When is In-Sourcing Required for the Digital Transformation of FSIs?

Also in this issue: What the New Breed of FSI Vendors Keeps Missing About Engaging with FSIs; FSI Executives Have to Choose Between Gimmicks and Solving End-User Problems

When is In-Sourcing Required for the Digital Transformation of FSIs?

As technology transitioned in the minds of investors from a cost center to an enabler, many FSIs have been bragging about the large efforts associated with this phenomenon. We often hear about billions spent on technology overall or millions on specific capabilities, but the highlights of technology talent are also becoming increasingly prominent.

Santander recently made such an announcement, specifically emphasizing the thousands of digitally skilled employees it is hiring to drive digital transformation:

As one of the more digitally mature banks in Europe, this move makes sense for Santander. With the company now scaling its value streams and platforms (Phase 4 of digital transformation in the chart below), it needs a lot more experienced digital talent to staff those newly formed teams.

Lower maturity FSIs wouldn't need that much external digital talent until completing the third phase of digital transformation: IT Product. During the IT Project and the initial scaling of the IT Product phases, the financial services or insurance company does not have enough evolved teams to staff that advanced talent, and those people will quit if assigned to traditional IT projects.

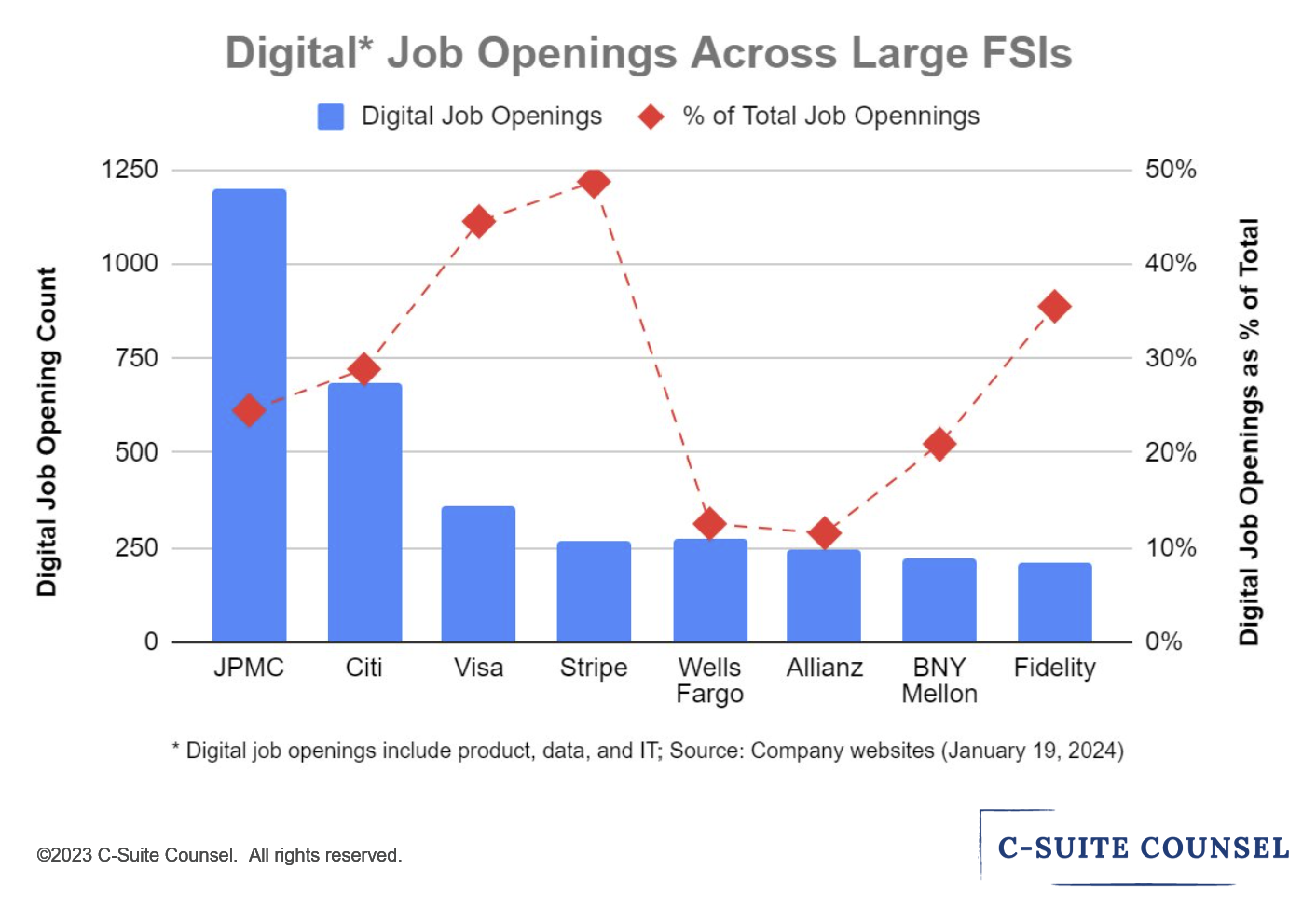

Santander currently has about 10% of its employees in digital roles, which is about average for larger FSIs and is in line with about 10% of the average revenue they are spending on technology. However, there are some exceptions like J.P. Morgan spending 9% of revenue on technology, but that $15 billion spend translates into...

...62,000 tech employees or 20+% of the overall staff. Using the percentage of digital job openings (product, data, IT) in total as a proxy for the target state composition, the ratio is naturally correlated with a higher portion of revenue spent on technology. BNY Mellon is on par with JPMorgan, Citi is higher, and Fidelity is even farther ahead:

As expected, digital-native players like Visa, and especially those founded in the 21st century like Stripe, are ahead of traditional FSIs in the ratio of digital job openings. But some traditional players are determined to catch up, as seen with Fidelity. We already described in another newsletter how Fidelity fully embraced the digital mindset by creating an army of employees in the "Squad" and "Scrum" roles.

Fidelity is also unique in elevating IT executives into business leadership roles. Such promotions are still extremely rare among FSIs, and Fidelity doing it twice in the last few years, most recently with Roger Stiles, is unprecedented:

Preserving and promoting internal talent is key to digital transformation, and it requires FSIs to learn how to level up staff rather than hoping that external hires or vendors could do the work for them. The good news is that the more committed an FSI is to a talent strategy where internal employees are not replaced but augmented, the easier it would be to retain top performers. Despite the constant drip of news articles and analyst reports about the "Tech retention crisis," "Quiet quitting," "Great resignation," and "Quiet firing," the reality is quite different in well-managed FSIs:

From a scalability and in-sourcing perspective, consider the historical example of German military rearmament: from around 100,000 troops in 1933 to 550,000 in 1935 and eventually reaching 2.7 million in 1939, maintaining the world’s most effective army all along (which ultimately didn’t help because they decided to fight against most of the world). What the architects of the Treaty of Versailles didn’t appreciate a century ago, and some FSI CEOs don't realize today, is that once the core organization has leveled up all units above the average benchmark, rapid scaling enabled by massive in-sourcing is much more likely to succeed.

What the New Breed of FSI Vendors Keeps Missing About Engaging with FSIs

“Our goal is to offer banks profitable solutions; they need to learn how to digitally transform on their own, and we can't do it for them," explained the head of a fintech vendor. That is an accurate statement - relying on a vendor to accelerate digital transformation without doing the hard work internally is a recipe for failure.

But here lies a Catch-22 for the new breed of fintech vendors promising game-changing improvement to traditional FSIs with out-of-the-box solutions:

They can't make an FSI more digitally mature, so their solutions won't deliver the main benefits until that FSI becomes digitally mature.

The more digitally mature an FSI becomes, the more it would be able to create differentiated solutions, so an out-of-the-box vendor would have to target lower-maturity FSIs.

This conundrum is evident in the recent news from well-known fintech and insurtech vendors: 10X Banking and Unqork. 10X Banking has struggled to scale due to overpromising transformational improvement and believing that replacing technology by itself could make a massive difference. Its website still shows only 2 client examples, and the last published results for 2021 were disastrous:

In a recent press release for a smaller $50-million round, 10X Banking described itself as a 'company with the strongest offering in this space, offering unparalleled resiliency and scale, combined with flexibility and speed beyond the rest of the market.' Even if those points were accurate, these attributes only matter if they create a significant ROI for the clients that justify the risk of a novel vendor.

Unqork is a similarly struggling vendor, but instead of a 10X improvement vs a core banking platform, it is promising to remove the need for FSIs to ever write any line of code (aka, 'Codeless'). You can see why many FSIs would love that idea. Selecting a vendor is a hassle, so a typical FSI executive naturally gravitates to the promise of minimum customization, out-of-the-box. Unqork’s offer is even better - just tell us what you need, and we will seamlessly spin up that functionality.

Unqork’s founder recently impressed upon FSI executives to stop coding:

“… enterprises should be asking how they can create software without a ‘shelf life’ and without creating a legacy footprint behind it. That is solved in a codeless world where software is defined using data, and there is a single code base across all industries leveraging that.”

As the cloud is just another company's computer, Codeless just makes coding someone else's problem. But even if Unqork ever gets to a point of having the world's most elegant code that it could easily expand for any client and any use case, the Catch-22 would make it moot. Most FSIs are completely unprepared to transition from coding and can't move in real time to ask for new business features from a vendor.

There are leading FSIs that could move fast, but they are busy in-sourcing digital talent to create unique product features on their own, requiring full control of data and scaling. Another newsletter described how to level up the Service Desk in FSI, with the final step being to embed support costs into the P&L of granular value streams. This is how leading fintechs like Wise operate. Now imagine Unqork approaching Wise and offering them to stop coding.

To escape this Catch-22, rather than setting unrealistic transformation expectations, the new breed of FSI-focused vendors should a) Prioritize incremental use cases with clear ROI, and b) Target the client segment already capable of capturing the benefits.

FSI Executives Have to Choose Between Gimmicks and Solving End-User Problems

“We purchased an AI-cloud-based solution to detect fraud, but 100% of red flags have been false positives,” shared the Head of Analytics of a $500B-asset bank. His company needed to implement a platform to fight financial crime, but the business leadership didn’t want to bother with careful selections and intensive customization. Instead, they trusted a promise from a well-known vendor to install an inexpensive out-of-the-box module that already meets all requirements. “Business is still not willing to be involved, so they asked me to help find consultants or a different vendor,” the Head of Analytics concluded.

Like gamblers who gotta have an edge, some FSI executives are looking for the external force that would make them look more capable without the hard work of transformation. Out-of-The-Box, Generative AI, Full Return to Office, Codeless, Cloud-Only, and Behavioral Science all offer such wishful promise that if your FSI embraces this lever, the metrics will move up and to the right.

For example, making money in auto insurance is very hard, in part due to the propensity of criminals to submit fraudulent claims. The larger the insurance carrier and the longer it has been in business, the more data points it has on the difference in fraudulent claims. But what if you work for an insurtech that wants to disrupt those incumbents and accomplish it in years rather than a century? Lucky you, famous behavioral science professors from Harvard and Duke found out that asking a claimant to certify the accuracy of their claim before providing the details leads to a higher likelihood of honesty.

The study was celebrated around a decade ago, and its inputs were leveraged far outside of the insurance industry until the data for that study appeared to be fraudulent. What an irony!

AI presents a similar hope, except it costs a lot of money to make it work. Bank of America CEO, Brian Moynihan, made this fantastic disclosure in a recent earnings call with analysts:

“And so the billions we've spent literally over the last ten years on data -- cleanliness data, or getting the data in the right place, making sure it's dependable, and the models that operate are either [Phonetic] under that aren't -- these open autonomous natural language models, but are models that are machine learning models.

We've seen great promise. That's partly how we operate the company now, basically on the same dollar amount of expenses we had in 2015 or '16, to give you a sense. So yes, it's been digitization, but it's also been using more than that. So it's got -- we have high hopes for it. We just have to make sure it does a great job for the customer.”

To summarize, after spending billions over the last decade, the great promise of digitization resulted in maintaining the same operating expenses since 2015. Scaling advanced tech works! Except, when examining the actual data for noninterest expenses (and revenue), the expenses went up by $9 billion, but maybe it was normalized for inflation and only for expenses :-)

2015: $57B ($83B)

2023: $66B ($99B)

Ok, so AI didn’t seem to create a clear ROI after a decade and billions of dollars spent as far as expense reduction, but maybe it resulted in delighted customers? Bank of America’s recent report points to a gradual uptick in the usage of its AI-based chatbot, Erica, with the CEO explaining that in Q4, 2023, users had 170 million interactions with Erica, getting effective responses to their questions instead of spending much more time on phone calls, trips to branches, and communicating via email.

Again, such a positive declaration doesn’t jive with the data from Bank of America itself - in the most recent report for Erica’s transactions breakdown, 60% were proactive notifications. To test it further, I asked Erica the following questions, and it didn’t even attempt to offer me the answer:

Where can I cut my spending?

How can I improve my FICO score?

How should I reallocate funds to make more money?

Have I made any mistakes in handling money?

Should I keep renting or buy a house?

It doesn’t have to be this way. FSIs could use that effort to solve real client needs as they have done well historically. The same Bank of America has introduced a new payment rail, Zelle, which made it easier for its customers to send money domestically without downloading a different app:

There is no shortage of end-user problems where the digital transformation of traditional FSIs could add value. One of the favorite PR points among FSIs is helping low-income customers and communities. Unfortunately, it is often accomplished only via charity or launching more products with unclear financial wellness impact:

Imagine if, instead, FSIs like Wells Fargo applied the same effort and funds to try and help poor customers:

Save or make money that they wouldn't have otherwise

Get out of delinquency or poverty

Spend less time with their provider without a negative impact

Then, it might realize that a typical customer in that demographic doesn’t make it to a bi-weekly or monthly paycheck and has to get credit, including from costly payday lenders, to close that gap. And there is a solution to such a predicament: early wage access (EWA). According to one study of EWA customers by Aite-Novarica, 81% of previously reliant users stopped using payday loans.

Wells Fargo even has a related product, except it offers "up to two days" access to deposit, which won’t solve the needs of those poor customers:

Instead of such pseudo-solutions or technology gimmicks that don’t require a change in the operating model, FSI executives could try being customer-centric and start solving end-user problems. It will guarantee free publicity and might even cost less money.