GenAI in FSIs: Shifting from Broad Cheerleading to Nuanced Optimism

Also in this issue: How to Address Employee and Customer-Enabled Fraud When Government and Media Are Hostile to FSIs

GenAI in FSIs: Shifting from Broad Cheerleading to Nuanced Optimism

A typical IT and Data executive in FSI is more excited about the technology itself than the business outcomes it can create. This is normal for leaders in any cost center, and it’s beneficial to have people in FSI who are energized by innovation rather than fearful of it. However, it creates an oversight conundrum during hype cycles for novel technologies (e.g., Cloud, API, AI), as business leaders and CFOs also jump on the bandwagon, leaving no one to insist on ROI. Without anyone saying “no,” funding starts pouring in, and everyone hopes for the best.

As we approach the two-year mark since ChatGPT's introduction, the hype for Generative AI still seems strong, as evidenced by Nvidia stock trading near all-time highs with a market cap above $3 trillion. However, in financial services, more than a year of pilots and in-production implementations have gradually made executives, including those in IT, more cautious. In a recent HFS Research survey of IT executives, the response from FSIs signified an industry shift from broad cheerleading to nuanced optimism.

The respondents' initial hopes of quickly gaining a competitive advantage and making significant staff cuts have collided with the reality of scaling GenAI:

unstructured data + model limitations + regulatory constraints = elusive ROI

In parallel, there is a growing appreciation that Generative AI is not effective as a standalone solution (highlighting the shortsightedness of some FSIs hiring a standalone Chief AI Officer). Instead, new evidence points to the complementary relationship between traditional ML and GenAI for use cases like predicting credit risk. According to a recent study by Oxford University researchers, reported by Fintech Blueprint, predictive accuracy across models was as follows:

ML only: 54%

GenAI only: 40%

ML + GenAI: 70%

Even though the best scenario falls far from perfect accuracy and might seem discouraging, FSIs have implemented several use cases where a positive ROI is achievable. The lack of accuracy suggests that the most likely applications are in improving employee productivity rather than enhancing direct client engagement.

In that context, improving the productivity of software developers, sales personnel, or customer service reps has been a popular focus for GenAI in FSI. However, there has yet to be a significant announcement of material staff cuts due to scaling this capability.

Evaluating large potential clients for underwriting has shown a more substantial business impact, with turnaround times decreasing by more than half, based on a sufficient 80% accuracy rate. In a recent article in Digital Insurance, Rima Safari, a partner in the insurance practice at PWC, confirmed the popularity of GenAI for KYB among group insurance carriers:

"When there are broker requests coming in, we're seeing a ton of value in data ingestion before you get into the underwriting process," she said. "We're seeing the same thing in group insurance, as opposed to personal lines, where there is a lot of data to ingest."

Digital transformation is an advancement of the operating model to accelerate business value capture from novel data and technology capabilities. Ideally, this creates a lucrative business model that wasn’t possible in a less advanced FSI, but more often, it should greatly increase scalability. GenAI is likely to create benefits in the latter area, provided FSIs proceed in a very targeted and gradual fashion.

How to Address Employee and Customer-Enabled Fraud When Government and Media Are Hostile to FSIs

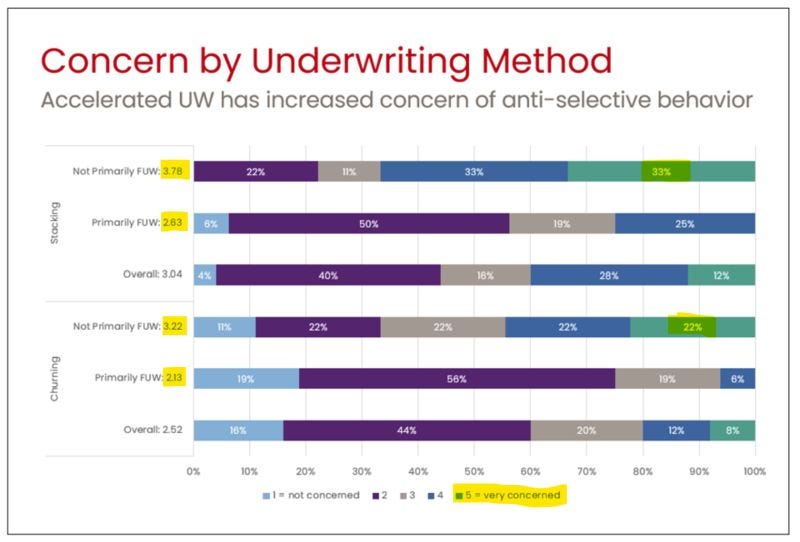

Digital transformation outcomes are often portrayed as no-brainers, but greater financial inclusion could lead to persistent debt for low-income populations, and increased digitization could enable much higher levels of client-enabled and internal fraud. For example, in life insurance, policy stacking by clients and policy churning by agents become more significant when carriers adopt automated rather than traditional underwriting, with the overall annual cost to the industry in the US around $0.5 billion.

Digitization is driving down the cost of business not only for FSIs but also for organized crime syndicates. Laundering money through banks used to be a respectable endeavor, often consuming up to a quarter of the funds; nowadays, drug cartels can achieve it for a mere 1-2%. A recent exposé by The Globe and Mail revealed over a decade of money laundering through TD Bank in the US. Apparently, some TD employees took the tagline "America's Most Convenient Bank" quite literally:

The criminals routinely deposited bundled stacks of U.S. dollars at multiple branches in the New York borough of Queens, and over five years the ring’s leader, Da Ying Sze, bribed employees, at TD and at other banks, using US$57,000 worth of gift cards and other financial incentives.

Of course, TD has been trying to address this with a myriad of internal tools and processes, investing half a billion dollars in AML fixes to date. However, standard compliance playbooks and tools seem ineffective when employees are involved. In recent months, executives and managers at advanced digital firms like JPMorgan Chase and Root Insurance have received four-year prison sentences for fraud and embezzlement.

In the current zeitgeist in the West, where all structural problems are blamed on enterprises (even inflation), FSIs are naturally penalized by courts and governments for law enforcement agencies' inability to reduce white-collar crime rates. TD agreed to pay $1.2 billion in 2023 to settle an investor lawsuit over a Ponzi scheme and has now allocated $2.6 billion for expected fines related to this AML case.

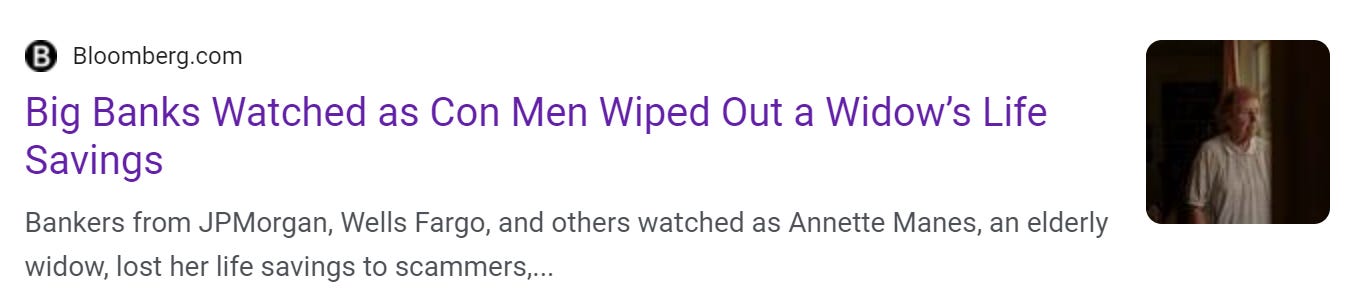

Moreover, even supposedly business media portray FSIs as heartless exploiters who do nothing while watching elderly widows sink into destitution:

Never mind that the widow was a multi-millionaire, and the FSIs involved pleaded with her to reconsider transfers, blocked some of her attempts, and even closed her accounts. Never mind that the banks involved contacted adult protection services, who reached out to her son despite her objections. Never mind that JPMorgan Chase, Wells Fargo, and Capital One absorbed more than $50,000 in losses before the lawsuits and fines. They just “watched.”

As a former youth communist leader growing up in the Soviet Union, it’s almost nostalgic to see the current level of hostility against bankers by today’s regulators and media. This leaves FSIs with little choice. Longer jail sentences for employees and customers committing fraud, and not treating gullible customers as victims, would be helpful, but in our current environment, that seems unlikely.

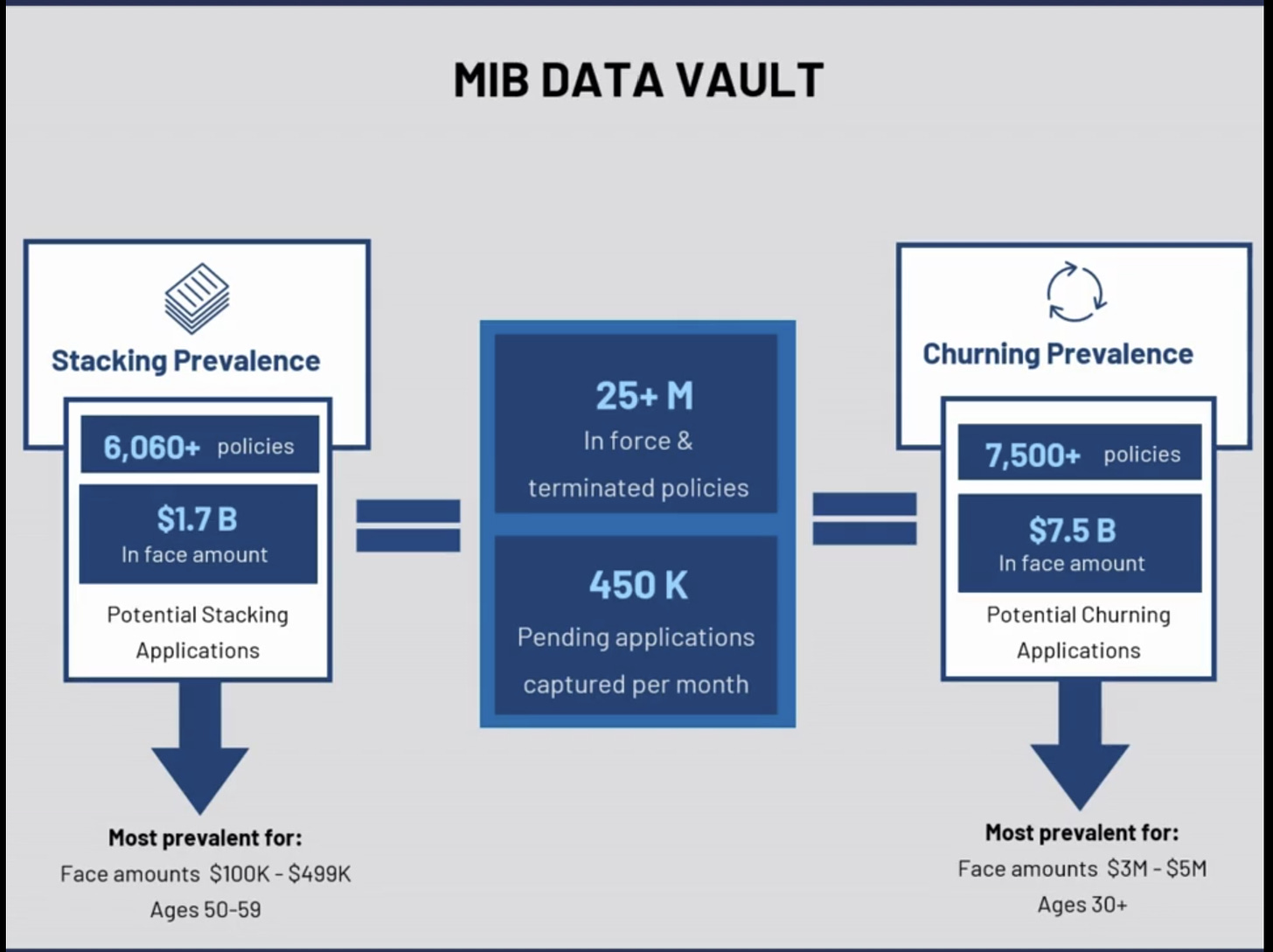

Instead, FSIs should focus on sharing data via industry utilities. In life insurance, an example is MIB Group, an industry data aggregator for over a century. Together with TAI, a life reinsurance system vendor, it provides insights to participating carriers into both in-force and pending application activity.

With an industry-wide view of an individual's application activity for the past two years and covering 74% of all in-force policies in the US, this model helps limit policy stacking and churning. Hopefully, other FSI sectors will adopt similar data-sharing models.