Expanding ML to GenAI in Large FSIs: Same Data and Models, More Customization

Also in this issue: Consumer Resistance to Digital Use Cases from FSIs Continues

Expanding ML to GenAI in Large FSIs: Same Data and Models, More Customization

“There are only three clear use cases for AI in financial services: customer support, fraud detection, and underwriting,” explained the Head of Risk for a top-3 credit card issuer in the US in 2016. The reason was simple and hasn’t changed since then: AI success is predicated on vast volumes of structured data, which only exist in certain businesses and functions of large FSIs. Generative AI has excited some CIOs, causing them to forget this, leading to recent surprising discoveries:

After 1.5 years since the seminal ChatGPT launch, it should be obvious to even the most credulous FSI executives that GenAI neither can reason nor magically pull precise information from unstructured sources. However, instead of pausing to consider the limitations, many FSIs are spending billions on consultants who learn about GenAI alongside their clients. According to a recent New York Times story, GenAI topics have become one of the largest revenue generators for consulting firms, representing 40 percent of McKinsey’s business this year.

In one example, McKinsey built a service chatbot for ING Bank in 7 weeks, only to discover that the tool provided incorrect information due to outdated sources. Despite ongoing fixes, every chatbot conversation has to be reviewed to ensure the system doesn't use discriminatory or harmful language or hallucinate.

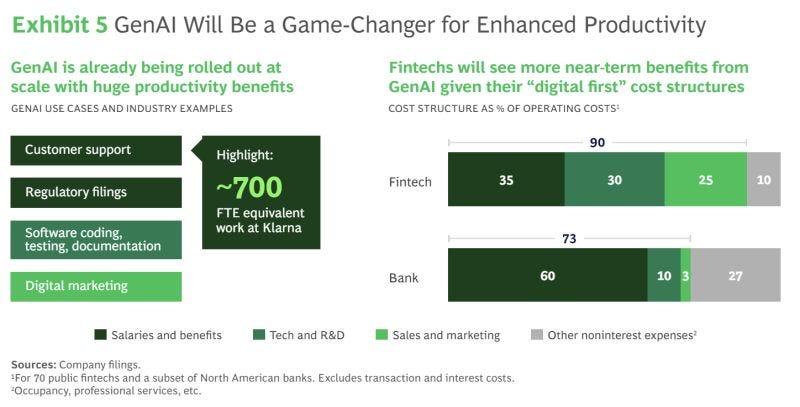

For digitally-minded FSI executives, it is understandably hard to resist the temptation of spending unlimited resources with C-Suite blessing, especially when consultants and vendors assure them that GenAI is already delivering “huge” productivity gains. A recent report by BCG and QED Investors supports this claim, citing Klarna as proof:

The only issue was that Klarna hadn't captured those benefits. The fintech had to clarify that the claim of "700 FTEs" was concocted to spark a conversation in society about AI's impact. Moreover, Klarna’s users consistently reported that its chatbot provided the same clunky experience as other companies, mostly involving scraping internal documents.

In these early days, some FSIs grapple unnecessarily with the binary choice of either halting GenAI efforts or empowering all departments to experiment with it. However, the more novel the technology, the greater the need for select talent and thoughtful prioritization of use cases. A glimpse into where leading FSIs and fintechs are heading is evident in the recent acquisition by one of the world's largest neobanks, Nubank, of a small data intelligence startup, Hyperplane. The focus will be on product-specific AI tools that leverage first-party data to enhance models in risk, collections, and marketing departments.

The evolutionary rather than revolutionary potential of GenAI should dissuade FSIs from entertaining the idea of a Chief AI Officer, instead emphasizing the leveling up or replacement of their Chief Data Officer. The underlying data and models remain the same; while GenAI can improve them, it doesn't represent a parallel universe like the Metaverse or Web3 fantasy and thus doesn’t require a separate focus. Similar to the Chief Innovation Officer role, a Chief AI Officer would be viewed as a bureaucratic response to hype aimed at scoring PR points, with limited potential for substantial impact. Worse, it can divert leadership attention and serve as an excuse to avoid evolving the operating model across core business, data & analytics, and technology groups.

Beyond business use cases, the most practical entry point for GenAI in large FSIs remains enabling developers to work faster (up to 20%). Starting with their best development teams who generate the most code, FSIs could monitor whether productivity gains yielded by GenAI can lead to workforce reductions without compromising quality. Until then, it is prudent to allocate only a small percentage of the technology budget to GenAI, as recently disclosed by Goldman Sachs CIO to the Wall Street Journal:

Generative AI remains a relatively small part of the technology budget, Argenti said, with most resources dedicated to running the bank, and keeping it safe and compliant.

Argenti said he sees AI drawing more dollars in the future, but “it’s not something where all of a sudden we pivot resources from other things.”

Consumer Resistance to Digital Use Cases from FSIs Continues

A common expectation among digital experts has been that fintechs and insurtechs would sustain high growth rates indefinitely, eventually catching up to and disrupting the incumbents. However, reality paints a different picture where startup scale negatively correlates with growth rates, with some leading fintechs approaching low double-digit figures. They attempt to mask this by expanding into additional products and countries, but the digital revolution isn't as pervasive because many consumers remain indifferent to it.

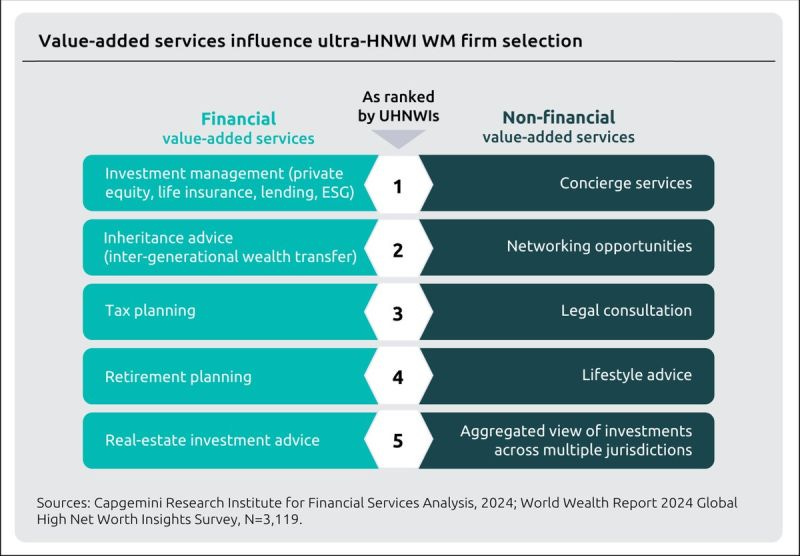

A clear illustration of traditional consumer preferences is Wealth Management. When asked about their reasons for choosing a firm, clients prioritize features—both financial and non-financial—that are entirely non-digital. While digital self-service options for money management are accessible to everyone, wealthy clients often value and are willing to pay for the exclusivity of old-fashioned personal assistance:

A recent study by Vericast, shared by The Financial Brand, reveals a consumer preference for another 20th-century medium: direct mail. Not only do consumers enjoy reading it, but they also favor it over digital ads:

72% of consumers regularly read or look at ads in the mail, with 82% doing so at least once per week.

On average, people spend 1.6 minutes with a direct mail ad compared to 1.1 minutes with a digital ad.

58% find direct mail trustworthy, and 67% trust it in terms of privacy concerns.

60% say direct mail ads are easy to remember when ready to make a purchase, compared to 44% for digital ads.

The greater trustworthiness of traditional channels may surprise proponents of imminent disruption in financial services. While it might have been true a decade or two ago that FSIs used traditional channels primarily to push high-margin products, today many in the industry genuinely aim to assist consumers. Even for skeptics of questionable products like ESG funds, it's noteworthy that they were introduced to affluent consumers interested in supporting environmental causes.

This stands in contrast to the efforts of some digital-only players who have been attempting to create demand rather than addressing unmet needs. For example, wealthtech Ellevest was founded to persuade women that they have been disadvantaged by the male-dominated financial cabal."Our journey building a woman-first financial company began in 2014 with a team of industry experts with decades of experience on Wall Street — even as we were told 'women don’t need their own investing platform.'" How do you think female consumers responded to such digital pandering?

A decade later and $153M raised over several rounds, only tens of thousands of customers use Ellevest, indicating that women indeed don’t need their own digital investing platform. Instead of cutting losses, Ellevest has introduced a new top metric, “community,” which includes over 3 million of the founder's connections on LinkedIn and Ellevest's followers on Instagram.

On a side note, technology limitations present another systemic challenge in satisfying customers solely through digital means. The average person lacks the knowledge or inclination to navigate the complexities of different investment horizons or insurance product bundles across household members. Since GenAI is incapable of reasoning, a human advisor cannot be replaced by a digital-only service for more complex products.

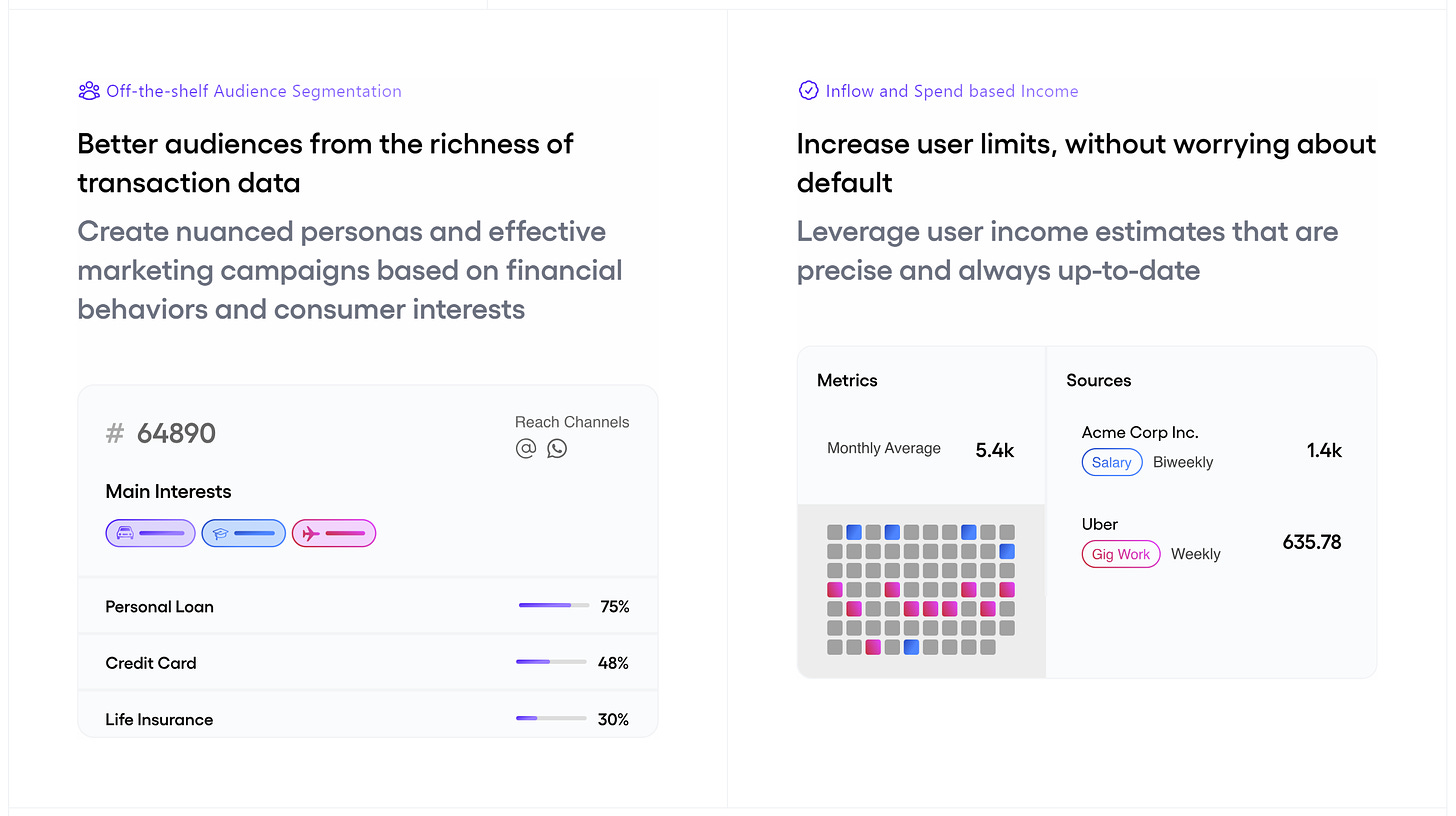

Consumer apprehension about financial services and insurance products is also a primary reason for the underwhelming results of Open Banking. Even QED Investors and BCG recently had to acknowledge that the idea of consumers owning their own data and security has not generated much excitement:

Open banking will have a modest impact on banking… unlikely to change the basis of competition in consumer banking. In countries where open banking has had a decade or more to mature, no “killer” use case has emerged on the new service front… revenue pools in the connectivity layer will remain modest…

The extreme case of underwhelming digital-only adoption by consumers is crypto. For the first 5-10 years, its proponents were convinced that once consumers tried it, they would abandon all their fiat-based providers. Banks, Visa, and even the Fed would disappear as a result. When adoption failed for money transfers and payment processing, the crypto industry shifted to trading increasingly esoteric coins and derivatives. Following the FTX fiasco, regulators finally woke up, and now the crypto industry is donating unprecedented sums to influence the outcomes of congressional races, according to recent reporting by CoinDesk:

The crypto industry has been deploying a $169 million fund that's so far supported more than 20 congressional primary wins in the 2024 elections – including helping knock off an incumbent congressman in New York this week.

So, what should FSIs do when consumers are saturated with products and satisfied with their services? For existing customers, the primary focus should be on retention rather than overwhelming them with additional digital features that are guaranteed to see low usage. When acquiring new customers, emphasize traditional channels, especially for more complex products. To paraphrase Mike Tyson, "Everyone likes digital until they get hit with a difficult question."