Some FSIs Like Transforming Without Transforming

Also in this issue: FSIs Conflate Bigger Dashboard for Customers with Helpful Insights

Some FSIs Like Transforming Without Transforming

Transformation is straightforward in theory. When an FSI can’t achieve its business goals with the current operating model in some business line or function, it has to change it to a more effective one. Everyone from the head to front-line employees in the affected areas has to learn how to work more effectively (aka, “level up”).

Following examples of digital natives, the majority of FSIs have experienced some degree of digital transformation in the 21st century, advancing from IT projects and applications to IT products, and with increasing autonomy to the front lines. In rarer cases, FSIs advanced their operating models to Business-led teams and platforms. The transformation has happened at various paces in different groups driven by client demand among other things. That makes a modern FSI a complex organism executing at various speeds and quality under one enterprise umbrella.

The reason for so many transformations failing or progressing excruciatingly slowly is also straightforward. That theory goes against the human nature of a typical FSI executive: it requires them to learn new tricks, be nuanced, and delegate to others, while they naturally prefer to guide others, reduce complexity, and expand their decision power. Hence, we often hear emphasis on the “digital” component of digital transformation where an FSI celebrates the deployment of new digital features and implementing a modern technology stack while accomplishing them with the same level of effectiveness as before.

Erie Insurance’s Early Stages Transformation

The recent interview with the CIO of Erie Insurance, Partha Srinivasa, illustrates a common approach among less advanced FSIs that are starting to transform. First, they setup Enterprise Transformation Office. Then define transformation themes, in Erie’s case those are modernization, best-in-class agent experience, multi-channel customer experience, product excellence, and innovation. There is usually an appreciation that business needs to more involved in the transformation, so Partha discussed 4 factors to make it happen:

CEO highlighting the criticality of the transformation.

Deprioritizing all work that isn’t aligned to that strategy,

Cross-functional leadership team

Regular updates to the board

Notice how minor the difference of the above themes and success factors from the modernization efforts and well-run IT PMOs of leading FSIs in late 90s. CEO championship, cross-functional SteerCos, termination of pet projects, and program dashboards have been best practices even if all digital initiatives are managed as IT projects.

In contrast, 21st-century digital transformation becomes real when there is a change in the organizational design impacting the day-to-day activities of executives and front-line employees, not just the members of the Transformation office. Change from 90s is clearly noticeable when an FSI has fewer management layers, pushes autonomy to the field, aligns support functions by capabilities, and generates revenues with persistent cross-functional teams.

Santander US Plans More Advanced Transformation

In FSIs at the more advanced stages of digital maturity, transformation is usually led by the COO or P&L Head. Santander US recently announced the hiring of Swati Bhatia to lead the U.S. Consumer and Business Banking business and all related digital transformation initiatives.

Since Santander wants to become a national digital bank with branches, the digital transformation focus would be “on building new capabilities, simplifying existing processes, and enhancing customer experiences while lowering the cost to serve." Swati indeed would face a transformational challenge. While the playbooks for neobanks and traditional banks’ successful strategies have proven examples, a digital-first traditional bank with branches is a novel phenomenon. It would require an even more complex operating model that explains which groups own clients' P&L and which play an enablement role.

Role of Enterprise Digital Chiefs in Advanced Transformation

What would be the role of Enterprise digital-related Chiefs in FSIs with relatively high digital maturity? They need to agree to enable P&L heads like Swati Bhati at Santander rather than pursuing their own modernization/innovation initiatives. That could be frustrating, as I often hear from CIOs, CDOs, and others how slowly business heads are in implementing digital capabilities.

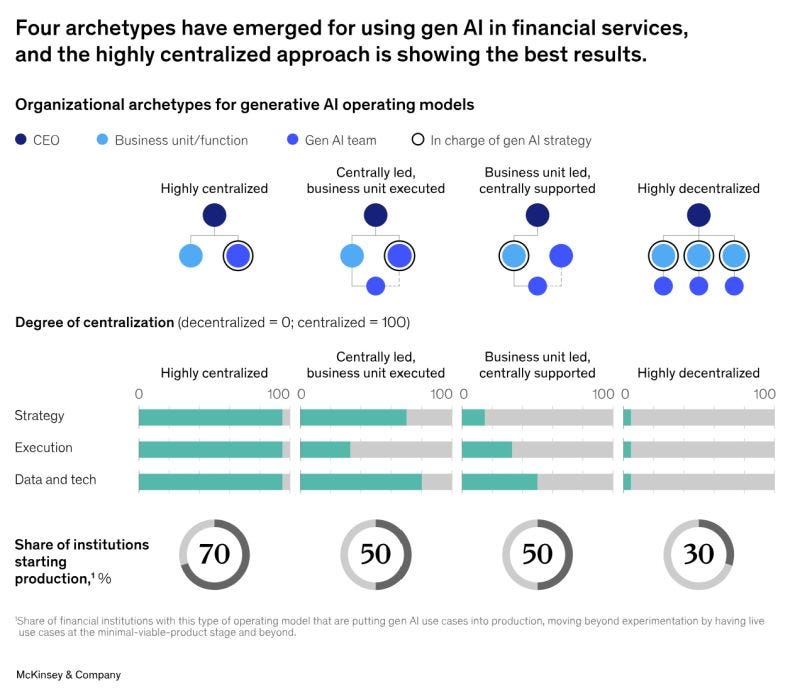

Such tension was highlighted in a recent McKinsey study of how effectively FSIs have been scaling Gen AI depending on their operating model. McKinsey's conclusion was clear: highly centralized operating models are more than twice as effective as highly decentralized ones.

But here's the catch often overlooked by some advisors and enterprise digital chiefs: observe how McKinsey measures success—by getting AI use cases into production. Undoubtedly, any digital transformation initiative, including GenAI, will likely achieve greater success when overseen by the enterprise rather than individual business units, particularly if the success metric is deployed into production. Enterprise executives wield budgetary control and approval authority, enabling them to expedite such initiatives compared to line-of-business heads. However, when the success metric revolves around ROI, business units consistently come out on top.

In a scene from Curb Your Enthusiasm, Jason Alexander (known for his role as George Costanza in Seinfeld) authored a slim volume titled "Acting without Acting," drawing skepticism from his friends regarding its impact. Similarly, deploying AI use cases into production and establishing an Enterprise Transformation Office is akin to transforming without truly transforming.

FSIs Conflate Bigger Dashboard for Customers with Helpful Insights

“Customers don’t want to know what they did wrong; they want to know how much money they made and hear some cool investment ideas,” responded a divisional head of a mid-size asset management firm, and most of the C-Suite agreed with him. They were betting big on AI, and I suggested trying to use it to tell customers something useful for a change. My suggestion was to differentiate from others by telling customers how they could have managed their money better. Alas, there was no interest.

Instead of something helpful, consumers in asset management might receive quarterly cold calls to schedule a meeting with a local portfolio manager to discuss their investments. Nobody looks at a customer portfolio before the call to identify potential gaps in the investment approach. A portfolio manager explained to me the reason for such behavior. “The chance of anyone picking up a phone is close to zero, while it would take me half an hour to read each profile and prepare personalized insights.”

It is not unreasonable. Unlike wealth management clientele that earns FSIs nice fees, upper mass and even affluent consumers are not that profitable and are too numerous. But can’t AI cut preparation time for each outreach or send such insights directly to consumers? Machine Learning capabilities have been around for a decade—couldn’t Fidelity, Morgan Stanley, and wealthtechs identify the effective investment behavior and train their models to identify large gaps in the approach of their customers?

Current State of Personalized Insights: My ESG Score

I held my breath when I recently received an email from my asset management firm. It was about a new tool that would guide my investing approach and adjust it based on personalized insights:

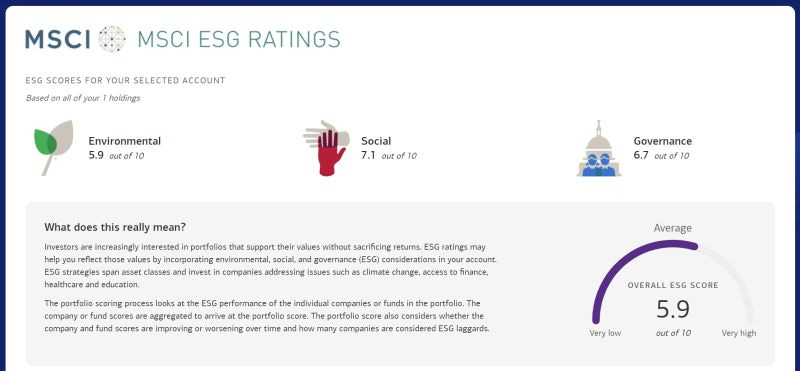

But when I logged in to my “portfolio story,” there were no personalized insights. The dashboard was neat, with colors and everything, but it displayed the same trivial information about my account as it did a decade ago. Except there was one new piece of information: my ESG score! It was even broken into three categories: greener leaves for air quality, darker skin for hiring practices, and bluer people working in government buildings for something less intuitive:

It looked like I was above average in ESG, especially with my Social score, and I do admire the ESG hassle. A bunch of clever entrepreneurs and FSI executives figured out that there was a demand from well-off folks to feel good about themselves. So the expensive products were designed to monetize that demand with dashboards, ratings, and awards - it was a win for those customers, FSIs, and government bureaucrats. In Europe, the game is expanding, but in the US, Blackrock overplayed its hand and made ESG a political issue, jeopardizing a part of the gravy train for everyone. Not the whole train though, since my FSI still seems to be spending money on buying some rating and implementing it into a dashboard.

Nevertheless, this new ESG information was still just data points, not an insight. Let’s imagine I was that customer who wanted to feel good about my investments instead of just caring about return. How would this information help me decide on becoming a more ESG-conscious investor? Why not push me to some expensive fund with a much higher ESG rating and tell me that buying it would place me in the top 10% of the most enlightened people?

How to Get Started with Helpful Customer Insights

Let us cease the pretense that customers are indifferent to genuine insights on how they could better manage their finances and insurance. Such an assertion is akin to claiming that employees universally eschew developmental feedback. While some may indeed show reluctance, others actively seek it out. In high-performing cultures, development feedback is readily provided, whereas in low-performing ones, it tends to be either avoided or outsourced to HR.

The strategic challenge with personalized client insights stems from FSIs not perceiving a material ROI for enhancing client effectiveness. This predicament is understandable, especially when FSIs may already observe low retention rates and a high share of wallets among their core customer segments. For instance, Bank of America reports that 92% of its consumer checking accounts are customers' primary accounts. Moreover, what if more effective clients opt for products with lower margins or transfer their business to a more formidable competitor?

Thus, the initial step for FSIs is to ascertain whether investing in the provision of more effective insights aligns with underlying business objectives: higher retention rates, increasing wallet share, or generating more referrals. Subsequently, FSIs can monitor whether the incorporation of insights is indeed influencing these key metrics.

A more technical hurdle lies in FSIs' current inability to automatically assess customers' effectiveness. This necessitates the development of novel analytical models and meticulous analysis. While Gen AI may hold promise for the future, it currently falls short in addressing this challenge. For example, Fifth Third's CIO recently shared that the bank's chatbot achieved 97% accuracy in classifying customer intent. However, identifying whether a customer is annoyed is much easier than determining if they've made incorrect investment choices.

Which traditional FSI or fintech will be the first to develop such a distinctive differentiation in the marketplace?

Other Insightful Reads

The Importance of Primacy in Banking (The Financial Brand’s survey of banks and credit unions on using CAC vs. LTV metrics, with analysis of common mistakes)