Why FSIs Struggle to Enable Autonomy in Digital Transformation

Also in this issue: Chasing Novel Tech Could Get in the Way of FSIs Growing Revenue

Why FSIs Struggle to Enable Autonomy in Digital Transformation

“Dress like British, think like Yiddish” was standard advice from Goldman Sachs partners to new hires half a century ago. When I joined Wall Street 25 years ago, onboarding still included an executive casually outlining which secretaries were available for hookups and which were already spoken for by senior staff. But within a few years, the era of excess—stereotypes, coke, and strippers—came to an end. FSI culture shifted toward political correctness, with executives rarely sharing unfiltered thoughts.

Even supposedly rebellious fintech CEOs have learned to keep their mouths shut, with only occasional slip-ups—like the recent comment from Affirm’s founder about finding it "cathartic and therapeutic" to help laid-off employees pack their things. The one exception, of course, is the crypto world—where I have no other founders to offer you:

Therefore, a recently leaked Jamie Dimon staff call quickly became legendary for its unprecedented frankness on the most taboo topics. And coming from the most respected CEO of the largest FSI—approaching $800 billion in market cap—it is especially instructive.

Jamie’s comments, made during a town hall in Ohio on February 12, 2025, included unfiltered takes on DEI (“stupid shit”), regulators (“son of a bitch”), employee activism (“fucking petition”), and AI (“attrition is your friend”). Given the large in-person and Zoom audience, Jamie clearly wanted the world to hear his truth. He succeeded, setting off news cycles that lasted for days.

For digital transformation, the most interesting takeaway from Jamie Dimon’s remarks was his rationale for mandating full-time office work. While COVID provided a natural experiment proving professionals could be more productive and happier working remotely, many FSIs have since eliminated even hybrid arrangements. So how does Jamie weigh the trade-off between his mandate and the energy-draining commute, followed by soul-crushing meetings where executives get updates without fundamental change, then spending the rest of the day on video calls—while also increasing pollution?

In a 2023 newsletter, we explored possible motivations behind this push—ranging from filling empty real estate to hazing young hires—but, more importantly, the underlying mistrust of managers. Disempowering them from making workplace decisions contradicts a core tenet of digital transformation: empowering autonomy on front-line teams. Jamie’s explanation only reinforced this thesis:

1. The Problem with Remote Work

"Headcount has gone up by 50,000 people in four or five years. We don’t need all those people. We were putting people in jobs because the people weren’t doing the job they were hired to do in the first place… We’ve built up too much inefficiency and bureaucracy."

"These bureaucracies—I need more people, I can’t get it done. No, because… you’re filling out requests that don’t need to be done. We’re nice, we collaborate well—we over-collaborate."

"I call a lot of people on Fridays, and there’s not a goddamn person you can get a hold of."

"The ones who aren't here are meeting fewer people, learning less, being challenged less, not being put on as many teams."

2. The Solution

"Going back to the office will improve efficiency a lot."

"There is no chance that I will leave it up to managers. Zero chance. The abuse that took place is extraordinary."

3. The Benefit of Office-Only Work

"Reducing bureaucracy literally will reduce cancer."

"Every area should be looking to be 10% more efficient. If I were running a department with 100 people, I could run it with 90 and be more efficient. I guarantee you. I could do it in my sleep."

Jamie correctly identifies the self-propagating nature of bureaucracy, where excessive hiring and redundant processes emerge to justify their existence. However, he takes no responsibility for enabling this environment, nor is he willing to strengthen his operating muscles to foster a different management culture. Instead, he mistrusts his managers yet expects that forcing people back into the office will somehow lead to bureaucracy dismantling itself.

This is especially nonsensical for global FSIs, which have spent decades setting up worldwide units based on talent pools and cost efficiencies. At the town hall, one manager asked whether work location decisions could be left to managers, given that his entire team was globally dispersed. A few hours later, he was fired and reinstated the same day.

Without autonomy, the typical FSI executive culture is performative: pretending to be excited about the dumbest ideas if they come from a politically stronger executive. I left two companies because a senior executive insisted on pushing irrelevant products into my markets. As is standard in FSIs, I found out only after those sales were baked into my targets. I pushed back, but no one cared—so I quit. Those product groups were shut down within a few years in both cases.

JPMorgan Chase will spend more money to soften the blow of this illogical return-to-office push and make the daily commute slightly more palatable. Its new $3+ billion Manhattan headquarters will feature circadian rhythm lighting, personalized temperature and coffee, a signature scent, high-end art, a restaurant-quality food court, an Irish pub, physical therapy, yoga, and meditation.

Jamie's hands-off and superficial preference was also evident in his remarks about digital strategy. For a decade, he positioned the creation of consumer fintech as a manifest destiny for JPMorgan Chase. After significant public failures with Finn, Viva, and Frank, most of his peers would have been too embarrassed or cautious to press on. Yet, Jamie doubled down, investing $1-2 billion in digital banking to make JPMorgan Chase a top-5 consumer player in Europe.

Of course, in a centralized culture, it’s rare for an executive to have the courage to challenge such a visionary leader. That would be like pioneers telling Brigham Young that the heavy casualties and massacring of so many native tribes and settlers might not be worth the promise of their destination. But as Utah became one of the best US states, JPMorgan Chase remains one of the best FSIs, so clearly, centralization works.

Moreover, those expenditures may seem like peanuts for a $4 trillion asset FSI. However, it’s telling how Jamie frames the effectiveness of his digital strategy to date. Much like his analysis of the work-from-home experiment, he doesn’t realize that his management style has fostered a culture where managers have become willfully less competent. Now, without changing the underlying operating model, he’s expecting them to fix themselves.

"But it's your job to catch up now. And so, but, there are other things that we could have done like a Stripe or stuff like that, but we didn't have the imagination, including me, to say, hmm, we have the best payments, but we should add data and make it easier for the client. What does the client really want? It wasn't the payment they wanted. They wanted to close the sale faster and more certainly."

Traditional FSIs typically launch digital products without first confirming client needs, reflecting a company operating at lower levels of digital maturity. When visiting clients, I always ask them to spend an hour with their best digital team. One of my key questions is how often they leave the building to meet with target clients. The usual answer is "never."

Digital maturity won’t magically evolve by bringing everyone back into the office or spending billions on scaling bells and whistles. It requires every executive in the chain of command to level up their operating muscles, ideally starting with the CEO. While Jamie’s comments suggest most bank managers are incapable, that’s clearly not the case. Some even know what good digital transformation looks like but need autonomy and alignment to level up their teams.

For any CEO who believes they could run their departments with 10% fewer staff “in their sleep,” why aren’t you setting that target for 2025 and replacing executives who can’t effortlessly achieve it? Why would you keep incompetent executives who overhire while tolerating waste and abuse? Complaining and implementing top-down solutions is easier than sorting through and developing your reports one by one.

As we often say in our newsletter, FSIs like JPMC don’t need to undergo a real digital transformation with autonomy if they plan to maintain their existing scale. As the CEOs of Citi and HSBC are currently demonstrating, 20th-century methods can still work well for gaining significant efficiencies. A centralized approach can be highly effective, as long as layoffs aren’t theatrically limited to 0.3% of the workforce but closer to the 10+ % range.

Chasing Novel Tech Could Get in the Way of FSIs Growing Revenue

"The company is doing well, but the C-Suite is refusing to make large investments in data analytics and technology. Could you help me build a case for a data modernization program?" The CTO of a $5 billion revenue FSI was offering a consulting gig. I asked if the CEO was satisfied with the current growth rate. He responded, "Yes, he mostly wants better reporting."

For hundreds of years, financial and insurance companies understood the basics of growing their business: identify an underserved segment, develop a product to profitably meet that need, and expand into tangential products and regions. This approach is straightforward when entering a developing market or launching a new product in a developed market, such as crypto trading or BNPL. But how do you grow market share in a saturated market?

For the last quarter-century, novel technology has seemed like the answer. The five digital pillars of the 21st century—Agile, AI, API, Cloud, and DevOps—have given FSI CEOs hope that these tools could provide differentiation and drive customer growth. As a result, financial and insurance companies have invested heavily in IT modernization and digital features, with some banks spending up to 20% of their revenue on technology.

JPMorgan Chase has led the way in absolute spending, and its CEO has been notably vocal about the threat of fintech disruption, even when those startups were relatively small. Yet, despite spending nearly $18 billion on technology, the race to lead in digital features is not solely driven by financial investment. JPMorgan's CEO recently acknowledged that Bank of America is ahead in digital.

"Don't say, well, we're the best in the world. Assume that they're doing something better. Even Bank America does something better than us. Shocking, I know, but. [laughter] It's the digital world. They were ahead of us in digital."

But why does that matter? Bank of America’s revenue has grown in line with inflation, and its efficiency ratio has worsened. If JPMorgan Chase catches up with BofA in terms of digital capabilities, what are the expectations for different outcomes?

While traditional FSIs could hide the lack of ROI on digital investments, it’s much harder for fintechs to do the same. For example, in the consumer cross-border space, Wise and Remitly are still performing well, but Azimo had to exit, and WorldRemit (Zepz) is struggling. Its traditional competitor, Ria (part of Euronet), has similar revenue growth but is four times bigger.

Even more striking is that Ria’s operating income is growing at 13%, while WorldRemit’s operating losses are increasing by 30%. As a result, fintech, not the traditional finance provider, has been laying off more employees—20% most recently.

A modern tech stack and a superb digital UX are just small parts of the equation. McKinsey recently profiled a European private bank client that struggled to expand into the mass-affluent segment despite millions spent on a new app and marketing technology. The main issue turned out to be a high investment threshold. Once that was addressed, the bank increased its customer base by over €1 billion in new assets within a year.

Before the digital finance age, low thresholds and high savings rates were effective for decades. More recently, Goldman Sachs launched Marcus with deposits in 2016 and Santander launched Openbank venture in the US in 2024, offering the nation’s best high-yield savings account. Both attracted around $2 billion within their first few months.

Have some of the world’s best fintechs figured out how to use technology to raise deposits more effectively? Imagine how much Revolut collected across 22 countries offering money market funds in the first year—the answer: $1.9 billion—roughly the same as those traditional players.

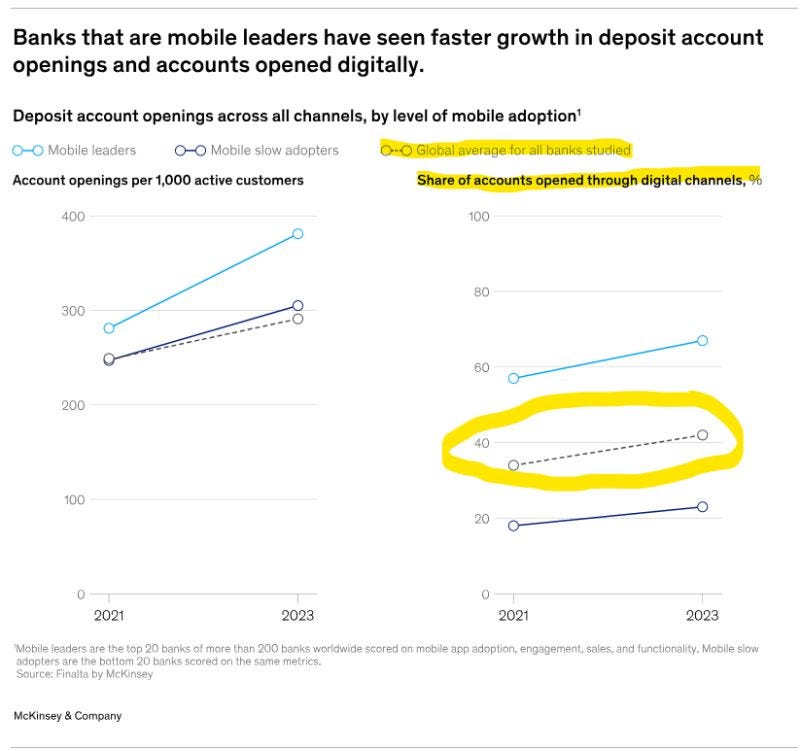

Beyond the tried-and-true basics of supply, consumer preference—sometimes referred to as apathy—also plays a more significant role in accelerating revenue growth than novel technology. Unfortunately, the shift in customer preference happens slowly. For example, in digital acquisition across various insurance and financial products, the transition occurs at just a few percent per year, with deposit account openings now surpassing 40%.

While many digital experts believe FSIs maintain legacy acquisition channels due to laziness or ineptness, the reality is that these channels continue to generate positive returns. For example, direct mail still holds a significant advantage over digital marketing in certain areas, as highlighted in the recent The Free Toaster Newsletter:

Consumer lenders spend $3B per year on 6B mail pieces, and the power of pre-screened marketing. Thanks to the Fair Credit Reporting Act (FCRA), you can “pull” certain consumers’ credit data at the marketing stage (without permission) and decide exactly who qualifies before you send the offer.

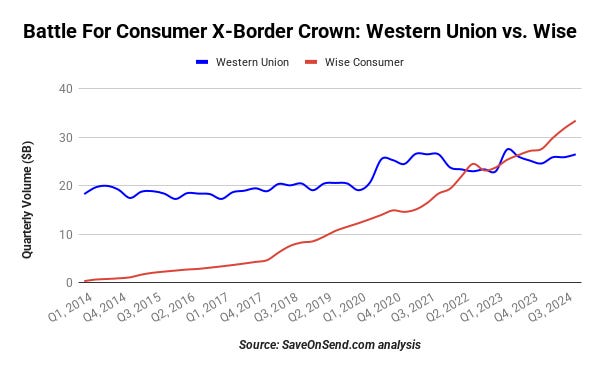

Even when it appears consumers are flocking to a digital-only player, it’s essential to confirm whether they are targeting the same use cases. For instance, consumer cross-border volumes are nearing $2 trillion, split roughly 50/50 between remittances and other use cases. Despite its meteoric rise and overall dominance, Wise still rarely captures customers from traditional remittance giant Western Union, as both largely continue to serve their respective halves of the market.

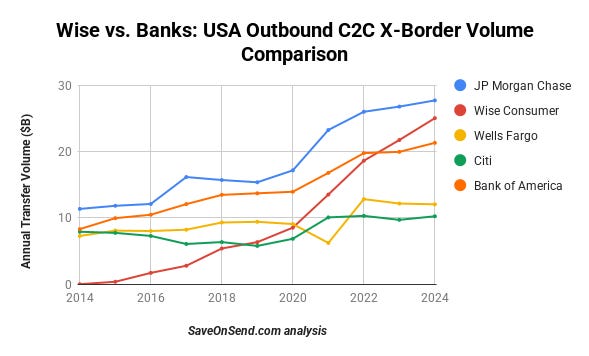

But at least Wise’s direct competitors for the same use cases—top banks—are starting to suffer without having a similar digital maturity, right? Nope, they’re doing just fine, thanks to consumer preference (or apathy). While Wise is on track to overtake JPMC as the C2C cross-border leader in the US this year, both JPMC and BofA still grew in 2024.

Our newsletter also frequently discusses how regulators prevent traditional FSIs from offering more products to underserved consumer and business segments—not due to digital or data capabilities limitations. The California home insurance market is Exhibit A in this regard. Its price controls are compounded by the expropriation of carrier funds, which are compounded by the expropriation of consumers' money.

With no desire to adapt, regulators recently denied State Farm’s emergency request for price increases after losing billions in the recent LA fires. Jamie Dimon also had choice words about the CFPB in a similar context.

"… there are consumer protective rules that are good, [but] they massively overstepped their authority. I think this guy — Chopra or whatever his name is — was just an arrogant, out-of-touch son of a bitch who just made things worse for a lot of Americans."

Regulation, not technology, also limits geographical expansion. Trump mentioned the inability of US banks to expand as one reason for the tariffs on Canada. Some have a few branches, but none offer a full line of consumer products.

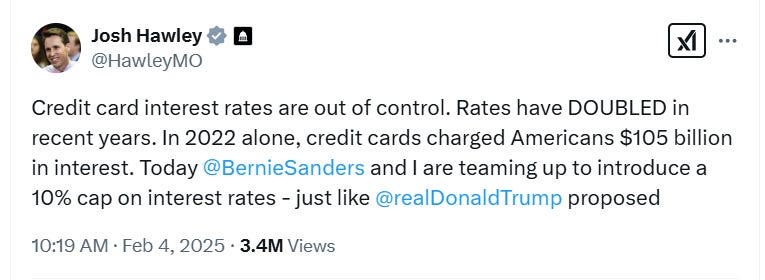

While regulation in the West may loosen a bit with the rise of right-wing populism, the downside could be more price controls. Growing revenue in such an environment is less about technology and more dependent on the effectiveness of lobbying.

In some FSI verticals, technology still mostly doesn’t matter. How badly do you think Citi’s wealth management arm performed in 2024, using legacy platforms that aren’t even integrated from numerous acquisitions? In a recent interview with Banking Dive, Citi Wealth head Andy Sieg had to respond to analysts’ perception of a severe tech gap, with competitors miles ahead:

Bank of America analyst Ebrahim Poonawala, talking with Sieg on Wednesday at a BofA Securities financial services conference, mentioned a perception of “a tech product deficit” at Citi given the bank’s technology challenges and that competition “has moved on.”

Well, Citi Wealth’s revenue grew 20% with 13% fewer staff. How did those “moved on” competitors perform in comparison? If your FSI is eager to accelerate revenue growth in a saturated market, fight the urge to launch digital features or scale novel technology, hoping for their self-evident powers. Sometimes, the answer might lie in 20th-century insights.