The Failure Of The "Leading With Empathy" Experiment at Citi

Also in this issue: Lessons for Digital Transformation in FSIs from Fintech Successes and Insurtech Failures

The Failure Of The "Leading With Empathy" Experiment at Citi

After narrowly surviving the financial crisis of 2008, Citi faced a prolonged period of recovery and healing from its excessively risky investment strategies. Federal bailouts and loss-sharing agreements also constrained its growth appetite considerably. However, 13 years later, by early 2021, the stock price remained nearly 90% below its all-time highs, leading investors to finally push the CEO out in the hope of a turnaround under the new leadership.

The success of transformations hinges on the willingness of FSI executives to change their own operating habits and disrupt the habits of others. Therefore, it was surprising to see the new CEO, Jane Fraser, introduce a fresh vision for Citi's culture in March 2021: leading with empathy. Transformation necessitates a temporary suspension of comfort because it's designed to be challenging, and affirming individuals with empathy can result in prolonged hesitation and slower personal growth. It's worth noting that this proclamation wasn't merely a trendy PR move or a symbolic gesture because Jane happened to be the first woman to lead a major US bank. She genuinely believed in it and articulated a rationale for why leading with empathy establishes an enduring competitive advantage.

“… what we have found at Citi is that empathy is foundational to how we deliver for our clients and how we attract and retain talent. Empathy enables the excellence we strive for every day. It helps create our edge… In this new age of disruption, where scale, agility, and a relentless focus on the needs of clients and customers are imperative for every business, empathy is the competitive advantage that will separate the winners from the losers.”

1. The value of empathy

The former CEO's departure was prompted by 13 years of stagnation, so scaling the way Citi had operated during that time appeared to be the antithesis of a turnaround. More crucially, a lack of interest in client needs isn't necessarily linked to empathy. In fact, some of the least effective FSI executives I've encountered over the last two decades were highly empathetic. They had an exceptional ability to perceive the emotions of clients or employees, but they simply chose not to engage in those discussions.

Why might an FSI executive not be eager to meet their clients and personally understand their needs if not for the lack of empathy? For example, a majority of IT executives in FSIs do not even consider meeting clients, which would be helpful for a successful digital transformation - their limiting factors are not empathy but their operating muscles, budget, and job security. In other words, they are not sure how to engage with clients effectively, they might lack the budget authority to react to client feedback, and they do not want to upset their senior colleagues by moving on their turf.

Certainly, Citi has numerous executives who regularly meet with clients. However, are the top deal makers necessarily the most empathetic among their peers? Are they the most attuned to client needs and adept at providing appropriate solutions? Not necessarily. They may also excel at persuading clients to purchase unnecessary high-margin products. As one senior Citi executive revealed as his secret of success, "Sell as many expensive loans as you can."

This behavior is a common occurrence in many banks. Furthermore, clients often do not even mind when some of those discretionary high-price deals eventually fail (such as 70+% of acquisitions) because it involves using other people's money. Therefore, in some cases, doing what's right for the clients can be a lose-lose situation - a banker makes less money, and the client ends up hiring someone else who is willing to pursue a deal that doesn't necessarily make sense.

2. Citi’s culture and empathy

In Citi's case, the effectiveness of emphasizing empathy is also diminished due to its opaque culture, even when compared to other large banks. In such an environment, empathy often appears to be performative, while critical decisions are made without direct conversations or transparency. In contrast, achieving a turnaround necessitates a leveling up of the operating muscles of executives and their teams in a highly transparent manner. Setting elevated expectations, leading by personal example, encouraging self-selection, and providing intensive coaching render behind-the-scenes deliberations and emotional considerations redundant.

Since March 2021, Citi's adoption of empathy seems to have resulted in even less clarity regarding its direction. Instead of offering specific guidance, the leadership meetings would include the catchphrase, "Can you do me a favor?" resembling a used-car sales meeting. This has, in turn, resulted in more eye-rolls and private deliberations behind the scenes.

But what really matters for our newsletters are outcomes. All large banks carry a bureaucratic burden, partially caused by nonsensical regulations and inconsistent enforcement. If compared to peers, Citi's prioritization of empathy made the bank more valuable, then my initial perception was probably wrong, and it’s time to develop an "empathy" playbook.

3. Citi's performance amidst the embrace of empathy

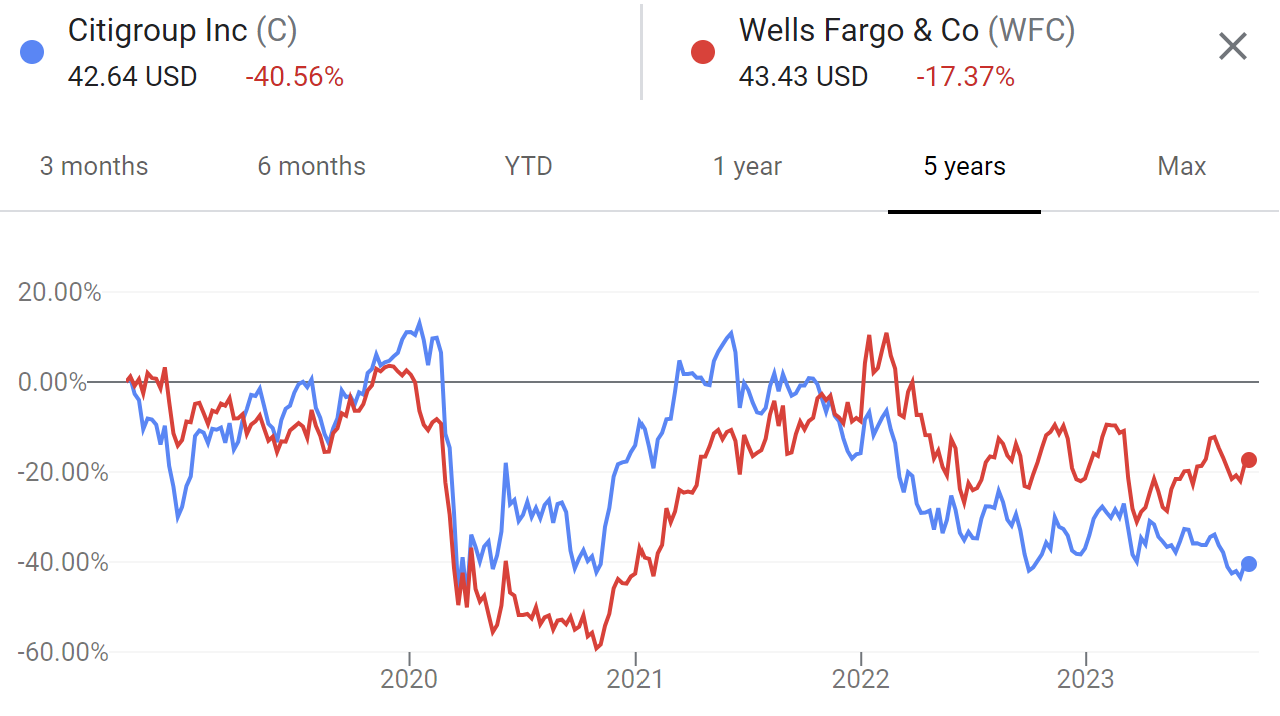

Unfortunately, Citi's stock performance has lagged behind that of all top banks. This includes Goldman Sachs, which is often portrayed in the news as having an unempathetic CEO. Ironically, Citi and Goldman's stocks were trending similarly until the era of empathy began at Citi in early 2021. While Goldman's stock remained relatively stable, Citi's stock plummeted by almost half.

A similar comparison can be made between Citi and JPMorgan:

Even Wells Fargo, which frequently makes headlines for regulatory enforcement, has experienced less loss in shareholder value over the past couple of years compared to Citi.

4. Are employees happier?

Evidently, "leading with empathy" did separate winners from losers, but not in the way the new Citi CEO intended. But did it, at the very least, make employees happier? Turnarounds are challenging, while being asked for a favor creates a positive feeling. Hence, employees might indeed appreciate having such an affable CEO, especially when compared to a tough-styled one like David Solomon of Goldman Sachs.

However, the focus on empathy alone is insufficient for employees to enjoy their work and recommend it to friends. Are there different personal qualities emphasized by Jamie Dimon, whose bank leads the pack on all fronts? For him, it's "Humility, openness, fairness, and authenticity." Interestingly, these attributes align more closely with the leveling up of operating muscles for executives and their reports.

5. What is next for Citi?

If emphasizing empathy doesn't establish an enduring competitive advantage, what else could be done to avoid the painful process of leveling up the operating muscles of Citi's leadership and their reports? A top-down re-organization! And it should be executed in an opaque manner as a surprise to the senior executives, including the top performers. After all, what do they know about making their areas of responsibility more effective?

Removing roles, consolidating divisions, selling off non-core units, and creating new positions have long been favored tactics for "change" in the financial services and insurance industries. These efforts can result in years of everyone feeling busy and hopeful before it becomes evident that they don't make a significant difference either.

Imagine if the Citi CEO, instead of dedicating countless hours first to empathy and then to re-organization, would invest that time in activities where a CEO's personal involvement is imperative for transformation. Delving into the details, personally refining management playbooks, and leveling up her team are the CEO actions that truly establish lasting differentiation, as we discussed in another newsletter. And lasting differentiation is what, in the language of shareholders, translates into empathy.

Lessons for Digital Transformation in FSIs from Fintech Successes and Insurtech Failures

When pursuing new revenue generation ideas through digital transformation, an FSI executive can either identify a significant pain point that clients are willing to pay to alleviate or disrupt competitors with high profit margins. For executives who prefer not to invest extensive time in analysis, there is a shortcut: observe whether there are several well-funded and rapidly growing startups in that niche. During the peak of a business cycle, the profitability of these startups may matter less, but even irrational investors like SoftBank have limits on how much cash they are willing to burn.

Using that indicator, some consumer banking fintechs are performing well. For example, Cash App and SoFi in the US are still growing at around 40% despite having already surpassed a billion dollars in revenue. However, it appears that all consumer insurtechs are struggling or even trying to survive

By this simplified indicator, executives in consumer banks should indeed prioritize identifying areas for digital transformation, while Property and Casualty (P&C) insurance carriers might be content with their existing capabilities and proceed with a more gradual evolution.

But why are consumer insurtechs struggling in the US vs. consumer fintechs? Is it indeed due to the absence of significant pain points that can be profitably addressed or the absence of generous margins among incumbents? According to BCG, the total shareholder return of the reinsurance industry is significantly higher than that of the primary insurers that the insurtechs are attempting to disrupt.

But even for P&C reinsurers, when measuring performance based on return on equity, the absence of value creation from the core business is evident: underwriting generates zero return, with all value stemming from the companies' investments.

A former C-suite executive of State Farm also enlightened me a couple of years ago that they didn't generate profits from P&C consumer insurance, with all their earnings originating from investments.

When examining the home insurance segment, the picture appears especially grim:

The situation in the US home insurance sector has become so concerning that, in an unusual step, an insurance industry credit rating agency has changed the outlook for the segment to negative.

When startups and traditional companies are facing challenges in generating profits, the potential for digital transformation to have a significant impact or for startups to disrupt the market becomes even more limited. However, it's essential for FSI executives not to dismiss the possibility of an obscure niche where there may be a significant underserved market. For example, government intervention can sometimes limit the supply of FSI products rather than encourage competition or leave markets alone. One such niche seems to be home insurance in hurricane-prone coastal areas, where state governments play a significant role, potentially creating a gap between supply and demand.

Coincidentally, a few days ago, there was an exciting fundraising announcement about a home insurance startup targeting that niche. Despite the tough macro environment, Kin Insurance raised $33 million at a unicorn valuation while declaring profitability. Has someone figured out how to disrupt this challenging industry segment?

According to Kin’s press release, their performance was not random; it was a result of a clear differentiation from the very old incumbents:

Like Sarah, who shared the news, I'm not an insurance expert, but there were some red flags when delving into the details. For some reason, Kin only mentioned profitability in the first two quarters of a calendar year, used "adjusted" next to the loss ratio, and its incredible unit economics were again only reported until Q2.

Fortunately, industry experts Ian Gutterman and Matteo Carbone took the time for a quick analysis, explaining to their audiences on LinkedIn and Twitter that:

Kin underwrites catastrophe insurance in hurricane-prone states like Florida.

The majority of catastrophic-level weather events tend to occur in Q3 and Q4.

In 2022, Kin's loss ratio for the homeowner business was 111%.

This doesn't necessarily indicate that Kin will follow the path of other consumer insurtechs with declining value. However, it may take several years of performance data to confirm this. Till then, FSI executives should concentrate digital transformation on use cases with a more certain long-term profitability.

A very insightful article on Leadership of Citi Group. They really need to invest in the digital transformation as their performance lags behind all players. I guess the choice of empathy as a competitive differentiator should be a learning lesson for other businesses. Empathy should be embedded in the culture of any business but not as the sole competitor advantage!

Check out this follow-up development of Citi's re-org announcement: https://www.ft.com/content/5e8d7d8f-e435-4c80-b275-0b1baea86f8f