Should FSIs Prioritize Customer Experience among Digital Transformation Use Cases?

Digital experience is the key reason for customer attrition and the main focus of digital transformation, but the real root causes and solutions are hiding behind the surface and are often overlooked.

Should FSIs Prioritize Customer Experience among Digital Transformation Use Cases?

The digital transformation hype is compelling FSIs to spend close to 10% of their revenues on technology. In the most recent quarter, Citigroup spent 15%. As Citigroup is a diversified FSI, the technology spending in its retail line of business is likely closer to 20% of revenue. Besides the significant spending, FSI CEOs now routinely mention technology as a key focus and differentiation strategy. Capital One’s CEO recently touted the company’s technology initiatives as its overarching strategy (see the snapshot below). He further explained, "Capital One is at the vanguard of a very small number of players who are investing to build and leverage a modern technology infrastructure from the bottom of the tech stack up to put themselves in an advantaged position to win as banking goes digital.”

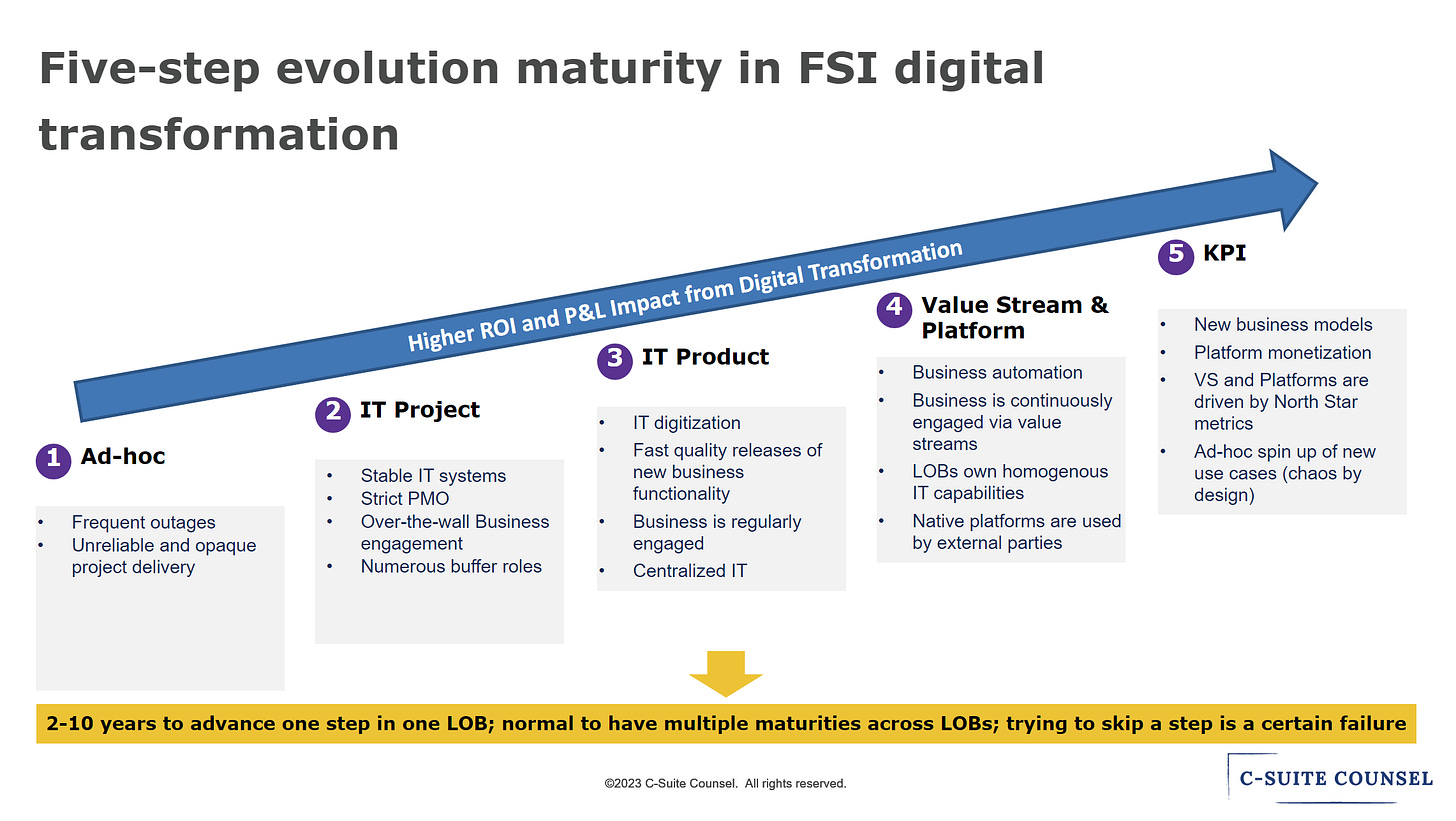

With the avalanche of digital building capacity, figuring out what specifically creates a P&L impact vs. value leakage is extremely difficult. The sheer number of initiatives is overwhelming while quarterly earnings are large enough to hide even big mistakes. Additionally, the owners of those initiatives usually operate in the IT Project or IT Product phases of digital maturity, which means they are more driven by delivery metrics rather than value creation.

1. Customer experience remains the main focus of digital transformation.

So FSIs are spending millions, some even billions, annually on delivering new digital capabilities: digital products, digital services, and newly digitized processes, hoping that some of those initiatives would create an impact. Improving customer experience remains the favorite focus of digital transformation.

But how does FSI decide which customer experience improvements should be prioritized? Rather than the ideal measurements of P&L impact and ROI, an interim easier KPI of digital transformation of customer experience could be its impact on customer attrition. To simplify, as the attrition rates picking up in some FSI segments, if digital transformation is not resulting in reverting or at least slowing down customer attrition, what is it then for? Let’s delve together into the causes of attrition and if improving customer experience should be a priority solution.

2. Customer attrition is growing.

As discussed in another newsletter, customer attrition in certain FSI segments has reached an inflection point. Advanced incumbents and leading fintechs have finally learned how to capture the benefit of much more advanced digital capabilities at scale. And of course, their main focus is on stealing on-the-cusp customers from the less advanced competition.

For example, in retail banking, the attrition historically was less than 10%. But several recent surveys of banking executives point to an alarming trend. According to Forrester, customer attrition for the multichannel banking industry reached 24%. A Salesforce survey points to 25-35% customer attrition across FSI segments:

Here is how an executive from a top-10 retail bank in the US described to me privately the urgency on their leadership team:

‘Large customer attrition is a real phenomenon. We basically have to spend all kinds of money on acquiring new customers to replace the ones we lose!’

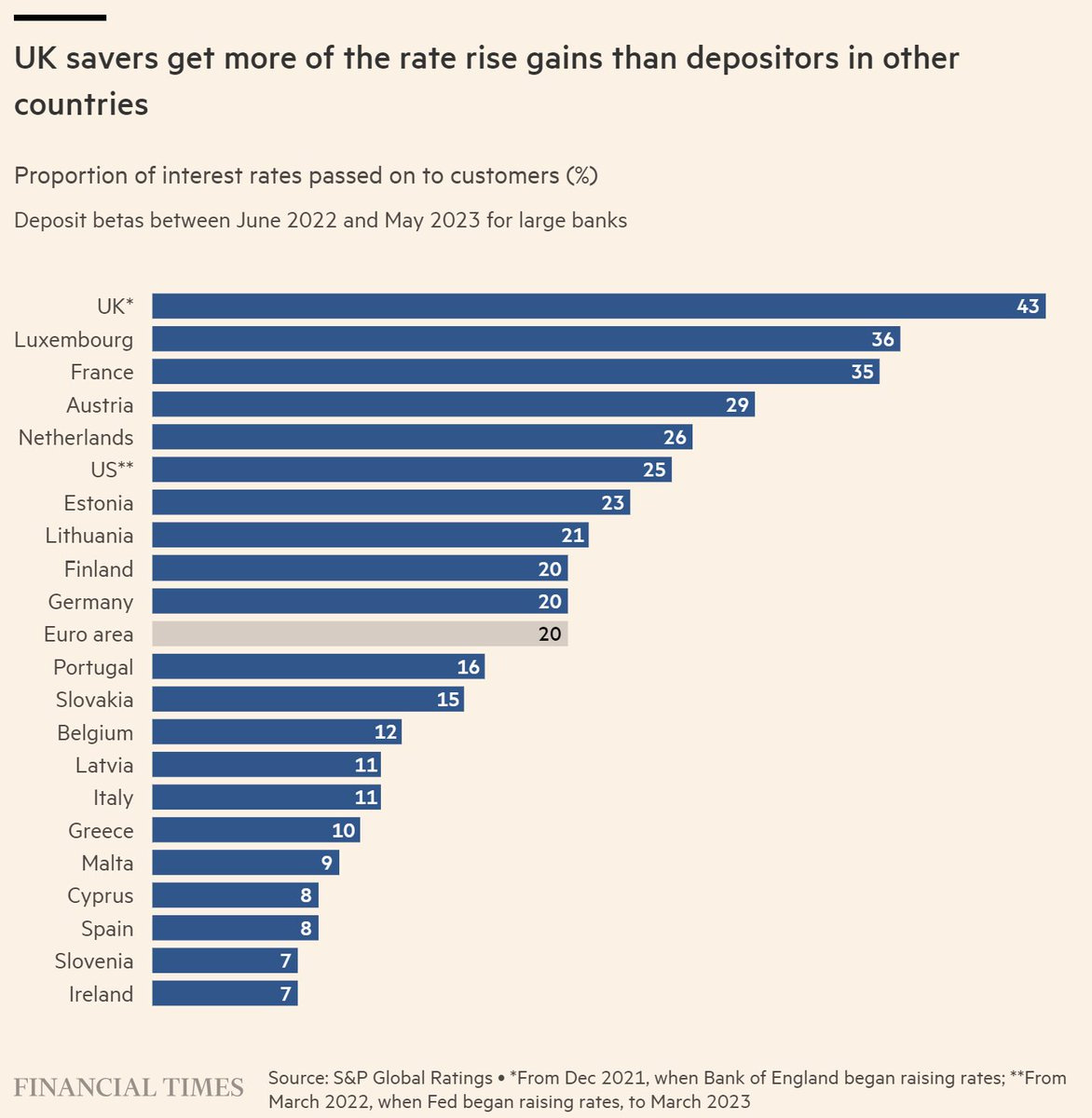

The situation is even more dire in the UK where a plethora of fintechs and price comparison sites pushed incumbents to begin competing on price:

3. What is driving increasing attrition?

Nobody knows for sure if it is true, but there is a good story about how American Express and Costco's partnership fell apart. It came down to a perception gap in loyalty between the two CEOs:

As the negotiations dragged into January 2015, however, he [Amex CEO] became agitated and called his counterpart [Costco CEO] to remind him that Amex hadn’t only furnished Costco with its prestigious card; it had been Costco’s “trusted partner.” Jelinek interrupted, according to people who were briefed by Chenault about the call, and told him that as far as he was concerned, Amex was another vendor, just like the one that sold Costco ketchup. “If I can get cheaper ketchup somewhere else, I will,” he said. As rumors about the call spread, the rank and file who heard about it couldn’t believe someone from Costco had the nerve to insult Amex like that. Ketchup! Chenault called Jelinek a few weeks later to say Amex was pulling out.

The same fate seems to follow FSIs with their customers. For better or for worse, customer loyalty is no more. Whatever customers love about their FSI, product features, service, or pricing, they need regular validation that those criteria remain competitive. Not necessarily “What have you done for me lately?” but “Make sure to treat me fairly” expectation.

But which specific deficiency in FSI capabilities is driving increased customer attrition? The answer is naturally different across FSI segments. According to a recent Salesforce survey, digital experience and customer services are the top attrition factors in the Banking and Insurance industries:

Looking further into what creates a negative digital experience, it appears that all problems are self-inflicted. FSIs are spending enormous resources to introduce digital features like Chatbots and Personalization, so a customer gets overwhelmed and struggles to get proper answers and support:

4. New digital customer experience always comes with trade-offs.

If FSI’s customers are voicing significant complaints about digital experiences, it is essential to address those issues promptly. However, it's crucial to prioritize the loudest complaints first. As a general guideline, receiving a rating of 4 out of 5 for customer-facing digital assets indicates that they are good enough to prevent high attrition rates. Beyond this point, introducing new digital experiences may lead to material trade-offs, requiring careful consideration.

Even some of the more advanced FSIs can’t escape those trade-offs. Progressive auto insurance is the most advanced carrier in the US when it comes to digital capabilities. Naturally, its main mobile application gets great customer reviews. How did Progressive do when it launched a sister mobile app for its usage-based insurance? Much worse (on the left vs. core app on the right):

5. Does digital experience even matter to FSI customers?

So customers are penalizing FSIs for poorly launched digital experiences without careful evaluation of trade-offs. But could even great customer experience be a differentiation in the current environment? Many large FSIs have wasted collective billions of dollars on creating a better experience for the customers just to realize that it was not the secret sauce by itself:

Many of the fintechs and insurtechs are trying to survive rather than hoping to cause disruption specifically because they focused too much on customer experience and marketing rather than developing a differentiated business model.

So why, despite all the evidence, FSIs still have customer experience as the main focus of digital transformation? Because building new digital products/features is easier than identifying and scaling new business and operating models. Why else would Fidelity or Intesa Sanpaolo launch stand-alone fintechs under new brands which are designed to fail in creating an impact?

6. Where should FSIs focus digital transformation instead?

With FSIs spending 5-15% of revenue on digital transformation, where else should a company spend those millions or even billions every year? The right answer is more likely around improving customer analytics and the end-to-end underwriting process.

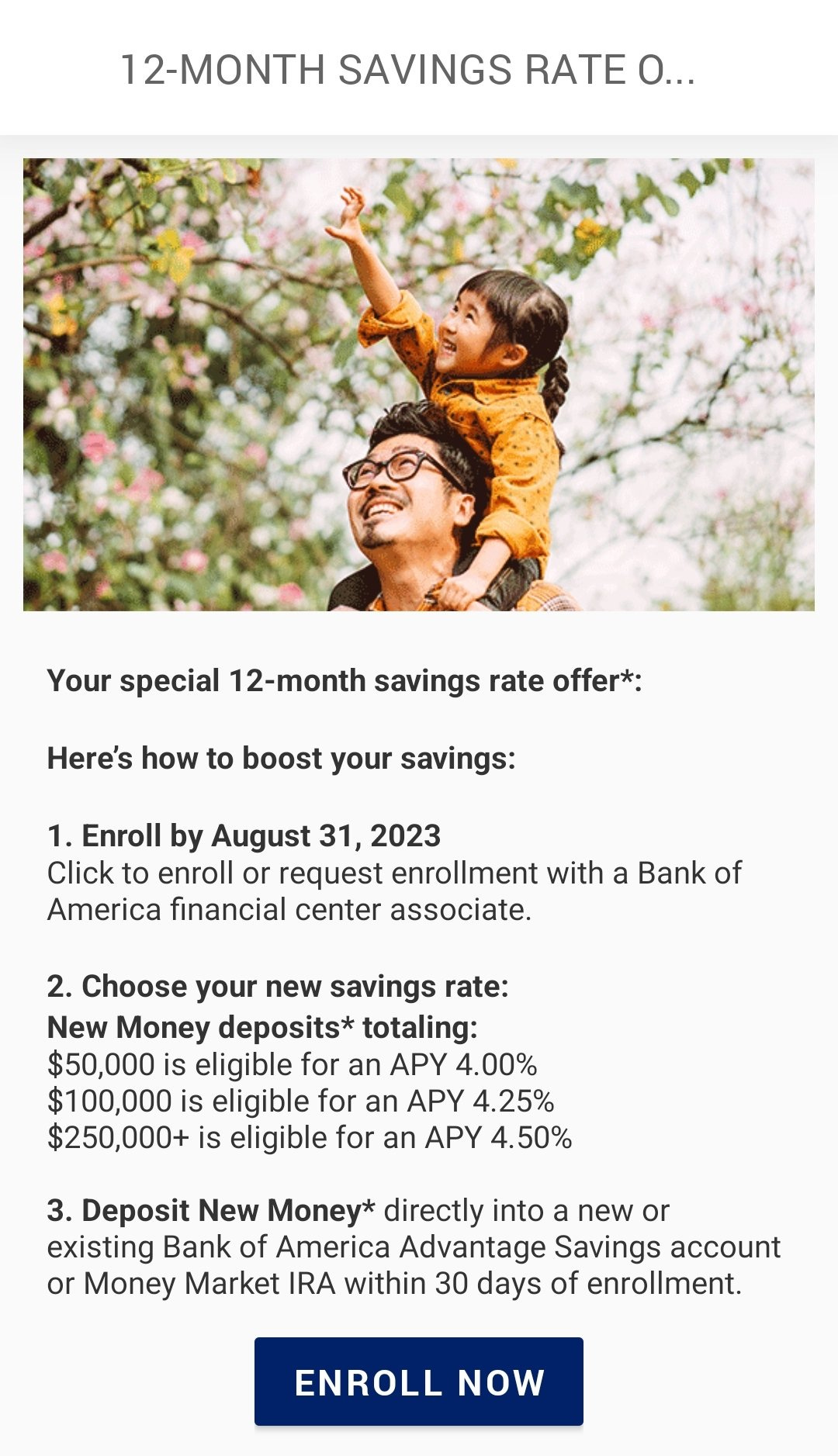

It is incredible that after a decade of massive digital transformation efforts, most of FSIs still don’t know their customers and don’t even understand the meaning of customer analytics. Just look at this recent offer below from one of my banks. The bank is obviously worried about losing deposits, so they are launching a new digital initiative, a higher savings rate product. Comparing it to the best offers on the market, this is 10-20% worse pricing, a big upfront commitment, and a long lock-up period. Instead of wowing me, my bank tells me that they don’t understand me as their customer and want to take advantage of me. Is it any surprise that traditional banks are losing market share to digital players?

By “customer analytics” a traditional FSI basically means proactive targeting of customers with somewhat relevant offers. For example, don’t send a credit card customer who never took credit a balance transfer offer. By the way, that is already an improvement that took a couple of decades to introduce and that is worth celebrating. But unfortunately for FSIs, that is not a digital experience that would prevent customer attrition. The bar is much higher.

The recent BCG report across P&C insurance firms identified underwriting capability, not digital customer experience, as the key differentiator of top performers. Focusing digital transformation on better customer segmentation and risk-based pricing seems much more effective than launching another mobile app feature.

Tediously getting better with data analytics and customer micro-segmentation is hard, and it is not surprising that only a few FSIs have such discipline. In 25 years, Progressive’s market share in auto insurance went from 1/7th of State Farm's to becoming a market leader because it took that hard road. In 1997, Progressive was already capable of real-time price comparison, dynamically sending bad prospects to competitors. How many FSIs can do this today?

If your FSI wants to become a market leader in the next few decades or at least to slow down customer attrition, be very selective in improving customer experience and try attacking harder business areas with digital transformation instead.