Why Do FSIs Spend So Much Money on Vendors?

Also in this issue: Most FSIs Do Not Require an Innovation Strategy

Why Do FSIs Spend So Much Money on Vendors?

A couple of decades ago, I was helping a large commercial bank in a developing country to select a core vendor. Comparing between a well-known global vendor and a domestic one, the decision was obvious. The domestic option was 10X cheaper and had a proven track record with similar local clients, while the foreign one did not. “Thank you. This was very helpful. We will pursue the foreign one then,” responded the Head of Ops & IT in the final review. I thought that he didn’t hear me correctly and began restating clear reasons, but he interrupted me, “Thank you. We are going with the foreign one.”

Different types of such interaction have been a regular occurrence in my client discussions ever since. Their seemingly irrational decision to spend millions, often tens of millions, on vendors without a clear ROI no longer shocks me. Plus, those decisions are very instructive in understanding FSI’s operating model (aka “culture”). Here is how a CIO of a regional bank in the US recently described this paradox to me:

"We had consultants for integrating two core systems. They cost us a fortune, were completely useless and everybody thought so too, but we have to have some third party for these sorts of things.”

The whole issue of why FSIs select seemingly unimpressive vendors made the news recently when a well-known short-seller, Hindenburg Research, published a series of accusations against one of the global leaders in core banking platforms, Temenos. The stock immediately dropped 30% since the accusations included accounting improprieties. But a more nuanced problem was an alleged history of failed implementations:

Our research uncovered a series of failed implementations and frustrated customers in North America… Former Temenos executives, partners, and customers confirmed dozens of failed Infinity implementations, with one former Temenos executive calling the entire division “a huge destruction in value”… Many of Temenos’ most highlighted deals in Europe and Australia have been plagued with delays, cost overruns, and regulatory issues.

Hindenburg then listed numerous specific cases of traditional FSIs and fintechs where Temenos allegedly failed to various degrees, including termination. Can you imagine what such an awful track record does to a client’s churn and NPS? And this is not just Temenos; in a recent survey of community banking executives, only about 30% were at least somewhat satisfied with their core vendor responsiveness and roadmap execution:

Well, none of that seems to matter. Temenos responded to Hindenburg that its churn is the industry's lowest at 3%. How is this possible? Part of it is that FSI executives have lived through so many overpromises and underdeliveries, and they've heard so many similar disaster stories from their peers, that most of them don’t believe there is a much better alternative. But digging into the more nuanced underlying reasons in my client conversations, it comes down to 3 operating principles:

1. Spend budget or it will be decreased next year (“Other people’s money”);

2. Buy from a well-known brand (“Nobody ever got fired for buying IBM”); and

3. Pursue long-term relationships (“People buy from people").

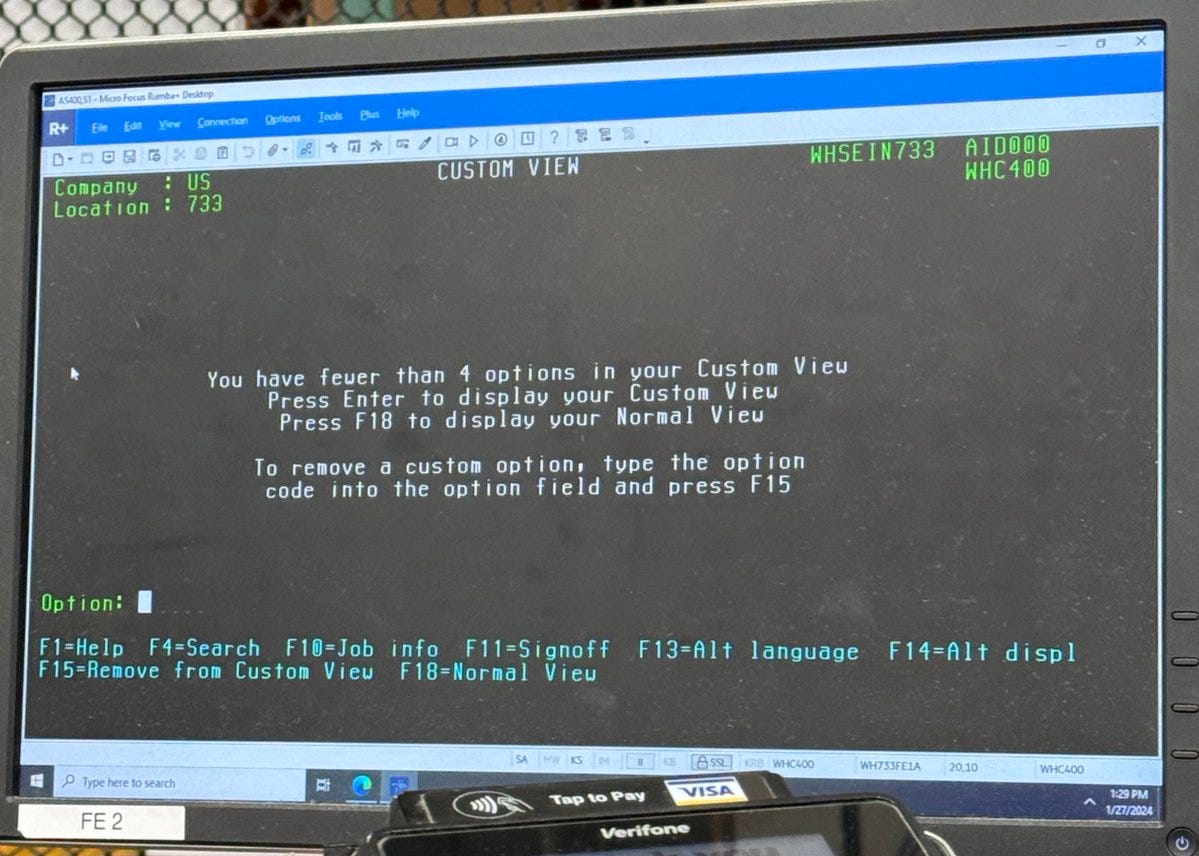

Finally, the rational choices are boring. One of the globally most successful retail companies, Costco, is still using green screens in its stores. Sure, it requires little resources, is secure, simple to use, perfect for data entry, and doesn’t need a mouse. Switching to a more modern solution would cost tens, maybe even hundreds of millions of dollars, and will be an implementation nightmare. But doing such transformational initiatives is what makes an FSI executive's job at least somewhat fun.

Most FSIs Do Not Require an Innovation Strategy

Fear of Missing Out (FOMO) is a powerful selling tool for VCs, vendors, research analysts, and consulting firms to open FSI wallets. FSI executives are told that the world is rapidly changing and unless something is done right now, their job is in jeopardy. The first step is, of course, to invest in a startup or buy a piece of advice to better understand what is going on. This has worked for decades and continues to work, also in part because FSIs have budgets specifically for these expenditures.

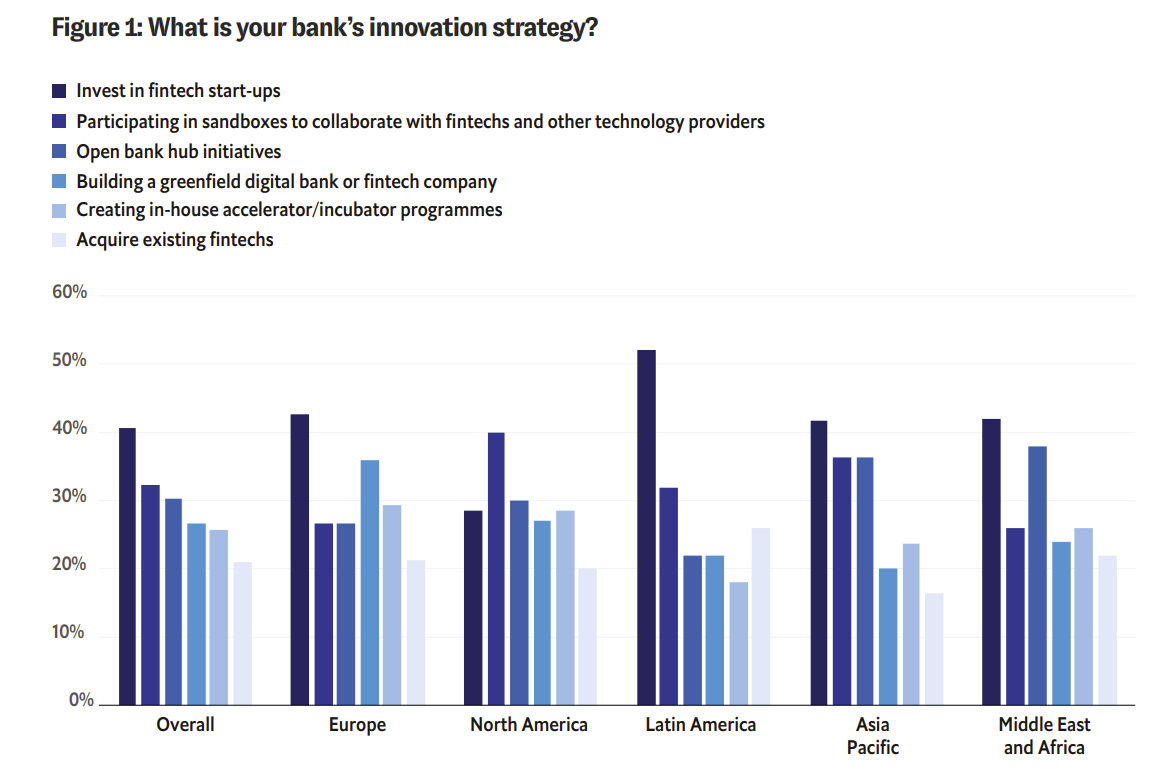

Economist Impact recently surveyed 300 banking executives across the globe, demonstrating how various types of significant innovation activities are applied by 40+% of respondents. The most prevalent type overall is investing in fintechs, while the most popular in North America is participating in sandboxes with startups:

Should the participation percentage be so high for such a risky set of activities? In a practical sense, as opposed to theatrics, innovation succeeds when it allows an FSI to break out of its legacy business model, not just evolving but revolutionizing it. To understand how hard it is, one just needs to look at the innovation-native players, the world’s leading fintechs.

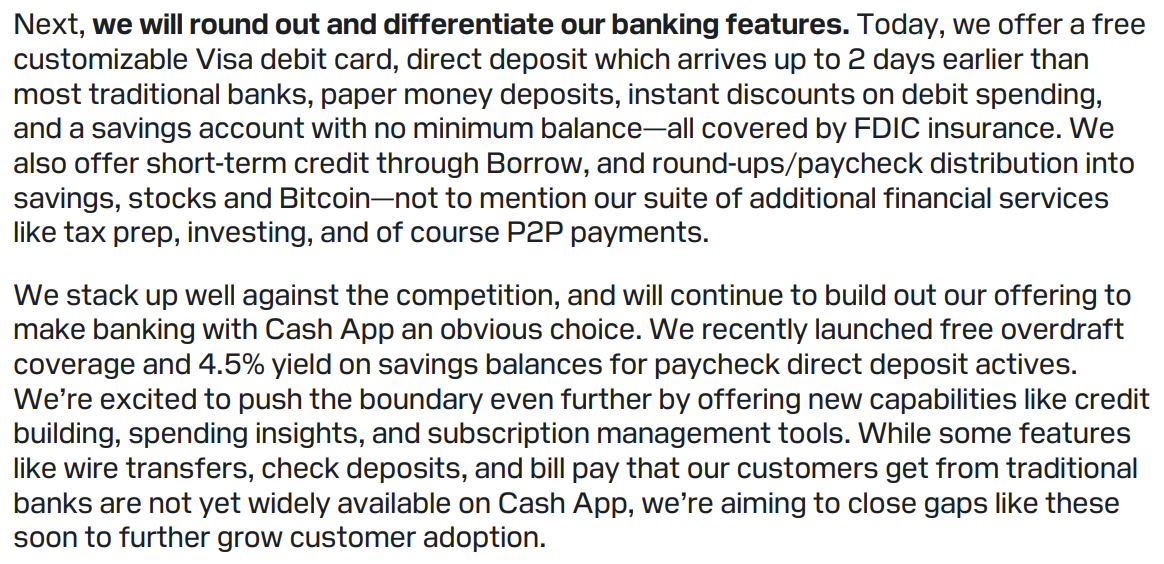

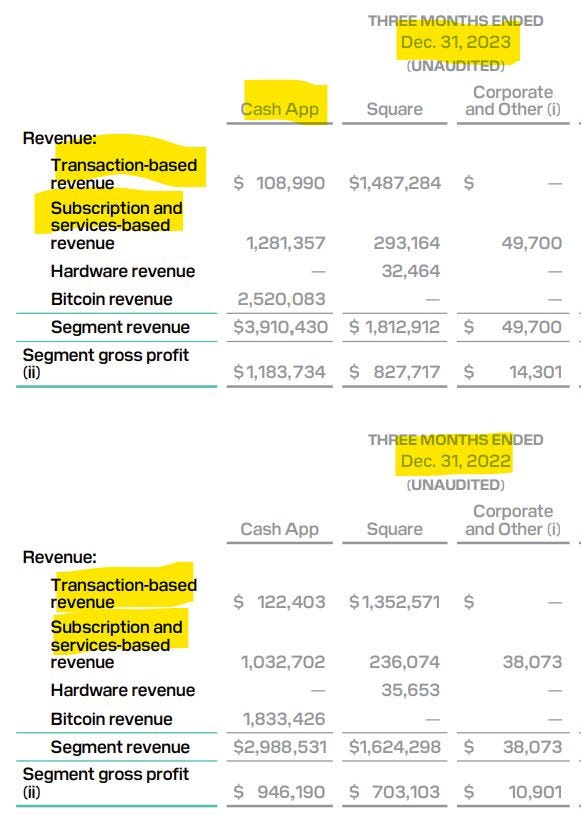

Cash App generates $5+ billion annually from non-bitcoin revenue sources, which makes it among the top 15 US banks by noninterest income and is 10X more than the UK’s biggest challenger bank, Monzo. Cash App explains its success by listing differentiation features it has developed so far and plans to launch:

Bitcoin aside, most of the items on the list are common among large banks, and Cash App still acknowledges missing some basic features. This is not 10X or even 2X innovation. Cash App is just trying to build a standard bank but without branches or normal credit products. That could work to a degree, and every P2P fintech dreams about becoming a bank. But without real innovation, Cash App’s growth has been decelerating by about 10% every quarter, down to 20%:

The world’s most advanced traditional FSIs are also struggling with real innovation. JP Morgan Chase's status requires it to have a whole AI research group, led by the former Head of the Machine Learning Department at Carnegie Mellon University, Manuela Veloso. How does that group create value from innovation? Manuela explained in a recent interview with American Banker:

In a recent meeting, Veloso's team heard that some salespeople had completed 30,000 client meetings. She offered to summarize and analyze those meetings. “That's the role of AI research – for them to be exposed to what can be done,” Veloso said. “The more I show them things that they probably have not thought about before, the more success we bring to the firm. It's the level of 'aha,' the level of novelty that we may bring to their thinking.”

And this is what innovation typically represents among FSIs - a solution in search of a problem. But why is it so difficult to create a revolutionary business model akin to what Amazon, Netflix, and Spotify have achieved in other industries? Consumers and employees are mostly satisfied with the current offerings, and their preferences haven’t changed dramatically in the last quarter-century. EPAM Systems' recent survey shows that consumers still trust their bank, like having branches nearby and getting money faster, plus, they appreciate useful financial advice:

Instead of innovating and hoping for a 10X improvement, FSIs should pursue targeted digital transformation to become more effective by 10% at a time, “a game of inches.” Focus on those simpler opportunities and proven solutions to make customers pay more for your services and employees more productive. Leave innovation to the incumbents.

Other Insightful Reads

Moves By Chase and PNC Re-ignite the Branch Versus Digital Debate

Why Jackson CIO Mike Hicks had to flip the script on his proven 100-day plan