while consumers are becoming increasingly satisfied? In the recent Forrester consumer survey of their impression of credit card companies, two-thirds of respondents felt that benefits, security, and positioning were largely the same:

One such attempt is a unique credit card, Bilt, that figured out how to cover rent payments without charging a card or transaction fee. When working at American Express almost two decades ago, I already witnessed a strong interest in capturing rent payments onto credit card rails - in the US alone, consumers spend more than half a trillion annually. But the attempts at signing up rental companies to offer such products for a 3-4% fee haven’t resulted in big volume. With points and cash-back rewards at around 2%, most renters would lose money. Bilt had a seemingly ingenious approach.

A year after launching in 2021 and experimenting with various reward models, Bilt and MasterCard eventually partnered with Wells Fargo to issue a credit card that gave points for rent. Of course, the company is careful at managing the underwriting risk - there are restrictions on points if the card is not paid in full and on time. Moreover, the card does require 4 additional transactions per month.

However, the unit economics are still an open question since a material share of customers would only make 4 small transactions while getting thousands of free points. This resulted in a recent painful exchange on CNBC where the anchors kept questioning Bilt’s CEO, Ankur Jain, and Chairman, Ken Chenault, and after almost 10 minutes couldn’t get straight answers:

The hope for innovative models in financial services remains, even in the most developed economies like the USA. Chime is getting ready for an IPO while launching additional lending and investment products. Bilt recently raised $200 million at a $3 billion valuation. Traditional FSIs also keep launching new fintech subsidiaries. But taking a visible chunk of revenues from leading players will keep getting harder with every year.