Disruption in Financial Services: Niche Wins, But No Industry Overthrow

Also in this issue: Should Traditional FSIs Worry About Crypto Moving Beyond the Casino Phase?

Disruption in Financial Services: Niche Wins, But No Industry Overthrow

A simple way to think about disruption is when a startup discovers a far more effective model to acquire, cross-sell, and retain customers than an incumbent in financial services or insurance. While everyone markets similar products to the same audiences, the disruptor leverages differentiated product features and sharper analytics to generate stronger ROI at every stage of the customer lifecycle. Over time, incumbents struggle to acquire and retain customers profitably; eventually, some don’t survive.

Take remittances: After 14 years, Remitly has emerged as the largest player in the U.S. market. It’s growing volumes by 40% annually while spending 20–25% of revenue on marketing—multiple times more than legacy players—and claiming 6x LTV/CAC with payback in under 10 months. Meanwhile, the former market leader, Western Union, is seeing declining revenues and a stock price at all-time lows. Today, the disruptor is worth half more than its disrupted rival.

However, outside of specific product niches, incumbents aren’t going anywhere. Some are treading water with flat revenues, while others are growing. It’s almost cliché by now to note that top U.S. retail banks remain largely untouched by neobanks — but surely the UK’s concentrated cluster of top-tier neobanks is squeezing incumbents, right? Not quite. For example, Barclays’ Personal Banking income grew 20% in Q1.

Revolut is one of the most effective global neobanks. While it hasn’t toppled UK banking incumbents, its original use case was to disrupt airport foreign exchange kiosks. So what happened to Travelex, the category leader a decade later? Not much — it still generates over $300M in retail revenues.

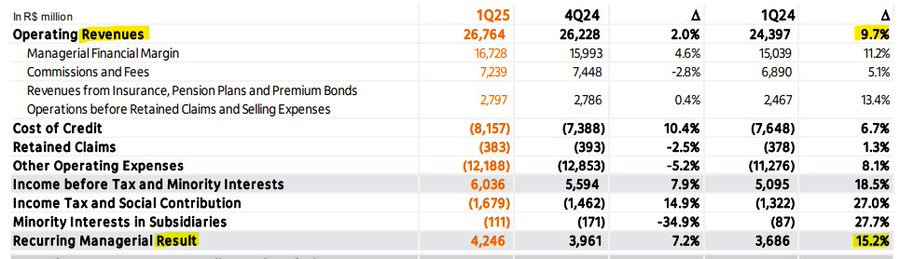

All right, but surely developing markets must be different. Conventional wisdom says top incumbents there are too incompetent and corrupt to withstand superb execution machines like Revolut and Nubank. Yet whatever Nubank is doing in LatAm, it hasn’t dented Itaú, the regional leader. Itaú’s Retail segment grew solidly in Q1, with revenues and profits up.

A decade ago, many viewed financial services and insurance markets as a fixed pie. In reality, market growth has enabled a handful of startups in each niche to rise quickly while incumbents mostly held their ground. The global P&C market expanded by hundreds of billions between 2020 and 2023, with some verticals adding $50 billion a year, leaving plenty of room to grow without requiring outright disruption.

This might also explain why U.S. consumer insurtechs could be 70–90% off their valuation highs due to no real differentiation in data, models, pricing, or UX, yet are still finding positive unit economics with decent growth. Deep analytics, scalable playbooks, and solid PR won’t disrupt an industry, but they’re enough to carve out a niche, especially with net new customers.

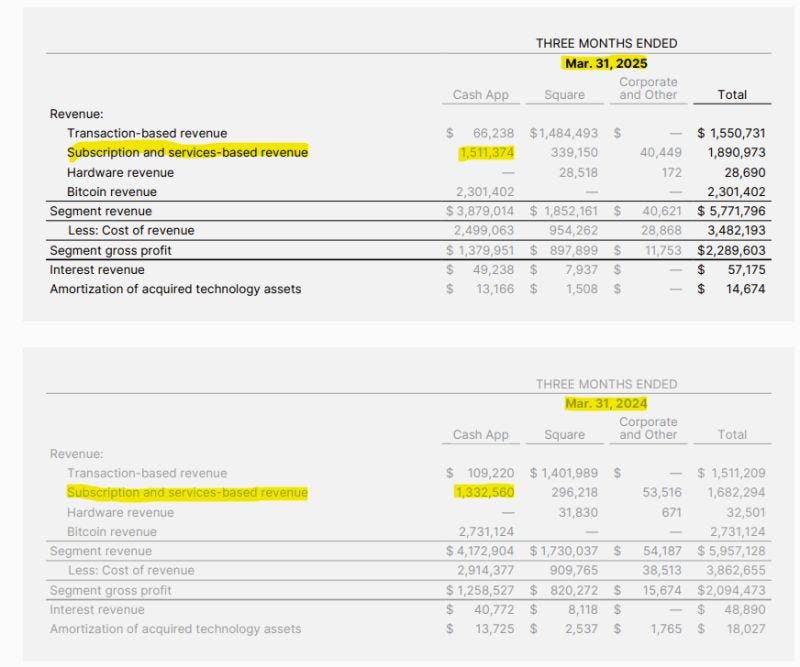

Have you noticed that so-called disruptors never disclose how much of their new customer base is new to the market versus poached from traditional competitors? If the majority are new to the market, investors might worry that fintechs could hit a growth ceiling at some point. The deceleration in growth rate is already evident in some markets and segments. For example, as soon as Cash App broke into the top 10 U.S. consumer banks by B2C fiat revenue, its growth slowed to 13%.

Most fintechs are not causing disruption but are instead struggling to survive. Banking expert Jason Mikula recently shared his analysis of Varo Financials, the first fintech to secure a de novo charter. The neobank raised an additional $21M in equity in Q1, bringing its total to $50M, but it burned through half of that, posting a $25M loss for the quarter.

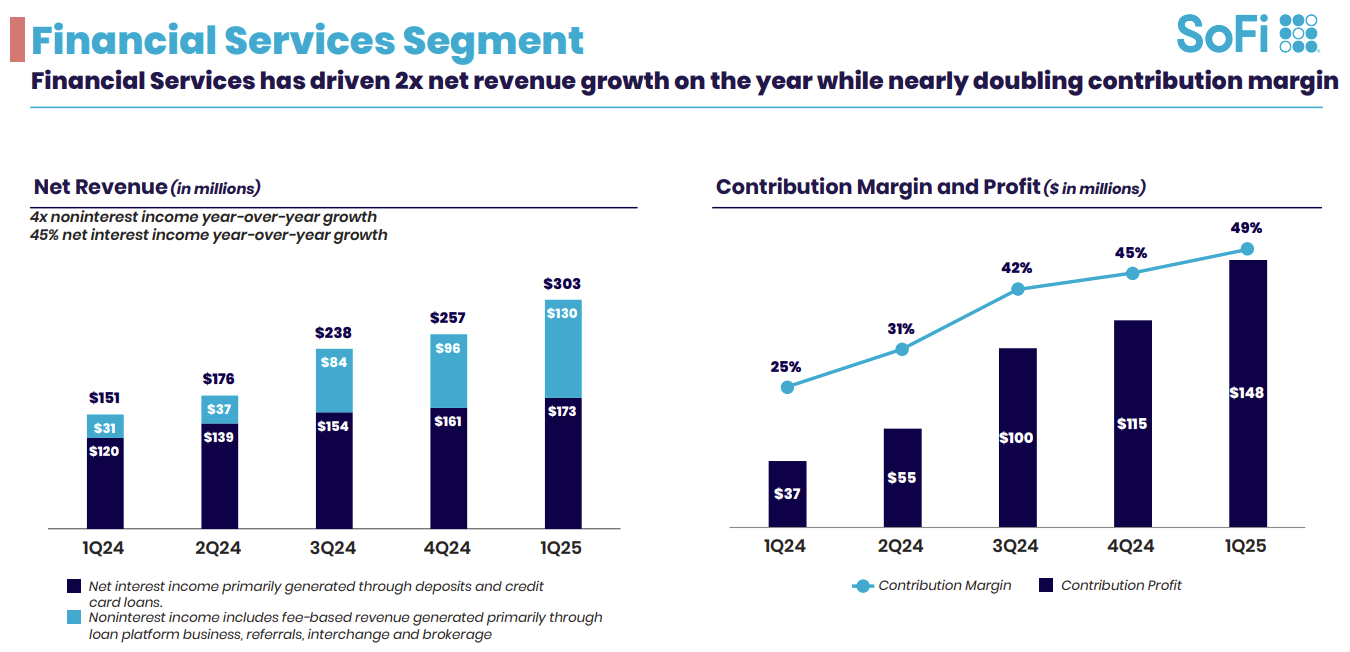

With Cash App slowing down, Varo struggling, and European players absent from the U.S., SoFi is the only neobank still showing momentum after reaching scale. In Q1, it doubled both revenue and contribution margin. However, that business line revenue is five times smaller than Cash App’s B2C fiat revenue. Can SoFi avoid the rapid decline in growth that Cash App has experienced? For now, at least, FSI incumbents worldwide don’t appear to be at risk of going out of business.

Should Traditional FSIs Worry About Crypto Moving Beyond the Casino Phase?

It’s an exciting time for crypto. No longer seen as a tool for speculation and money laundering, everyone from fintechs to traditional FSIs to governments seems to have a vested interest in its success. You might think that the U.S. Treasury's primary mission is to maintain a strong economy and protect the financial system's integrity, but now that also includes promoting crypto.

In a sign of the times, Tether's leadership can visit the U.S. without facing arrest, all while making $1 billion in quarterly profits. Even Meta is preparing for a crypto comeback. Years after its Libra/Diem venture was shut down in both the U.S. and Europe, the growing excitement for crypto might cause politicians from all sides to overlook past missteps and roll the dice. It seems we’re officially in the “move fast, break things” phase of the regulatory regime.

Not surprisingly, there’s a political element in the normalization of crypto, with Hollywood recently getting involved. The good guys are obviously portrayed as left-leaning, supporting government-controlled CBDCs to make the world a better place, while the right-wing villains champion private crypto for nefarious purposes. CBDCs stand for diversity and equity in this narrative, while private crypto represents fascism.

What does this mean for FSIs? Is crypto still a shady casino augmenting the metaphysical Web3, or is a genuine replacement of fiat finance underway? Listening to crypto experts and operators, the fiat years are numbered. Stablecoins, in particular, are supposedly instant, free, programmable, and preserve the stability of the beloved American dollar. Yet, when considering where money is flowing, no amount of new coins seems to deter the growing dominance of Bitcoin.

Is Bitcoin popular because it’s replacing payments and transfers conducted via fiat currencies? A decade ago, a startup called Abra had a fascinating solution—a-la Uber for Remittances. Recipients in Mexico could see nearby people with their exchange rates on their phones and choose the best option for home cash delivery. Despite significant funding, Abra couldn’t get the business model off the ground due to competitive and regulatory hurdles, so it pivoted to offering trading and wealth management services.

The failure of Bitcoin in El Salvador, despite massive pressure and support from its determined president, served as a final, conclusive confirmation. For payments and transfers, the pain points with fiat currencies are either nonexistent or there are no Bitcoin solutions to address them.

Public stablecoins don’t provide compelling evidence of success either. Much of the discourse around their meteoric rise curiously omits crucial details like end-user demographics, core use cases, and actual payments or transfer volumes. Visa recently made waves by investing in the stablecoin infrastructure platform BVNK, which claims to process over $12 billion annually for companies like Ferrari and Rapyd. Yet I’ve found no acknowledgment from Ferrari of such a significant move

Most crypto proponents willfully ignore the unprecedented transformation in fiat technology, from SWIFT and Visa to local real-time rails and fintech platforms. Instead, leading crypto voices often focus on selling sizzle rather than steak, making grand declarations without addressing the real substance behind stablecoin adoption.

There should be a special Olympic category for the mental gymnastics required to pretend that we still live with 1970s-era payment rails. A typical attitude among crypto experts, investors, and operators seems to be hoping for a calamity to destroy fiat-based finance, followed by a qualitative “proof” that fiat won’t last:

Trillions in fiat flows → Fiat rails were built in the 1970s → Users suffer from high costs and slow service → Stablecoins are superior tech → It’s already moving trillions.

For instance, Circle recently declared that “There’s no cross-border real-time payment system,” proudly showcasing that they moved USD to BRL in just 72 seconds in test mode. That would be news to networks like SWIFT or Visa, which have been processing millions of transactions in seconds for years. Nearly 60% of SWIFT GPI payments are credited to end beneficiaries within 30 minutes.

A typical sleight of hand in crypto pitches is identifying a customer segment that isn’t getting the best deal and attributing it to a nonexistent fiat alternative. Are consumers paying high fees for cash remittances? Let’s ignore the fact that the same providers offer cheaper digital options. Consumers earning zero interest on checking accounts? Let’s overlook cash management offerings that pay high yields.

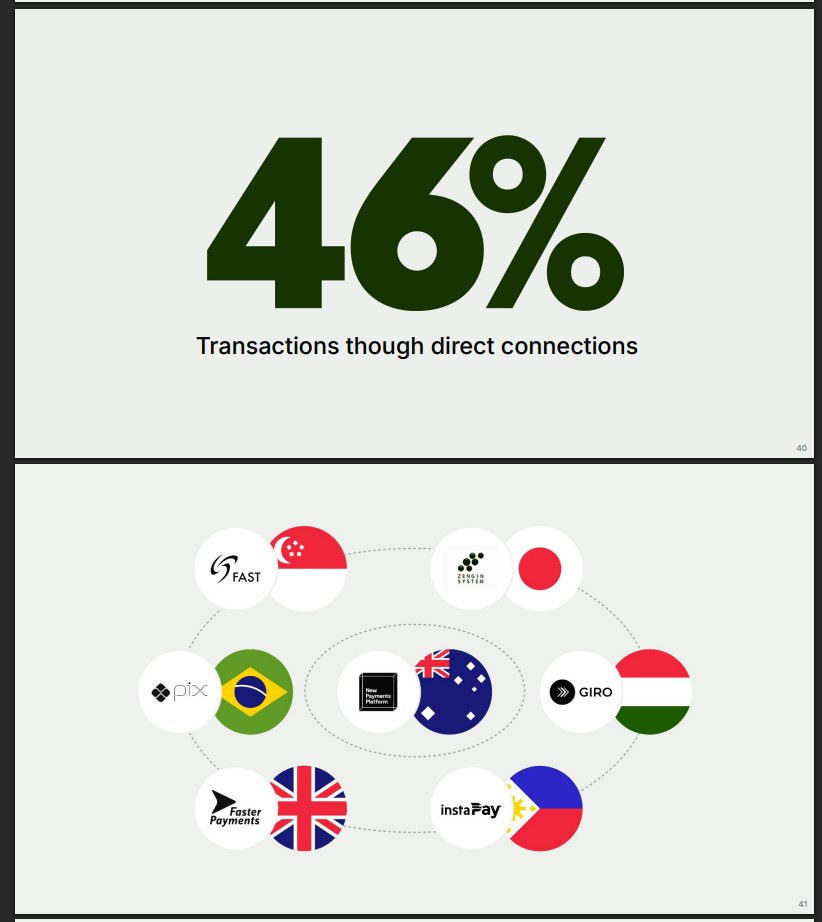

Meanwhile, fiat money transfers and payments work seamlessly — virtually instant and free. Of course, experts and operators in the stablecoin space are well aware of this, but as Upton Sinclair once said, "It is difficult to get a man to understand something when his salary depends upon his not understanding it." This is one fact that proponents of stablecoins for international money transfers hate to confront, even more than breakthroughs in fiat transfer rails across banks. Fintechs and traditional MTOs have massively scaled direct connections thanks to ever-expanding local real-time payment rails.

While Wise delivers two-thirds of transfers instantly with an average take rate approaching 0.5%, there are still corridors where costs exceed 5%, even for digital transfers. Are leading fiat specialists unable to lower costs due to old payment rails? Not exactly. The common reasons in these corridors are stricter regulatory frameworks and manual bank oversight, which often lead to inbound limitations (e.g., Morocco, Poland, Chile) and some outbound restrictions (e.g., India, Israel).

Of course, crypto providers could circumvent regulators, as they often do, offering services directly to consumers. However, the challenge with this approach is that committing white-collar crime could eventually attract the attention of local governments or Western authorities. Or will they? Top banks and fintechs are routinely fined, even when they’ve flagged AML issues on their own years earlier, while Tether, the dominant stablecoin provider, has not been fined since 2021.

The US to Argentina corridor is a small but interesting example. A rampant black currency market and a lack of enforcement of capital controls mean MTOs and fintechs use the unofficial rate, while a compliant player like Wise stays away. This presents a good niche for stablecoins. Yes, unrestricted USD accounts are better anywhere, including in the US, than USD accounts with restrictions.

We also know that stablecoin rails aren’t creating a significant competitive advantage because some leading global payments players now own stablecoin infrastructure. PayPal didn’t become a low-cost leader after launching PYUSD in 2023. Stripe is not planning to drop its high payment processing fees after acquiring Bridge, despite calling stablecoins "superconductors for financial services."

The niche applicability of crypto for supplementing fiat payments and transfers doesn’t mean traditional FSIs can’t profit from it. Revolut had fantastic financial performance in 2024, mainly due to crypto trading: "Wealth revenues grew 298% YoY, driven by increased crypto trading activity as observed throughout the industry and the launch of the Revolut X crypto exchange."

It gets hilarious when leading crypto players like Coinbase and Circle try too hard to convince regulators, politicians, and the media that they are solving the pain points of the ordinary person. Coinbase, in particular, keeps running ads focusing on regular people's mundane financial needs. That’s fine — at least commit to it by creating a fake landing page with those made-up use cases and customers. But nope, that would add friction to the journey of their actual core use cases: trading and tchotchkes.

One interesting edge case of crypto is private blockchains. Industry-leading operating models, coupled with top-notch talent, allow some FSIs to pursue use cases that others could only dream about. BlackRock's Aladdin has been a unique example for two decades, but now JPMorgan’s Kinexys has the potential to create something even more distinctive. This category-defining blockchain venture already handles over $2 billion in daily transaction volumes and has processed over $1.5 trillion on its platform since inception.

While crypto and stablecoins are primarily helpful for trading and gray areas, a proprietary blockchain ecosystem by a global financial giant could offer a viable alternative to the traditional correspondent banking maze in commodities trading and supply chain finance. HSBC and Citi could have been contenders, but they are years behind JPMorgan and currently in a phase of global retrenchment and cost-cutting. JPM Kinexys doesn’t break out its impressive daily volumes and growth by use case, so we’ll have to wait and see if more trade intermediaries like Trafigura sign up, providing any indication of adoption.

While the crypto industry remains an entertaining casino, it’s worth it for traditional FSIs to keep a periodic watch. It might sound counterintuitive, but creating an entire industry by criticizing the current order without offering a better alternative could work. Marxism achieved enormous political success by merely critiquing capitalism, with critical theory becoming a foundational ideology in the West. The real question is whether the crypto movement will find its own Lenin, Stalin, or Mao—figures capable enough to combine criticism with coercion and incentives to swing the pendulum away from fiat.