Rethinking Digital Transformation: Why Lagging Might Make Sense for Many FSIs

Also in this issue: Prioritize Executive and Employee Transformation over Clients and Third Parties

Rethinking Digital Transformation: Why Lagging Might Make Sense for Many FSIs

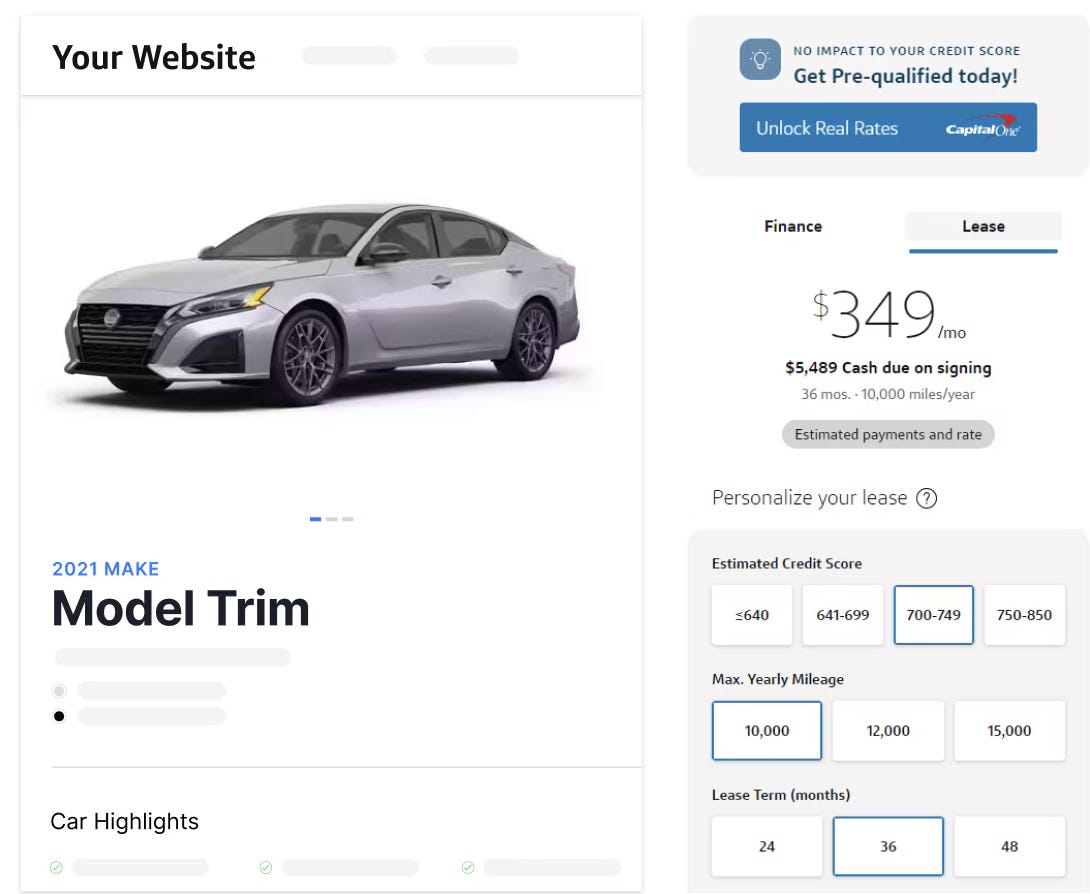

Digital transformation is too risky to be applied across all FSI areas. It’s best used as a targeted solution where substantial ROI and NPV seem likely, partly because an FSI has a track record for excelling at the current level and could climb further. Leading among peers in digital transformation is exponentially more challenging. A recent interview with the head of Capital One's Auto business, Sanjiv Yajnik, provides insights into what success looks like at that leading level and the risks involved.

Background of Capital One Auto

Only five years after being founded in 1994, Capital One expanded its credit card capabilities to auto lending, specializing in riskier consumer segments. Within a decade, through acquisitions and organic growth, it had a top-5 auto loan book in the US. More recently, Capital One Auto has been one of the two largest players in the country, each with about 15% market share, along with a century-old General Motors' spinoff, Ally Bank:

Not only was this novel player able to become an industry leader within two decades in a highly complicated and competitive field, but Capital One Auto also deployed a platform for car dealers in 2023, Navigator. It is based on a digital tool for consumers launched in 2015, with additional marketing, financing, and sales capabilities:

A Quarter Century of Lessons Learned

Engineer by trade, Sanjiv Yajnik's interview included five areas that he has learned as CEO from taking Capital One Auto from concept to industry leader in the last quarter-century:

Tech innovation should be spurred not only by addressing client pain points but also by applying a novel "hammer" to multiple potential "nails". While traditional FSIs should not pursue an "if we build, they will come" approach, the most digitally advanced FSIs have to make such risky investments.

Even expensive internally developed solutions should be replaced if a vendor builds a significantly better alternative. Costly "mistakes" followed by decisive pivots are the norm; being the best is more important than personal egos and office politics.

Building a great product can't be accomplished 9-5 remotely; it requires sprints of intensive in-person engagement, including weekends. While some FSI executives want to see people in the office purely for perception, Capital One Auto operates like that to level up faster.

Increasingly flexible technology, including LLMs, enables easier product development for one-tenth of the time and cost. Most FSIs want to launch products faster, but only a few have an adequate operating model for prioritizing the right features and then scaling/pivoting based on short-term learnings.

Generative AI is not meant to automate existing processes but to transform them to take advantage of novel power. While a typical FSI still relies on many manual processes, a leading digital player has already seized the low-hanging fruit and must now think more innovatively.

Most importantly, note the hands-on nature of the CEO, personally participating in front-line activities including weekend grind in the office. Such behavior is less unusual among digital natives or fintech companies, but how many traditional FSI CEOs are interested in such activity?

Avoiding the Pursuit of Novel Tech and Specialization

"After burning $20 million, we finally shut it down and assigned responsibility to a more competent leader," explained an IT executive of a $10 billion insurer. About five years ago, his company allowed one business executive to become a chief data officer and build a global data warehouse.

When I interviewed its potential clients in different business lines at the time, nobody knew what that solution would do for them, and some were even building something similar on their own. Business line executives of that insurer were doubly frustrated because they couldn’t get the most basic IT support from the enterprise to function properly and couldn’t get budget relief to solve it on their own.

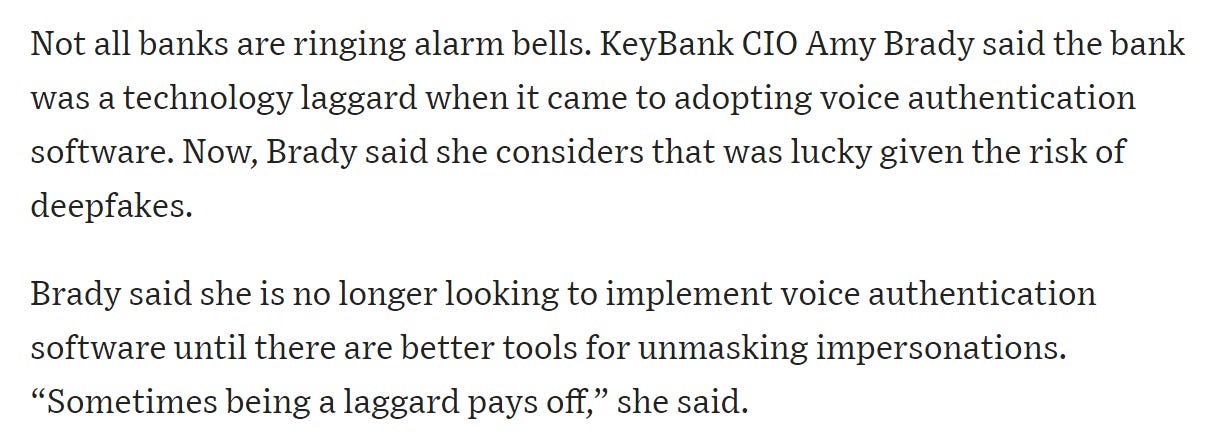

This situation is common in FSIs with lower digital maturity. Instead of focusing on improving their ability to address pressing business issues, the enterprise C-Suite often prioritizes innovation with novel technology or new processes. Luckily, some FSIs are learning that waiting longer could sometimes pay off:

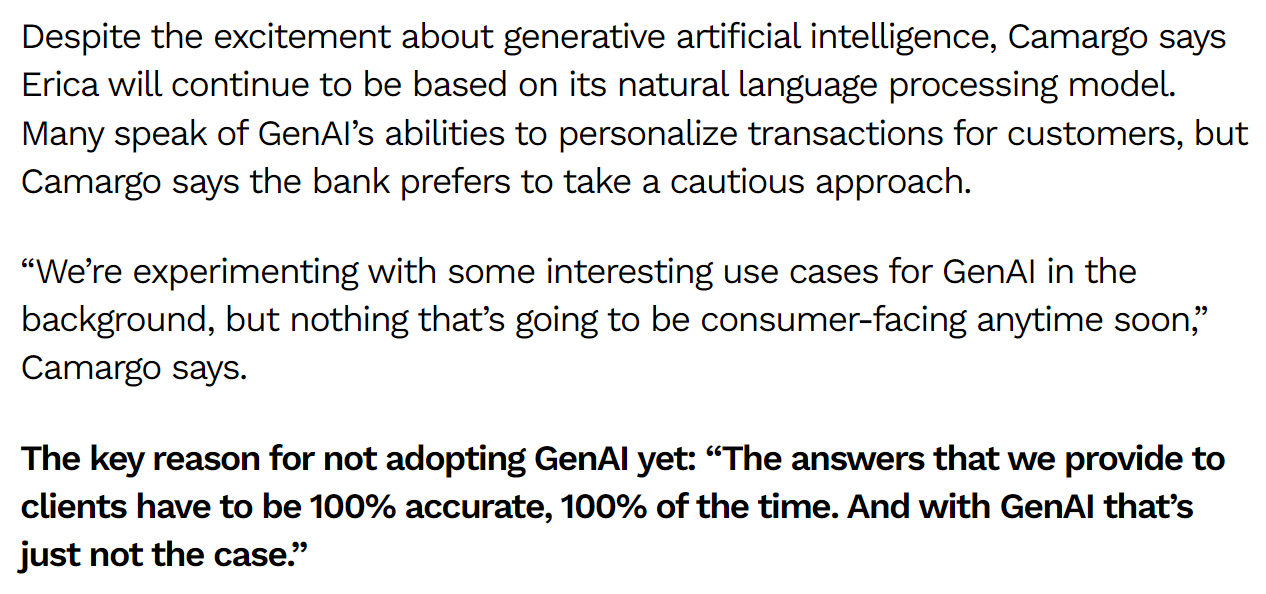

The latest area where being a laggard is fine is Generative AI. With so much hype, it's rare to hear FSI executives honestly acknowledge the long-term limitations for customer-facing purposes, like in the case of Jorge Camargo, a Bank of America leader in its digital product management:

Traditional FSIs should express a similar caution towards a client segment or product specialization. Specialization, i.e., placing highly concentrated bets, has proven to be a successful differentiation strategy for FSIs, as demonstrated by Capital One in Credit Card and Auto Lending. However, it also requires leadership to recognize a geometrically higher risk, with the board oversight and risk management needing to be much more robust.

In 2023, a few US regional banks learned this lesson the hard way, creating a correct apprehension in other less mature FSIs when hearing a specialization pitch from consultants:

Leading in digital transformation is as prone to failure as individual therapy - only a small percentage benefit from it, and only because they are eager to change their behavior. For most, it is a waste of time and money, and for a material portion, they get worse afterward. Avoiding the leading or even fast follower role is like avoiding therapy, a sensible choice for many FSIs.

Prioritize Executive and Employee Transformation over Clients and Third Parties

FSI CEOs dream about leading in their industry in their country. Leading FSI CEOs dream of creating a global franchise. Leading Global FSI CEOs dream about a large platform business that its competitors spend money on. By around five years ago, BlackRock CEO, Larry Fink, achieved it all.

Unlike Jeff Bezos and Elon Musk, Larry’s net worth was “only” a billion, so he couldn’t have bought a media company or started a spaceship company. Instead, Larry wanted to change the world by using BlackRock’s market power to force companies to adopt ESG and DEI policies. That worked fine in the lethargic Western Europe but received a major backlash in the still-feisty USA.

Despite later backtracking on its demands, BlackRock became a punching bag for large swathes of US politicians and has continued to lose business in some states. Since Larry hasn’t been known for his patience either, such ongoing political reaction prompted his peculiar remarks at the recent analyst call (my highlights):

“I've spoken before about the fear we see today, some is stoked by increasingly political polarization in the world. Our industry and BlackRock have been a subject of political dialogue mostly in the United States. We recognize some of this with being the industry leader. We have done a better job now of telling our story so that people can make decisions based on facts, not on lies and not on misinformation or politicization by others.

Unfortunately, there are still others out there who put short-term politics, who continuously lie about these issues. They are putting those issues above the long-term fiduciary responsibilities. As a fiduciary, politics should never outweigh performance. I do believe that with the vast majority of our clients, our long-term fiduciary approach and performance are resonating.”

In the US, if an FSI issues press releases about "the current thing" or even gets political internally, mostly nobody cares. If an FSI figures out how to monetize "the current thing" with an overpriced product (e.g., ESG funds), that's good old capitalism. It's only when an FSI starts forcing politics onto third parties that it attracts attention, and the BlackRock CEO has only himself to blame for taking such a unique risk.

Third Law of Transformation

Similarly to Newton’s Third Law of Motion from 1686, for every transformative action, there is an equal and opposite reaction. Blackrock has overcome resistance to transformation better than other leading FSIs until it reached the ultimate level:

Employees → Executives → Customers → Clients → Partners → Competitors → Unrelated 3rd Parties

Blackrock endeavored to compel companies without business ties to enact dramatic changes in their business models and governance. Their stocks just happened to be in Blackrock’s vast portfolio. Moreover, unlike typical activist investors, Blackrock demanded change not to achieve a short-term increase in stock price but for some long-term esoteric benefit related to climate and diversity.

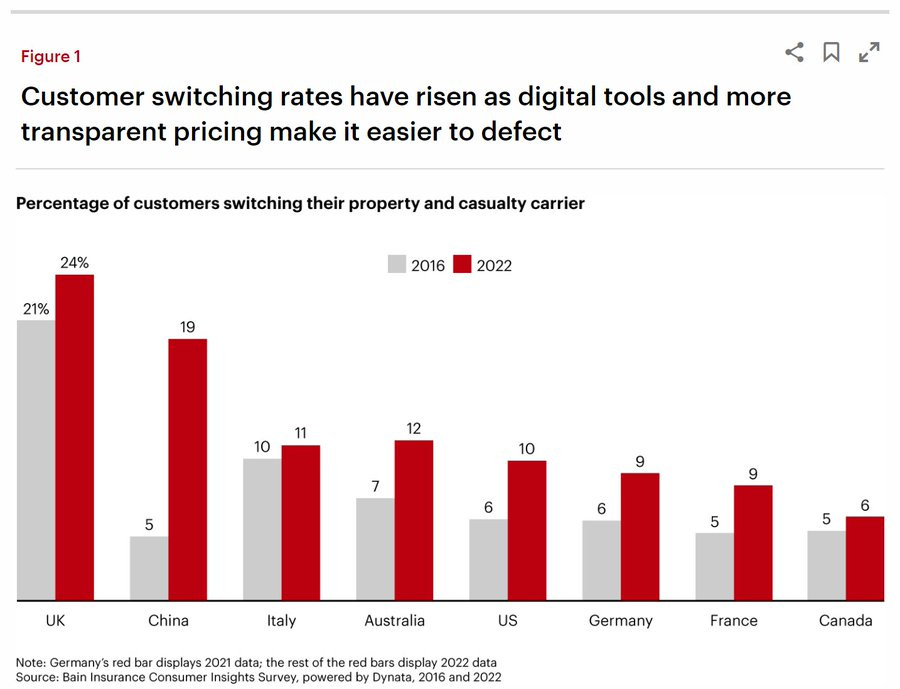

Even an easier transformation in FSIs’ customer behavior is not a forced change per se. For example, the degree of switching FSI providers differs across countries. Customers in the UK are switching their P&C carrier four times as much as in Canada. Is it because UK incumbents or insurtechs are four times more effective in nudging consumers to switch? No, the UK is ahead due to the prevalence of price comparison sites for selecting FSI products.

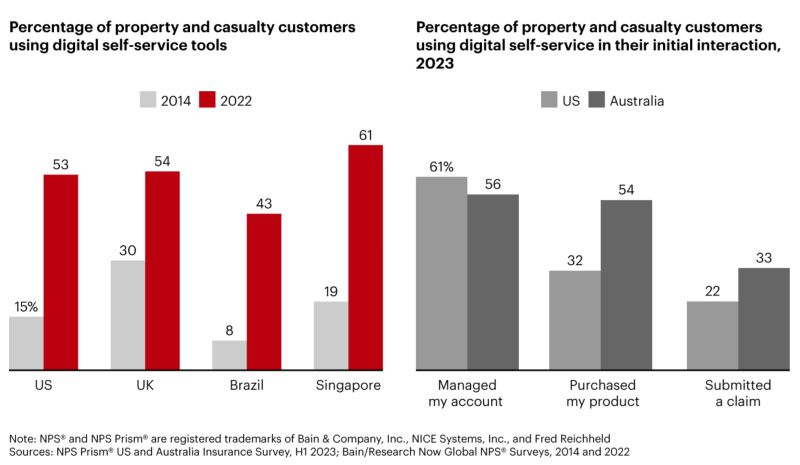

For simple tasks like using a website or mobile app for self-service activities, the differences across countries become much smaller and are mostly due to the availability of such services. However, when it comes to more critical tasks like purchasing a product, forcing digital behavior is virtually impossible. For example, in the US, across financial services and insurance products, approximately 70% of consumers still use physical channels:

Root Insurance almost went bankrupt trying to scale a business model that depended on new behavior from riskier consumers. It turned out that relying less on a credit score for underwriting and using telematics for tracking behavior does not have magical powers over drivers.

However, from its lowest point in 2023 with a drop of over 99%, Root’s stock is now only down by 85%. Root’s CEO recently explained one of the reasons for the turnaround during an earnings call: insurtech embraced higher credit customers who already exhibit responsible behavior by taking better care of their cars and filing fewer accident claims.

Transformation is challenging enough when it focuses on changing the habits of employees and executives. FSIs would be wise to leave clients and third parties alone, addressing their needs and wants instead. If Coinbase is worth $50 billion by satisfying consumers' desire to play with crypto, there are likely numerous value-generating opportunities to entice consumers and businesses to open their wallets without coercion.

Other Insightful Reads

The Worst Part of a Wall Street Career May Be Coming to an End (examples across large FSIs show how AI might replace the rudimentary tasks of junior analysts)