JPMorgan's Fascinating Insights into Digital Transformation

Also in this issue: Why Do FSIs Disappear? (Hint: Not Related to Digital Transformation)

JPMorgan's Fascinating Insights into Digital Transformation

With approximately 15% of total US deposits and 20% of credit card spending, JPMorgan Chase provides an invaluable source for learning about digital transformation. The bank's CEO, Jamie Dimon, is widely regarded as an industry sage among FSI executives. While many FSI pronouncements can be seen as repetitive across press releases, JPMorgan's statements tend to offer more originality. During the Bernstein Strategic Decisions conference, JPMorgan Chase COO Daniel Pinto's comments lived up to this reputation.

1. Rationale for expanding retail business to Europe

When JPMorgan Chase ventured into the UK in 2021, it seemed like a risky undertaking. Yet, the bank's top-line success surpassed expectations. Within just two years, it has amassed nearly 2 million customers and $20 billion in deposits, positioning itself as one of the largest fintech companies in the country. However, this accomplishment comes at a steep price, expecting upfront losses to exceed $1 billion and that it will take more than five years to break even.

Here is how Daniel Pinto explains the bank’s rationale

“… the retail business in the United States is an amazing business, very profitable, massive scale, great set of products, very good… But you never know when it could be disrupted by someone, by the technology platform and someone else… So we see this as a way over the long, long term to diversify and complement our fantastic US retail business."

With annual profits exceeding $20+ billion in its Consumer & Small Business division, JPMorgan Chase could certainly allocate around 5% of that amount to establish a retail presence in the original market of Morgan's banking empire. The upside in the US is already being captured organically, and further acquisitions in the country are unlikely to be allowed. Returning all excess cash to shareholders would be bad for the stock price multiples. While referencing competition might help rally the troops, JPMorgan seems more focused on putting the extra cash to good use. Venturing into the UK market appears to be a favorable choice in that regard.

It is surprising, though, how easily JPMC gained market share in the UK with so many challenger banks and formidable incumbents. Learning from Finn's failure, JPMorgan went with its own brand and didn't spare marketing expenses this time. But maybe it's another confirmation that the US retail banking capabilities are stronger than the UK's, also considering the limited success of the UK's challenger banks in the US so far.

2. Digital transformation is not a choice?!

As we discussed in the inaugural newsletter, it is amusing when an FSI executive, rather than a vendor or consultant, champions digital transformation as manifest destiny. After witnessing decades of significant failures in IT initiatives and a decade of frequent value erosions resulting from digital transformation efforts, one would anticipate a more tempered tone, particularly from a non-IT executive.

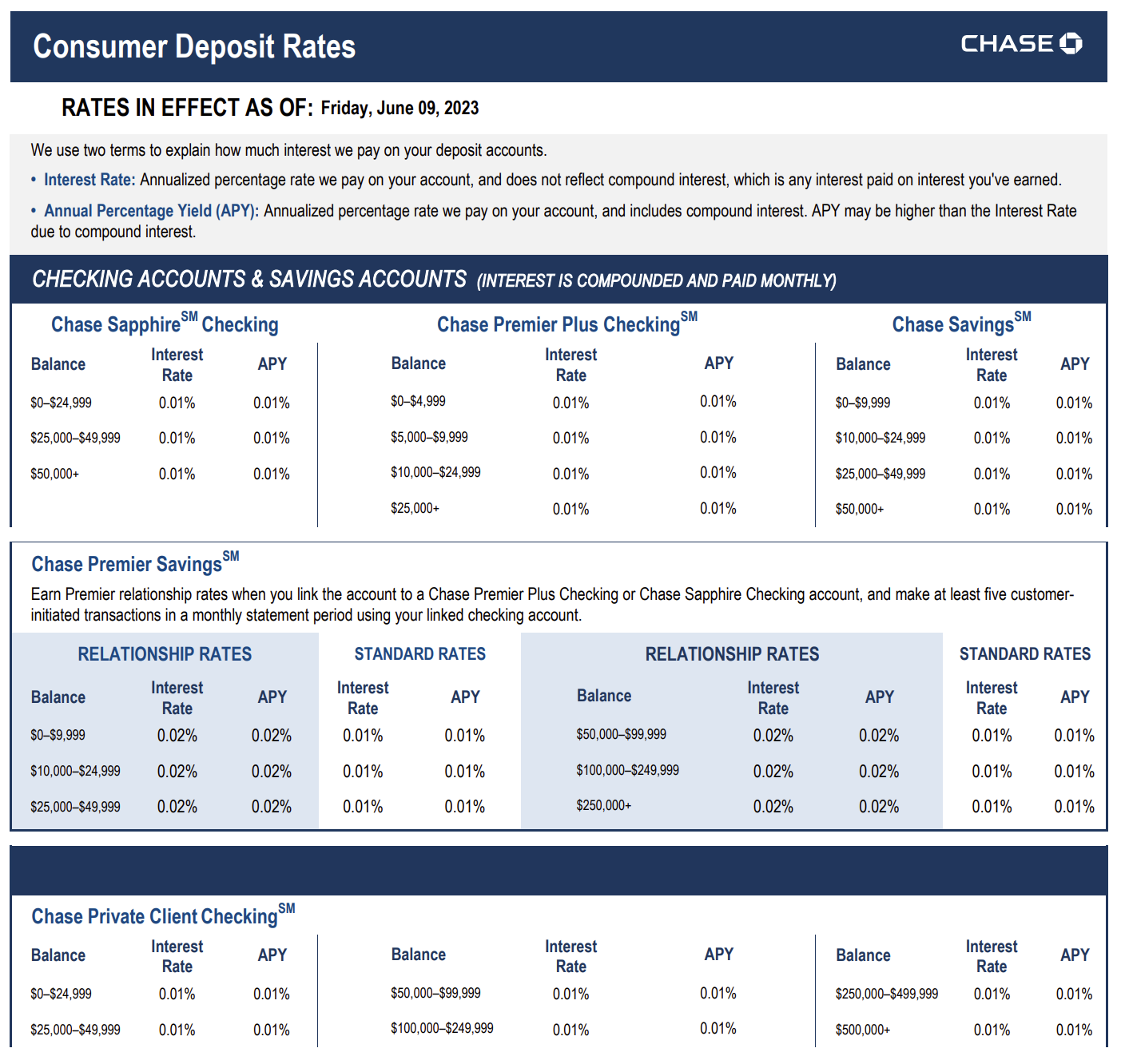

These days, within an advanced FSI like JPMorgan, there are no longer any low-hanging fruits that would make digital transformation a straightforward decision. Furthermore, not only is JPMC not currently facing an immediate threat from fintechs or BigTech, the primary macro concern lies in the bank's significant and growing market share despite offering zero interest on its deposits:

Yet, when Daniel Pinto articulates the bank's perspective on digital transformation, it sounds even more grandiose than what an assertive vendor or consultant would dare to proclaim. It feels akin to the visionary mindset of a venture capitalist founder who has invested all funds in startups that offer digital solutions to large banks:

"I will say that technology transformation modernization is the most important thing that this company has to do, without a doubt…” The bank's efficiencies "will improve as we move a lot of our applications to the new data centers, a lot of our applications to the cloud. So this is something that there is no choice. You have to do it ... it's crucial for the future of the company."

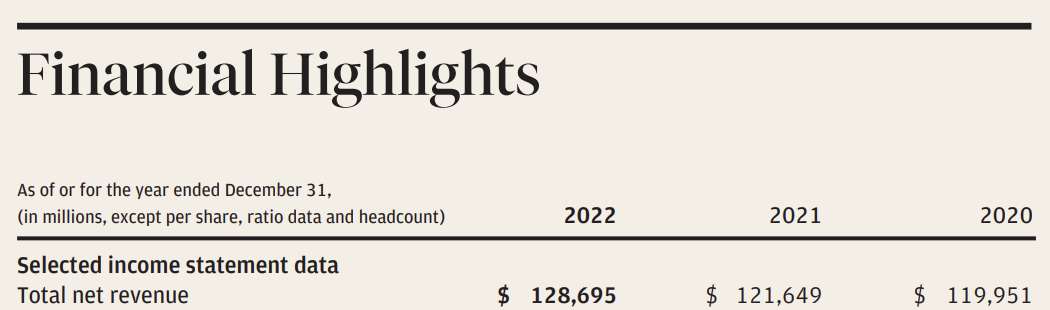

The second-in-command of a $150 billion revenue FSI considers moving applications to new data centers and the cloud as a game changer, viewing it as a necessity rather than a choice. Yet, how does one reconcile this perspective with the reality that application migration often leads to value leakage and is seldom associated with efficient realization? In truth, it is indeed a choice. Perhaps the answer lies in the fact that such monumental initiatives provide a way to utilize excess cash, present a compelling story to Wall Street analysts, and occupy the time of FSI executives.

While Daniel's assertion that digital transformation is a top priority for JPMorgan is valid, it may be due to the already highly optimized nature of the core business model, leaving limited alternative avenues for executive attention.

3. The predictability of digital transformation cost

As is typical for top banks in the current era, JPMorgan dedicates approximately 10% of its revenue to technology-related expenditures. The objective is undoubtedly to achieve cost-effective scaling by leveraging digital capabilities, thereby reducing reliance on manual human efforts. The theoretical advantage of digitization lies in enabling FSIs to cater to a larger customer base while incurring minimal marginal costs. Here is how Daniel Pinto describes this line of thinking for JPMorgan:

He acknowledged that the bank's plan to spend $15 billion on tech "is a lot of money," but said the budget "is really allowing us to scale without extra cost."

The question, of course, is how much scale would justify such a substantial upfront investment, even if the digital transformation proceeds smoothly. If JPMorgan were experiencing the expected 50% growth, as expected among leading fintech companies, or even a more typical 20% growth seen in the fintech sector these days, the numbers could potentially align. However, given the recent 5% growth in JP Morgan revenue, it seems that Daniel's concerns about the cost of scaling appear more like wishful thinking.

Ideally, JPMorgan would adopt a bottom-up approach to digital transformation, allowing for the selection of product lines with the greatest potential for scaling while deprioritizing the rest (for further insights, refer to this newsletter). However, the grandiose vision of manifest destiny leaves little room for such nuanced decision-making.

Why Do FSIs Disappear? (Hint: Not Because of Digital Transformation or Lack Thereof)

With the recent disappearance of apparently well-established FSIs, there is a natural inclination to uncover the primary underlying cause. When broaching such a sensitive subject, humans are often guided by two biases: the 'not my fault' bias and the 'aligns with my beliefs' bias. Presented below are some popular reasons put forward, followed by the actual correct answer.

1. Location

Perhaps unexpectedly, a member of the First Republic Bank Board has put forward this intriguing factor: :

2. Digital Maturity

FSIs have to have assets to match liabilities. Consumers and Businesses have a lot of liquid cash to park. Wouldn’t digital channels save the day?

However, it is noteworthy that the failed banks had a reputation for their highly competent cadre of Relationship Managers (RMs) who could have easily reached out to clients to pitch additional deposit opportunities. Their CEO might have even insisted on it:

If RMs possessed a compelling value proposition, the volume of digital acquisitions would be insignificant in comparison to the specific client segments of these FSIs.

3. Consultants

Another popular contributing factor is expensive but inept consultants. Here is how the Washington Post article illustrated this reasoning vis-a-vis Silicon Valley Bank’s failure:

SVB’s rapid growth “far outpaced the abilities of its board of directors and senior management,” according to the Fed, and so the bank “regularly engaged consultants to help prepare for the transition.” Consultants from McKinsey were joined by those from Curinos, Ernst & Young, Accenture and Protiviti, among others, according to records.

McKinsey’s work for SVB in 2020 and 2021 — which has not been previously reported — was sharply criticized by the Federal Reserve in its sweeping report on what caused the second-largest U.S. bank collapse since 2008. The Fed found that McKinsey had “failed to design an effective program” for assessing SVB’s problems and produced a report filled with “weaknesses.”

Indeed, consultants are unlikely to decline substantial fees, even if they lack profound expertise in the subject matter or doubt the client's capacity to implement their recommendations. Similarly, FSI executives are unlikely to reject a sizable budget for digital transformation, even if they believe it would be wasteful. However, blaming consultants for such outcomes is comparable to blaming calorie count data or personal financial management dashboards for individuals who persist in overeating and overspending.

4. The executive

A more logical root cause often lies with an individual directly in charge, although, sometimes, such a person may not even be present:

This, along with other shortcomings, led both regulators and SVB officials to conclude that the company’s then chief risk officer, Laura Izurieta, “did not have the experience necessary for a large financial institution,” according to the report. She stepped down from her role in early 2022 and formally departed the bank later that year.

Rather than the Board and CEO dedicating significant time and effort to hire a capable executive team, they often delegate C-Suite recruitment to HR and rely on consultants as temporary solutions.

5. The Root Cause Is Always The Same

The true root cause is surprisingly straightforward and has persisted throughout our industry's worldwide history. FSIs continue to fail today for the same reason as they did 500 years ago: a combination of management greed and excessive risk-taking. All of the recent failures could have been avoided if these FSIs had balanced their growth aspirations with spending more on de-risking their books before it was too late.

Greed, being an inherent motivator and driver of capitalism, can be beneficial and empowering. However, when unchecked, excessive greed poses significant risks, and eventually, luck tends to run out.

Other FSI Digital Transformation Content

Zurich Insurance Group Chief Information & Digital Officer Discusses The Business Climate In China